New Mexico Contract Withholding Tax Registration

Description

How to fill out New Mexico Refrigeration Contract For Contractor?

Individuals often connect legal documentation with something intricate that can only be handled by an expert. In a sense, this is accurate, as preparing New Mexico Contract Withholding Tax Registration necessitates significant proficiency in subject matters, which include state and local guidelines.

Nonetheless, with the US Legal Forms, the process has become simpler: a collection of ready-to-use legal forms for any personal and business situation tailored to state regulations is compiled in one online repository and is now accessible to all.

US Legal Forms provides over 85k current documents categorized by state and application area, making it easy to search for New Mexico Contract Withholding Tax Registration or any other specific template in mere minutes.

All templates in our collection are reusable: once acquired, they remain stored in your profile. You can access them at any time through the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

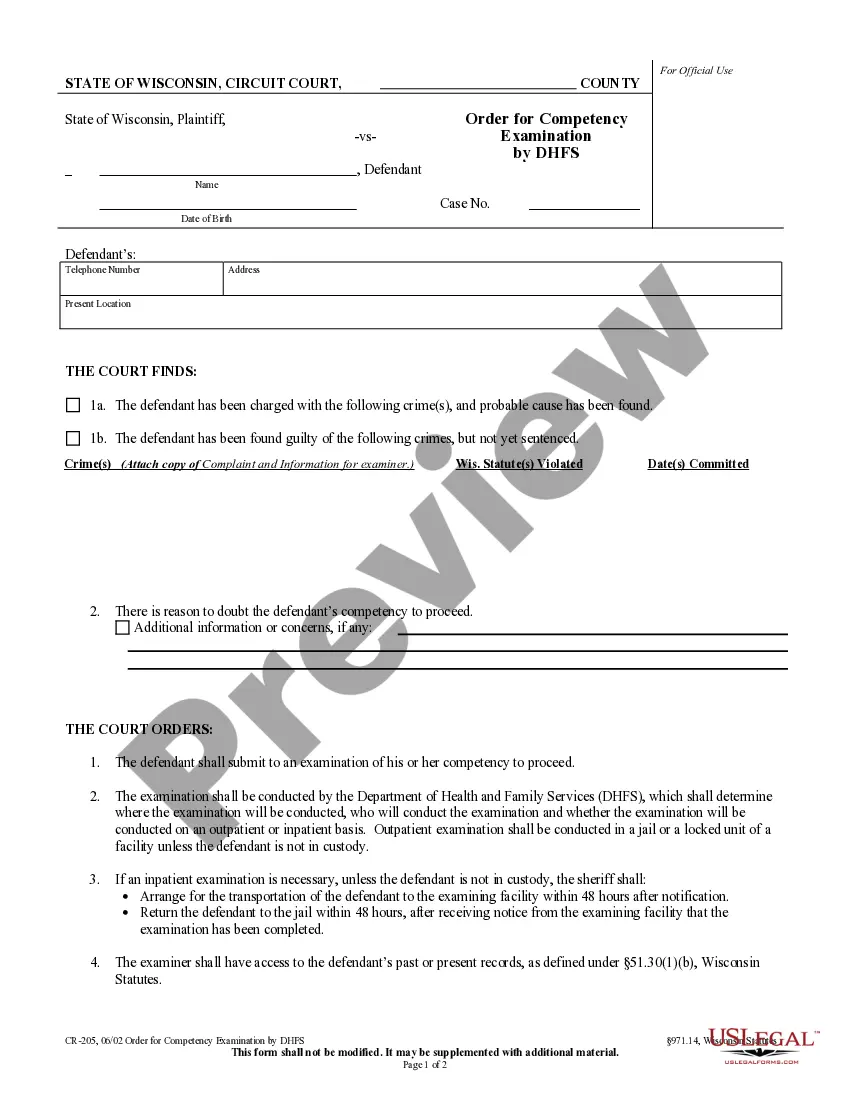

- Review the page content thoroughly to confirm it fits your requirements.

- Read the form description or examine it using the Preview feature.

- If the previous one does not meet your criteria, find another template using the Search field located in the header.

- Once you locate the appropriate New Mexico Contract Withholding Tax Registration, click Buy Now.

