New Jersey Quitclaim Deed With Right Of Survivorship

Description

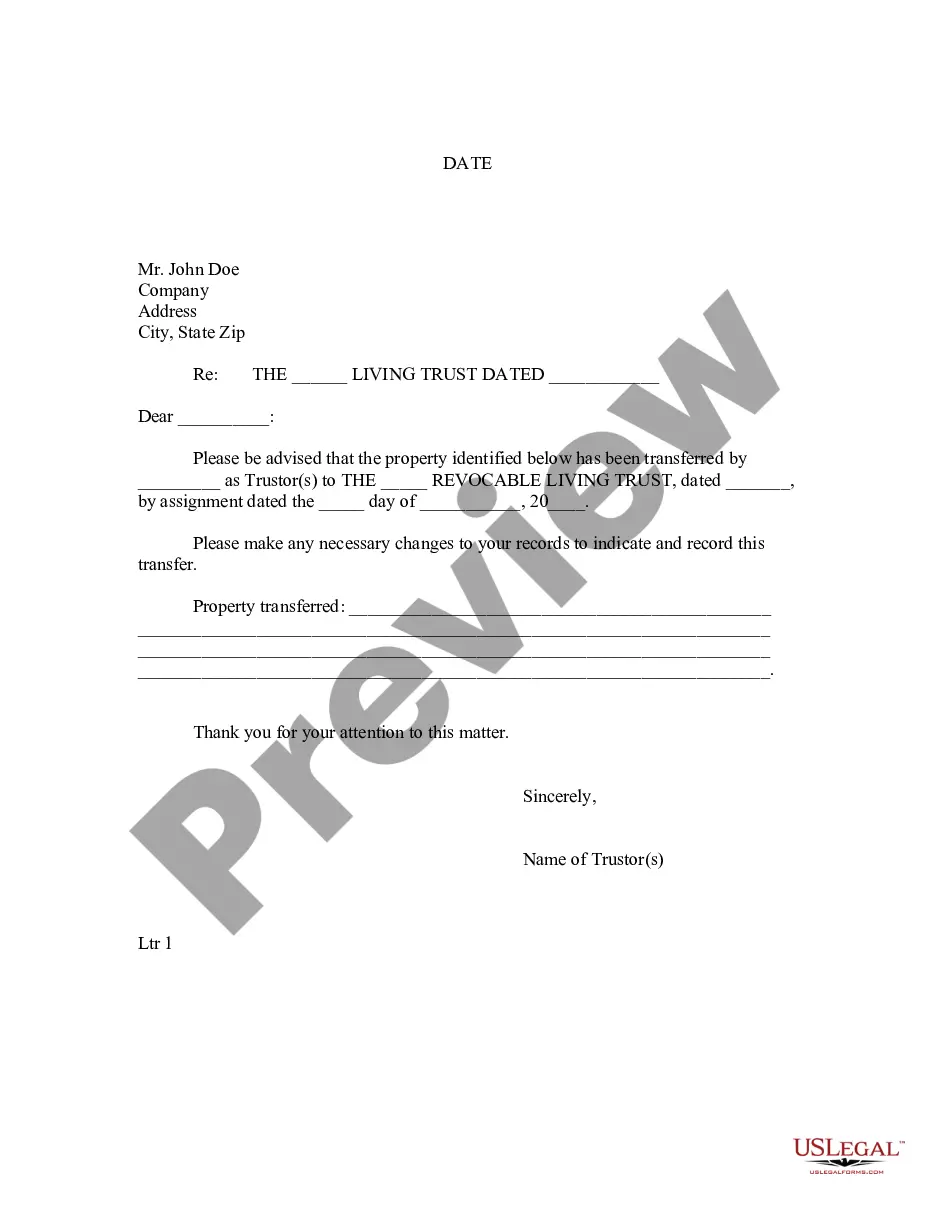

How to fill out New Jersey Quitclaim Deed From Husband To Himself And Wife?

What is the most dependable service to obtain the New Jersey Quitclaim Deed With Right Of Survivorship and various recent iterations of legal documents.

US Legal Forms is the answer! It boasts the largest assortment of legal forms for every situation.

