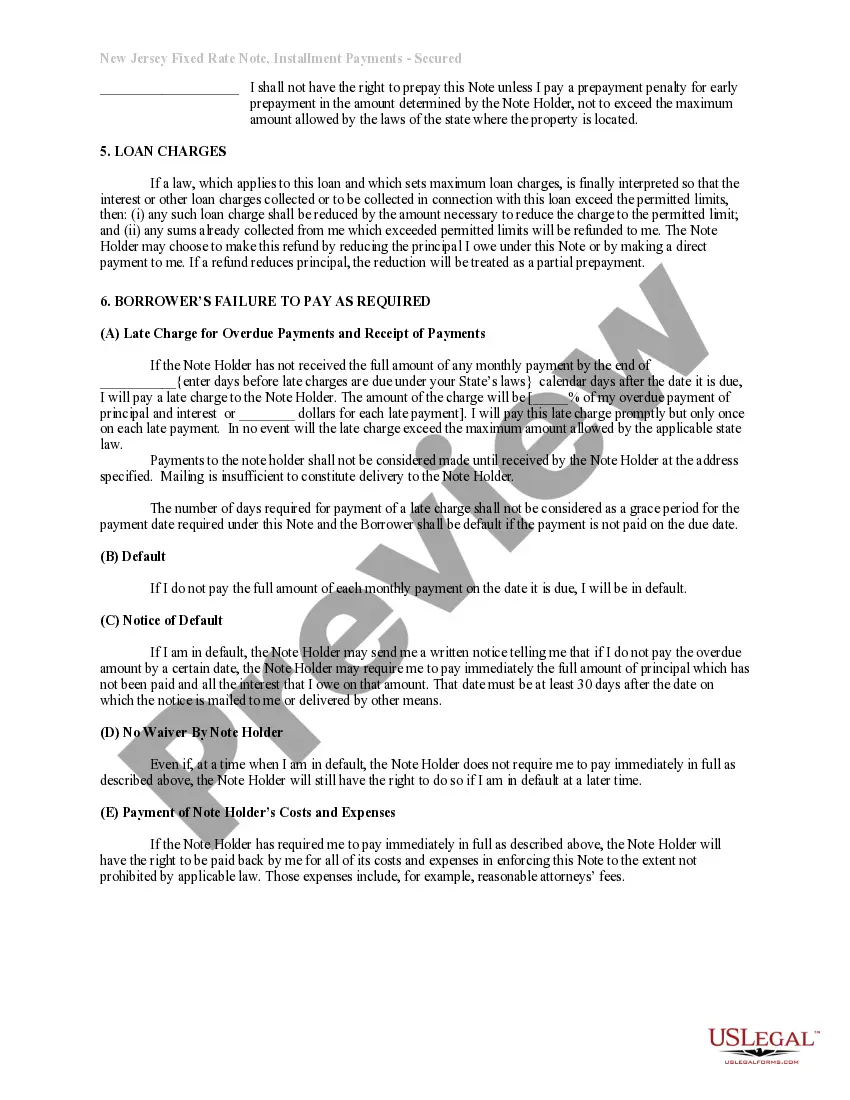

Fixed Promissory Note With Personal Guarantee

Description

How to fill out Fixed Promissory Note With Personal Guarantee?

Bureaucracy demands exactness and correctness.

If you don't routinely engage with forms like Fixed Promissory Note With Personal Guarantee, it may lead to some uncertainty.

Choosing the appropriate sample from the outset will guarantee that your document submission proceeds smoothly and avert any hassle of re-sending a document or performing the same task from the beginning.

If you are not a subscribed user, discovering the necessary sample may involve a few additional steps: Locate the template using the search bar. Ensure the Fixed Promissory Note With Personal Guarantee you've located is relevant for your state or county. Assess the preview or examine the description that includes the details on the usage of the template. If the result meets your search criteria, click the Buy Now button. Select the appropriate option among the proposed pricing plans. Log Into your account or set up a new one. Finalize the purchase using a credit card or PayPal payment method. Save the form in your preferred format. Finding the correct and current samples for your documentation is just a matter of a few minutes with a US Legal Forms account. Eliminate bureaucratic uncertainties and simplify your form handling.

