Nj Divorce Law Without A Lawyer

Description

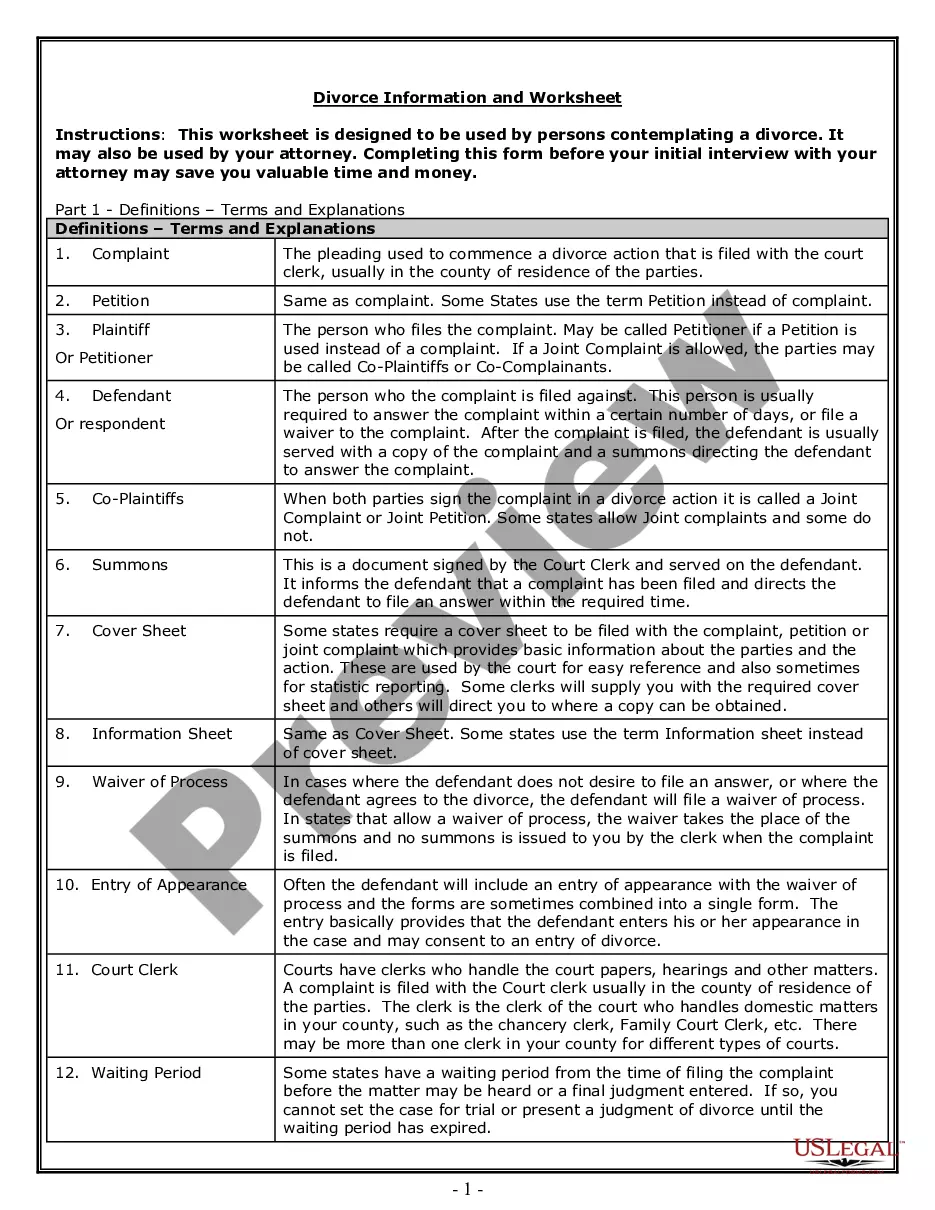

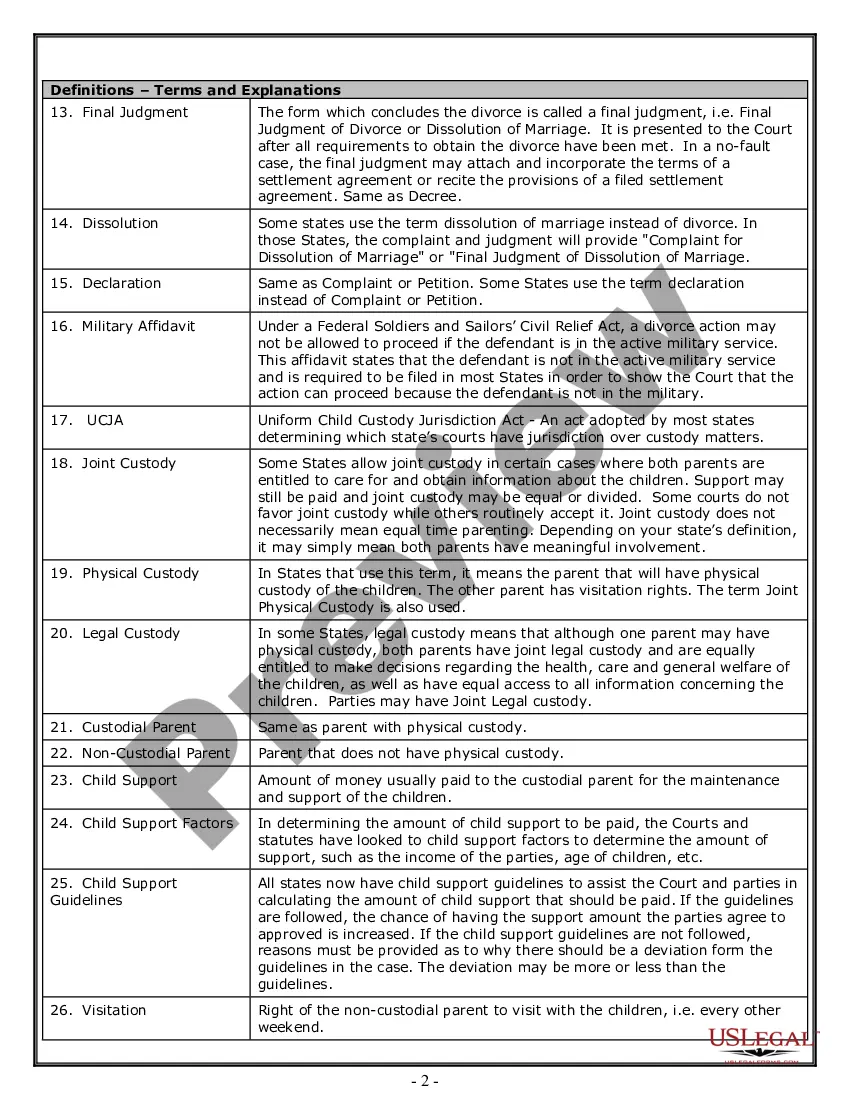

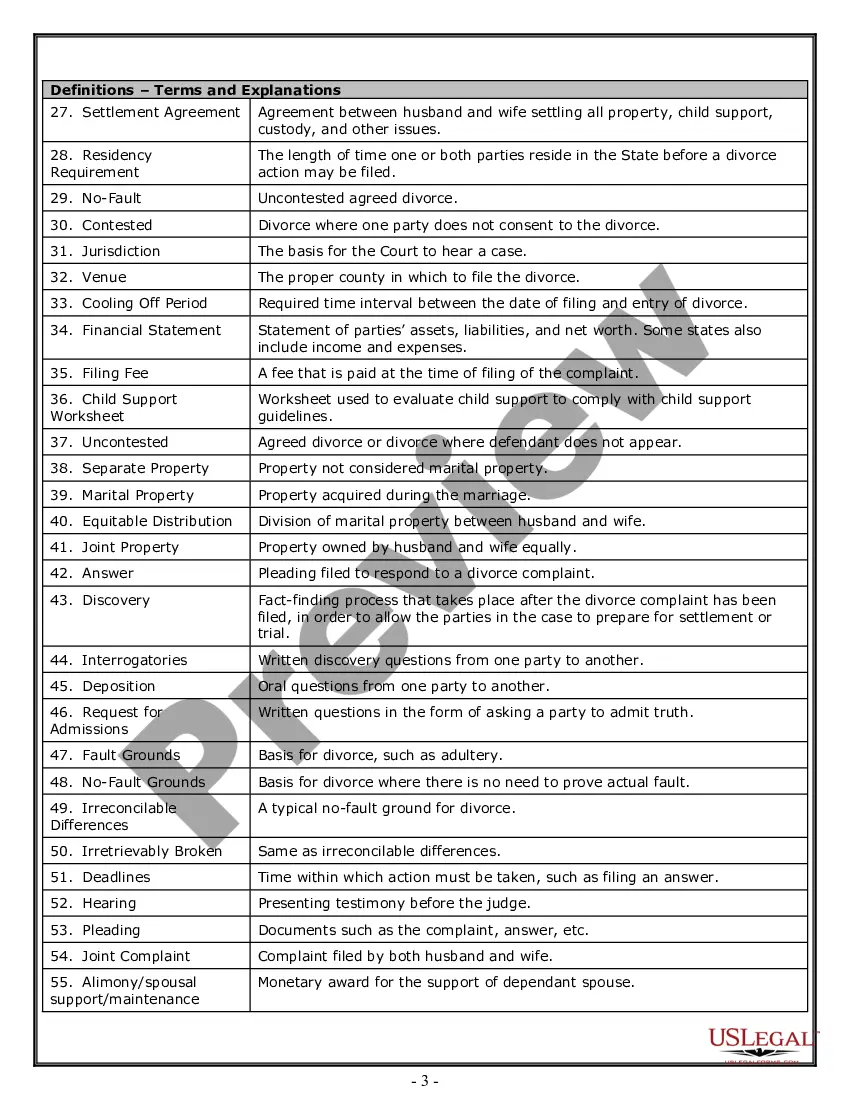

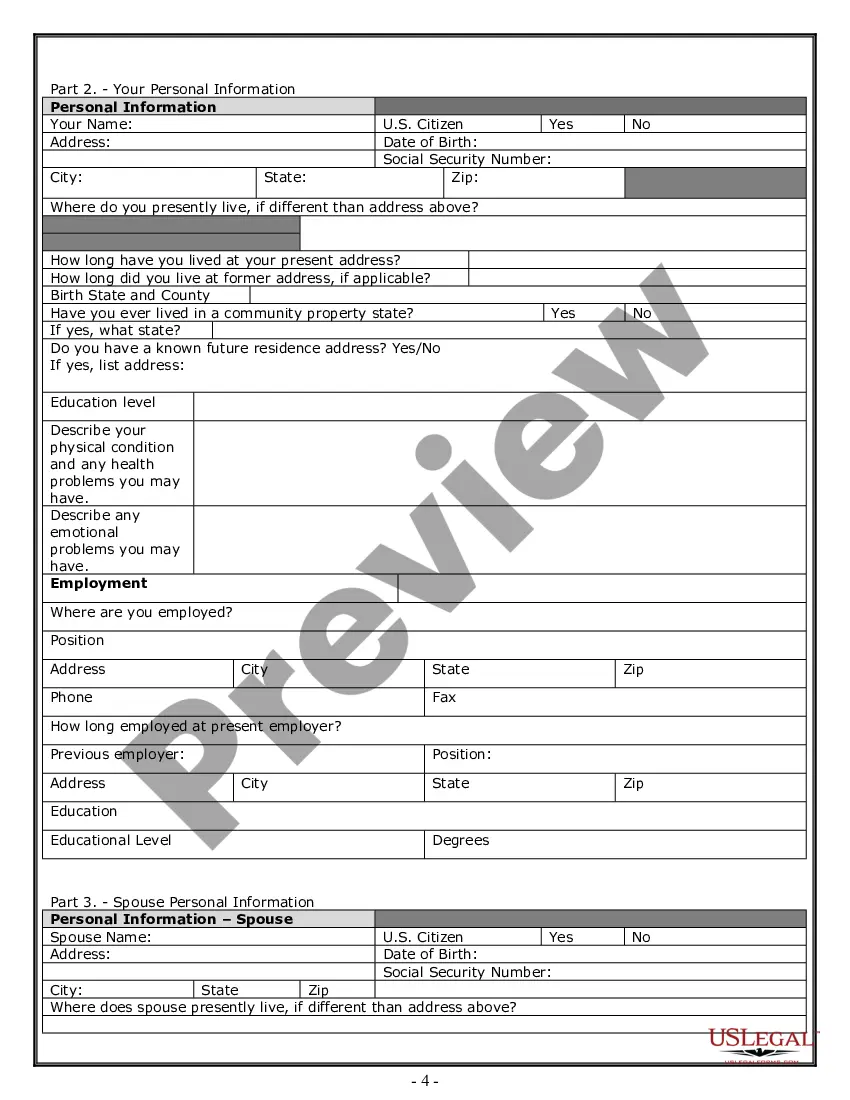

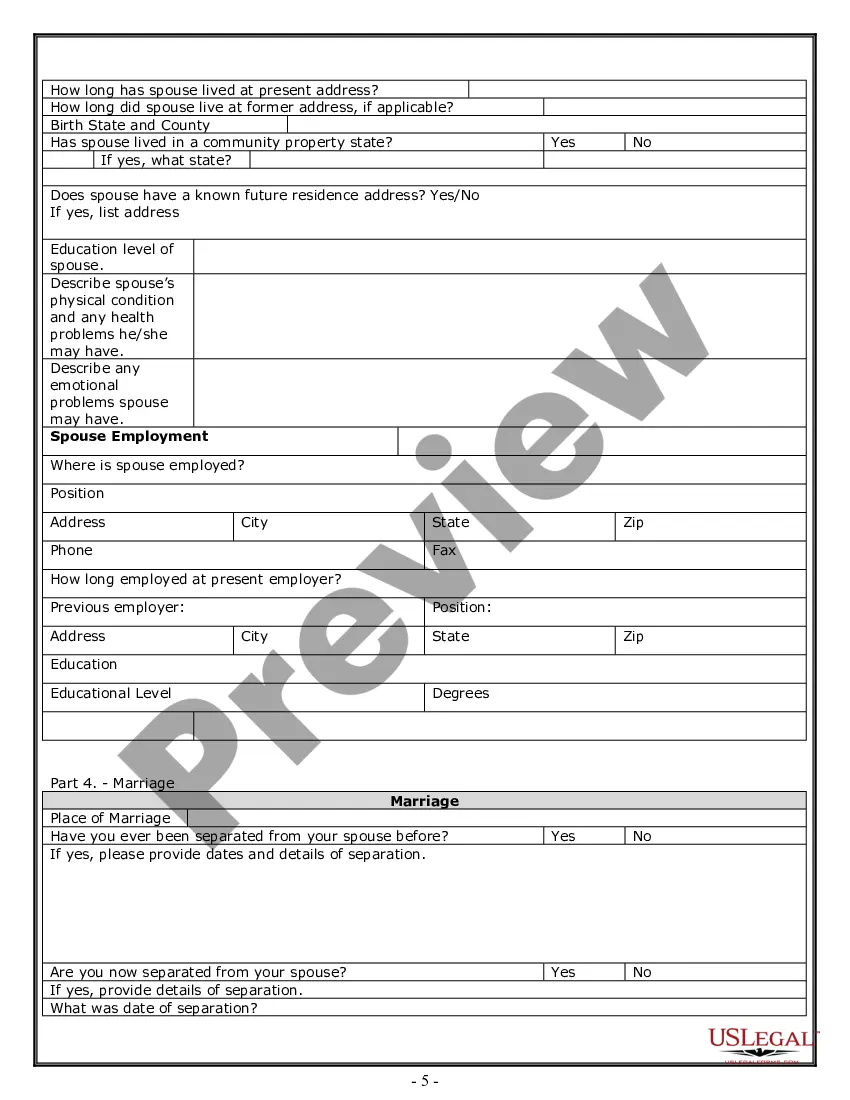

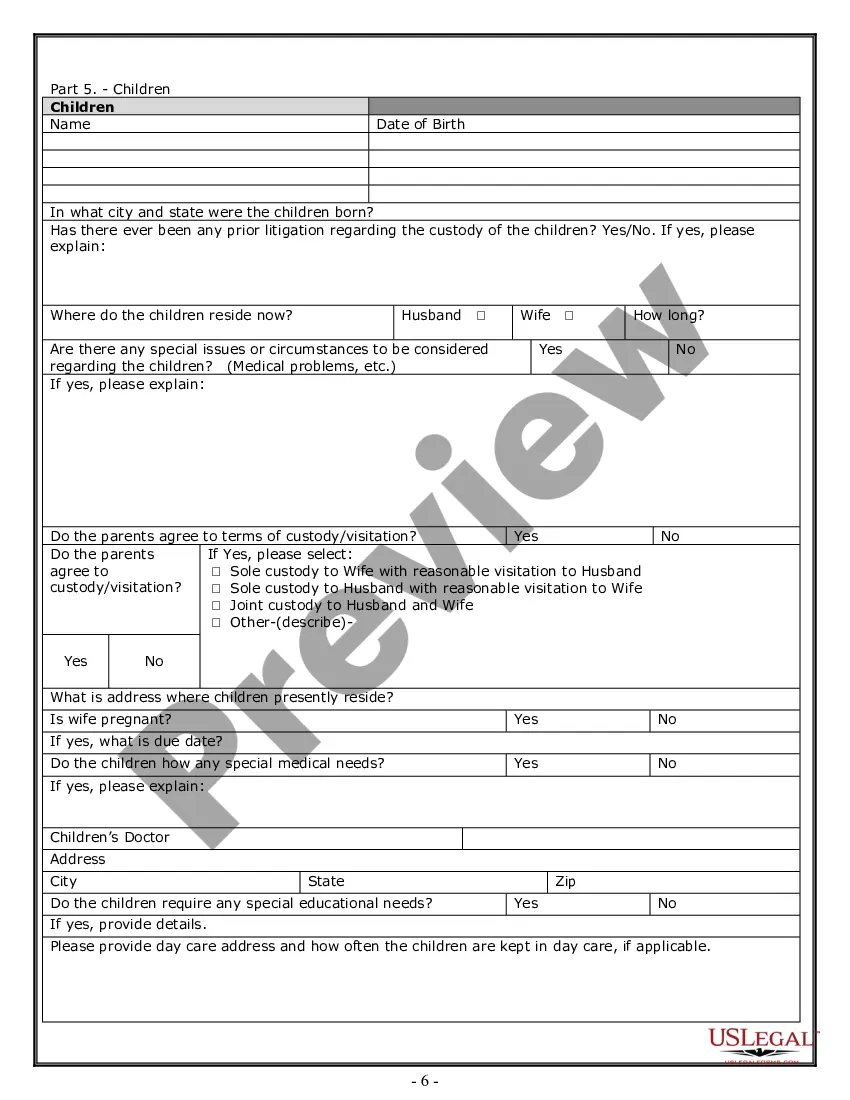

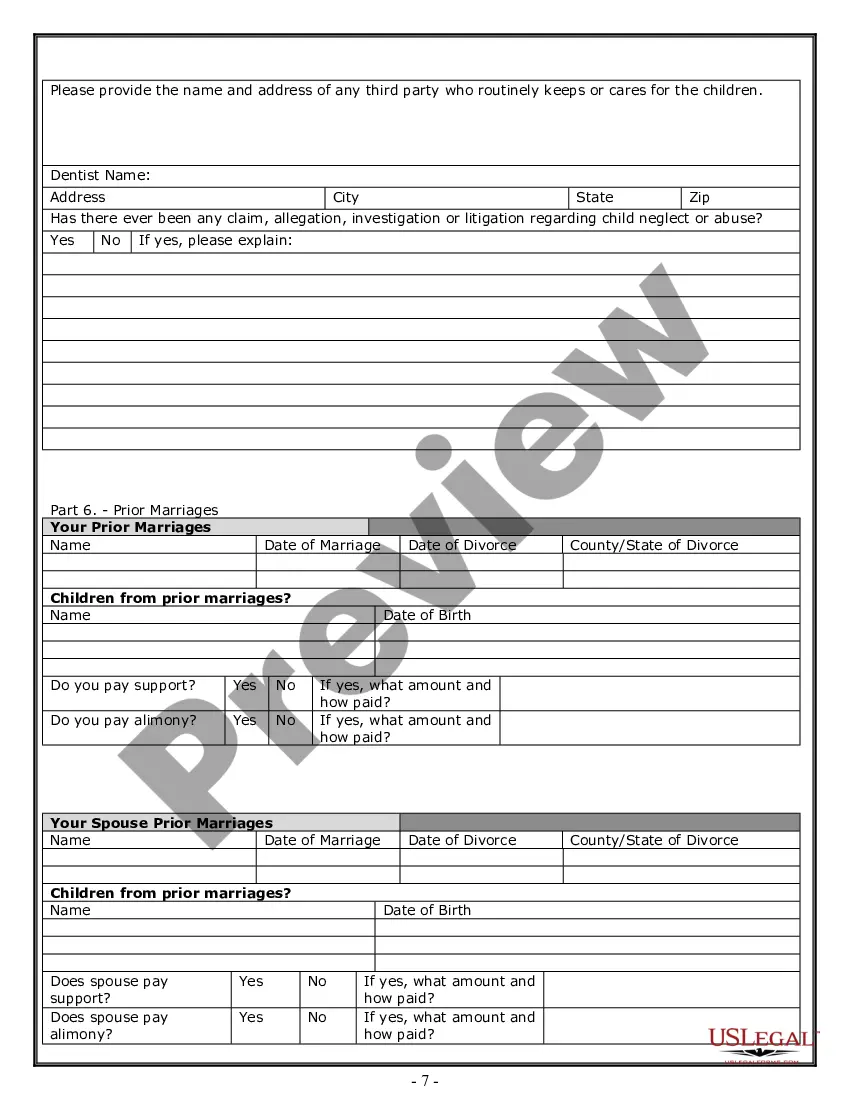

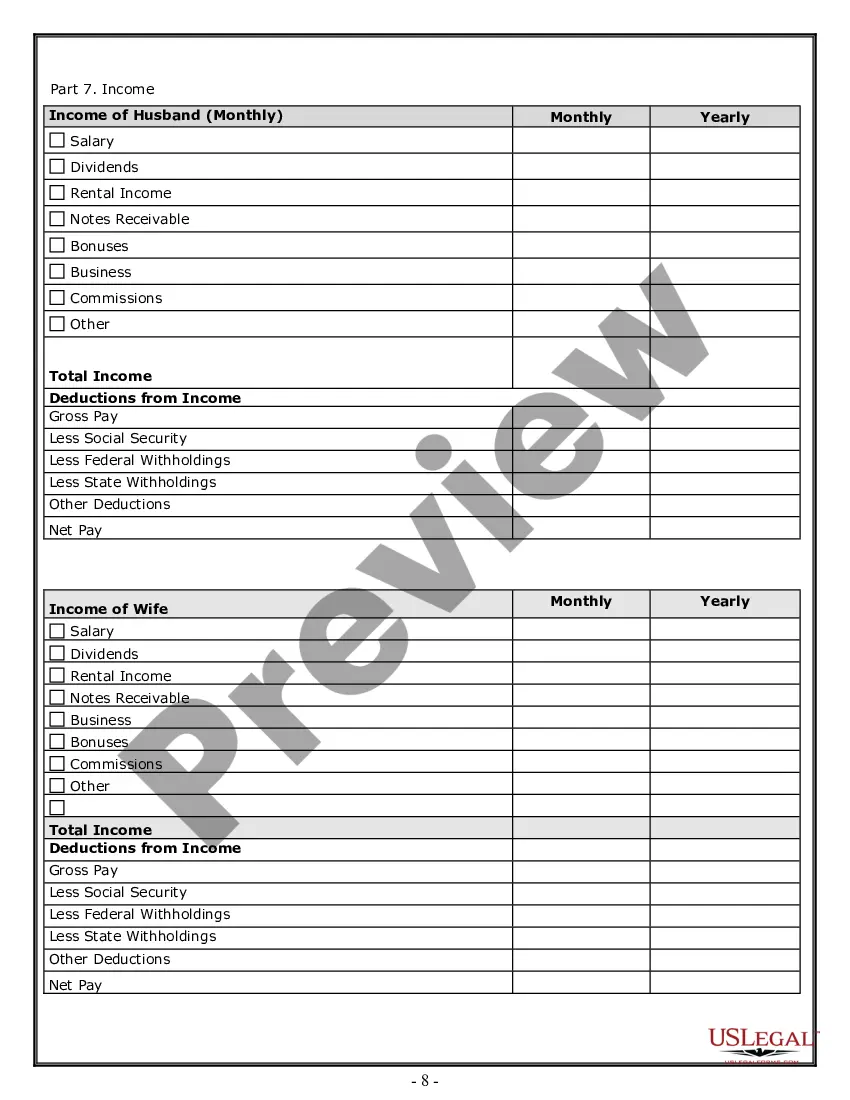

