Quitclaim From To Foreclosure

Description

How to fill out New Jersey Quitclaim Deed From A Husband And Wife And Husband And Wife To A Husband And Wife?

The Quitclaim From To Foreclosure you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and regional regulations. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Quitclaim From To Foreclosure will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it fits your requirements. If it does not, utilize the search bar to find the right one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Quitclaim From To Foreclosure (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

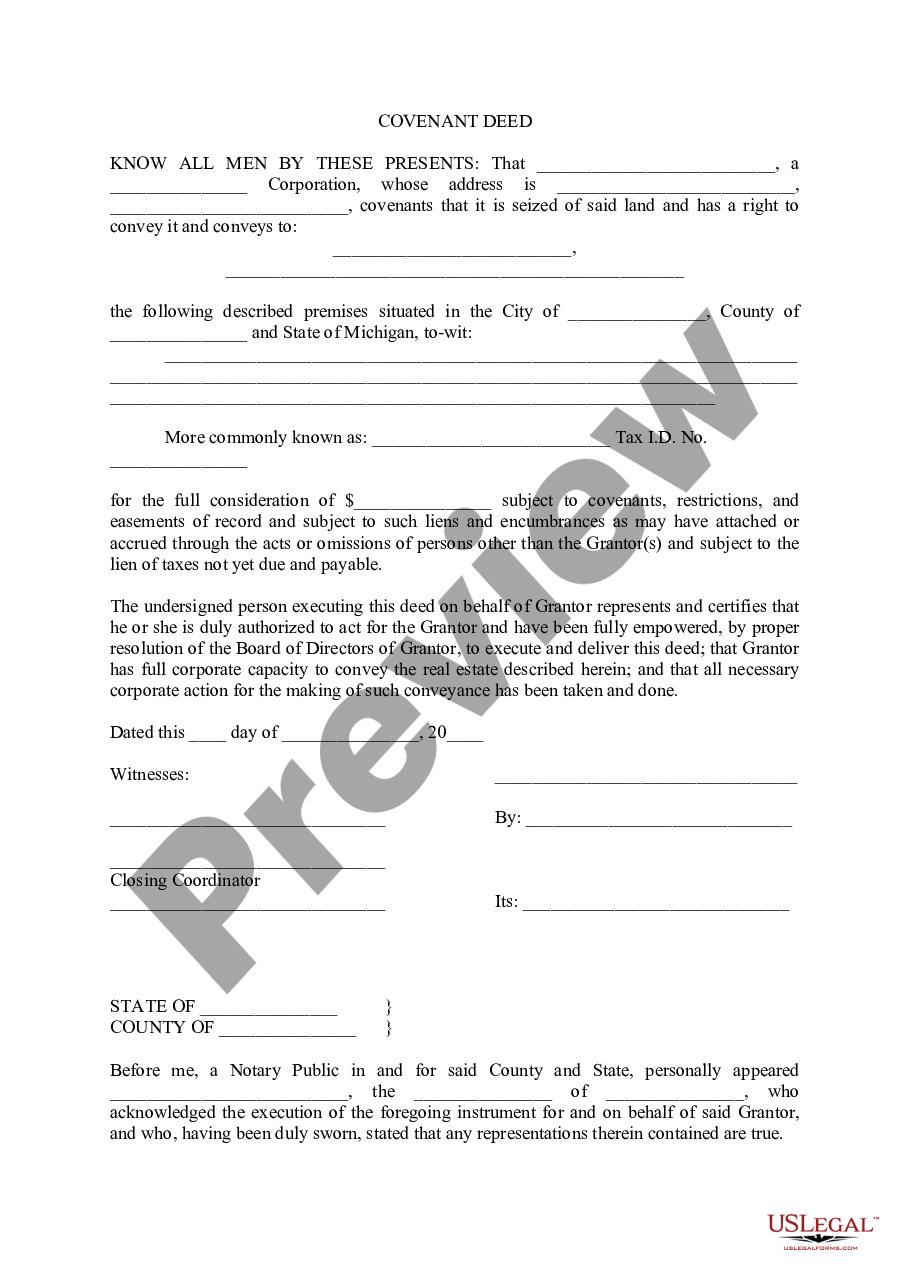

A deed in lieu of foreclosure is the process of when a homeowner transfers the deed of their home to the lender, without the legal process of a foreclosure.

