New Jersey Limited Liability Company With Multiple Members

Description

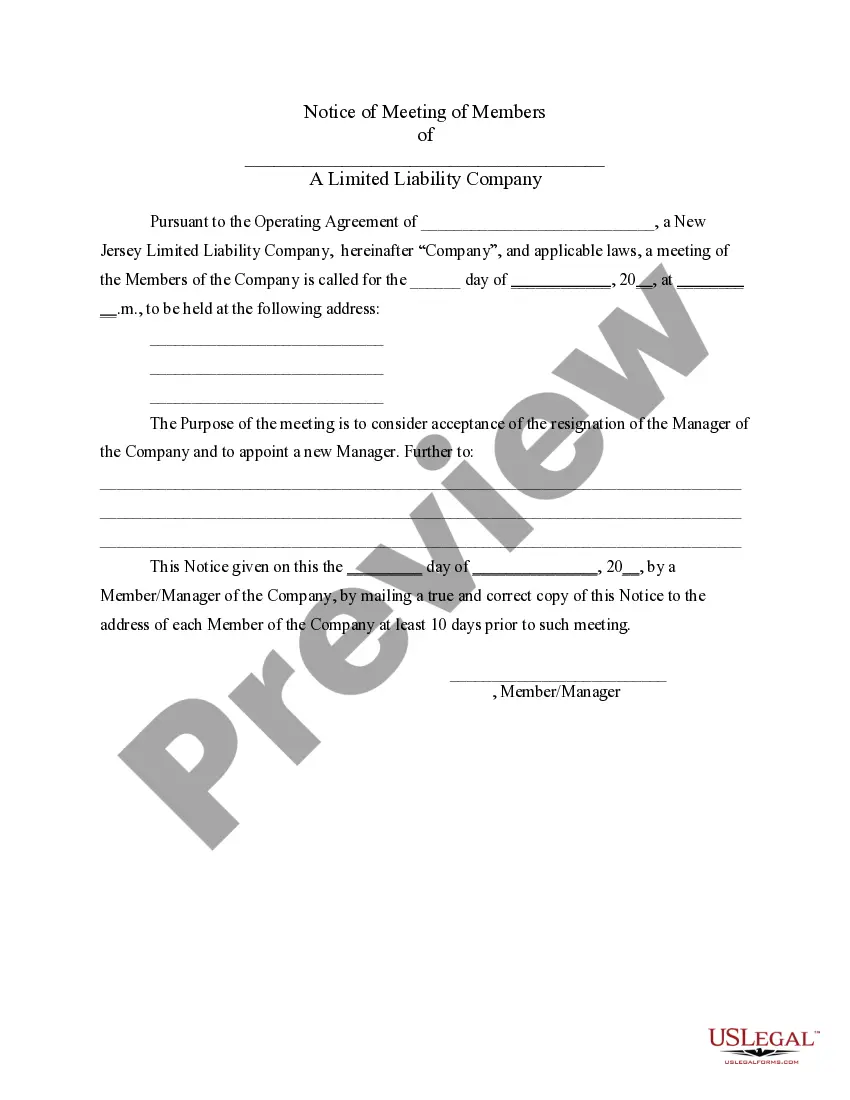

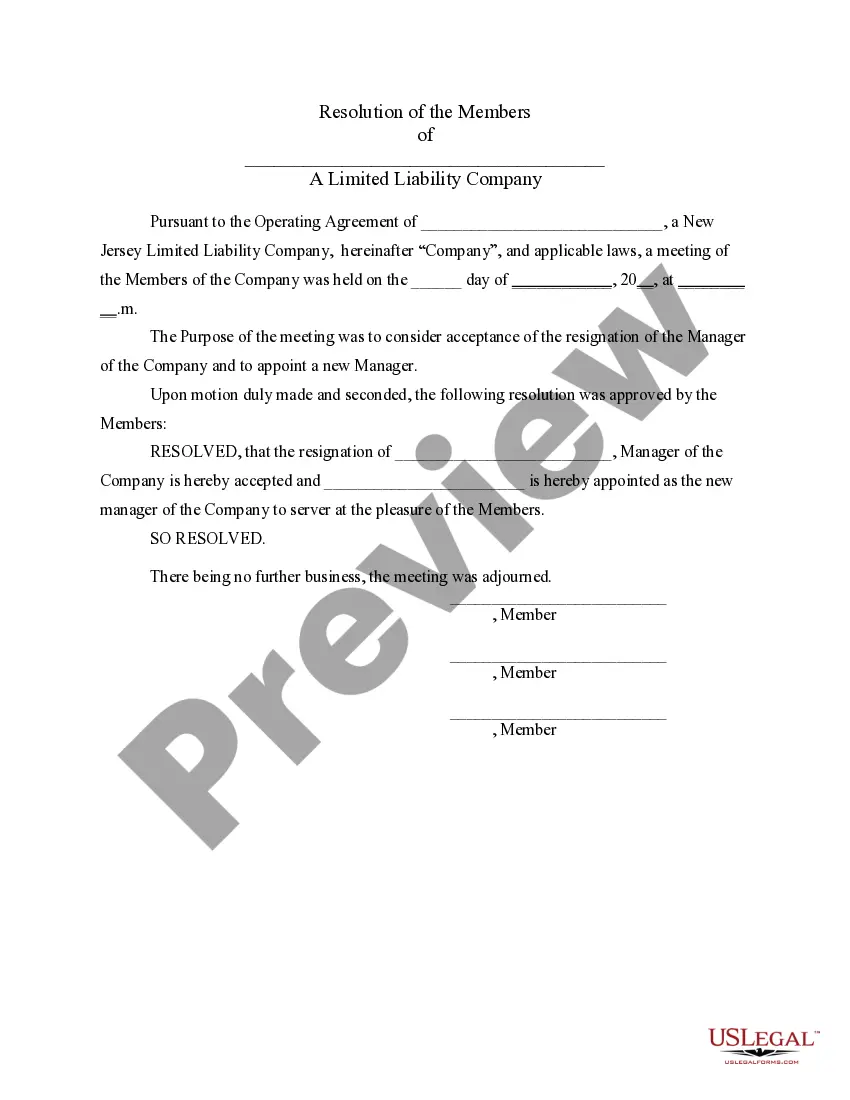

How to fill out New Jersey LLC Notices, Resolutions And Other Operations Forms Package?

Creating legal documents from the beginning can frequently be somewhat daunting.

Certain situations may require extensive research and substantial financial investment.

If you’re looking for an easier and more cost-effective method of preparing New Jersey Limited Liability Company With Multiple Members or other forms without unnecessary complications, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

