Transfer On Death Deed For New Mexico

Description

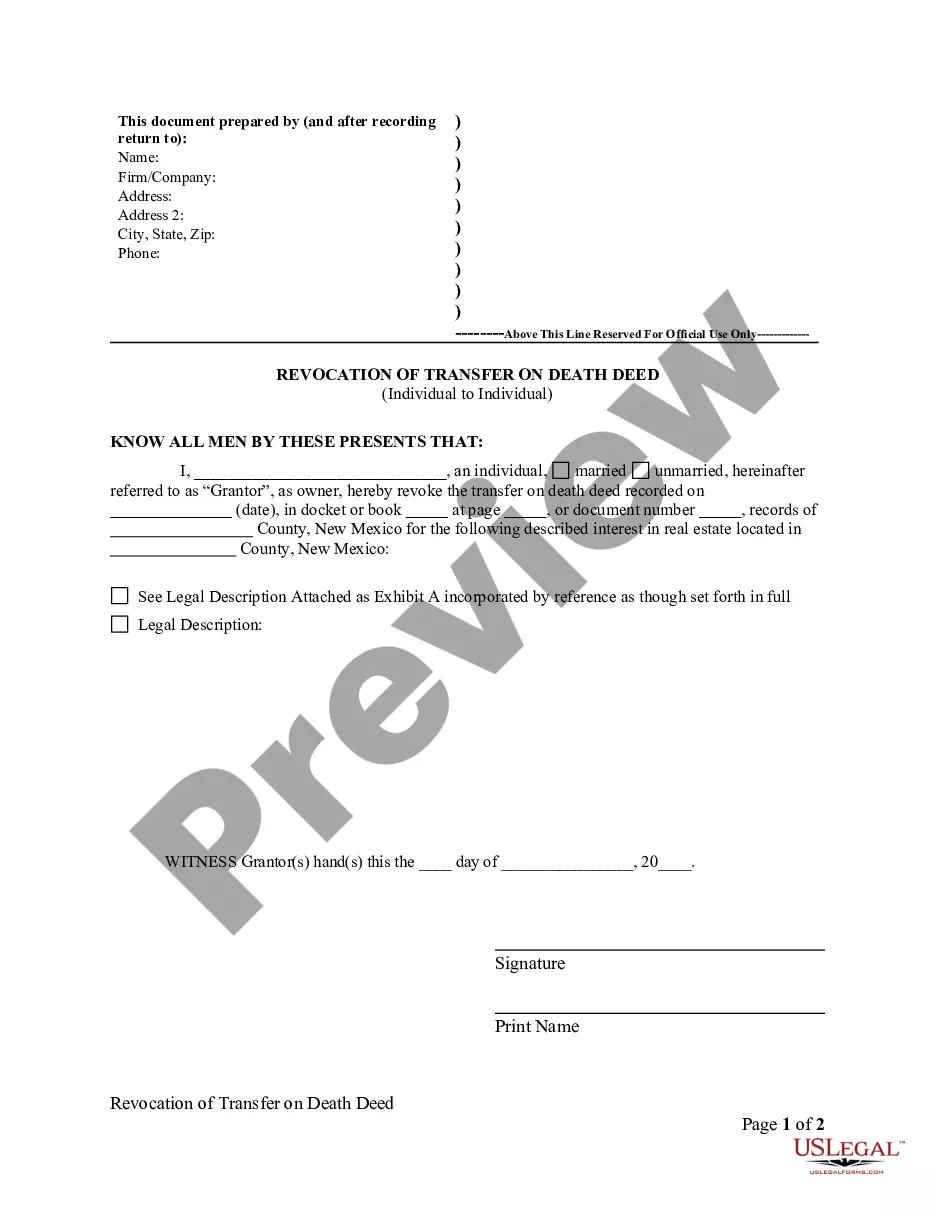

How to fill out New Mexico Revocation Of Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Individuals frequently link legal documents with something complex that solely a specialist can handle.

