Llc Operating Agreement Nevada Withholding

Description

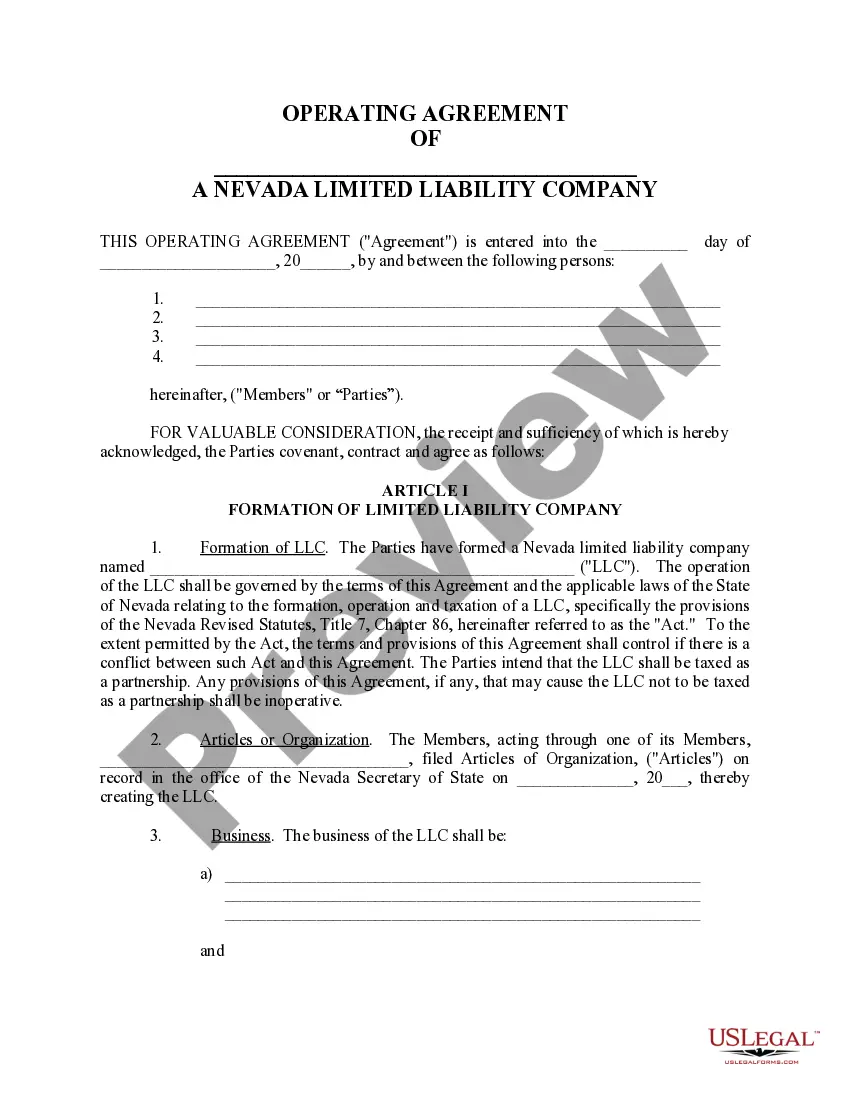

How to fill out Nevada Limited Liability Company LLC Operating Agreement?

Managing legal documents and processes can be a lengthy addition to your entire day.

LLC Operating Agreement Nevada Withholding and similar forms typically require you to locate them and navigate the route to complete them correctly.

Consequently, whether you are addressing financial, legal, or personal issues, having a comprehensive and functional online repository of forms at your disposal will considerably assist.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and various tools to help you finalize your paperwork swiftly.

Is it your first time using US Legal Forms? Sign up and create a free account in a few minutes, granting you access to the form library and LLC Operating Agreement Nevada Withholding. Then, follow the steps below to complete your document: Ensure you have located the correct form by using the Preview feature and reviewing the form details. Click Buy Now once ready, and select the monthly subscription option that suits you best. Click Download, then complete, eSign, and print the document. US Legal Forms has 25 years of experience assisting clients in managing their legal documents. Obtain the document you need today and streamline any process without hassle.

- Explore the collection of pertinent documents accessible with just one click.

- US Legal Forms offers you state- and county-specific templates available anytime for download.

- Safeguard your document management processes with high-quality support that enables you to create any form within minutes without any additional or unforeseen fees.

