Quit Claim Deed

Description

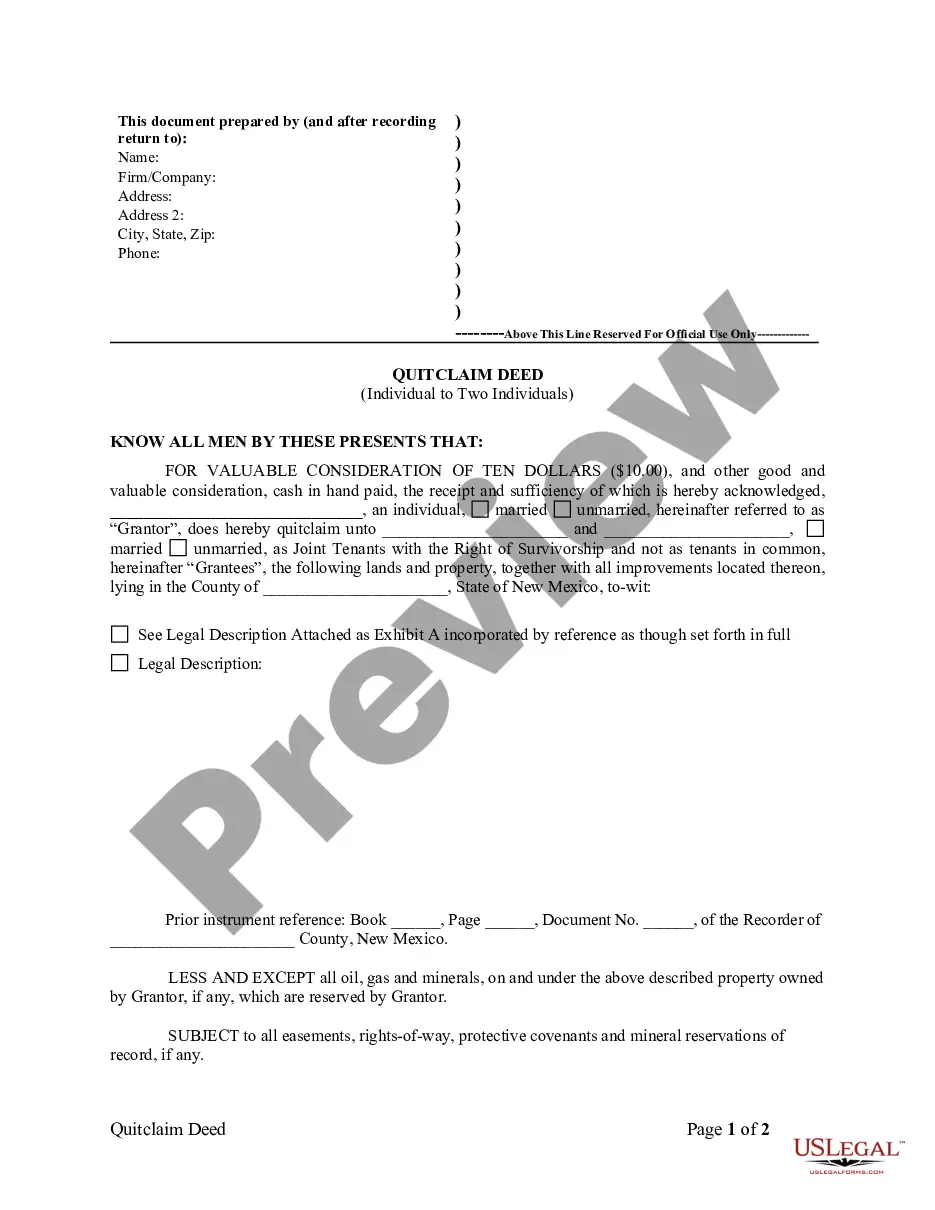

How to fill out New Mexico Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

- For existing users, log into your account on the US Legal Forms website and click the Download button for your quit claim deed template. Ensure your subscription is active, and renew if necessary.

- If you are a new user, start by checking the Preview mode and reading the form description to select the correct quit claim deed that meets your local jurisdiction requirements.

- If the chosen template doesn’t meet your needs, use the Search tab to find other options tailored to your circumstances.

- Once satisfied with your selection, click the Buy Now button to select your preferred subscription plan. You will need to create an account to access the library of forms.

- Input your payment details, either via credit card or PayPal, to finalize your transaction.

- After purchase, download your quit claim deed to your device. You can always find it later in the My Forms section of your profile.

By leveraging US Legal Forms, you ensure that you have access to a vast collection of legal templates, making property transactions simpler and more reliable.

Don’t delay in securing your legal documents. Visit US Legal Forms today to get started with your quit claim deed!