In a sense, this is accurate, as preparing a Transfer On Death Deed for New Mexico requires considerable knowledge of subject matter, including state and county laws.

Nevertheless, with US Legal Forms, tasks have become easier: ready-to-use legal templates for any life and business event tailored to state regulations are compiled in one online catalog and are now accessible to all.

Log In or create an account to move on to the payment page. Complete your subscription payment via PayPal or a credit card. Download your sample in the chosen format. You can print your document or upload it to an online editor for quicker completion. All templates in our catalog are reusable; once purchased, they are retained in your profile. You can access them whenever necessary via the My documents tab. Discover all the benefits of the US Legal Forms platform. Enroll today!

- US Legal Forms offers over 85,000 current forms categorized by state and application area, making it simple to search for a Transfer On Death Deed for New Mexico or any other specific template in just a few minutes.

- Previous users with an active subscription must Log In to their account and click Download to obtain the form.

- New users will need to first create an account and subscribe before they can save any document.

- Here’s a detailed guide on how to obtain the Transfer On Death Deed for New Mexico.

- Review the page content carefully to ensure it satisfies your requirements.

- Check the form description or view it using the Preview feature.

- If the previous sample doesn’t meet your needs, find another one through the Search bar above.

- Once you identify the appropriate Transfer On Death Deed for New Mexico, click Buy Now.

- Select a subscription plan that aligns with your needs and budget.

Form popularity

FAQ

The best way to transfer property after death in New Mexico is through a transfer on death deed. This legal document allows property owners to designate beneficiaries who will receive the property without going through probate. The transfer on death deed for New Mexico streamlines the process, ensuring that your loved ones inherit your assets efficiently. Additionally, utilizing the US Legal platform can simplify the creation of this deed, making it accessible and straightforward for you.

Yes, New Mexico allows a Transfer on Death deed, which lets property owners designate beneficiaries to receive their property automatically upon their death. This straightforward process eliminates the need for probate and streamlines the transfer of real estate. Using a Transfer on Death deed for New Mexico is an efficient way to ensure that your property passes directly to your chosen heirs without unnecessary legal complications.

To avoid probate in New Mexico without a will, consider using methods such as setting up a Transfer on Death deed for New Mexico. This allows you to designate beneficiaries who will receive your property directly upon your death, bypassing the probate process entirely. Additionally, joint ownership and certain types of trusts can offer alternative solutions to keep assets from going through probate.