Foreclosure Can Take Months or Years Notice of default: The lender typically issues a notice of default, indicating its intention to foreclose, when the loan becomes 90 days past due. Typically, the notice indicates legal foreclosure will begin in 90 days unless the borrower brings their payments up to date.

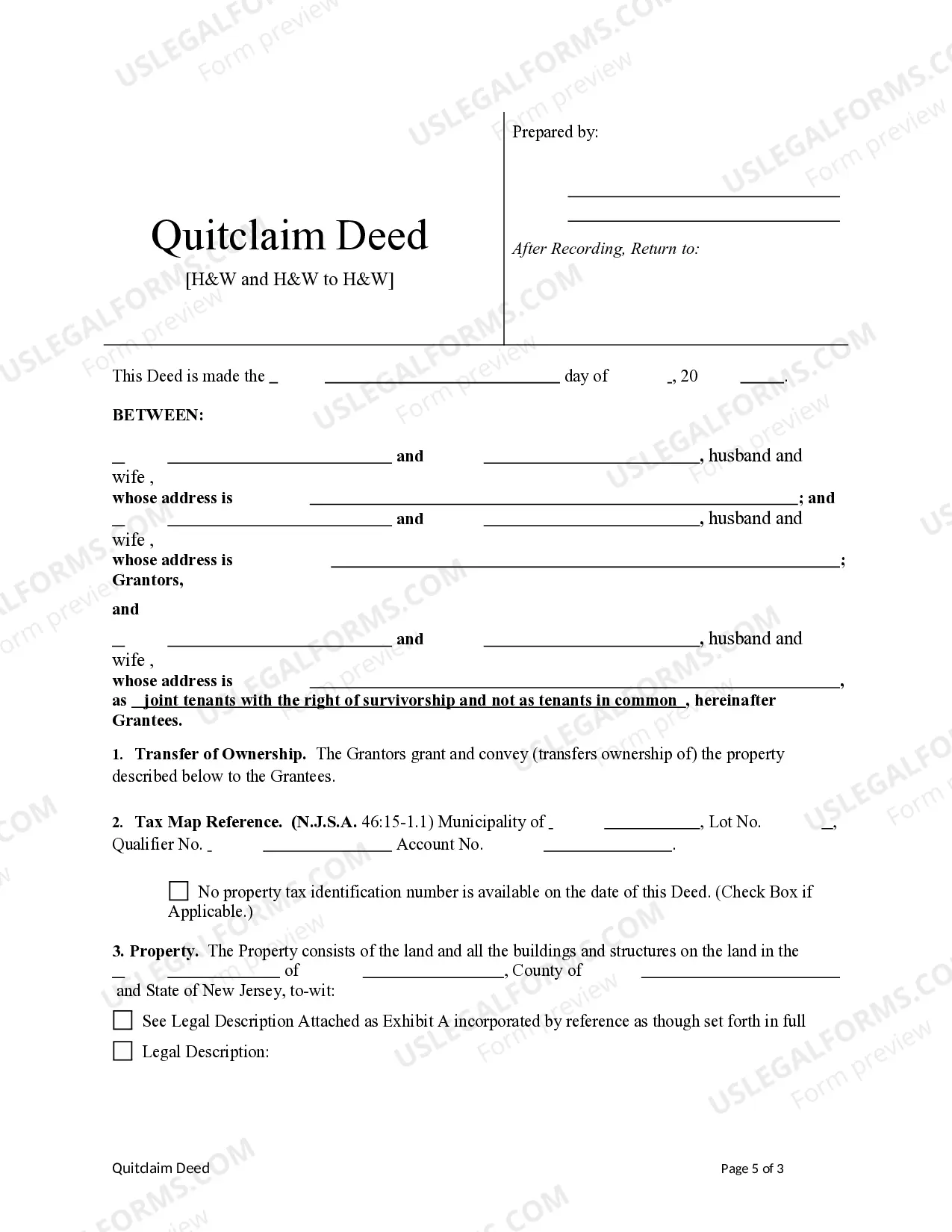

