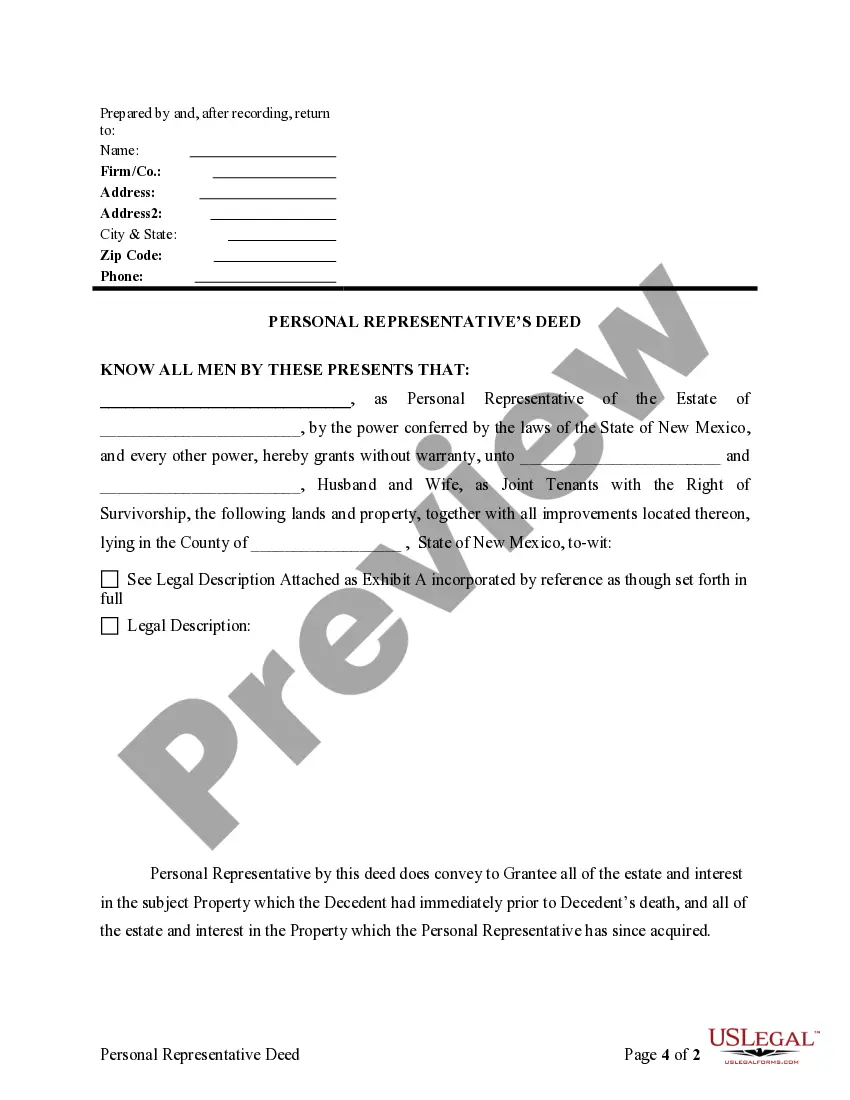

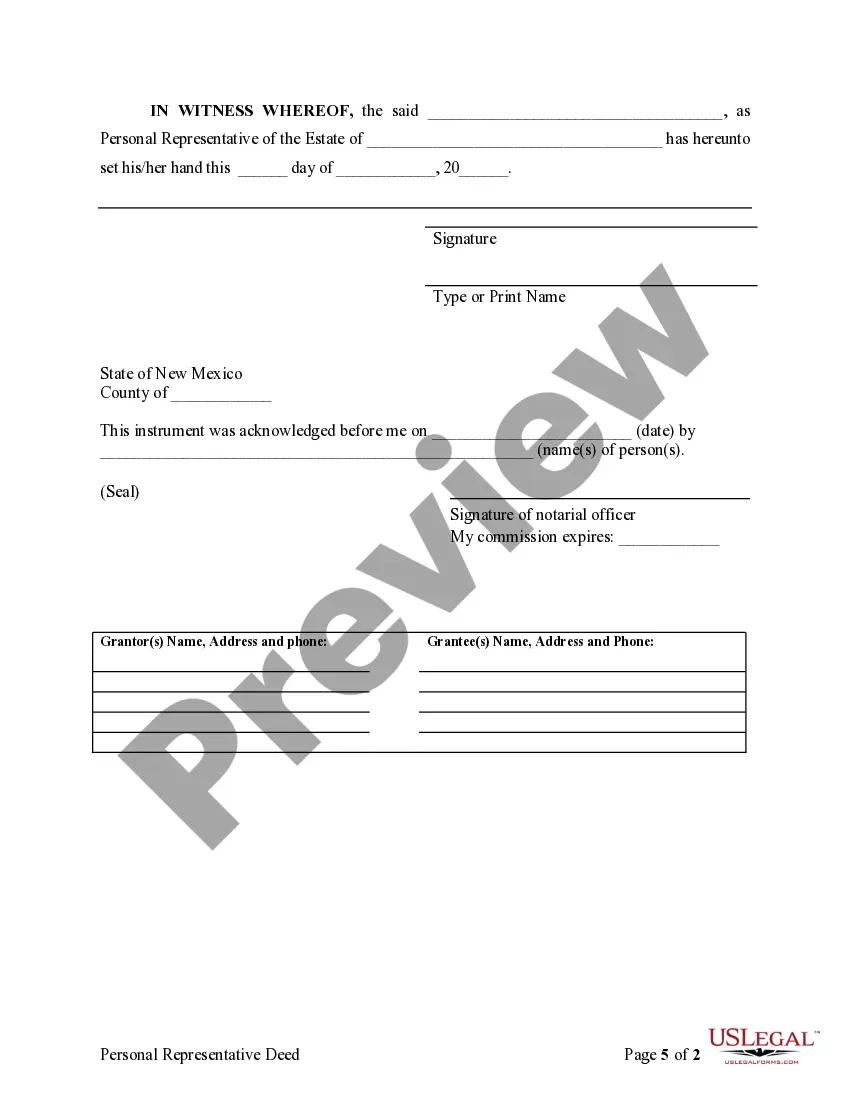

A Personal Representative Deed, also known as an Executor's Deed or Administrator's Deed, is a legal document used to transfer property from a deceased individual's estate to their heirs or beneficiaries. It is typically executed by the personal representative, executor, or administrator of the deceased's estate. In this article, we will provide you with an example of a Personal Representative Deed and explain its purpose and significance using relevant keywords and concepts. Keywords: Personal representative, deed, example, explanation, types. In general, a Personal Representative Deed is utilized when a person passes away, and their estate needs to be administered and distributed to the rightful beneficiaries or heirs. The personal representative, who is appointed by the probate court or named in the deceased's will, is responsible for managing the estate and ensuring a smooth transfer of assets, including real property. Example of a Personal Representative Deed: ------------------------------------- [Your State's Name] [County Name] PERSONAL REPRESENTATIVE DEED GRANTER: [Name of Personal Representative] CITY: [City Name], COUNTY: [County Name], STATE: [State Name] GRANTEE: [Name(s) of Beneficiaries or Heirs] CITY: [City Name], COUNTY: [County Name], STATE: [State Name] PROPERTY DESCRIPTION: Legal Description: [Provide the complete legal description of the property] Street Address: [Include the street address, if applicable] County: [County Name], State: [State Name] This Personal Representative Deed is executed on behalf of the estate of [Deceased Person's Name], hereinafter referred to as the "Granter", by the undersigned Personal Representative, [Full Name of Personal Representative], hereby referred to as the "Granter's Personal Representative." WHEREAS, the Granter passed away on [Date of Death] with a valid will, and the Granter's estate is subject to probate proceedings in [County Name], [State Name]. WHEREAS, the Granter's Personal Representative has been legally appointed by the probate court to administer the estate and distribute the assets to the beneficiaries or heirs according to the terms of the will or applicable state laws. NOW, THEREFORE, the Granter's Personal Representative, for and in consideration of the sum of [Purchase Price, if applicable] and other good and valuable considerations, hereby conveys and assigns all right, title, and interest of the Granter's estate in the aforementioned property to the Grantee. The personal representative represents and warrants that they have the authority to convey the property and that it is free and clear from all liens, encumbrances, or claims, except as otherwise stated in the will or probate proceedings. This Personal Representative Deed shall be binding upon the Granter's estate and its successors, heirs, and assigns, and shall be considered as the Granter's final act and deed in relation to the subject property. IN WITNESS WHEREOF, the Granter's Personal Representative has hereunto set their hand and seal this [Day] day of [Month], [Year]. _____________________________ [Full Name of Personal Representative] Granter's Personal Representative [Notary Acknowledgment] ------------------------------------- Explanation: A Personal Representative Deed is a vital legal instrument in the estate administration process. It allows