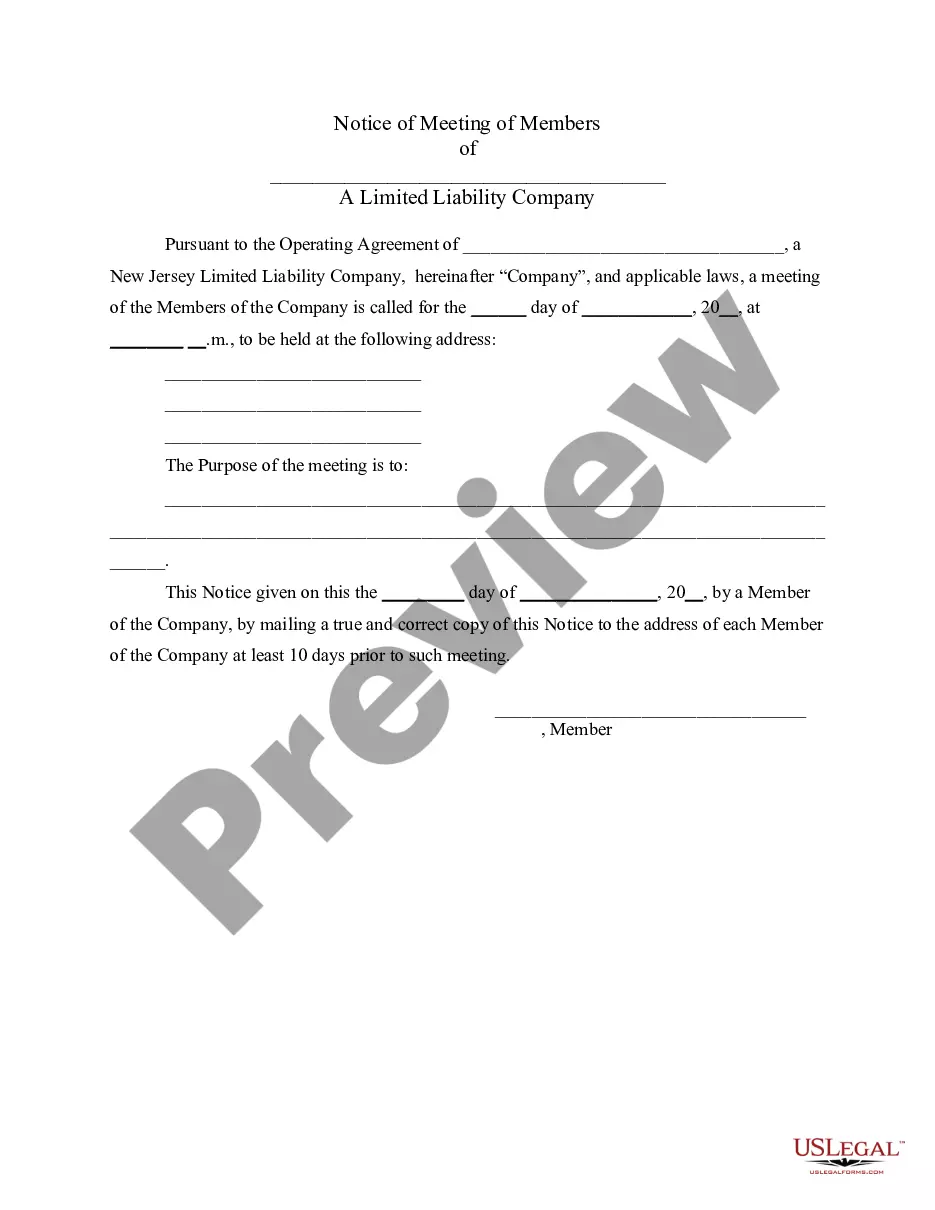

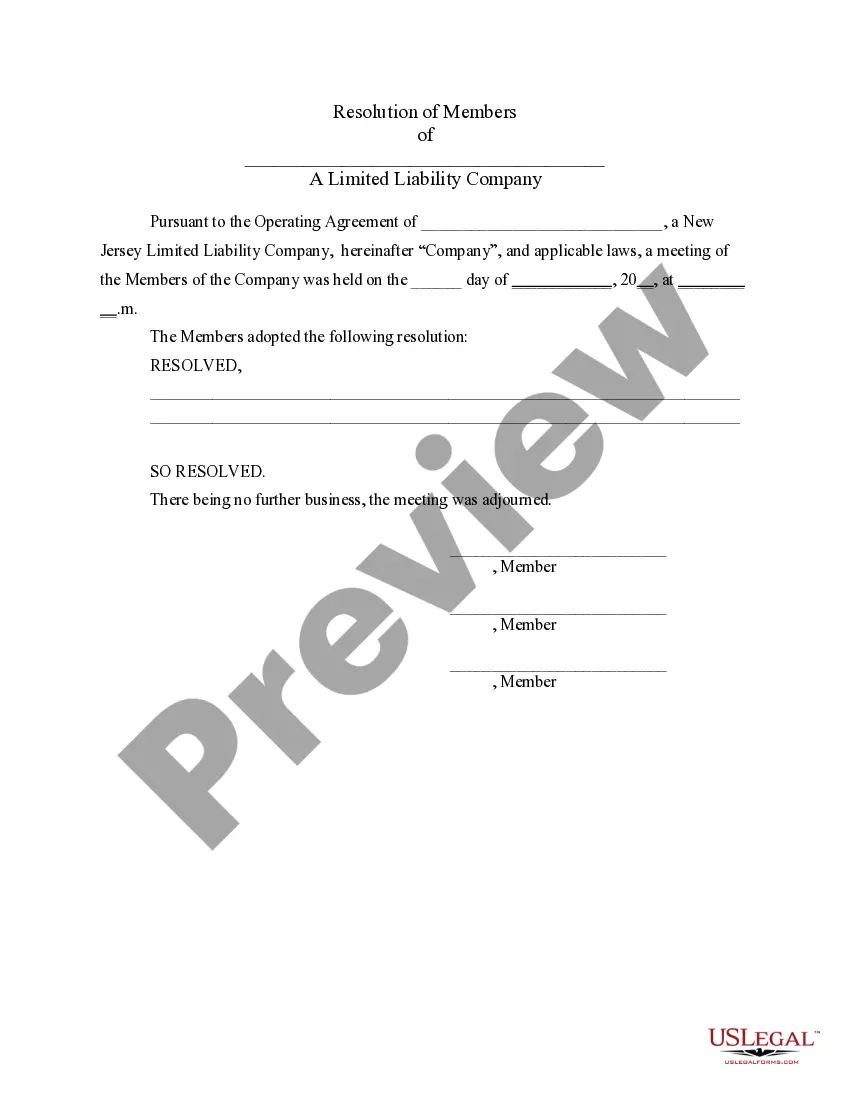

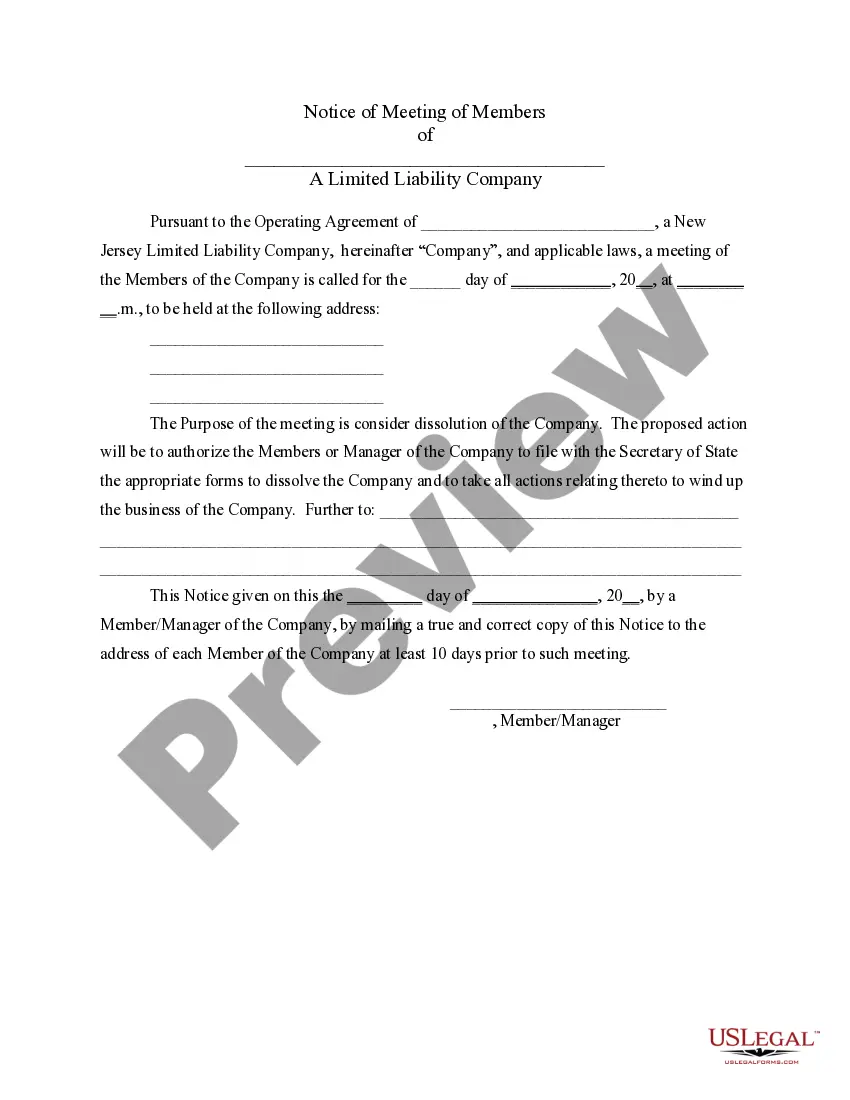

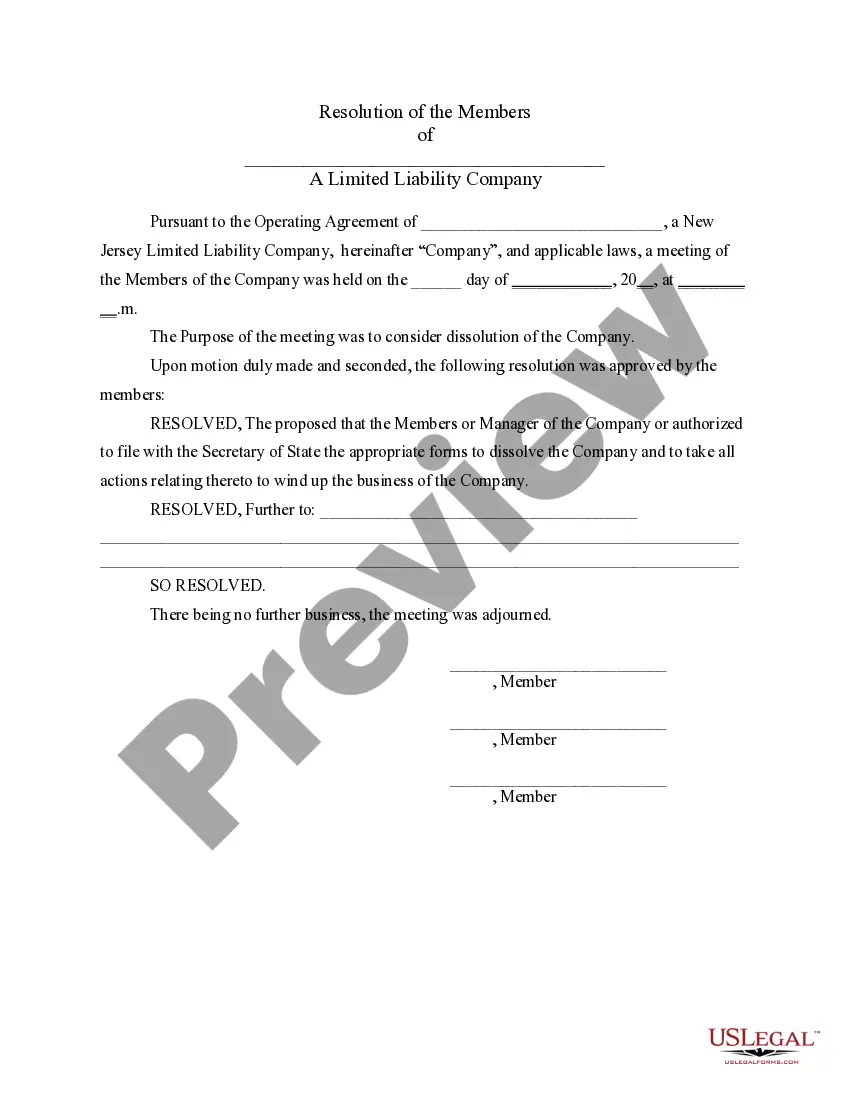

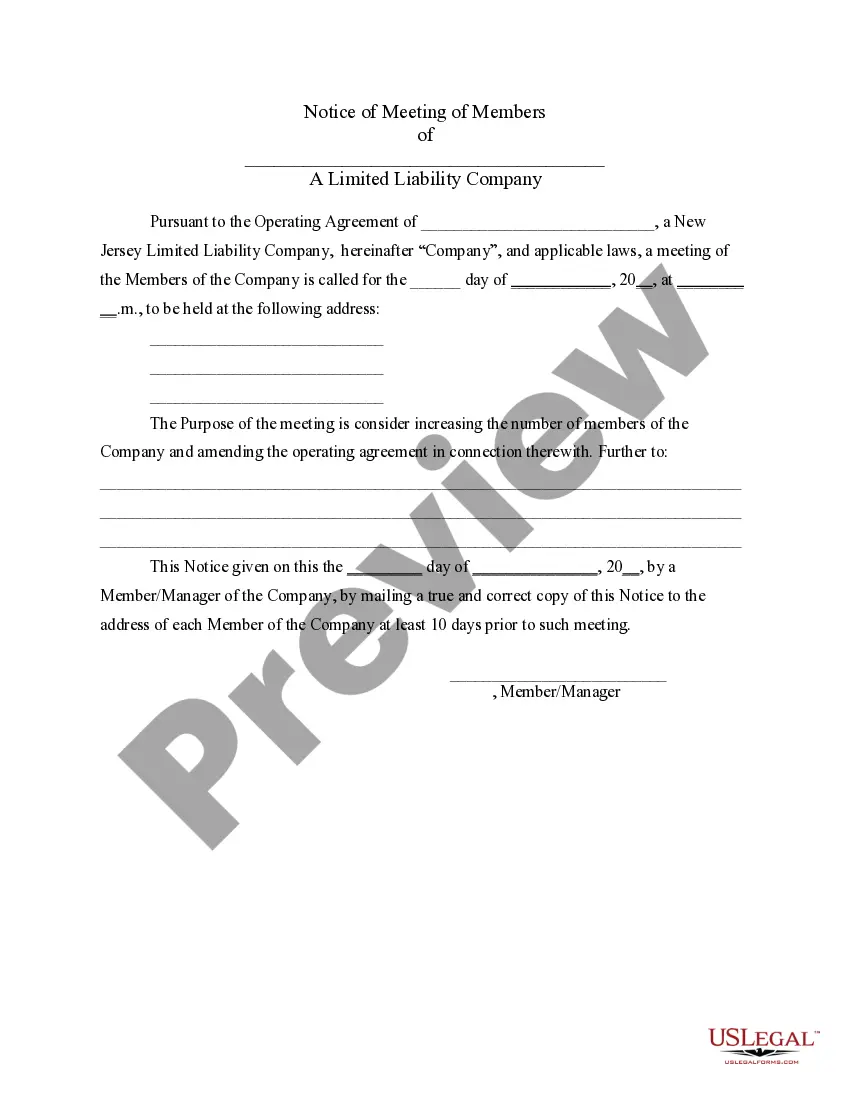

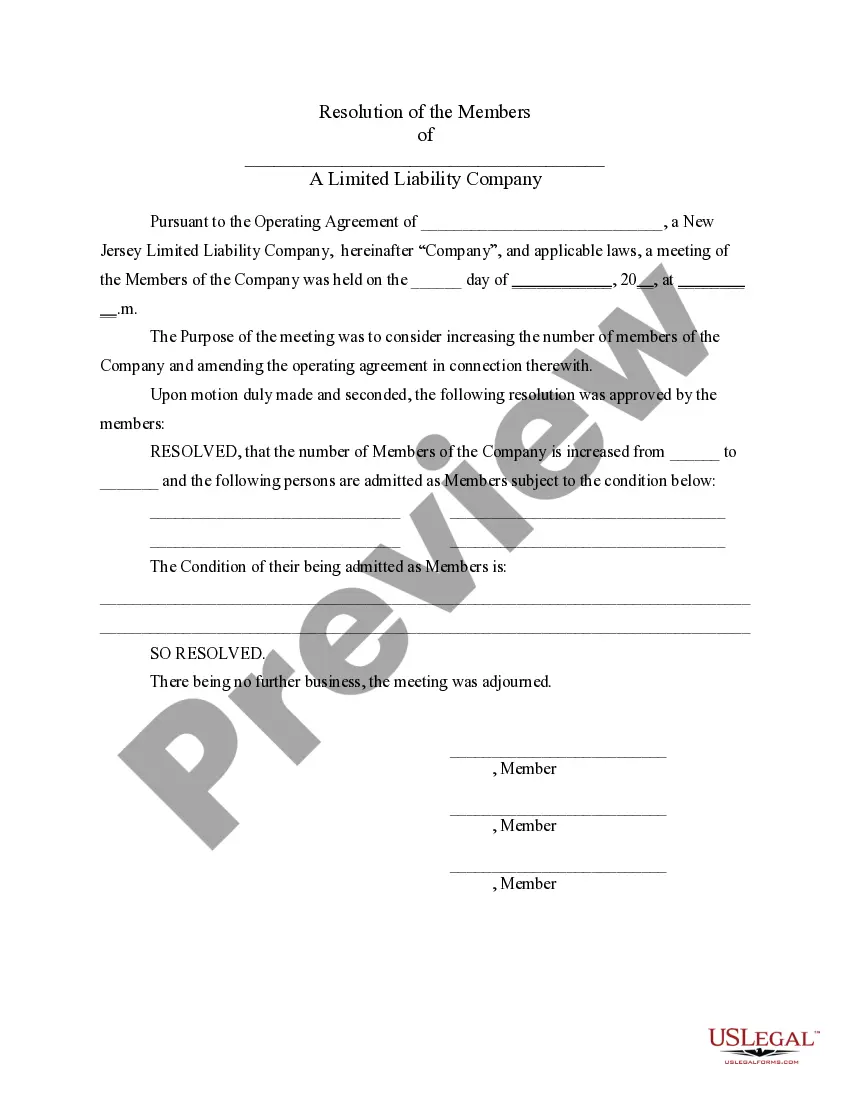

Review the form preview and descriptions to confirm that you have located the document you seek. Ensure the form you choose complies with the laws and regulations of your state and county. Select the most appropriate subscription option to purchase the New Jersey Limited Liability Company With Multiple Members. Download the form, then fill it out, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and simplify your document execution process!

- With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared by our legal professionals.

- Utilize our platform whenever you need dependable services through which you can quickly find and download the New Jersey Limited Liability Company With Multiple Members.

- If you're familiar with our site and have previously registered with us, simply Log In to your account, find the template, and download it or re-download it any time later in the My documents section.

- Not signed up yet? No problem. It takes just a few minutes to register and explore the library.

- Before diving straight into downloading New Jersey Limited Liability Company With Multiple Members, consider these suggestions.

Form popularity

FAQ

Although they may have different classes of members, there is no requirement for a board of directors. Also, LLC's may have anywhere between one and an unlimited number of members, who may be people or other businesses.

Then the New Jersey Division of Taxation honors this and taxes your LLC the same way at the state level. An LLC with 1 owner (Single-Member LLC) is taxed like a Sole Proprietorship. An LLC with 2 or more owners (Multi-Member LLC) is taxed like a Partnership. The above are referred to as the ?default status?.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit ?single-member? LLCs, those having only one owner.