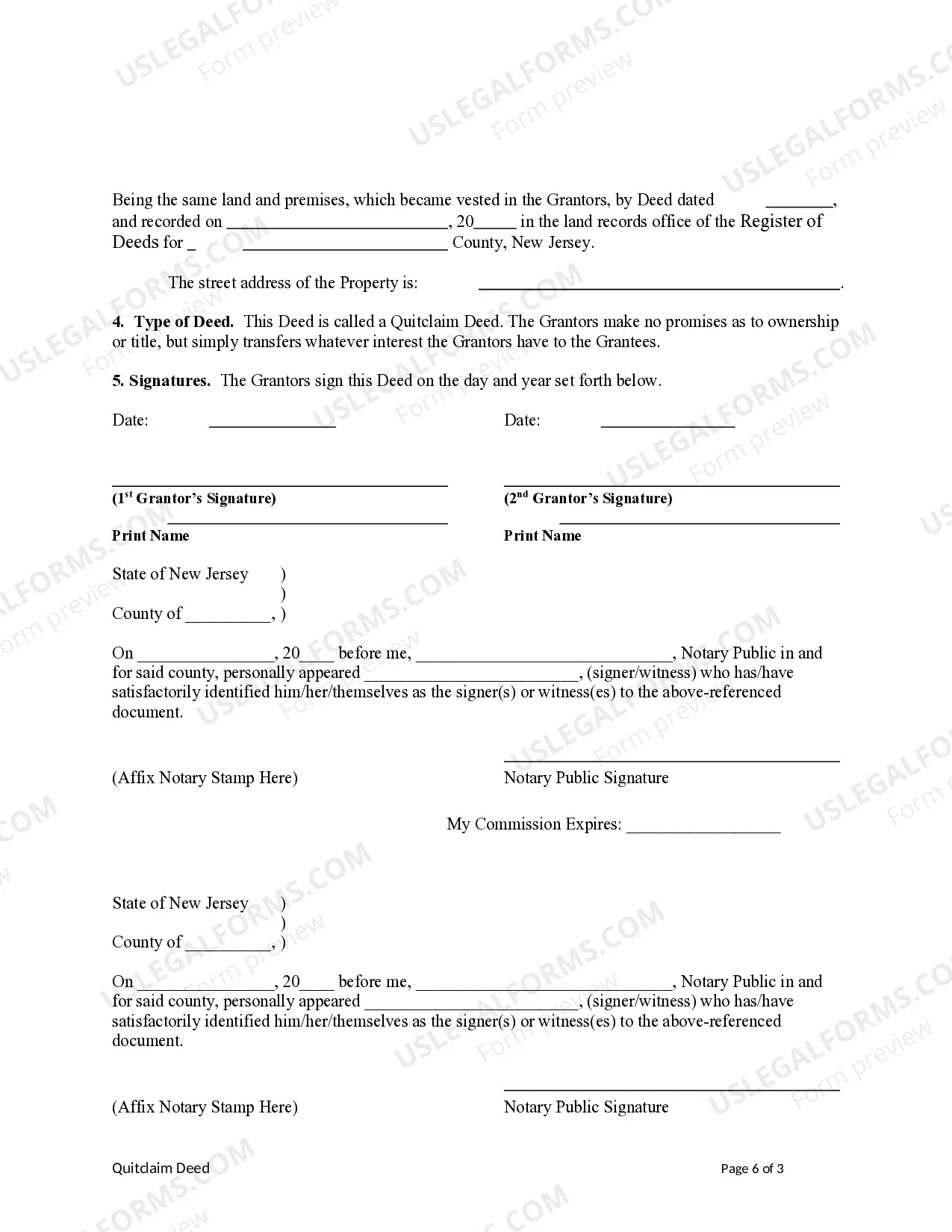

A quit claim deed should be filed with the clerk of court in the county where the property is located. This will involve taking the deed to the clerk's office and paying the required filing fee (typically about $10 for a one-page quit claim deed).

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.