Personal Representative Deed Example With Explanation

Description

How to fill out New Mexico Quitclaim Deed For Personal Representative's Deed?

Utilizing legal document samples that adhere to federal and state regulations is crucial, and the web provides numerous alternatives to choose from.

However, what is the purpose of spending time searching for the accurately composed Personal Representative Deed Example With Explanation sample online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable templates created by attorneys for any professional and personal scenario.

Review the template using the Preview function or through the text description to ensure it meets your requirements. Search for another sample utilizing the search tool at the top of the page if necessary. Click Buy Now once you’ve located the appropriate form and choose a subscription option. Create an account or Log In and process payment via PayPal or a credit card. Select the format for your Personal Representative Deed Example With Explanation and download it. All templates available through US Legal Forms are reusable. To redownload and fill out previously acquired forms, access the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal documentation service!

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts monitor legislative changes, ensuring you can always trust that your form is current and compliant when obtaining a Personal Representative Deed Example With Explanation from our site.

- Acquiring a Personal Representative Deed Example With Explanation is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in your desired format.

- If you are a newcomer to our site, follow the steps outlined below.

Form popularity

FAQ

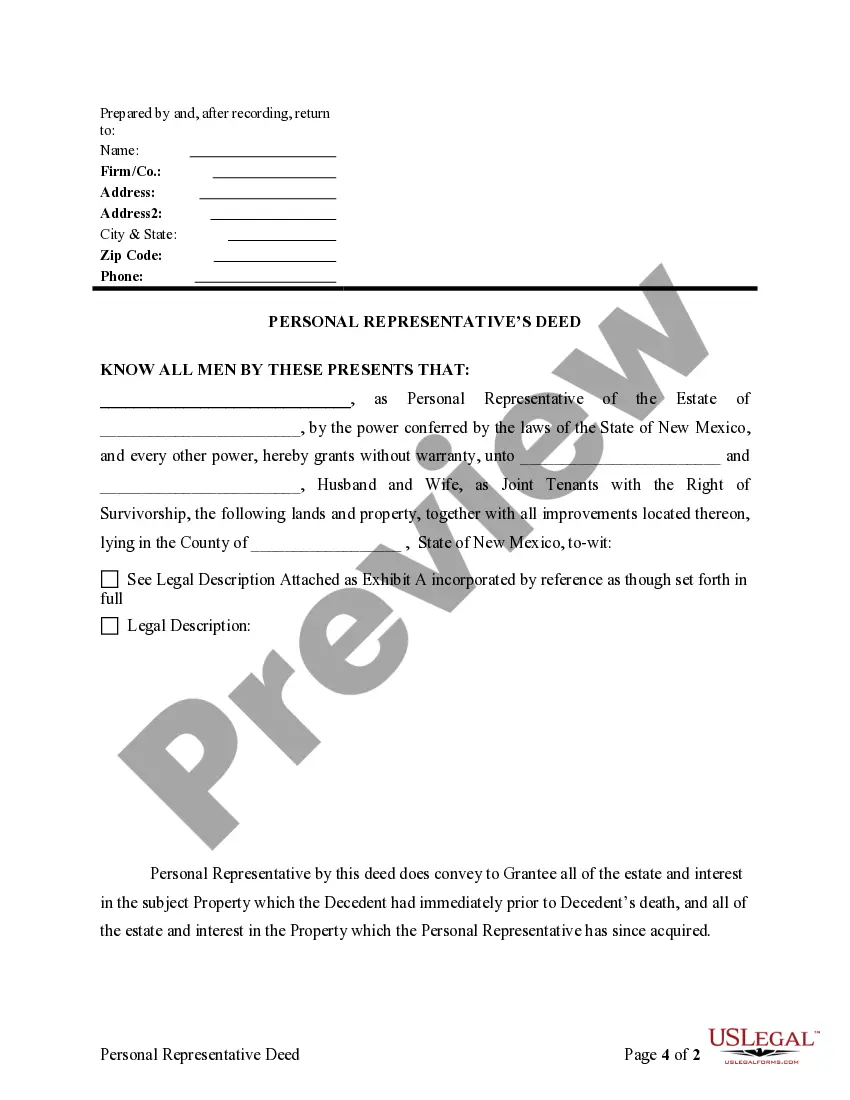

Hear this out loud PauseIt is legal and often common for a personal representative to be a beneficiary of the estate for which they are the executor. The law requires personal representatives to follow the terms of the deceased person's will (assuming that the individual who died had a will).

The Find property information (FPI) service allows citizens to download a summary of information about a property including the address, title number, current owner's name and address, what they paid for the property, whether it is freehold or leasehold, if there is a mortgage on the property and the lender's contact ...

Yes, it's quite common for the personal representative to also be the beneficiary. Oftentimes, that personal representative/beneficiary is a surviving spouse or immediate family member.

To transfer the property to a beneficiary, you'll need to complete: form AS1 - Whole of registered title: assent. ... If beneficiaries are buying others out, then a form TR1 Registered title(s): whole transfer is required in place of form AS1 [See also below for additional requirement] form AP1 - Change the register.

Hear this out loud PauseAs a personal representative (an executor or administrator) you're legally responsible for the money, property and possessions of the person who died (the 'estate's assets'). You're responsible for the assets from the date of death until the date everything has been passed on to the beneficiaries.