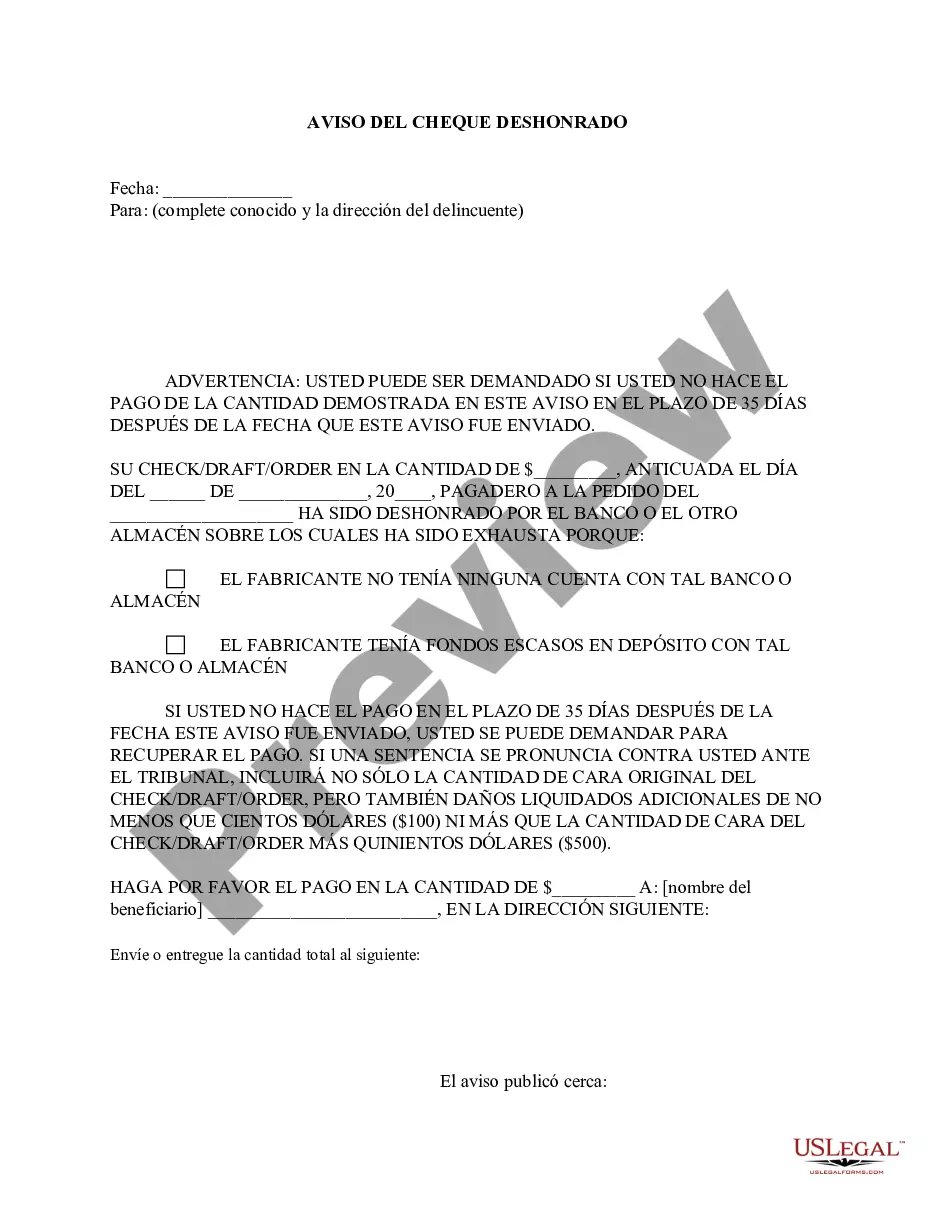

Dishonored Check Dmv Withdrawal

Description

How to fill out New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check - Spanish?

Managing legal documentation and procedures can be a lengthy addition to your overall day.

Dishonored Check Dmv Withdrawal and similar forms usually require you to search for them and comprehend how to fill them out correctly.

Therefore, whether you are handling financial, legal, or personal issues, possessing a comprehensive and user-friendly online repository of forms readily available will be extremely beneficial.

US Legal Forms is the leading online platform for legal documents, featuring over 85,000 state-specific forms and numerous tools to help you complete your paperwork effortlessly.

Is this your initial experience using US Legal Forms? Sign up and create a free account in just a few minutes, and you’ll gain access to the form library and Dishonored Check Dmv Withdrawal. Then, follow the steps outlined below to complete your form: Ensure you have located the correct form using the Preview option and reviewing the form description. Select Buy Now when ready, and choose the subscription plan that suits you best. Click Download then fill out, eSign, and print the form. US Legal Forms has 25 years of expertise assisting clients in managing their legal documents. Obtain the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes with a high-quality service that enables you to create any form in minutes without any extra or concealed fees.

- Simply Log In to your account, locate Dishonored Check Dmv Withdrawal, and download it immediately from the My documents tab.

- You can also access previously downloaded forms.

Form popularity

FAQ

Describe the error or erasure. Show how the entry should read. Be sure to draw one line through the error and write in the correct name on the document. Printed name and signature of either: Person or business who made the error or whose name appears in error, or Person whose signature appears in error.

If any of the bank information submitted to DMV is incorrect, DMV will not be able to locate your account and your bank will not show an inquiry or withdrawal. If the bank information cannot be verified by the bank, it becomes a non-payment and a dishonored check account is created.

Pay By Mail Send a cashier's check or money order payable to DMV. Do not mail cash. Do not send a personal check or credit card payment information. ... Write your account number on the front of your payment. Your account number is the ten-digit number located in the upper right hand corner of the Demand for Payment letter.

The Dishonored Check or Other Form of Payment Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.

Pay By Mail Send a cashier's check or money order payable to DMV.