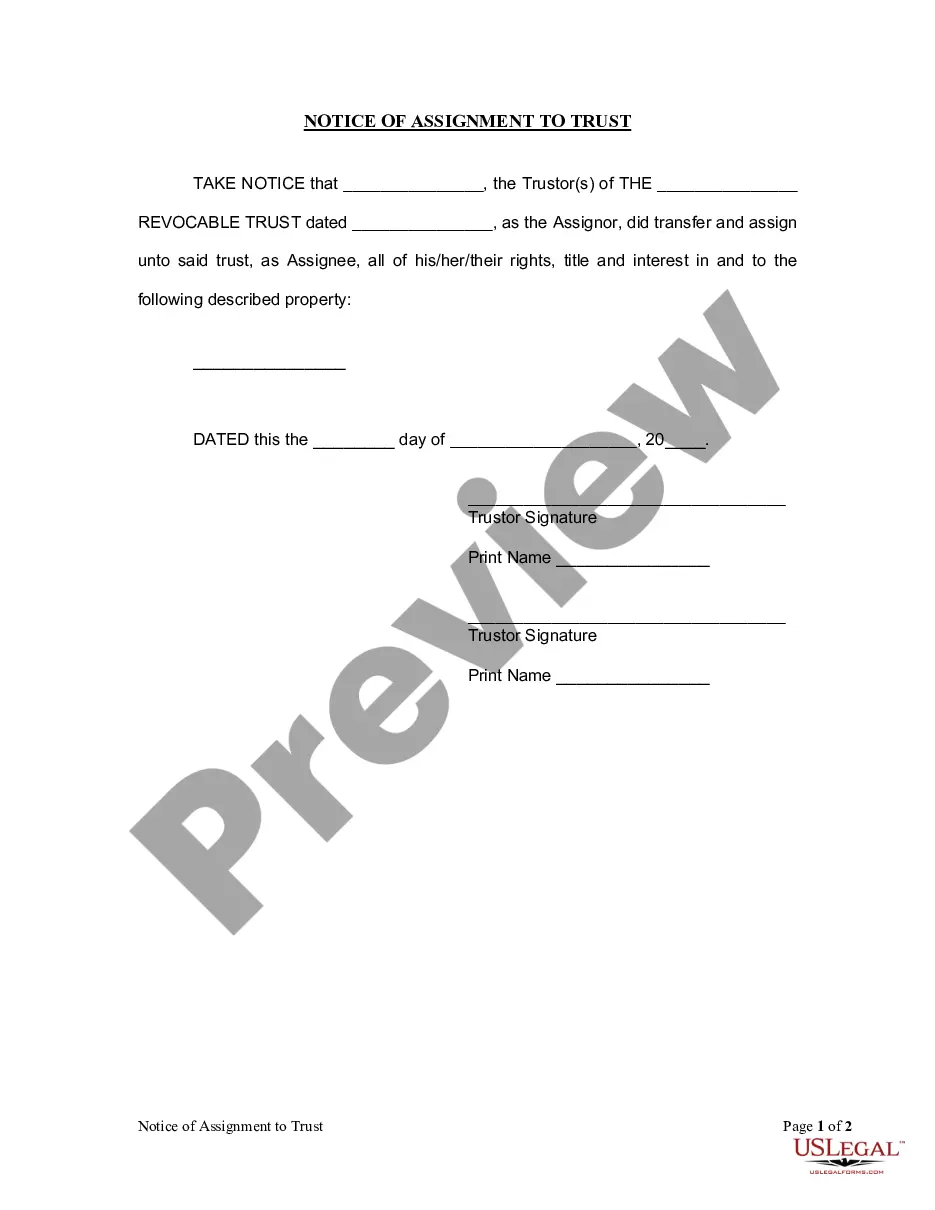

New Jersey Trust Without Power

Description

How to fill out New Jersey Notice Of Assignment To Living Trust?

Precisely composed formal documents are among the key assurances for preventing complications and lawsuits, but obtaining them without legal counsel may require time.

Whether you need to swiftly locate an updated New Jersey Trust Without Power or any other forms for work, family, or business situations, US Legal Forms is always available to assist.

