Sale Motors

Description

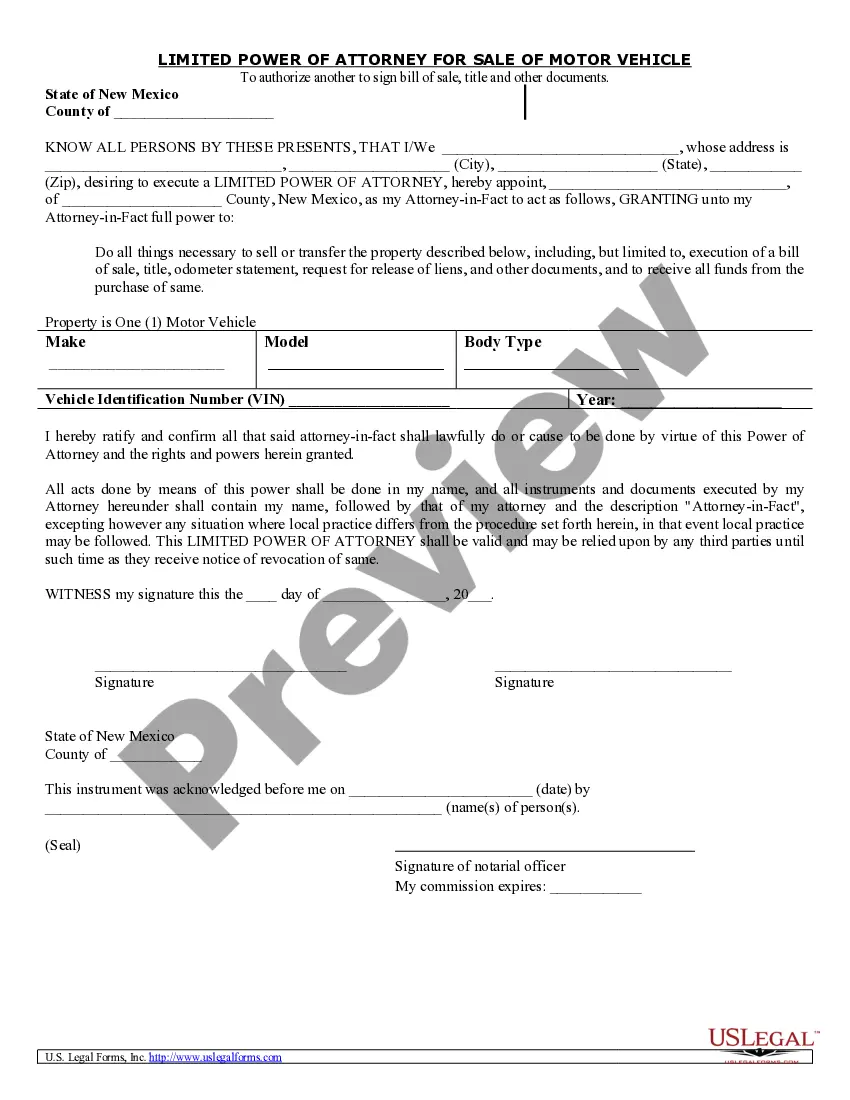

How to fill out New Mexico Power Of Attorney For Sale Of Motor Vehicle?

- If you're a returning user, log in to your account at US Legal Forms and navigate to the 'My Forms' section to download any previously acquired templates.

- For first-time users, begin by exploring the available document previews. Verify that the selected form aligns with your jurisdiction requirements.

- If the form doesn't meet your needs, utilize the search function to find a more suitable template.

- Once you find the correct document, click the 'Buy Now' button and choose your preferred subscription plan to gain access to the full library.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- After payment, download your form. You can easily access it anytime from the 'My Forms' menu in your profile.

In conclusion, US Legal Forms simplifies the process of obtaining essential legal documents. With a vast library offering over 85,000 forms, you can ensure your documents are complete and compliant with local laws.

Start your hassle-free experience today by visiting US Legal Forms and find the legal solutions you need!

Form popularity

FAQ

Yes, car sales can get reported to the IRS, especially if they involve substantial transactions. When dealing with sale motors, understanding the reporting requirements is essential to avoid issues later. Keeping thorough documentation will help you navigate this process effectively.

Claiming sales tax can potentially lower your taxable income, making it a worthy consideration. If you frequently engage in sale motors, documenting these expenses can ensure you maximize your deductions. Be sure to maintain accurate records to support your claims.

Claiming sales tax can be beneficial, especially if you have large purchases or recurring transactions. For instance, sale motors may involve significant amounts where tax claims can offer deductions. Assess your financial situation to determine if claiming sales tax is advantageous for you.

Refunding sales tax can depend on various circumstances, such as the nature of the sale and applicable statutes. If a transaction related to sale motors results in a return or cancellation, you might be required to refund the sales tax. Always check your local regulations to ensure compliance.

If your hobby involves selling items regularly, you may need to collect sales tax. In the context of sale motors, if you sell vehicles as a part of your hobby, it's crucial to understand your local laws. Utilizing platforms like uslegalforms can guide you in determining your tax obligations.

Yes, you must report the sale of your car on your taxes, especially if you made a profit. When you sell a vehicle, specifically in the realm of sale motors, the IRS expects you to report any gain. It's best to keep detailed records of the transaction to ensure a smooth reporting process.

Sales tax can provide crucial funding for public services like education and infrastructure. When dealing with sale motors, understanding the implications of sales tax can help you make informed decisions. It's important to recognize how sales tax impacts both buyers and sellers in the automotive market.

Getting a sales job at a car dealership involves a few key steps. First, present yourself professionally with a well-crafted resume that emphasizes your customer service experience. Next, visit local dealerships and express your interest directly. Platforms like USLegalForms can assist you in finding specific listings for sales jobs in the field of sale motors.

To land a job selling cars at a dealership, start by researching local dealerships and understanding their sales motors strategies. Prepare your resume highlighting relevant skills and experiences, even if they come from other customer-focused environments. Reach out directly to dealerships, attend job fairs, and utilize platforms like USLegalForms to explore potential openings.

Yes, you can secure a job at a car dealership even without prior experience. Many dealerships offer entry-level positions for individuals looking to start a career in sales motors. Focus on showcasing your enthusiasm, willingness to learn, and strong customer service skills. Networking and applying through platforms like USLegalForms can help you find the right opportunities.