If you don’t have an account with us yet, follow these steps to create one: Template compliance assessment. Prior to acquiring any template, ensure it meets your usage requirements and complies with your state or county's regulations. Review the template description and utilize the Preview if available. Alternative document retrieval. If you encounter any discrepancies, use the search bar at the top of the page to find a different template. Click Buy Now to select the correct one. Registration and subscription acquisition. Select the most appropriate pricing option, Log In to or create an account, and purchase your subscription using PayPal or a credit card. Obtaining the documents. Select the desired format to save the New Jersey Quitclaim Deed With Right Of Survivorship (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an excellent option for anyone needing to manage legal documents. Premium users can enjoy even more benefits as they can fill and authorize previously saved documents electronically at any time using the built-in PDF editing tool. Explore it today!

- Each template is expertly crafted and verified for adherence to federal and state laws and regulations.

- The documents are organized by region and state, making it effortless to find what you need.

- Experienced users of the site merely need to Log In, confirm their subscription is active, and click the Download button adjacent to the New Jersey Quitclaim Deed With Right Of Survivorship to obtain it.

- After saving, the template stays accessible for future reference under the My documents section of your account.

Form popularity

FAQ

If you are married in New Jersey but your name is not on the property deed, you may still have rights to the property, especially if it is considered marital property. New Jersey follows equitable distribution laws, which can protect your financial interests in the event of divorce. To ensure you understand your rights fully, consider exploring resources like US Legal Forms for legal documentation and assistance regarding property interests in marriage.

In New Jersey, if a spouse signs a quitclaim deed with right of survivorship, they relinquish their ownership rights to the property. However, if the deed specifies joint ownership, the surviving spouse retains rights to the property after the other spouse's passing. It’s essential to understand your specific situation, and consulting a resource like US Legal Forms can provide clarity on your rights regarding quitclaim deeds.

A New Jersey quitclaim deed with right of survivorship primarily benefits individuals looking to transfer property ownership quickly without the need for a complex legal process. It is especially useful in cases involving family members, such as transferring property between spouses. Additionally, this deed allows the new owner to inherit the property automatically upon the previous owner's death, providing a streamlined transition of ownership.

