New Jersey Affidavit Of Consideration

Description

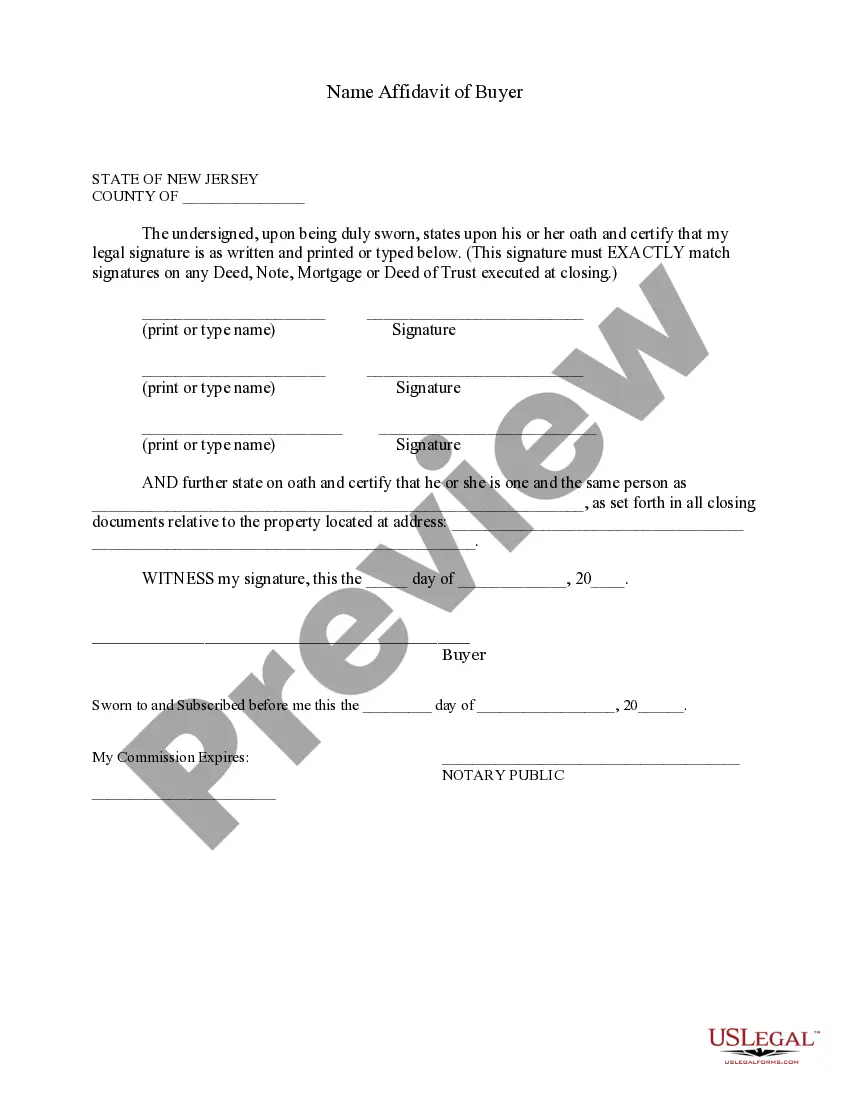

How to fill out New Jersey Name Affidavit Of Buyer?

What is the most dependable service to acquire the New Jersey Affidavit Of Consideration and other recent versions of legal documents.

US Legal Forms is the solution! It boasts the largest repository of legal documents for any purpose.

If you do not yet have an account with us, follow these steps to create one: Form compliance verification. Prior to obtaining any template, you must verify that it meets your use case requirements and complies with your state or county's regulations. Read the form description and use the Preview if available. Alternative form search. If you find any discrepancies, use the search bar at the top of the page to find another template. Click Buy Now to select the appropriate one. Registration and subscription acquisition. Choose the best pricing plan, Log In or create your account, and pay for your subscription using PayPal or credit card. Downloading the paperwork. Select the format you wish to save the New Jersey Affidavit Of Consideration (PDF or DOCX) and click Download to get it. US Legal Forms is an excellent option for anyone needing to manage legal documentation. Premium users can benefit even more by completing and approving previously saved documents electronically at any time within the integrated PDF editing tool. Check it out now!

- Each template is expertly drafted and verified for adherence to federal and local regulations.

- They are categorized by field and state of use, making it easy to find the one you require.

- Experienced users of the platform only need to Log In to their account, verify that their subscription is active, and click the Download button adjacent to the New Jersey Affidavit Of Consideration to obtain it.

- Once saved, the template will be accessible for future reference in the My documents section of your profile.

Form popularity

FAQ

An affidavit of title is a legal document provided by the seller of a piece of property that explicitly states the status of potential legal issues involving the property or the seller. The affidavit is a sworn statement of fact that specifies the seller of a property holds the title to it.

The mansion tax applies to real estate purchases over $1 million. It is a 1 percent tax imposed on such purchases, which means that you or your buyer will pay a minimum of $10,000 to satisfy the New Jersey mansion tax. This tax applies to both Class 2 and Class 4A Commercial properties.

NJ Taxation An Affidavit of Consideration (RTF-1 ) must be filed with any deed in which a full or partial exemption is claimed from the Realty Transfer Fee.

Relationship to the mansion tax The NJ mansion tax is a fee that applies to transfers of deeds in New Jersey on Class 2 residential and Class 4A commercial properties above $1 million. It is equal to 1% of the total sale, with some exceptions. It is due at the time of the deed transfer.

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.