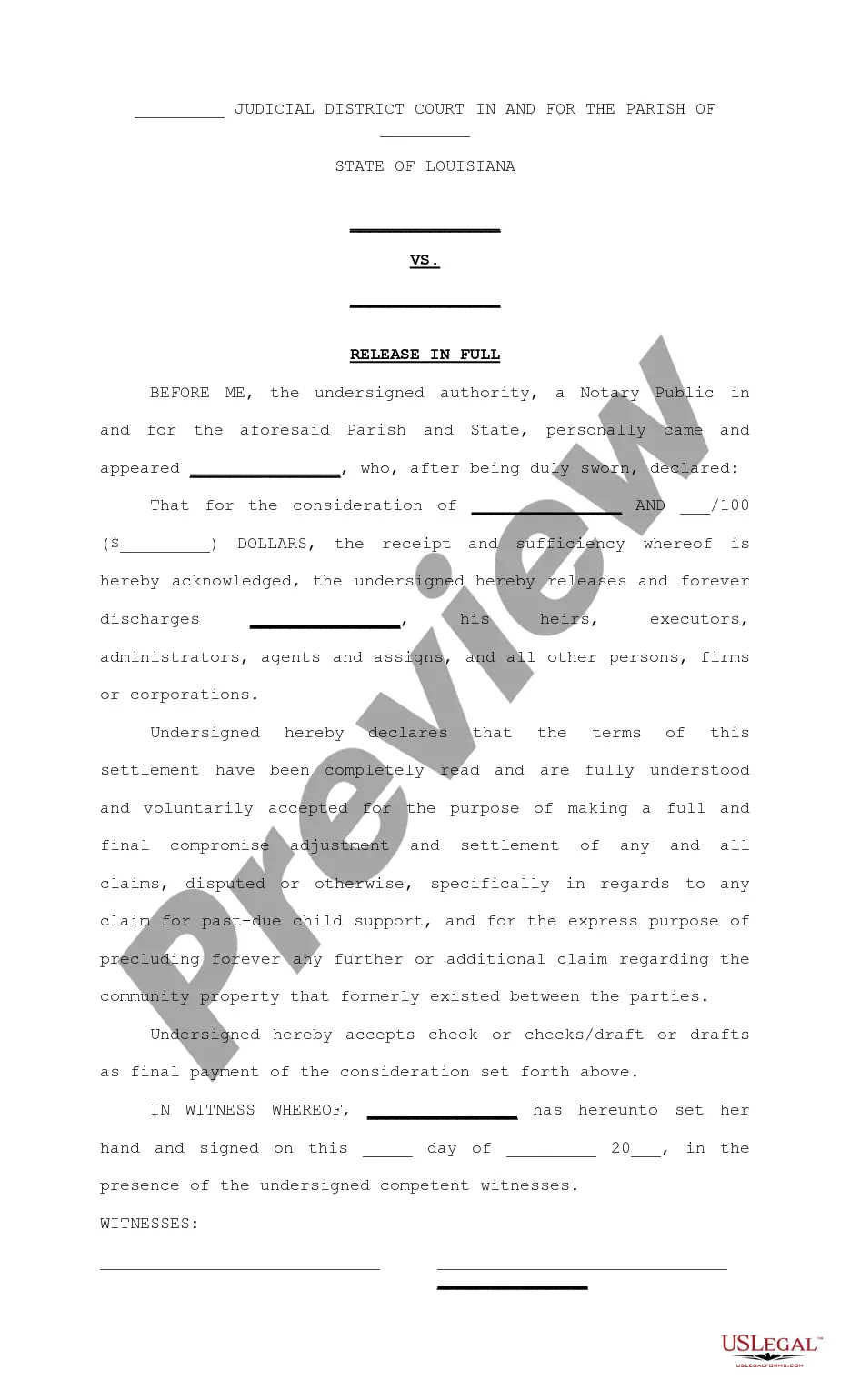

How to fill out New Jersey Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more cost-effective way of preparing Nj Divorce Law Without A Lawyer or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific templates carefully put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can easily find and download the Nj Divorce Law Without A Lawyer. