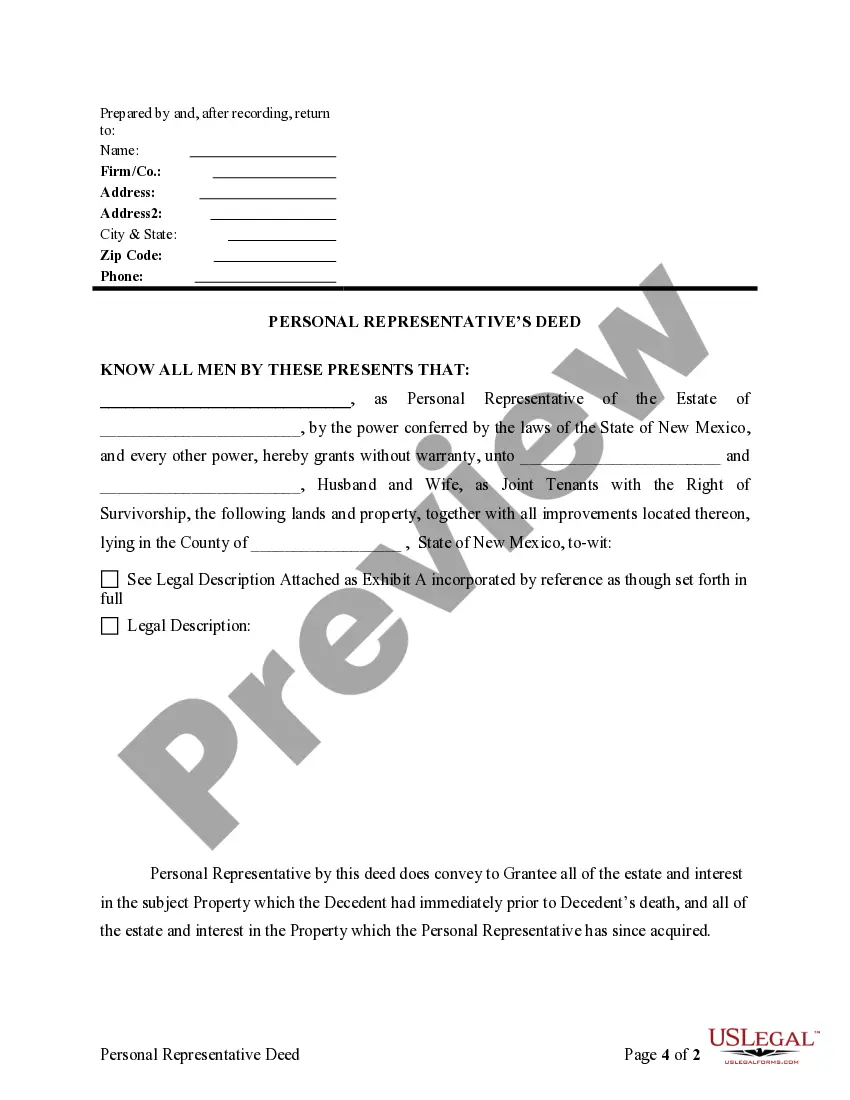

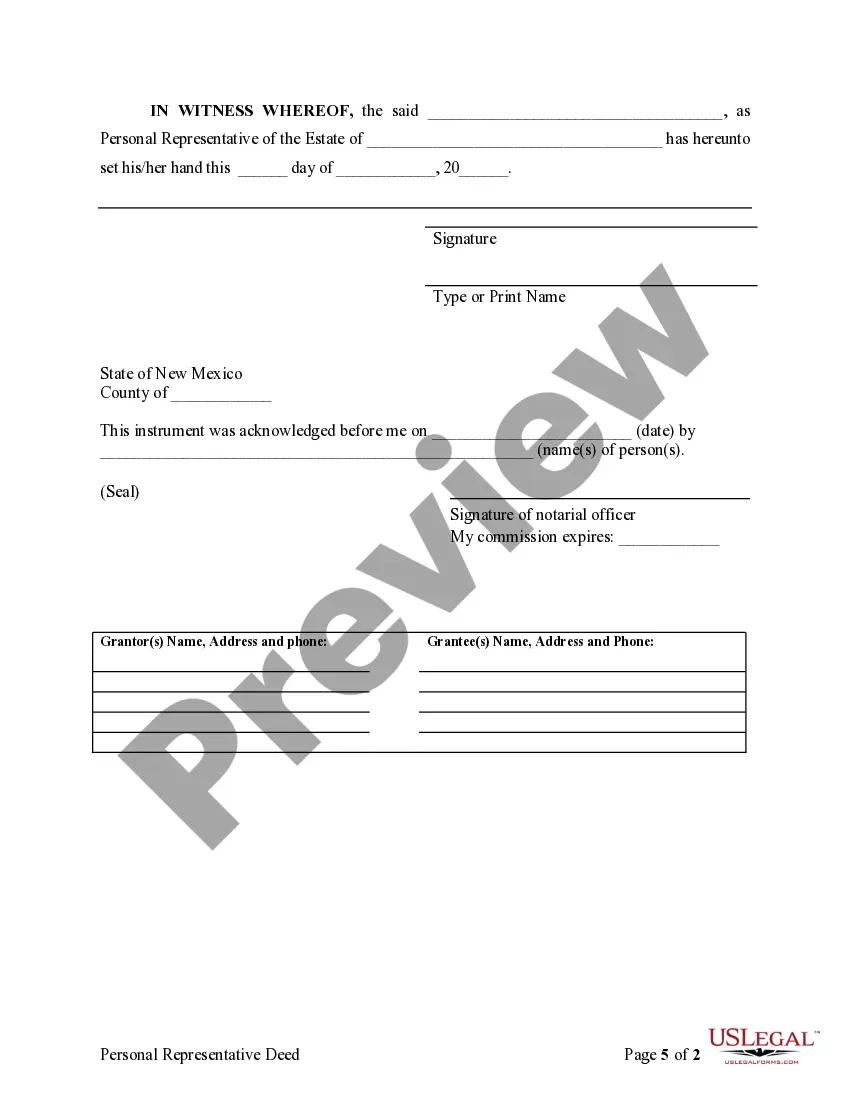

Personal Representative Deed Form New Mexico Withholding Tax

Description

How to fill out New Mexico Quitclaim Deed For Personal Representative's Deed?

Creating legal documents from the ground up can occasionally feel a bit daunting. Certain situations may require extensive research and substantial financial investment.

If you seek a more straightforward and cost-effective method of generating Personal Representative Deed Form New Mexico Withholding Tax or similar documents without unnecessary complications, US Legal Forms is perpetually available to you.

Our digital repository of over 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant documents meticulously prepared for you by our legal professionals.

Utilize our service whenever you need a dependable and trustworthy means to effortlessly locate and download the Personal Representative Deed Form New Mexico Withholding Tax. If you are already familiar with our services and have created an account with us before, simply Log In to your profile, select the template, and download it right away or re-download it anytime from the My documents section.

Download the file. Then complete, verify, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make document preparation a straightforward and efficient process!

- Not have an account? No worries. It takes only minutes to sign up and browse the library.

- Before directly downloading the Personal Representative Deed Form New Mexico Withholding Tax, review these suggestions.