Form popularity

FAQ

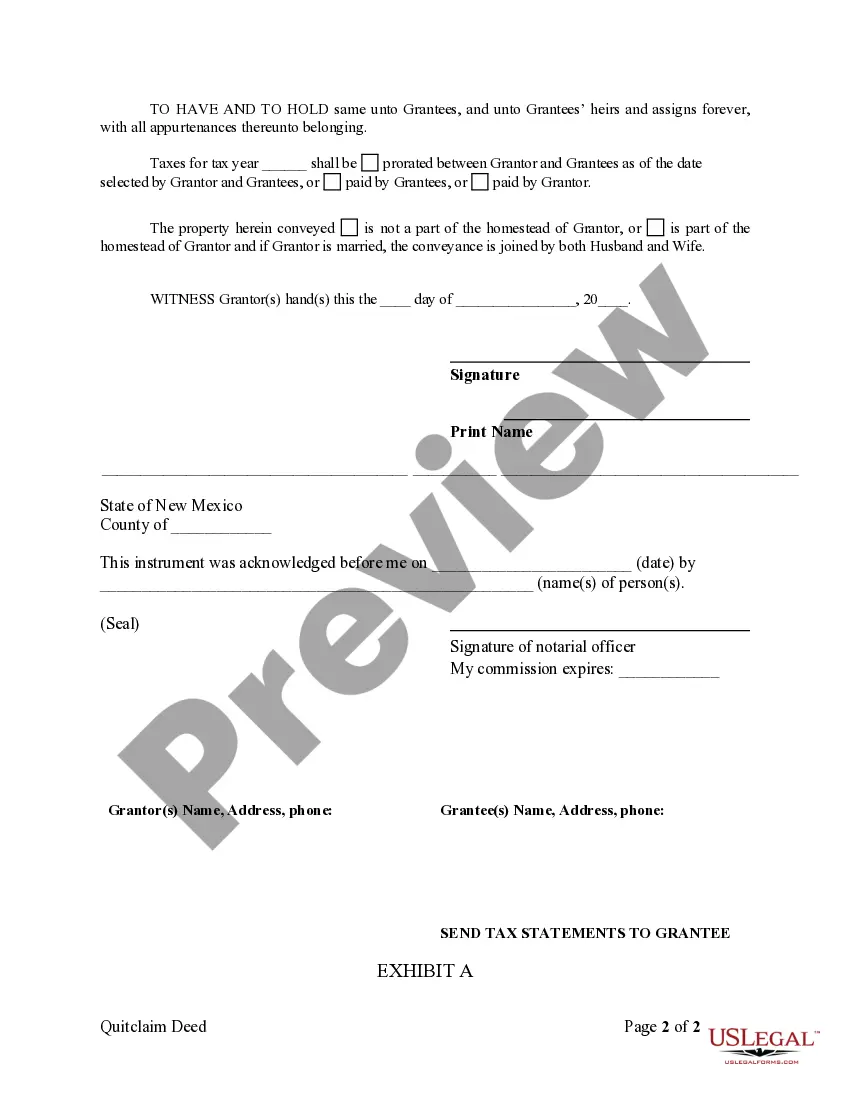

Filling out a quitclaim deed involves a few essential steps. First, ensure you have the correct property description and the names of both the grantor and grantee. Next, include any relevant information such as the date of transfer and sign the document in front of a notary public. If you seek clarity and accuracy, consider using US Legal Forms, which offers templates and guidance for completing a quitclaim deed effectively.

The most common use of a quitclaim deed involves transferring property ownership between family members or friends. It provides a straightforward method for individuals to change property titles without the need for extensive legal formalities. In many cases, people use quitclaim deeds during estate planning or resolving property disputes. Remember, while it makes transfers easier, a quitclaim deed does not protect against title defects.

An example of a quitclaim deed could involve a parent transferring a house to their child. In this case, the parent, as the grantor, signs the quitclaim deed, effectively passing any ownership rights to the child, the grantee. This transfer occurs without any guarantees about the title's status, making it crucial to trust the parties involved. If you consider this type of transfer, ensure you understand both the benefits and limitations of a quitclaim deed.

The most common reason for utilizing a quitclaim deed is to clear up any potential title issues quickly and efficiently. Often, it helps transfer property between family members or in divorce situations where one party wishes to relinquish their ownership. Additionally, it can transfer rights without involving complex legal processes. Hence, if you need a straightforward option to transfer your interests, a quitclaim deed might be the solution.

In Minnesota, a quitclaim deed transfers ownership of property without guaranteeing the title's validity. Essentially, the person transferring the property, known as the grantor, relinquishes any claim they have to the property. This type of deed is often used among family members or in situations where the parties trust each other. Using a quitclaim deed simplifies the transfer process but does not provide any warranty against future claims.

The disadvantages of a quit claim deed primarily stem from the lack of legal protections for the recipient. This type of deed does not verify ownership or disclose any existing claims against the property, which could lead to disputes later. Moreover, quit claim deeds do not provide recourse if issues arise after the transfer. To navigate these challenges, utilizing resources like US Legal Forms can help you draft an effective quit claim deed while ensuring all legal bases are covered.

One of the significant negatives of a quit claim deed is that it offers no protection to the buyer. Since the grantor does not guarantee the property title, the buyer may face legal issues related to ownership or liens without recourse. Additionally, this type of deed can lead to complications during a sale or refinance, as lenders typically prefer more secure options. If you're considering a quit claim deed, be sure to consult with a legal expert or explore templates available at US Legal Forms to ensure you understand the implications.

The main purpose of a quit claim deed is to transfer ownership of property without any warranty or guarantee. This means that the person transferring the property, known as the grantor, only conveys their interest and does not assure that the title is clear. Quit claim deeds are commonly used between family members or in divorce situations when property must change hands quickly. If you need to create a quit claim deed, US Legal Forms provides the necessary documents and guidance to facilitate this process.

A quit claim deed cannot be used if there are existing mortgages on the property that need to be addressed or if the property is subject to a divorce settlement that prohibits such transfers. Furthermore, quit claim deeds are not suitable for transferring property as part of a sale where warranties are required. It's essential to evaluate the situation and choose the proper method of transfer for effective property management.

Yes, you can execute a quit claim deed yourself, but it is essential to follow proper procedures to ensure its validity. You should prepare the document accurately and understand the legal responsibilities involved. Using templates and guidance from platforms like US Legal Forms can help you create a valid quit claim deed without hiring an attorney.