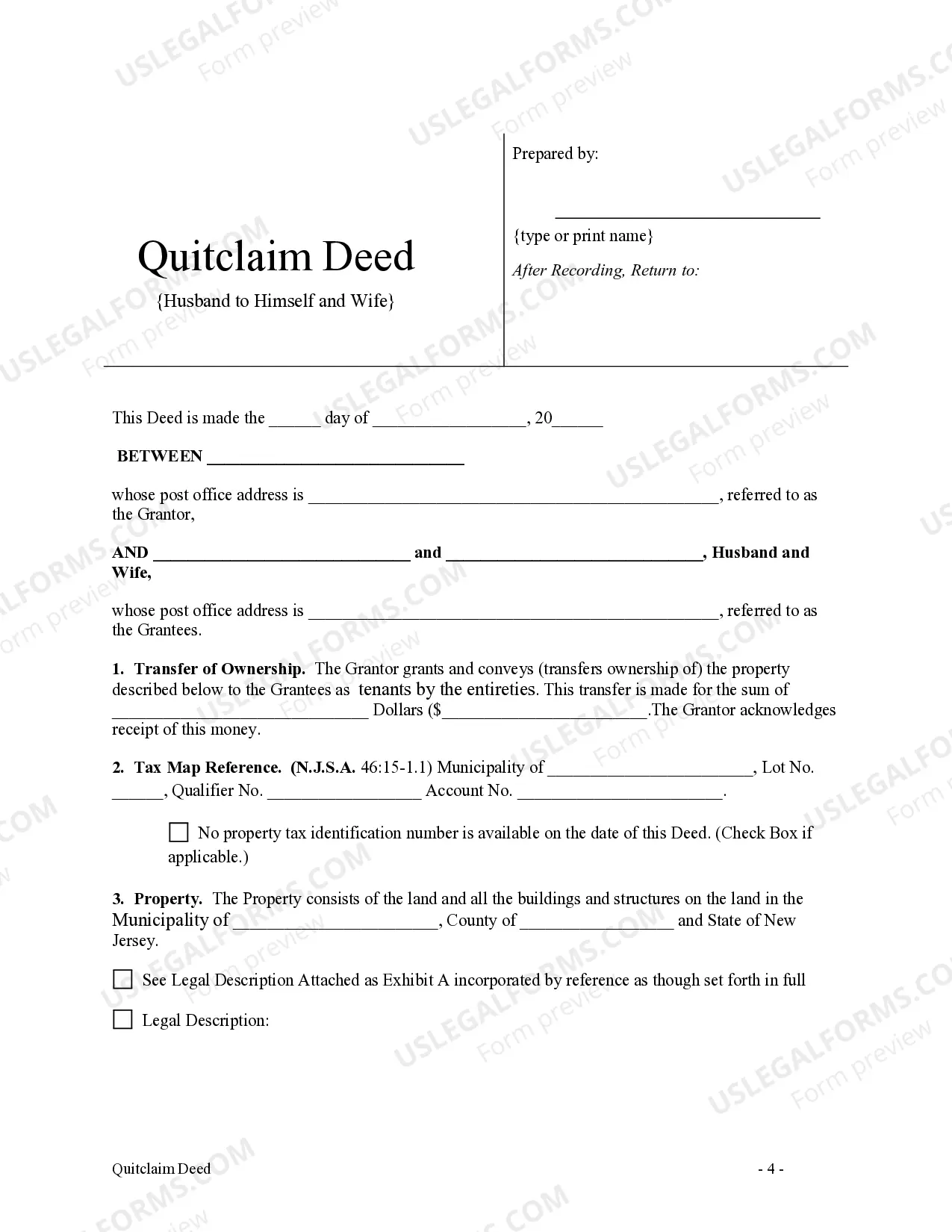

To file a New Jersey quitclaim deed with right of survivorship, you need to complete the deed form with accurate details, such as the names of the current and new owners. Next, you must sign the document in the presence of a notary public. Once notarized, you should record the deed at your county's Clerk's Office. Utilizing a platform like US Legal Forms can simplify this process, providing you with the necessary forms and guidance.

In New Jersey, a quitclaim deed transfers ownership of property from one person to another without any warranties. The primary benefit of using a New Jersey quitclaim deed with right of survivorship is that it allows co-owners to pass their interest in the property directly to the surviving co-owner upon death. This process simplifies the transfer, avoiding probate court. To facilitate this process, consider using the US Legal Forms platform, which provides the necessary documents and guidance for creating a quitclaim deed that meets all legal requirements.

When one person on a deed dies in New Jersey, the outcome largely depends on the type of ownership established. If the property has a right of survivorship, the surviving owner automatically becomes the sole owner. However, if the property does not include this designation, the deceased's share may go through probate. Using a New Jersey quitclaim deed with right of survivorship can provide clarity and simplicity in these situations.

A right of survivorship deed in New Jersey is a legal document that allows joint owners of a property to automatically transfer ownership to the surviving owner upon death. This is crucial in estate planning, as it avoids the lengthy probate process. A New Jersey quitclaim deed with right of survivorship provides a simple and straightforward way to ensure property transfer. It’s a popular option for couples and family members looking to secure their property.

In New Jersey, one owner of jointly owned property cannot sell the property without consent from the other owner. This is especially true when a New Jersey quitclaim deed with right of survivorship is involved. If one owner wishes to sell, they must reach an agreement with the co-owner, or both must agree to the sale. Communication is crucial in these situations to avoid disputes.

In New Jersey, the rights of survivorship allow joint owners to inherit each other's shares of property upon death. This principle is established in a New Jersey quitclaim deed with right of survivorship. This means that when one owner dies, the other automatically becomes the sole owner without going through probate. It’s a beneficial arrangement for partners and family members.

To transfer a deed after someone has passed in New Jersey, first determine if the property has a right of survivorship. If it does, the surviving owner can present the death certificate to the county clerk to update the deed. If not, the property will typically go through probate. A New Jersey quitclaim deed with right of survivorship can help avoid this process.