New Jersey Business Nj Withholding Form Nj-w4

Description

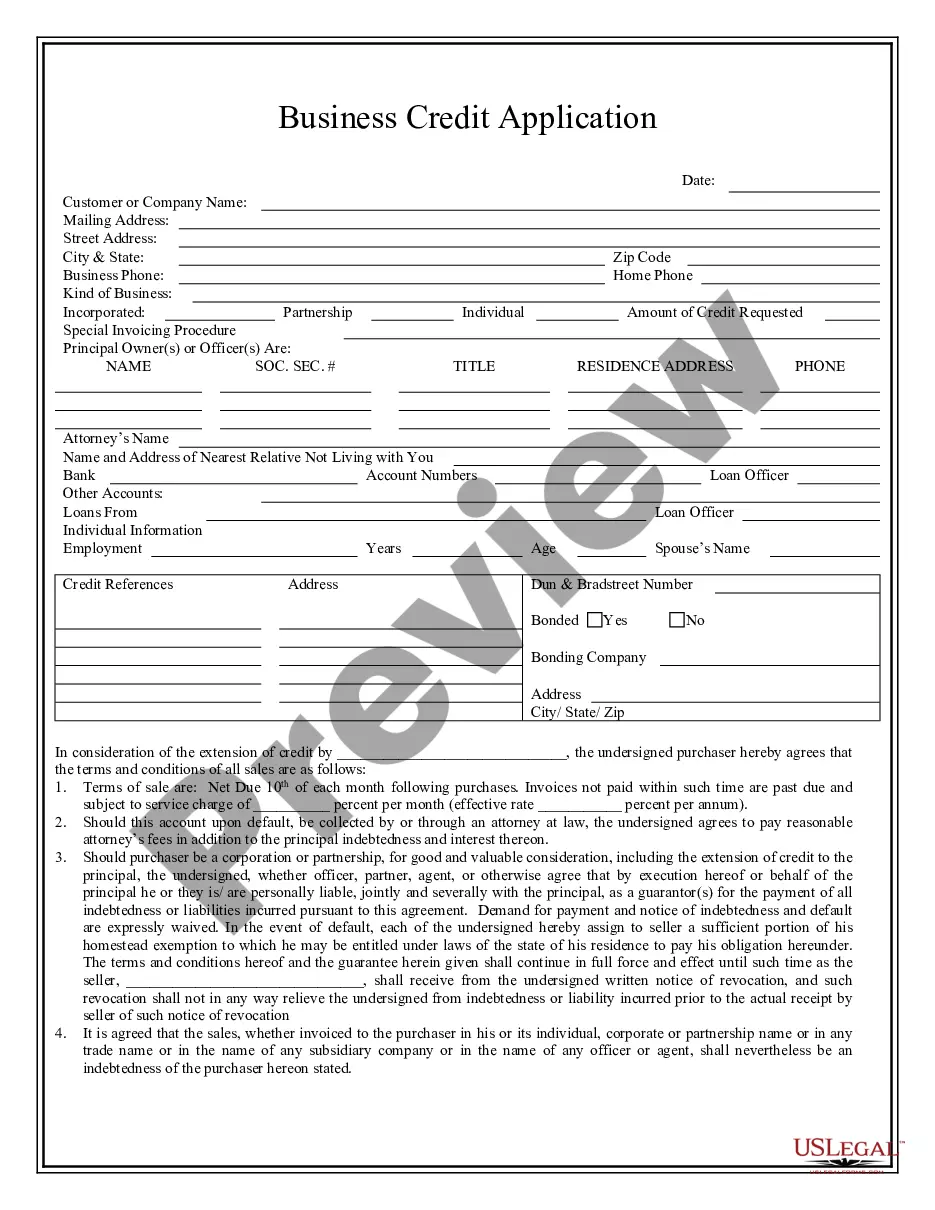

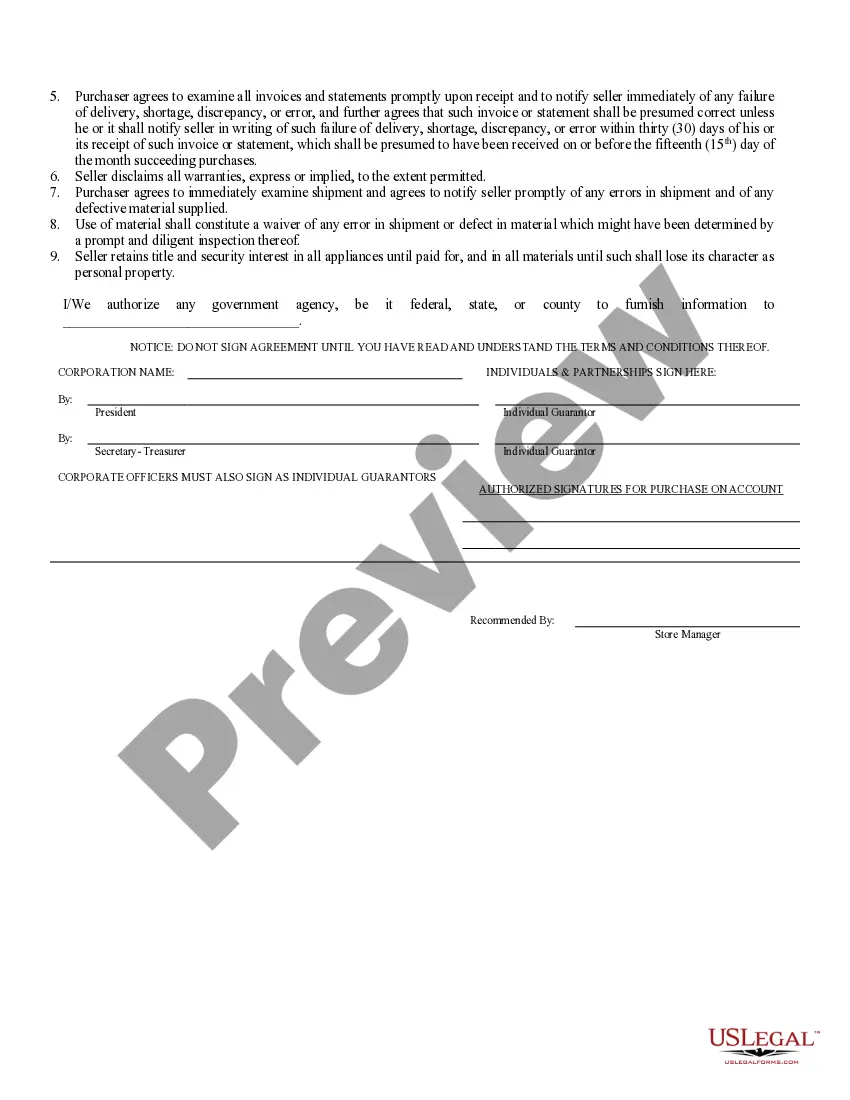

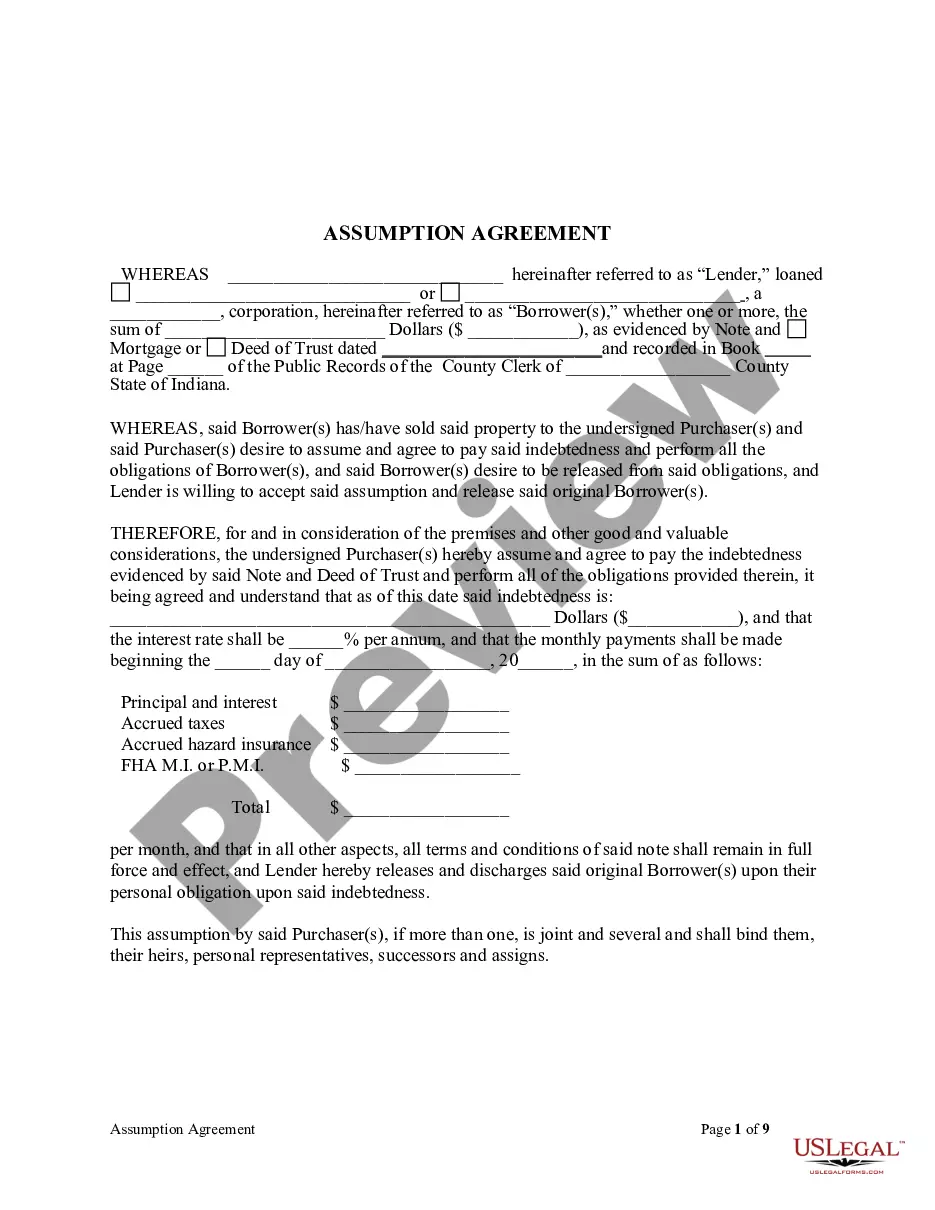

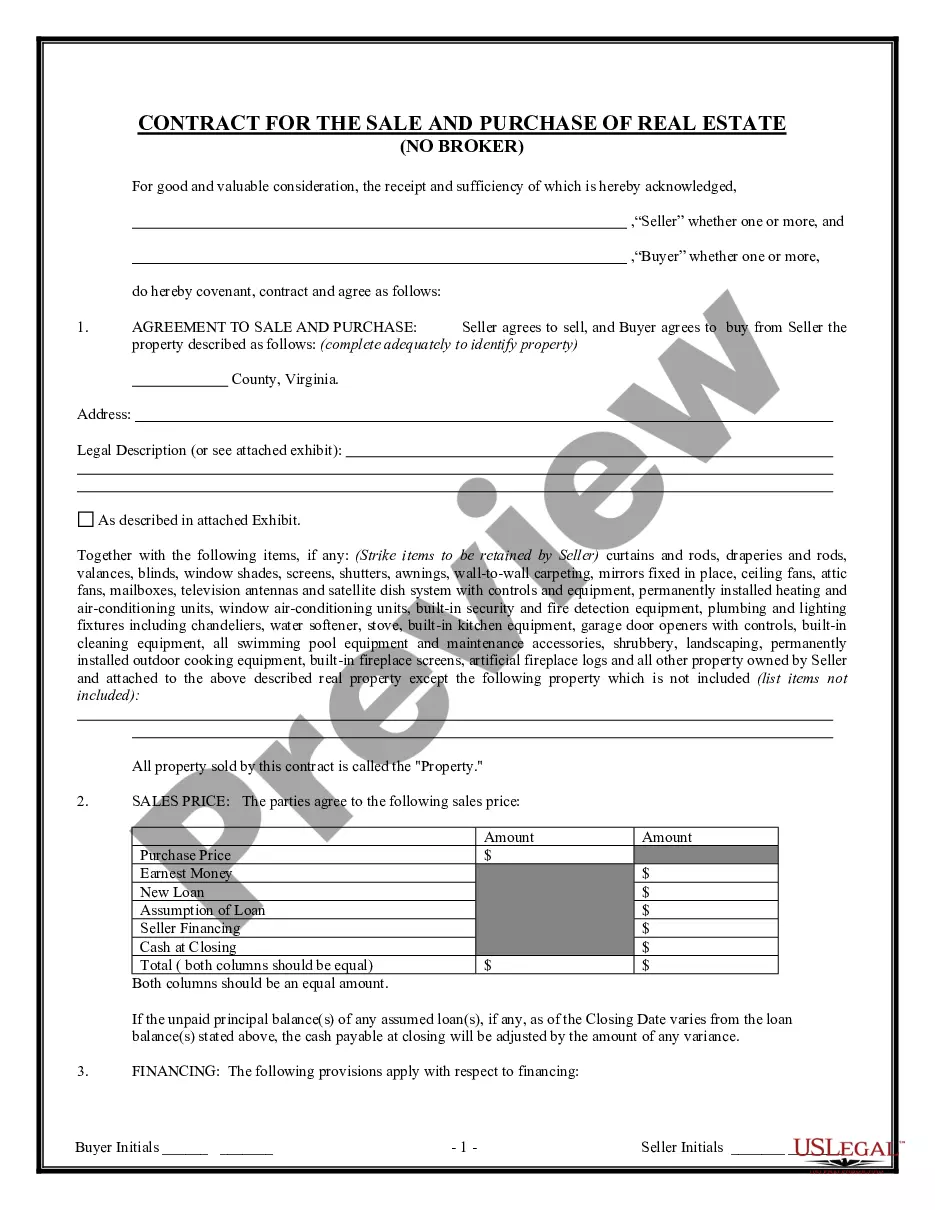

How to fill out New Jersey Business Credit Application?

Regardless of whether it's for professional reasons or personal issues, everyone must handle legal circumstances at some stage in their life.

Filling out legal documents necessitates meticulous care, starting from choosing the appropriate form template.

With an extensive catalog from US Legal Forms available, you will never have to waste time searching the internet for the proper template. Utilize the library’s straightforward navigation to find the right sample for any purpose.

