New Jersey Business Nj Form Nj-1065 Instructions 2021

Description

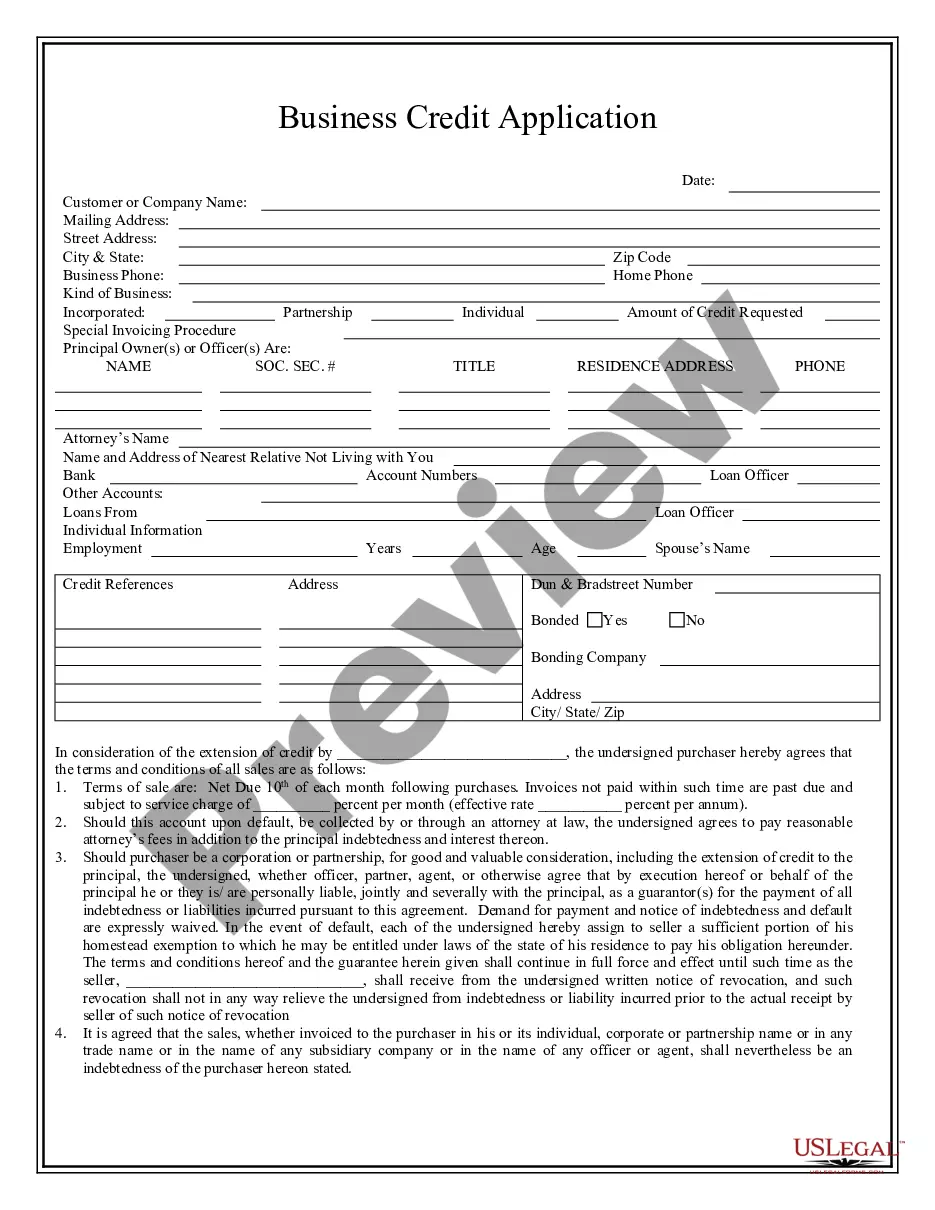

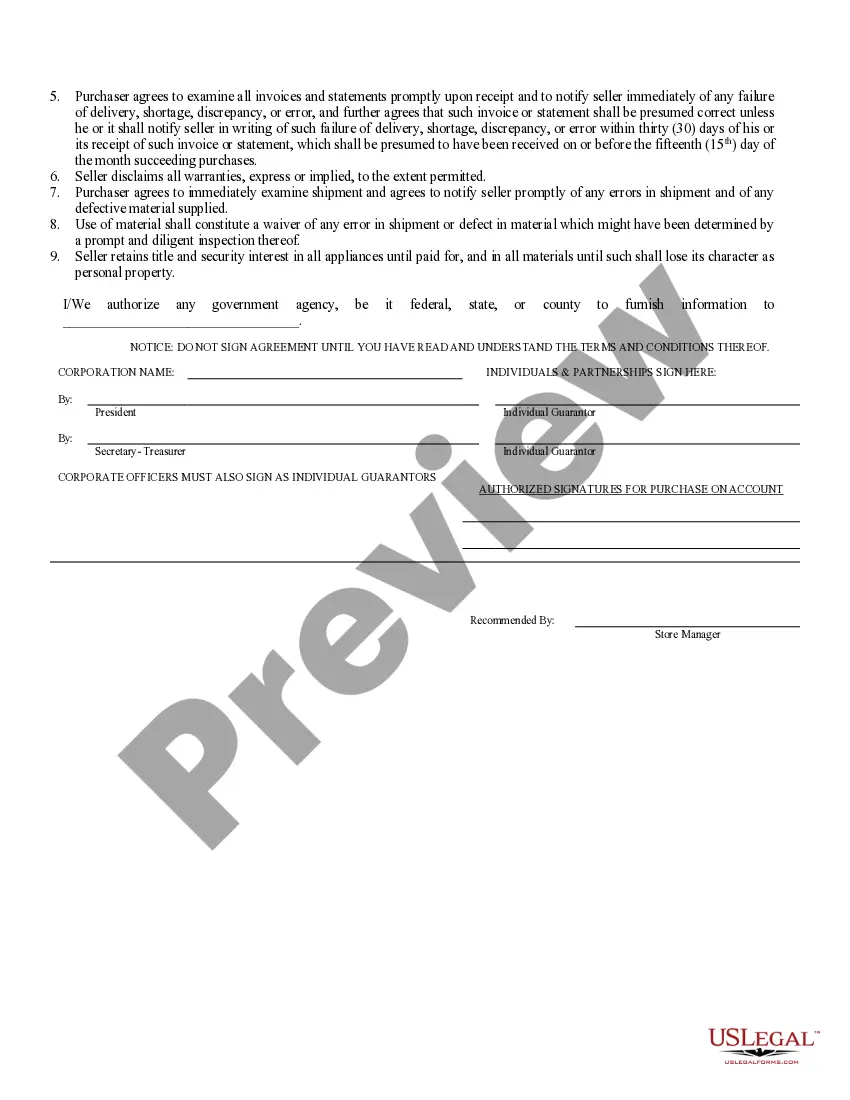

How to fill out New Jersey Business Credit Application?

Creating legal documents from the ground up can frequently be intimidating.

Certain situations may involve extensive research and significant financial investment.

If you’re seeking a more straightforward and economical approach to generating New Jersey Business Nj Form Nj-1065 Instructions 2021 or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

- With just a few clicks, you can quickly access state- and county-compliant templates meticulously crafted for you by our legal experts.

- Utilize our service whenever you require a dependable and trustworthy option to effortlessly find and download the New Jersey Business Nj Form Nj-1065 Instructions 2021.

- If you’re already acquainted with our services and have previously established an account, simply Log In to your account, search for the form, and download it now or access it again later in the My documents section.

- Don’t possess an account? No problem. It takes mere moments to set it up and browse the library.

Form popularity

FAQ

How do I e-file the NJ-CBT-1065 return, extension or estimated payments? Close the tax return. Open the EF Center HomeBase view. Find the client and look for the line that shows NJ CBT as the return type (or NJ CBT Pmt for estimated tax payments). Highlight the line that you need to e-file.

You can find the 1065 tax form on the IRS website. You can fill out the form using tax software or print it to complete it by hand. If your partnership has more than 100 partners, you're required to file Form 1065 online. Other partnerships may be able to file by mail.

IRS Form 1065 Instructions Fill in Boxes A Through J. Once you have all the documents handy, it'll be time to fill out boxes A through J, which are located on the very top of 1065 Form. ... Complete the Remainder of Page 1. ... Fill Out Schedule B. ... Complete Schedule K. ... Fill Out the Remaining Sections. ... Review and File with the IRS.

For New Jersey Gross Income Tax purposes, every partnership or limited liability company (LLC 1065) that has income from sources in the State of New Jersey, or has a New Jersey resident partner, must file the New Jersey Partnership Return, Form NJ-1065; Form NJ-1065 is no longer solely an information return.