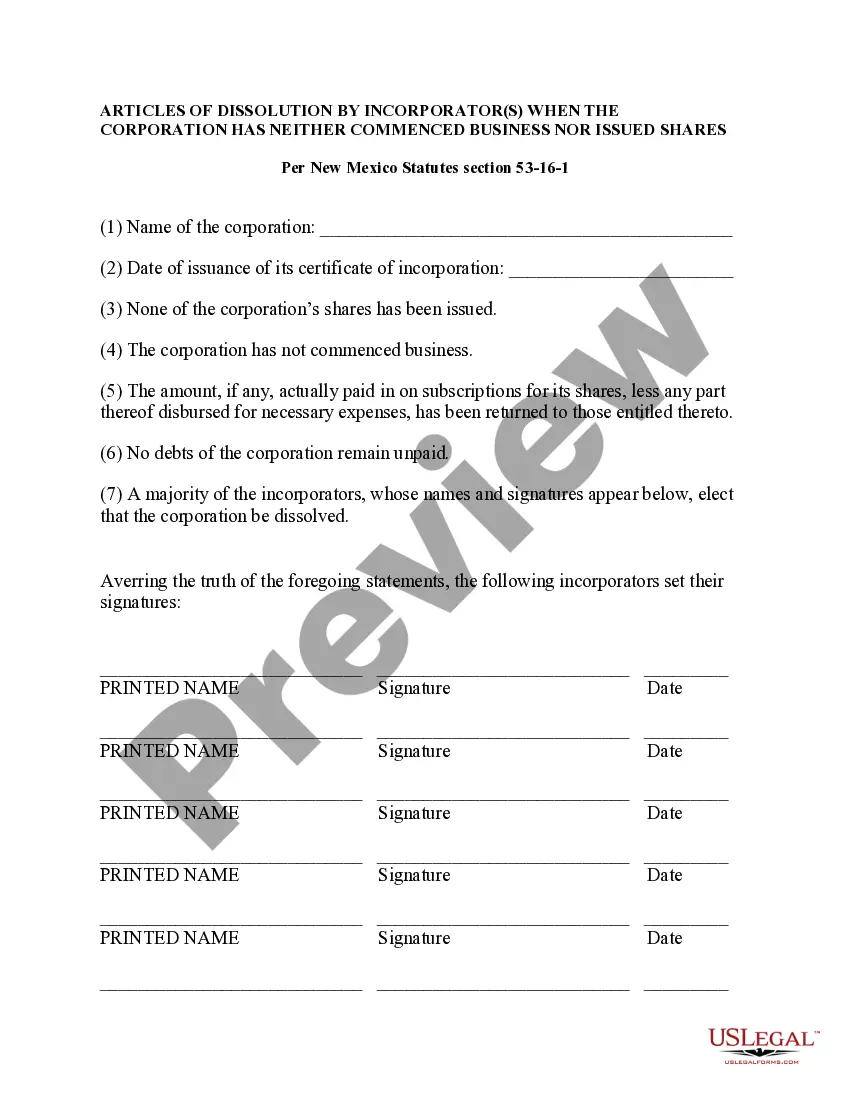

New Mexico Corporation Dissolution for LLC: A Detailed Description When it comes to dissolving a limited liability company (LLC) in the state of New Mexico, it is essential to understand the process and the various types of dissolution available. As a business owner, you may find it necessary to dissolve your LLC due to a variety of reasons, such as a change in business direction, owner disagreement, or financial difficulties. New Mexico recognizes two main types of dissolution for LCS: voluntary dissolution and administrative dissolution. 1. Voluntary Dissolution: Voluntary dissolution is initiated by the LLC members, signifying their unanimous agreement to close the company. This process often requires compliance with specific legal procedures set forth by the New Mexico Secretary of State and the LLC's operating agreement. Some key steps involved in voluntary dissolution include: a. Member Approval: All LLC members must agree, either through a written and signed resolution or during a formal meeting, that the dissolution is in the best interest of the company. b. Remaining Obligations: The LLC must settle all outstanding debts, taxes, and legal obligations before proceeding with dissolution. This includes filing and paying any outstanding tax returns, resolving pending lawsuits, and notifying creditors regarding the dissolution process. c. Articles of Dissolution: A formal document called the "Articles of Dissolution" must be filed with the New Mexico Secretary of State. This document should include the LLC's name, date of dissolution, and the signatures of all LLC members or managers. 2. Administrative Dissolution: On the other hand, administrative dissolution is an involuntary dissolution initiated by the state authorities. It may occur if an LLC fails to comply with annual report filings, pay taxes, maintain a registered agent, or otherwise fulfill its legal obligations. The New Mexico Secretary of State has the authority to administratively dissolve an LLC if it fails to rectify such non-compliance within a specific timeframe. If an LLC undergoes administrative dissolution, it is crucial to address the issue promptly to avoid potential legal consequences. The LLC members or managers must correct any outstanding compliance issues, file the required documents, and pay any outstanding fees or penalties to reinstate the LLC. In summary, whether you choose voluntary dissolution or face administrative dissolution, both processes involve specific steps that need to be followed to legally close or reactivate an LLC in New Mexico. It is highly advisable to consult with a qualified attorney or a certified public accountant (CPA) familiar with the dissolution and restoration procedures to ensure compliance with all legal requirements.

New Mexico Corporation Dissolution For Llc

Description

How to fill out New Mexico Corporation Dissolution For Llc?

Accessing legal document samples that meet the federal and regional regulations is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the appropriate New Mexico Corporation Dissolution For Llc sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are simple to browse with all documents collected by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when acquiring a New Mexico Corporation Dissolution For Llc from our website.

Getting a New Mexico Corporation Dissolution For Llc is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the steps below:

- Take a look at the template using the Preview option or through the text description to ensure it meets your requirements.

- Locate another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your New Mexico Corporation Dissolution For Llc and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

How to Dissolve an LLC in New Mexico ??Vote to Dissolve the LLC. An LLC is different from a corporation in that all LLC members must agree to dissolve an LLC before it happens. ... File Articles of Dissolution. ... Cancel Permits and Licenses. ... Cancel EIN and Pay off Debts.

How do you dissolve a New Mexico Limited Liability Company? To dissolve your LLC in New Mexico, file Form DLLC-DV, Articles of Dissolution and a duplicate copy with the Public Regulation Commission (PRC). The form is available online (see link below).

Dissolving an LLC in New Mexico comes with a $25 filing fee for submitting the Articles of Dissolution to the Secretary of State. However, there may be additional costs for same-day processing, tax advice, and settling obligations with your registered agent.

Usually this involves a vote by the board of directors and another by the shareholders, but more or less may be required depending on the local laws and the articles of incorporation. Second, one must satisfy the required filings and fees for the federal and state governments in which the business is registered.

To dissolve your New Mexico corporation you must file both the Statement of Intent to Dissolve and the Articles of Dissolution. Each one requires a $50 filing fee. Payment must be made by check or money order. You may expedite processing of your dissolution by the PRC.