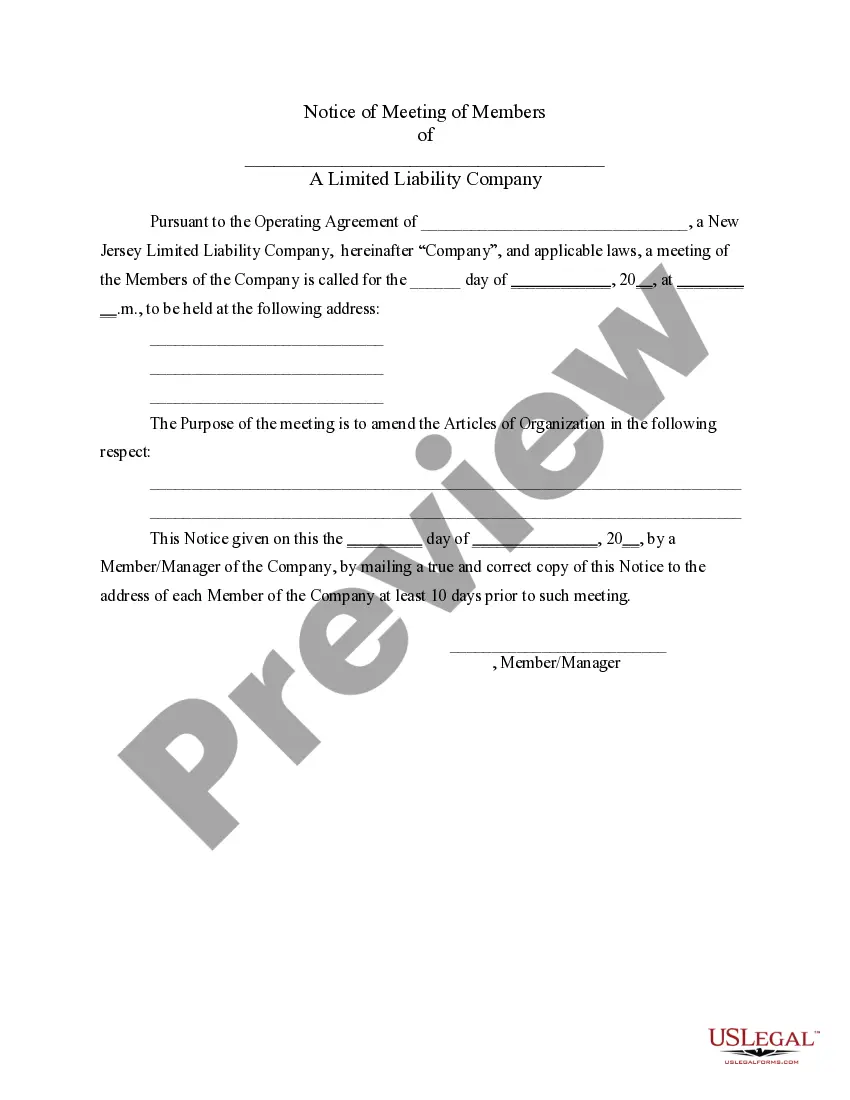

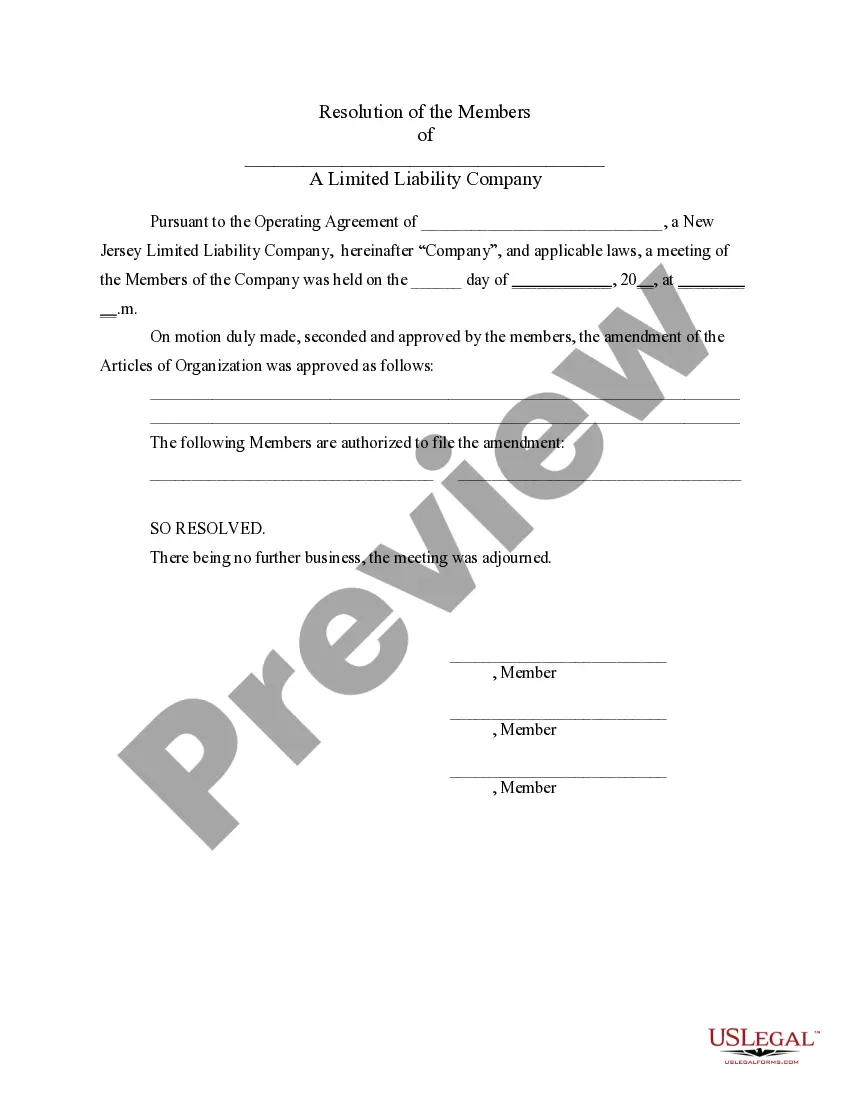

Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass. If you are a single-member LLC and add a new member, it will become a multi-member LLC, changing its tax status from pass-through to taxed as a corporation or partnership.

The process of adding a member to a New Jersey LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.