Personal Representative Deed Form New Mexico Withholding

Description

How to fill out New Mexico Quitclaim Deed For Personal Representative's Deed?

Creating legal documents from the ground up can often be overwhelming.

Certain cases may necessitate many hours of investigation and substantial financial investment.

If you’re searching for a simpler and more cost-effective method of generating the Personal Representative Deed Form New Mexico Withholding or other documents without facing obstacles, US Legal Forms is consistently accessible.

Our online catalog of over 85,000 current legal forms encompasses nearly every dimension of your financial, legal, and personal affairs. With just a few clicks, you can promptly obtain state- and county-specific templates meticulously crafted for you by our legal professionals.

Examine the form preview and descriptions to verify that you are selecting the correct document. Confirm that the template you select meets the stipulations of your state and county. Choose the appropriate subscription option to acquire the Personal Representative Deed Form New Mexico Withholding. Download the form, then complete, verify, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make document completion an easy and efficient task!

- Utilize our platform whenever you require reliable services through which you can effortlessly find and retrieve the Personal Representative Deed Form New Mexico Withholding.

- If you’re familiar with our services and have previously established an account with us, simply Log In to your account, search for the template, and download it or retrieve it any time later in the My documents section.

- Don’t have an account? No problem. It takes very little time to register and browse the catalog.

- But before proceeding to download the Personal Representative Deed Form New Mexico Withholding, adhere to these suggestions.

Form popularity

FAQ

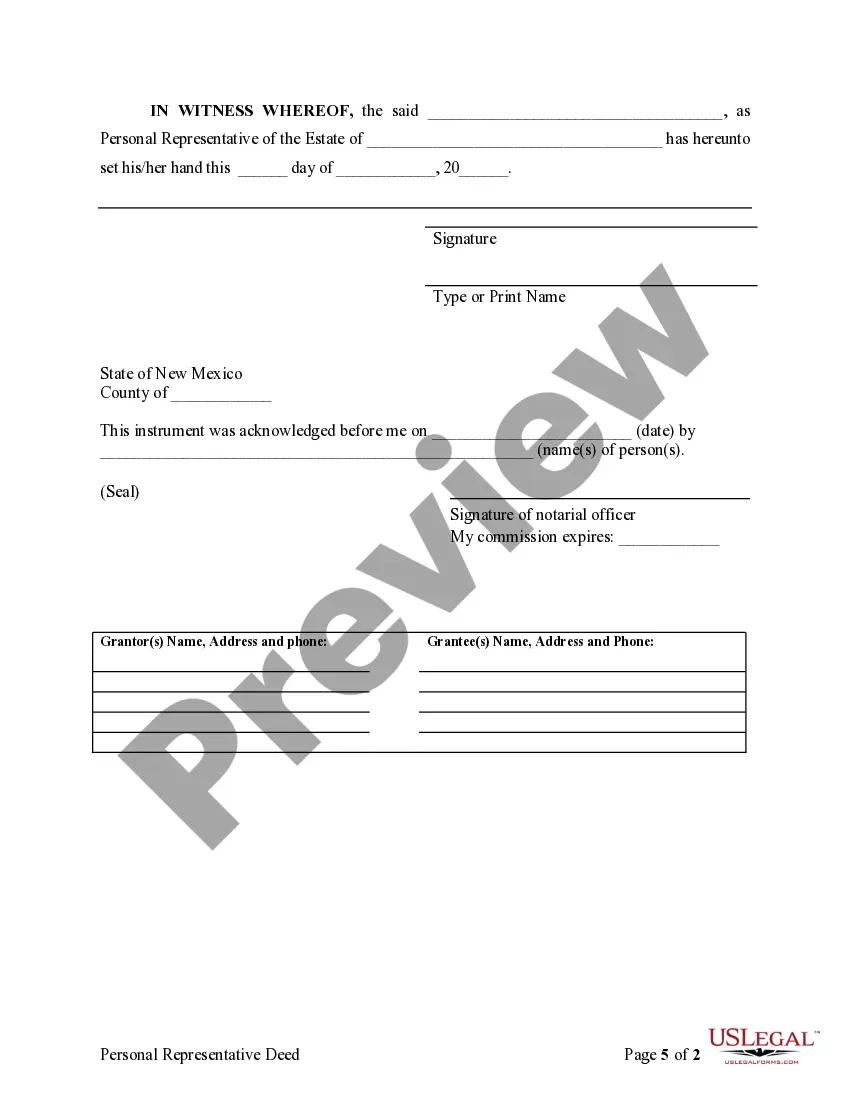

New Mexico law requires Form RPTDA when a deed transfers residential real estate to a new owner. A completed Form RPTDA must be signed by the current owner, new owner, or authorized agent and filed with the county assessor within 30 days after the deed is recorded.