- Obtain the form you require by utilizing the search bar or browsing through the catalog.

- Review the description of the form to confirm it suits your situation, jurisdiction, and region.

- Click on the preview of the form to view it.

- If it is the wrong document, return to the search option to find the New Jersey Business Nj Withholding Form Nj-w4 template you need.

- Download the document if it corresponds to your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you may acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the registration form for your account.

- Choose your payment method: credit card or PayPal.

- Pick the file format you prefer and download the New Jersey Business Nj Withholding Form Nj-w4.

- Once saved, you can complete the form using editing software or print it out to finish manually.

Form popularity

FAQ

To use the New Jersey business NJ withholding form NJ-W4 wage chart, first locate your total wages. Then, identify the correct filing status and the number of allowances you wish to claim. By referring to the wage chart, you can determine the amount of New Jersey state tax to withhold from your paycheck. This ensures that your withholding aligns with your tax obligations.

NJ Form W4 must be completed and signed before an employee can be paid. NJ Form W4 indicates your tax filing status (i.e. single, or married); it also permits you to have additional money withheld for New Jersey State Gross Income Tax purposes.

New Jersey Gross Income Tax The withholding tax rates for 2021 reflect graduated rates from 1.5% to 11.8%. The 11.8% tax rate applies to individuals with taxable income over $1,000,000.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

If your New Jersey taxable income is over:But not over:Your tax is:$0$20,0001.4% of your income$20,000$50,0001.75% of the excess over $20,000, minus $70.00$50,000$70,0002.45% of the excess over $50,000, minus $420.00$70,000$80,0003.5% of the excess over $70,000, minus $1,154.504 more rows

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.