New Mexico Corporation Dissolution Without Tax

Description

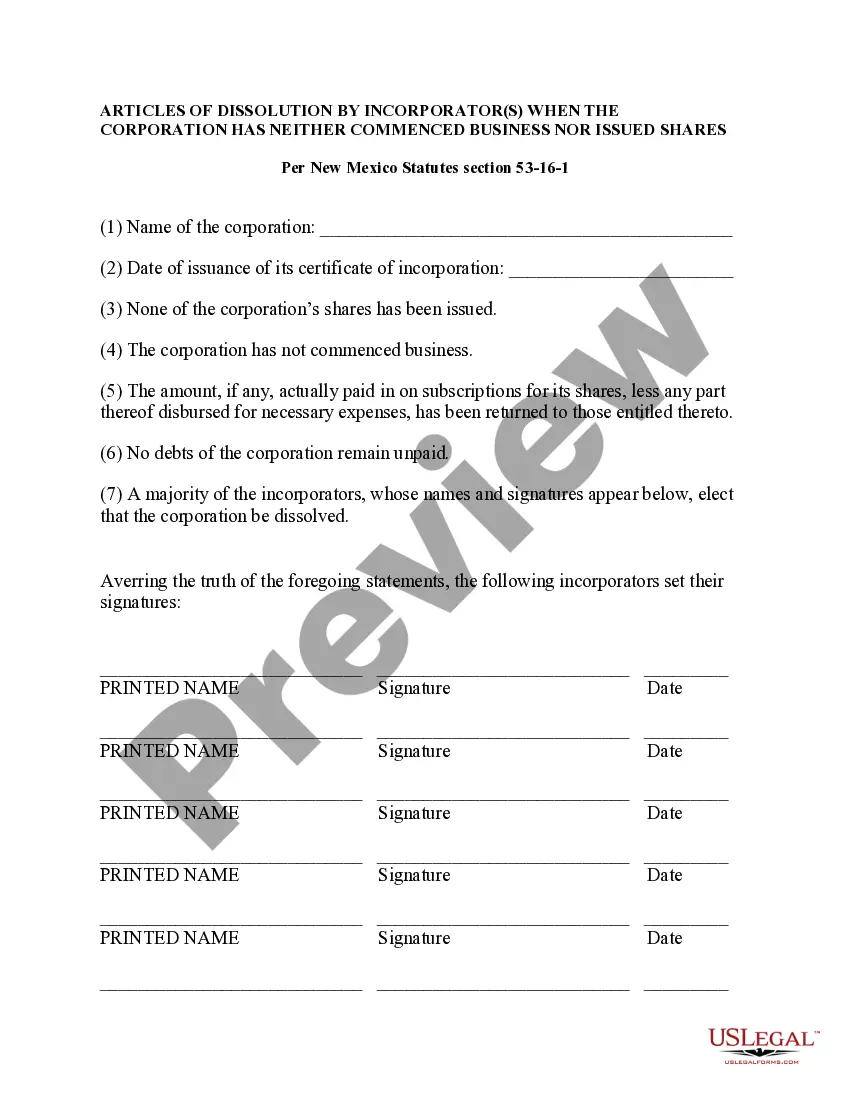

How to fill out New Mexico Dissolution Package To Dissolve Corporation?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of working with bureaucracy. Choosing the right legal documents demands accuracy and attention to detail, which explains why it is vital to take samples of New Mexico Corporation Dissolution Without Tax only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the information regarding the document’s use and relevance for the situation and in your state or region.

Consider the following steps to finish your New Mexico Corporation Dissolution Without Tax:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s information to see if it suits the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Get back to the search and locate the right document if the New Mexico Corporation Dissolution Without Tax does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Select the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading New Mexico Corporation Dissolution Without Tax.

- Once you have the form on your gadget, you may change it using the editor or print it and complete it manually.

Get rid of the inconvenience that accompanies your legal paperwork. Check out the extensive US Legal Forms collection to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

Notify the Taxation and Revenue Department of your close-of-business date by logging in to your administrator account online profile in the TAP system. Click ?more account options? under the BTIN you wish to close. Under the ?Manage my account? cube, click ?close account?.

To dissolve your New Mexico corporation you must file both the Statement of Intent to Dissolve and the Articles of Dissolution. Each one requires a $50 filing fee. Payment must be made by check or money order. You may expedite processing of your dissolution by the PRC.