- You can always acquire the suitable sample for your documentation from US Legal Forms.

- US Legal Forms is the largest online collection of forms, housing over 85 thousand samples across various domains.

- You can find the most recent and relevant version of the Fixed Promissory Note With Personal Guarantee by simply searching it on the site.

- Locate, save, and download templates in your account or consult the description to ensure you have the correct one available.

- With a US Legal Forms account, it is straightforward to gather, keep in one location, and peruse the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Next, navigate to the My documents page, where your document list is saved.

- Review the form descriptions and download the ones you need at any time.

Form popularity

FAQ

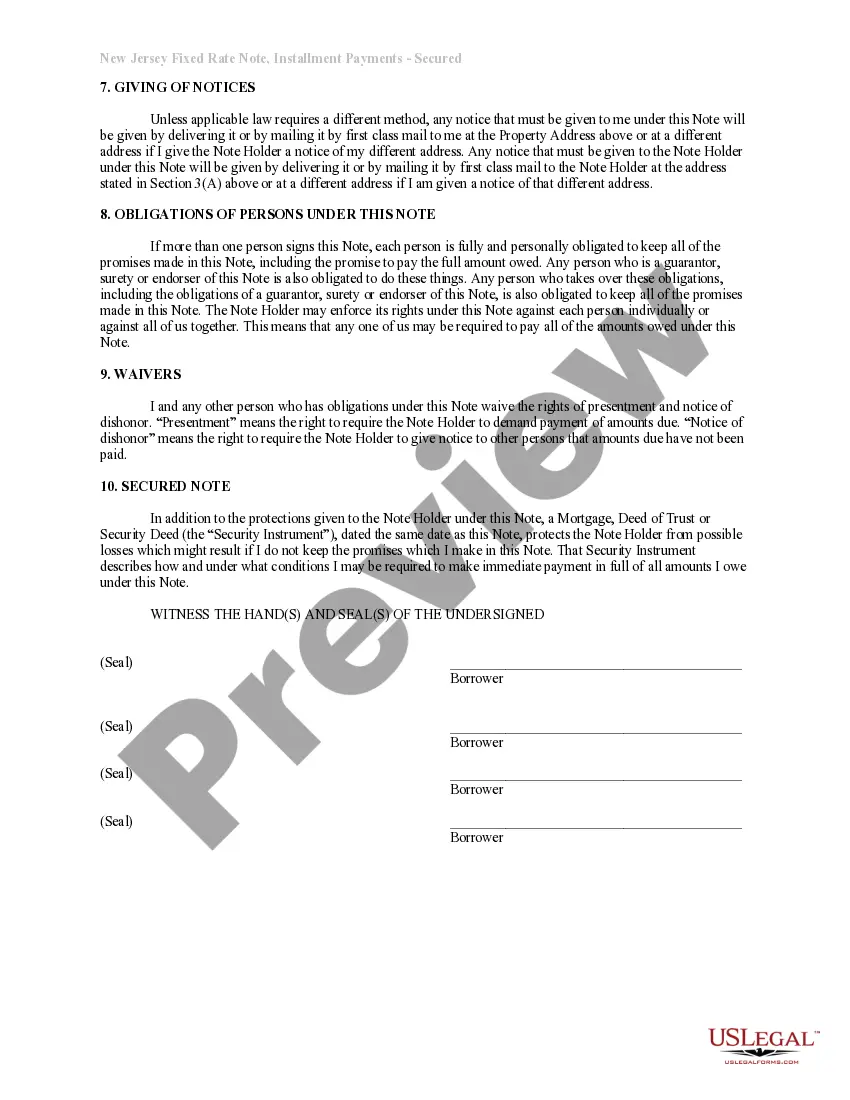

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.