- Select a subscription plan that aligns with your preferences and financial plan.

- Create an account or Log In to move to the payment page.

- Complete the payment for your subscription using PayPal or your credit card.

- Choose the format for your template and click Download.

- Print your document or upload it to an online editor for a faster completion.

Form popularity

FAQ

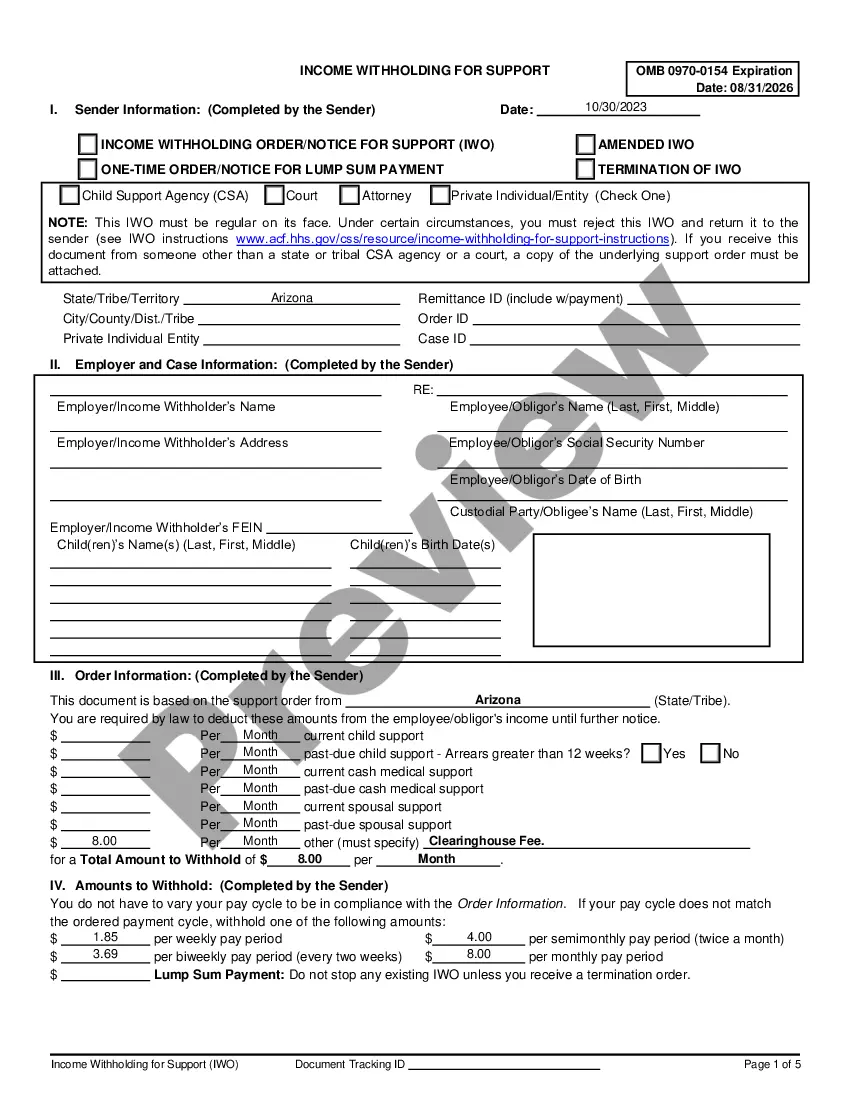

Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days. This number is also used for NM Worker's Compensation payments and filing.Find an existing CRS ID Number: On Form CRS-1, Combined Report System. By contacting the Dept. of Taxation and Revenue.12-Mar-2021

New New Mexico Employer: Register with the New Mexico Department of Workforce Solutions - (877)-664-6984Register your business with the New Mexico Department of Workforce Solutions.You should receive your Employer Account Number and tax rate instantly after registering.More items...?

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only.

Income tax withholdingRegister with the New Mexico Taxation & Revenue Department online. Click Apply for a CRS ID under "Businesses." You should receive your account number and tax deposit schedule the same day after registering online. The CRS Number is 11 digits plus a suffix of "WWT" (Wage Withholding Tax).

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only.