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Nj Divorce Law Without A Lawyer, follow these recommendations:

- Review the form preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Nj Divorce Law Without A Lawyer.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us today and turn form completion into something simple and streamlined!

Form popularity

FAQ

The Arkansas Secretary of State maintains a database of Arkansas business entities that exist or have dissolved. The corporation search platform is free to use and makes it easy to find existing businesses or see if a business name may be available.

For fees and tax purposes, the LLC is probably your best choice. An Arkansas LLC will only get taxed once, in the form of personal income taxes for each member. A corporation in Arkansas will be subject to double taxation: first through a state corporate tax, and second on the individual tax returns of shareholders.

You can use the Arkansas Business Entity Search tool to see if your business name is available. You can also call the Arkansas Secretary of State at (888) 233-0325 or (501) 682-3409 or email them at corprequest@sos.arkansas.gov for a preliminary name availability screening.

It costs $45 to start an Arkansas LLC. This is the only filing fees for the LLC Articles of Organization. Some LLCs may need a business license in Arkansas. This depends on your industry and where your LLC is located.

The Arkansas Corporation Entity Search is an online tool provided by the Arkansas Secretary of State's office that allows individuals or businesses to search for information about corporations and other business entities registered in the state of Arkansas.

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

Starting an LLC in Arkansas will include the following steps: #1: Choose a Name for Your Arkansas LLC. #2: Hire a Registered Agent in Arkansas. #3: Request a Federal Employer Identification Number (EIN) #4: File Your Certificate of Organization. #5: Create an Operating Agreement. #6: Fulfill Your Ongoing Obligations.

To maintain an LLC in Arkansas you will need to pay an annual fee of $150 along with income tax (1.125% to 6.925%), sales tax (6.5% + local county charges) and federal taxes.