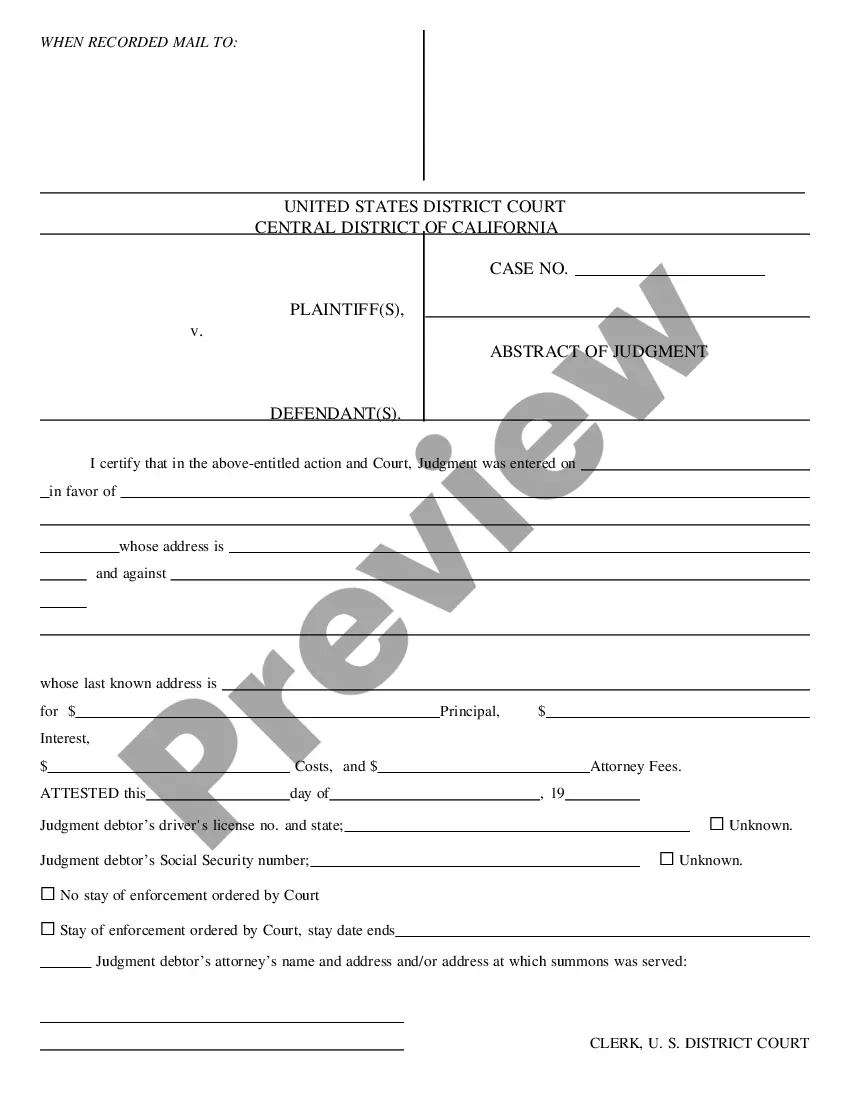

To transfer a property deed from a deceased relative in New Mexico, you will need to follow the legal process of probate unless a Transfer on Death deed for New Mexico is already in place. If a probate is required, you’ll need to file the will with the court, gather relevant documents, and adhere to state procedures to distribute the assets. Engaging with professionals, like those from US Legal Forms, can guide you through this process smoothly.

When there is no will in New Mexico, the state laws of intestacy will determine the heirs to the estate. Generally, the estate passes to the surviving spouse and children, if any, followed by other relatives in order of priority. This can lead to delays and disputes, which a Transfer on Death deed for New Mexico can help avoid by clearly designating beneficiaries in advance.

In New Mexico, you typically have nine months from the date of death to transfer property if it’s subject to estate taxes, or you can take your time if not. However, it is essential to act swiftly to avoid complications, especially regarding property that may require maintenance or management. A Transfer on Death deed for New Mexico provides an effective way to ensure the transition of property ownership without delay after death.

To transfer a deed in New Mexico, you must complete a deed form and ensure it meets state requirements. You will need to provide the necessary information, including the names of the parties involved and a legal description of the property. After completing the deed, you must sign it in front of a notary and then file it with the county clerk’s office. Utilizing a Transfer on Death deed for New Mexico can simplify this process by allowing you to designate beneficiaries directly.

Transferring property after death without a will in New Mexico typically involves intestate succession laws. This means that the state dictates how the property will be divided among surviving relatives. However, if a transfer on death deed for New Mexico is in place, the property will transfer to the specified beneficiaries without going through probate, providing a clear and efficient resolution.

To create a transfer on death deed in New Mexico, you must draft a written deed that names the beneficiaries and clearly states the property being transferred. This deed needs to be signed and notarized before being recorded with the county clerk. This is an effective way to ensure your property passes to loved ones without undergoing the lengthy probate process.

To transfer property to a family member in New Mexico, you can execute a quitclaim deed or a warranty deed, which legally reassigns ownership. It’s essential to ensure that the deed is properly executed and recorded with the county clerk. Additionally, utilizing a transfer on death deed for New Mexico allows for a smooth transition without immediate tax implications or probate, making it an appealing option.