- Simply Log In to your account, locate LLC Operating Agreement Nevada Withholding, and download it immediately from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

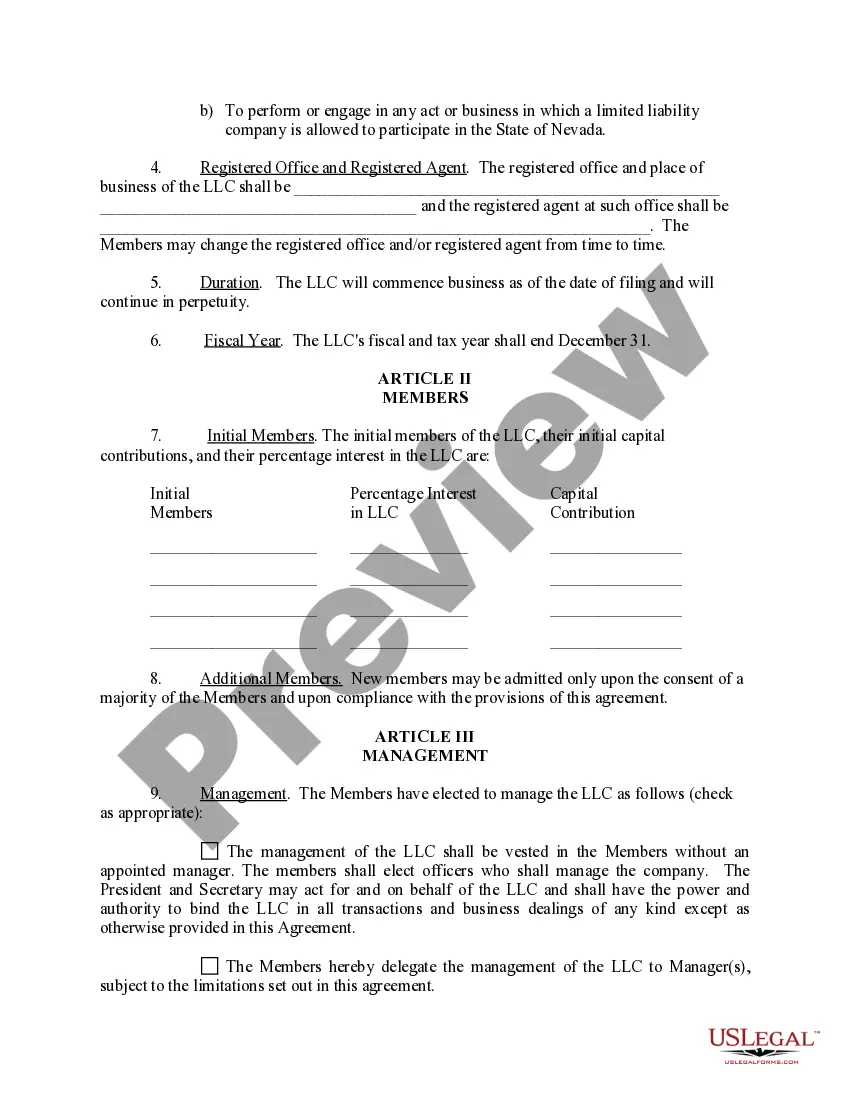

Annual report and business license requirement. Nevada requires LLCs to file an Annual List of Members/Managers and Business License. It is due by the last day of the month marking the LLC's incorporation anniversary. The filing fee is $150 for the Annual List and $200 for the business license registration.