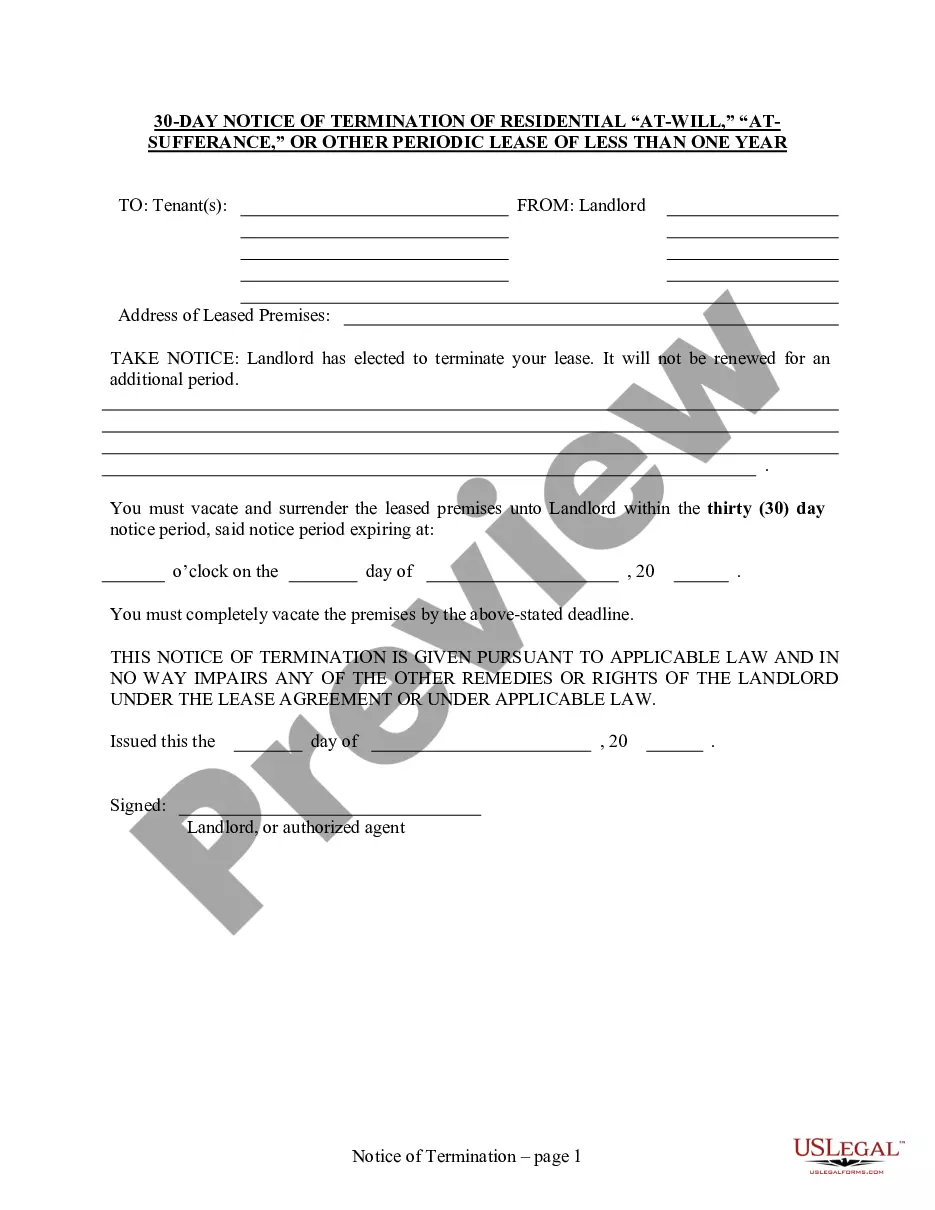

- Examine the form preview and descriptions to confirm you’re selecting the correct form.

- Verify that the form you select aligns with your state and county requirements.

- Select the appropriate subscription plan to acquire the Personal Representative Deed Form New Mexico Withholding Tax.

Form popularity

FAQ

New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return. State withholding tax is like federal withholding tax.

Pass-Through Entity Annual Withholding Return A Pass-Through Entity (PTE) is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level. A PTE can be any of the following: Estates. Trusts. S corporations.

? Internal Revenue Service Form W-4, Employee's Withholding Allowance Certificate. (New Mexico does not have a state equivalent of the federal W-4 form. Employees should complete a copy of the federal W- 4 for New Mexico, writing "For New Mexico State Withholding Only" across the top in prominent letters.

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

Pay online on Taxpayer Access Point (TAP) Making a payment online at the department website, Taxpayer Access Point (TAP). TAP is fast, easy, and electronic check payments are free. After you submit your payment information, you will receive an online confirmation.