Dishonored Check Dmv With Payment

Description

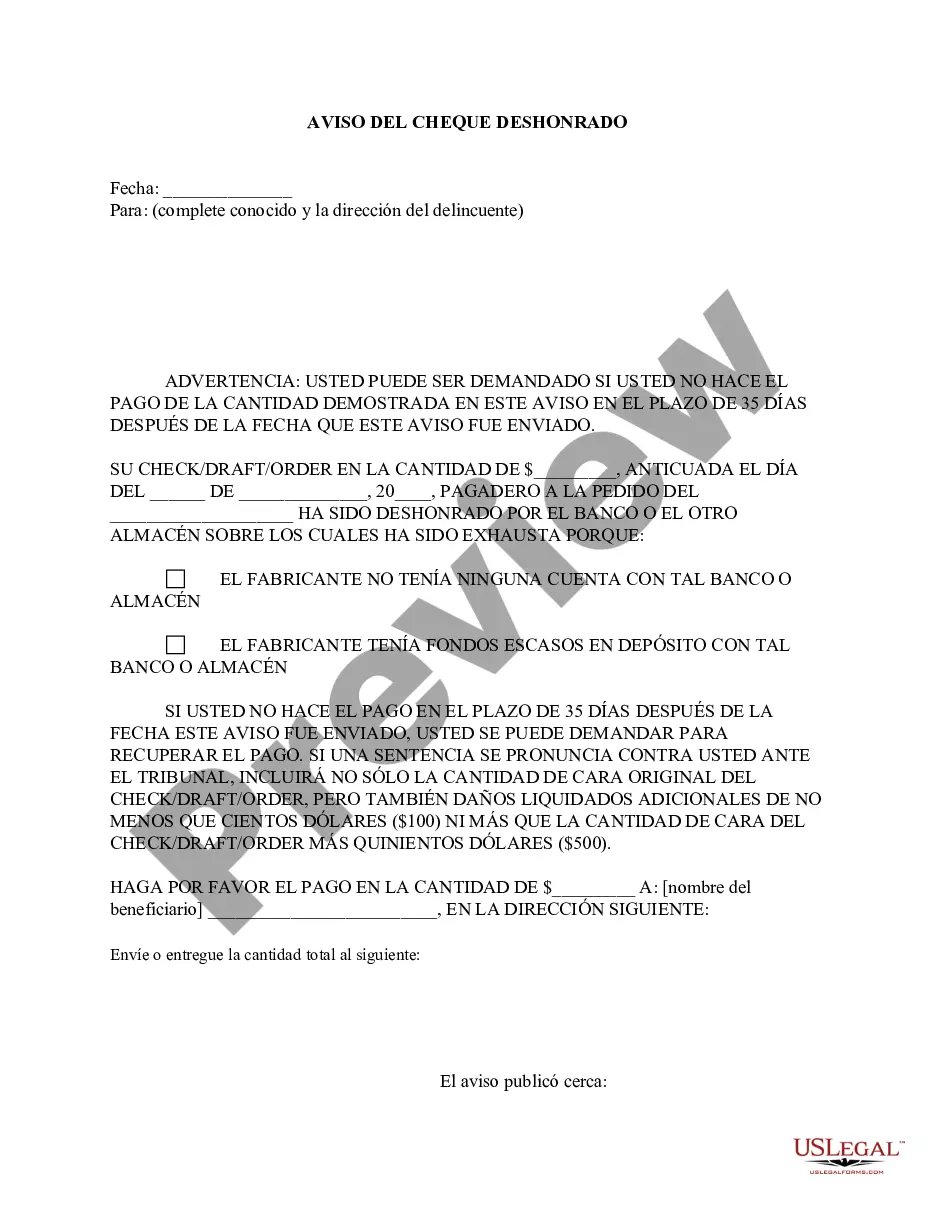

How to fill out New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check - Spanish?

Utilizing legal document examples that comply with federal and state regulations is essential, and the web provides countless choices to select from.

However, what’s the purpose of spending time searching for the appropriate Dishonored Check Dmv With Payment example online if the US Legal Forms digital library already has such documents gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for any business and life circumstance. They are straightforward to navigate with all documents categorized by state and intended use.

Search for another example using the search function at the top of the page if needed.

- Our experts keep up with legal updates, ensuring your documents are current and compliant when acquiring a Dishonored Check Dmv With Payment from our platform.

- Getting a Dishonored Check Dmv With Payment is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you require in your desired format.

- If you are new to our site, follow the steps below.

- Review the template using the Preview option or through the text outline to ensure it satisfies your needs.

Form popularity

FAQ

Pay By Mail Send a cashier's check or money order payable to DMV. Do not mail cash. Do not send a personal check or credit card payment information. ... Write your account number on the front of your payment. Your account number is the ten-digit number located in the upper right hand corner of the Demand for Payment letter.

Pay By Mail Send a cashier's check or money order payable to DMV. Do not mail cash. Do not send a personal check or credit card payment information. ... Write your account number on the front of your payment. Your account number is the ten-digit number located in the upper right hand corner of the Demand for Payment letter.

If any of the bank information submitted to DMV is incorrect, DMV will not be able to locate your account and your bank will not show an inquiry or withdrawal. If the bank information cannot be verified by the bank, it becomes a non-payment and a dishonored check account is created.

Cash. Check. Money order, or. ATM/Debit cards are now accepted at all DMV offices.

The Dishonored Check or Other Form of Payment Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.