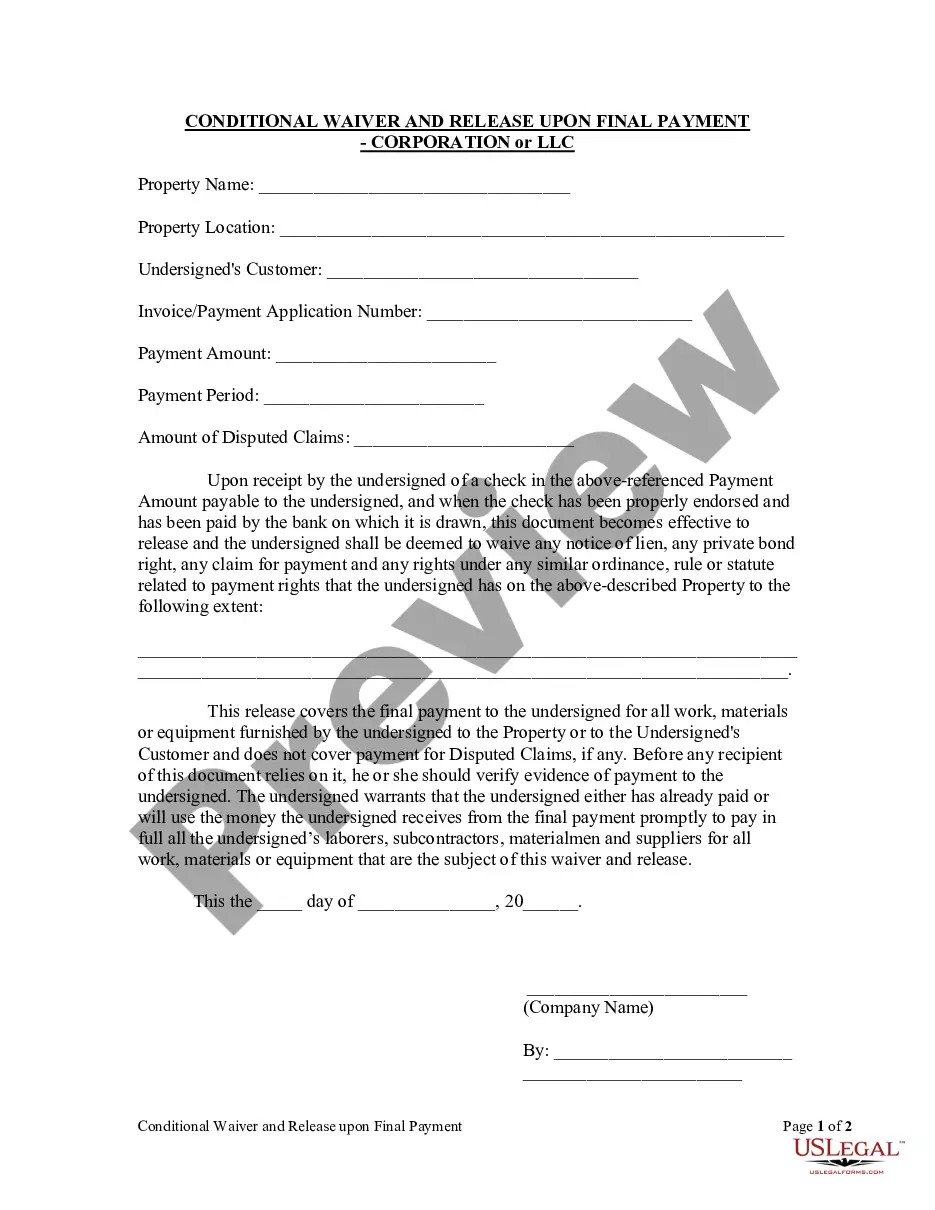

Failure to dissolve your business can also leave you open to forms of business fraud, such as business identity theft. Step 1: Get approval of the owners of the corporation or LLC. ... Step 2: File the Certificate of Dissolution with the state. ... Step 3: File federal, state, and local tax forms. ... Step 4: Wind up affairs.

If you're shutting your business down completely, you must file Articles of Dissolution to terminate your company's existence. If you discontinue business in a state where you had foreign qualified, you must file Articles of Withdrawal to avoid fines, penalties, and a potential loss of liability protection.

Taxes and Dissolution Most states require that corporations either pay their outstanding debts or make arrangements to do so prior to being granted a voluntary dissolution. Even if the corporation is involuntarily dissolved or dissolved by court order, however, it is still responsible for its taxes.