the personal representative to transfer ownership of real property from the deceased individual's estate to the rightful beneficiaries or heirs. This type of deed ensures a clear and documented transfer of assets, protecting all parties involved and providing a foundation for title insurance. Additionally, it is important to note that there are variations of a Personal Representative Deed, such as Executor's Deed, Administrator's Deed, or Probate Deed, which might be used interchangeably based on the specific circumstances and the terminology used in each jurisdiction. In conclusion, a Personal Representative Deed serves as a legal mechanism to facilitate the distribution of real property from a deceased individual's estate. It provides a transfer of ownership from the personal representative to the beneficiaries or heirs, ensuring a smooth and transparent process of asset distribution.

Personal Representative Deed Example With Explanation

Description

How to fill out Personal Representative Deed Example With Explanation?

Using legal document samples that comply with federal and regional regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the correctly drafted Personal Representative Deed Example With Explanation sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all files organized by state and purpose of use. Our specialists keep up with legislative updates, so you can always be confident your form is up to date and compliant when acquiring a Personal Representative Deed Example With Explanation from our website.

Obtaining a Personal Representative Deed Example With Explanation is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the instructions below:

- Examine the template using the Preview feature or via the text description to ensure it fits your needs.

- Look for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Personal Representative Deed Example With Explanation and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Hear this out loud PauseIt is legal and often common for a personal representative to be a beneficiary of the estate for which they are the executor. The law requires personal representatives to follow the terms of the deceased person's will (assuming that the individual who died had a will).

The Find property information (FPI) service allows citizens to download a summary of information about a property including the address, title number, current owner's name and address, what they paid for the property, whether it is freehold or leasehold, if there is a mortgage on the property and the lender's contact ...

Yes, it's quite common for the personal representative to also be the beneficiary. Oftentimes, that personal representative/beneficiary is a surviving spouse or immediate family member.

To transfer the property to a beneficiary, you'll need to complete: form AS1 - Whole of registered title: assent. ... If beneficiaries are buying others out, then a form TR1 Registered title(s): whole transfer is required in place of form AS1 [See also below for additional requirement] form AP1 - Change the register.

Hear this out loud PauseAs a personal representative (an executor or administrator) you're legally responsible for the money, property and possessions of the person who died (the 'estate's assets'). You're responsible for the assets from the date of death until the date everything has been passed on to the beneficiaries.