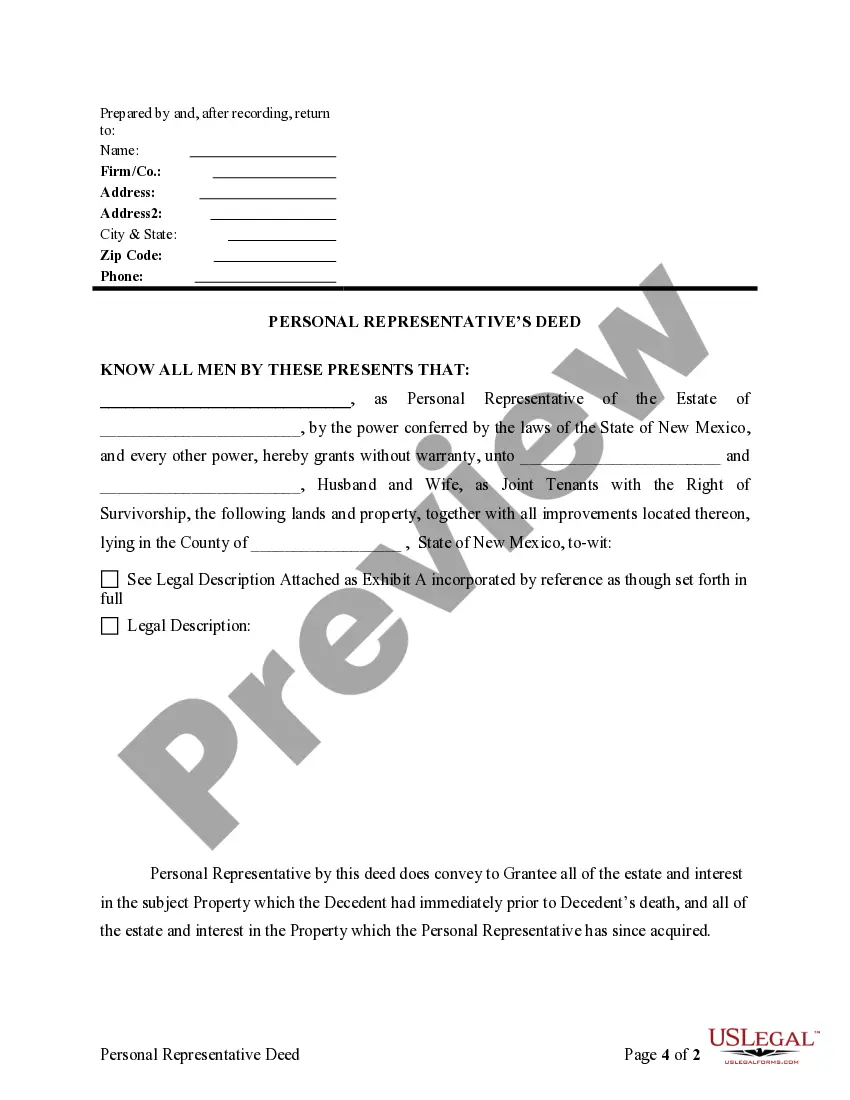

Title: Understanding Personal Representative Deed Examples with Distribution: Types and Detailed Description Introduction: In estate planning and administration, a Personal Representative Deed with Distribution is a legal document used to transfer assets from a deceased individual's estate to the designated beneficiaries. This comprehensive guide explains the concept of a Personal Representative Deed, provides examples, and outlines different distribution types associated with this deed. 1. Basic Description of a Personal Representative Deed: A Personal Representative Deed, also known as an Executor's Deed or Administrator's Deed, is a document executed by the personal representative (executor or administrator) of an estate. It establishes the legal authority of the representative to transfer and distribute the deceased person's property to the rightful beneficiaries. 2. Examples of Personal Representative Deed with Distribution: a. Specific Distribution: This type of distribution outlines the specific assets allocated to each beneficiary as mentioned in the decedent's will or as determined by intestate succession laws when no will exists. For instance, a person's will might specify that their house goes to their spouse and their investment portfolio is split equally among their children. b. Proportional Distribution: In some cases, the personal representative may need to distribute the assets according to a specific ratio or percentage mentioned in the will. For example, if the estate consists of real estate and financial holdings, the will may state that 70% goes to the spouse and 30% is divided among the children. c. Alternate Distribution: In situations where the primary beneficiaries mentioned in the will are unable to receive their share due to various reasons, alternate provisions come into effect. These may include contingent beneficiaries, charitable organizations, or other individuals specified in the will as secondary beneficiaries. d. Partial Distribution: Sometimes, a personal representative may need to make partial distributions if certain assets require immediate transfer before the completion of the probate process. For instance, if the will specifies that a car or a bank account should be transferred immediately to a particular beneficiary, the personal representative can distribute those assets early on. e. Final Distribution: Once all debts, taxes, expenses, and claims of the estate have been settled, the personal representative will execute the final distribution. This involves the distribution of the remaining assets of the estate among the beneficiaries as outlined in the will or guided by intestate laws if no will exists. Conclusion: Understanding the Personal Representative Deed with Distribution is crucial for ensuring a smooth transfer of a deceased person's property to the respective beneficiaries. This document, along with its various distribution types (specific, proportional, alternate, partial, and final), enables the personal representative to execute the decedent's wishes while adhering to legal requirements. Seek professional legal advice to create an accurate and enforceable Personal Representative Deed.