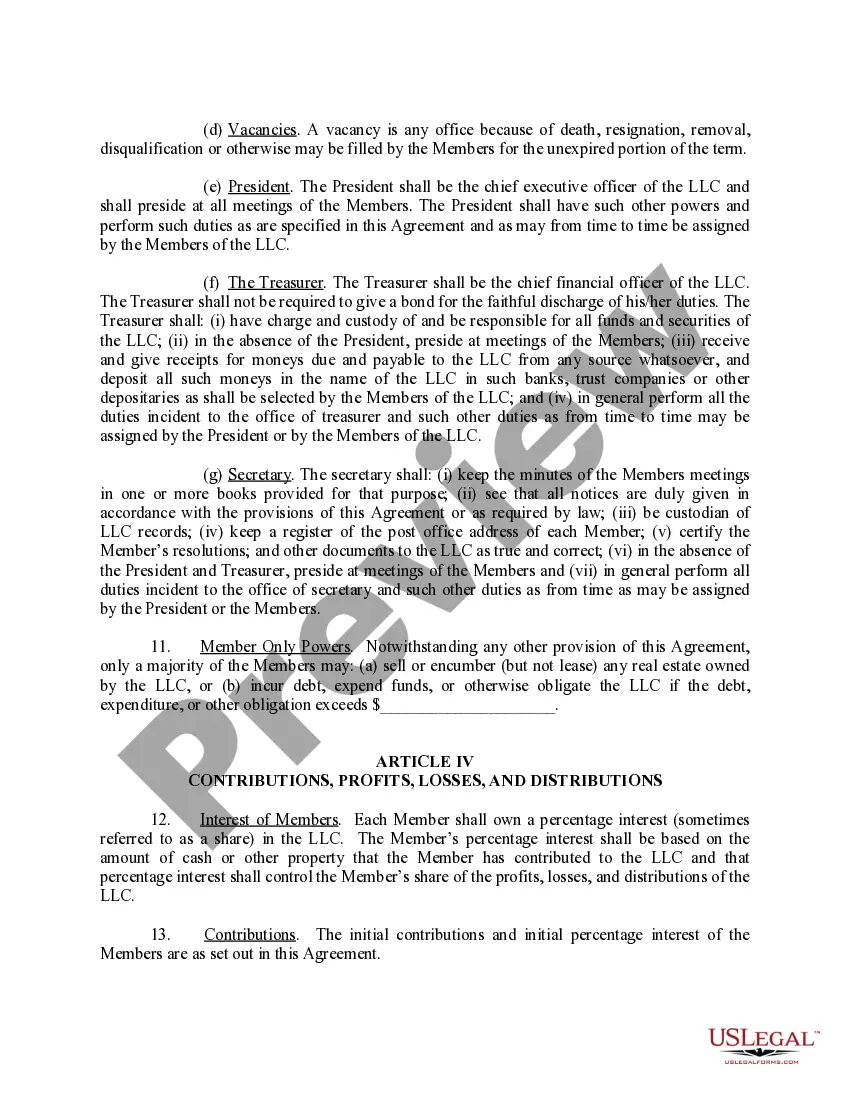

A Nevada single-member LLC operating agreement is a legal document that will allow a single owner of a business to set forth the policies and daily activities of their company. This document will make it possible to separate personal assets and financial accounts from those of the business.

Hear this out loud PauseTechnically, an SMLLC does not need an operating agreement in the state, and you do not need to file these organizational papers with Nevada. Even so, an operating agreement benefits your organization because your procedures are documented for reference.

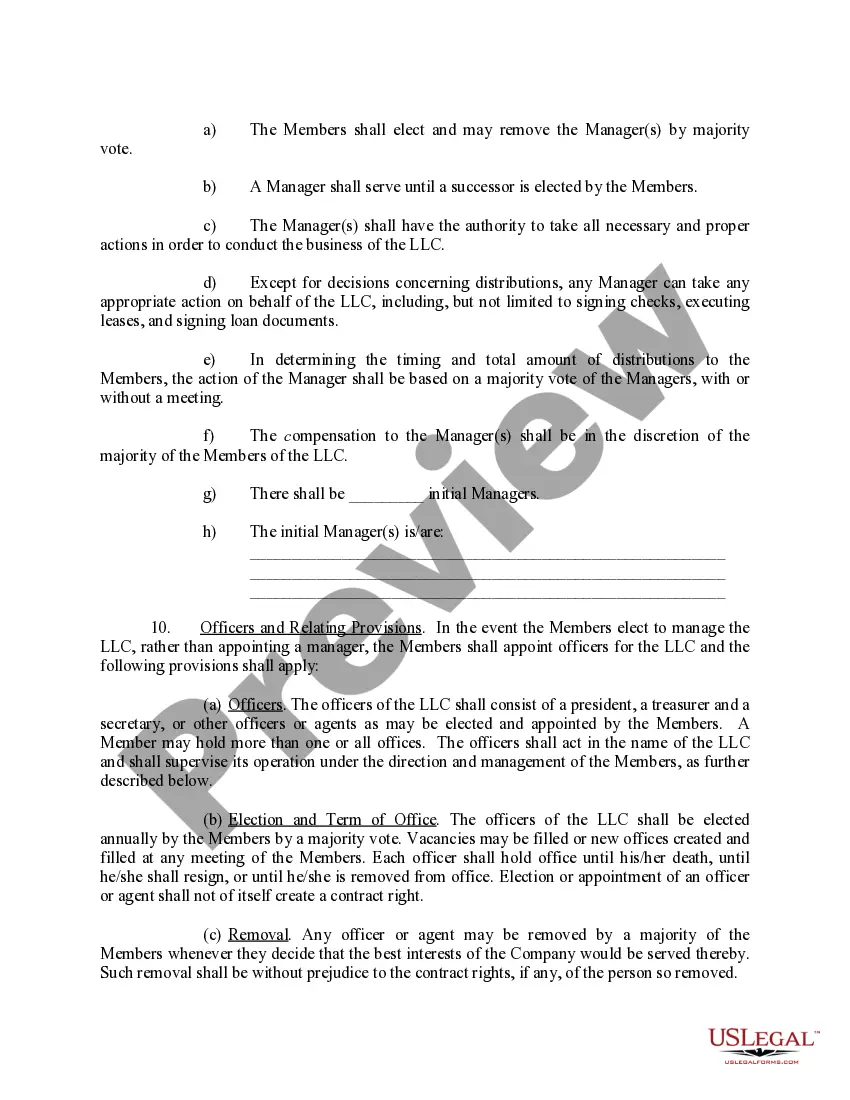

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

Operating Agreement There is no legal requirement for the form in Nevada, however, it is recommended that one be drafted and reviewed by the managing member(s), and thereafter signed by each member.