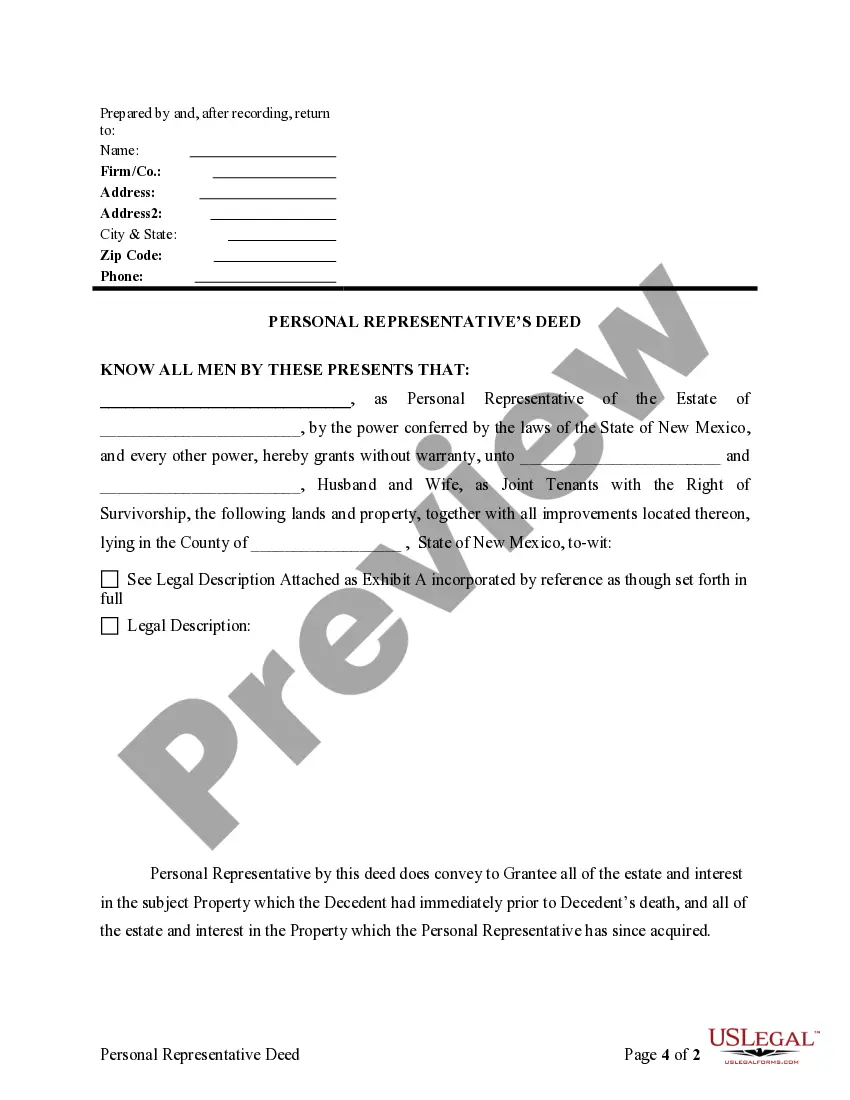

A PR appointed informally by the Probate or District Court has legal authority to sell real property and to transfer title to it via a ?Personal Representative's Deed? from the estate to the new owner(s). It is the PR's job to have this deed prepared, signed, acknowledged before a notary public, and properly recorded.

The probate court appoints legally qualified persons, called personal representatives, to manage and settle the decedent's affairs. personal representatives distribute the assets decedent's estate to the rightful recipients. These might include heirs, devisees named in a valid and current will, or creditors.

How to Write (1) Authorized New Mexico Filing Recipient. ... (2) New Mexico Grantor Name. ... (3) New Mexico Grantee Name. ... (4) New Mexico County Of Real Property. ... (5) Legal Description Of New Mexico Property. ... (6) Relevant Years. ... (7) Date Of New Mexico Conveyance. ... (8) New Mexico Grantor Signature.

The Estate Settlement Timeline: While New Mexico law does not specify a strict deadline for this step, it is generally recommended to do so within a month to ensure a timely start to the probate process.