The procedure is even easier for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Additionally, you can retrieve the New Jersey Trust Without Power at any time, as all documents ever acquired on the platform are retained in the My documents section of your profile. Conserve time and money on creating official papers. Give US Legal Forms a try today!

- Ensure that the document is appropriate for your situation and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar at the top of the page.

- Click Buy Now once you find the correct template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your New Jersey Trust Without Power.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Create the trust document: You can use an online program or create one with a lawyer. Get the trust document notarized: Go to a notary public and sign the document. Fund the trust: This means transferring your property into the trust.

Financial institutions' trust departments generally charge annual fees of 1% to 2% of the value of trust assets, with the rate declining as values increase.

The average cost for this document is about $3,500.00 plus a new deed and other documents necessary to transfer assets into the Trust.

If you put things into a trust, provided certain conditions are met, they no longer belong to you. This means that when you die their value normally won't be counted when your Inheritance Tax bill is worked out. Instead, the cash, investments or property belong to the trust.

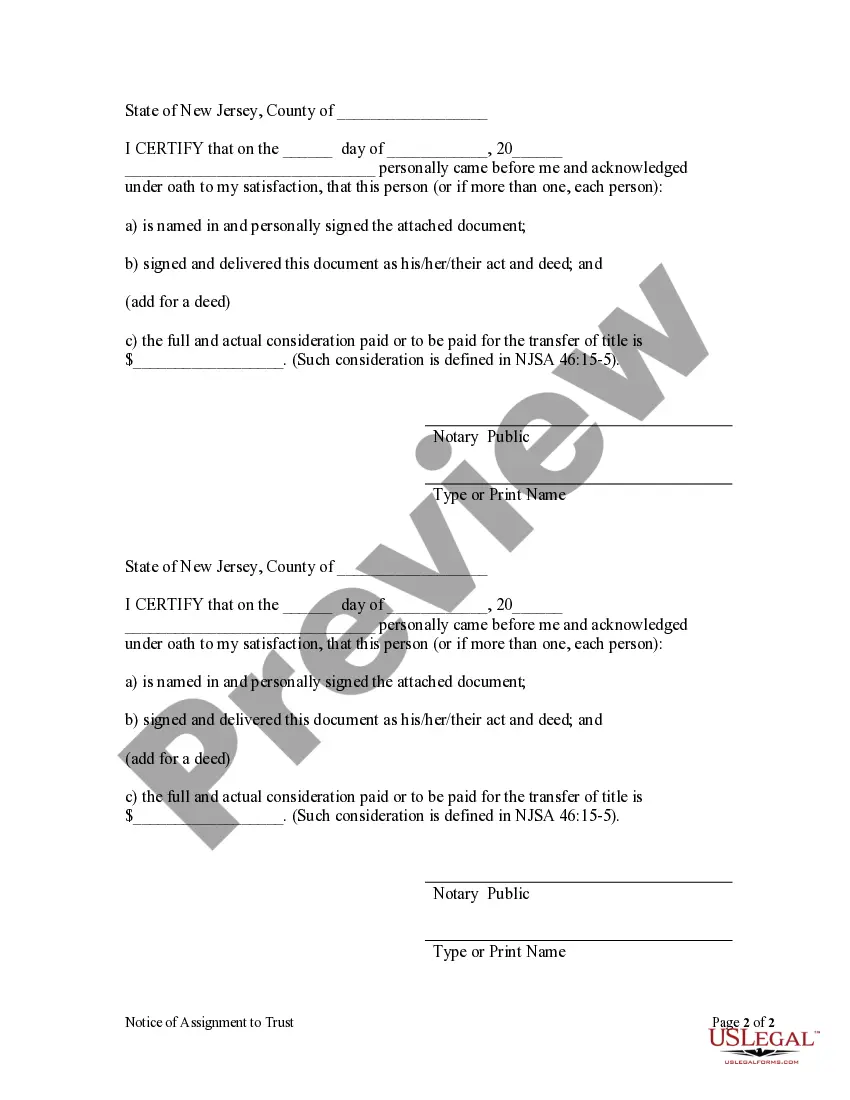

Under our statute for creation of a revocable living trust, N.J.S.A. 3B:31-18, there is no execution requirement. It is always better to have a revocable trust signed by two witnesses and notarized because the testator may relocate to another jurisdiction where such added formalities are needed.