Personal Representative Deed Example With Distribution

Description

How to fill out Personal Representative Deed Example With Distribution?

Legal document managing might be overwhelming, even for the most skilled experts. When you are interested in a Personal Representative Deed Example With Distribution and do not get the time to devote in search of the correct and updated version, the procedures may be stressful. A strong online form catalogue could be a gamechanger for anyone who wants to handle these situations efficiently. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you might have, from personal to organization paperwork, all-in-one spot.

- Make use of innovative resources to complete and control your Personal Representative Deed Example With Distribution

- Access a useful resource base of articles, instructions and handbooks and resources connected to your situation and requirements

Save time and effort in search of the paperwork you will need, and use US Legal Forms’ advanced search and Preview tool to find Personal Representative Deed Example With Distribution and acquire it. If you have a membership, log in for your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to view the paperwork you previously saved as well as to control your folders as you can see fit.

Should it be the first time with US Legal Forms, register an account and have unlimited use of all benefits of the library. Here are the steps to consider after getting the form you need:

- Confirm it is the right form by previewing it and reading through its description.

- Ensure that the sample is recognized in your state or county.

- Choose Buy Now when you are all set.

- Choose a subscription plan.

- Pick the format you need, and Download, complete, sign, print out and send your document.

Benefit from the US Legal Forms online catalogue, supported with 25 years of expertise and stability. Enhance your day-to-day document management in a smooth and intuitive process today.

Form popularity

FAQ

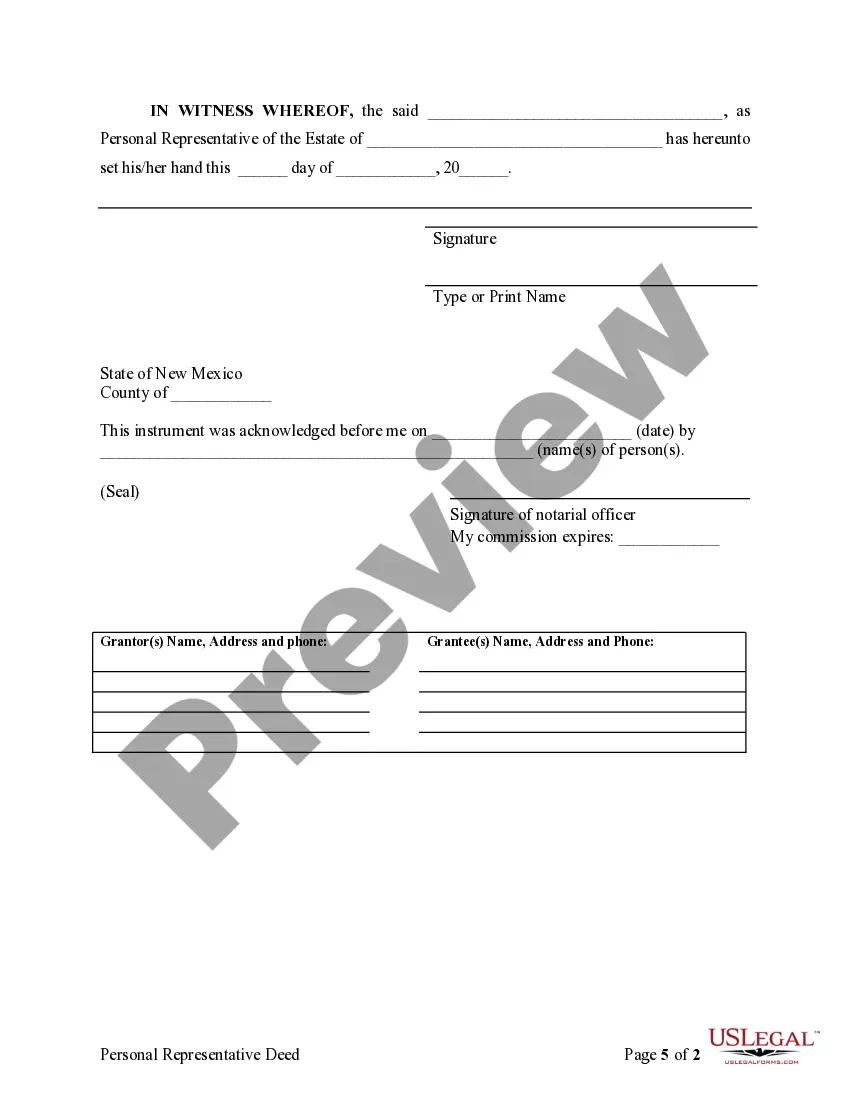

In South Carolina a Deed of Distribution releases real property such as a house or land from the deceased persons name to the name of the beneficiary. This is usually one of the last steps in the probate procedure and is done after the eight month creditor period has expired.

Deed of Distribution: The DEED OF DISTRIBUTION must be used to transfer any real estate/real property. After all claims have been settled and you are ready to transfer the property to someone, you need to fill out the DEED OF DISTRIBUTION and record it with the County Recorder.

Proof that a distributee has received an instrument or deed of distribution of assets in kind, or payment in distribution, from a personal representative, is conclusive evidence that the distributee has succeeded to the interest of the estate in the distributed assets, as against all persons interested in the estate, ...

A copy of the recorded Deed of Distribution needs to be filed at the Probate Court. Real property located in other South Carolina counties will require the Deed of Distribution be recorded in that location. You should then deliver the recorded Deed of Distribution to the new owners of the property.