New Jersey Executor's Deed Form

Description

How to fill out New Jersey Warranty Deed From Husband To Himself And Wife?

What is the most reliable service to acquire the New Jersey Executor's Deed Form and other updated versions of legal documents? US Legal Forms is the solution! It's the largest repository of legal paperwork for any situation.

Each template is well-crafted and verified for compliance with federal and local statutes. They are categorized by area and usage state, making it easy to find what you need.

US Legal Forms is a superb option for anyone needing to handle legal documentation. Premium users benefit even more as they can fill in and electronically sign previously saved documents at any time using the integrated PDF editing tool. Try it out today!

- Experienced users of the platform simply need to Log In to the system, verify their subscription status, and click the Download button next to the New Jersey Executor's Deed Form to get it.

- Once saved, the template is accessible for future use within the My documents section of your account.

- If you do not yet have an account with our repository, here are the steps to create one.

- Form compliance review. Before obtaining any template, you should confirm that it meets your use case requirements and complies with your state's or county's laws. Review the form description and take advantage of the Preview if it’s offered.

Form popularity

FAQ

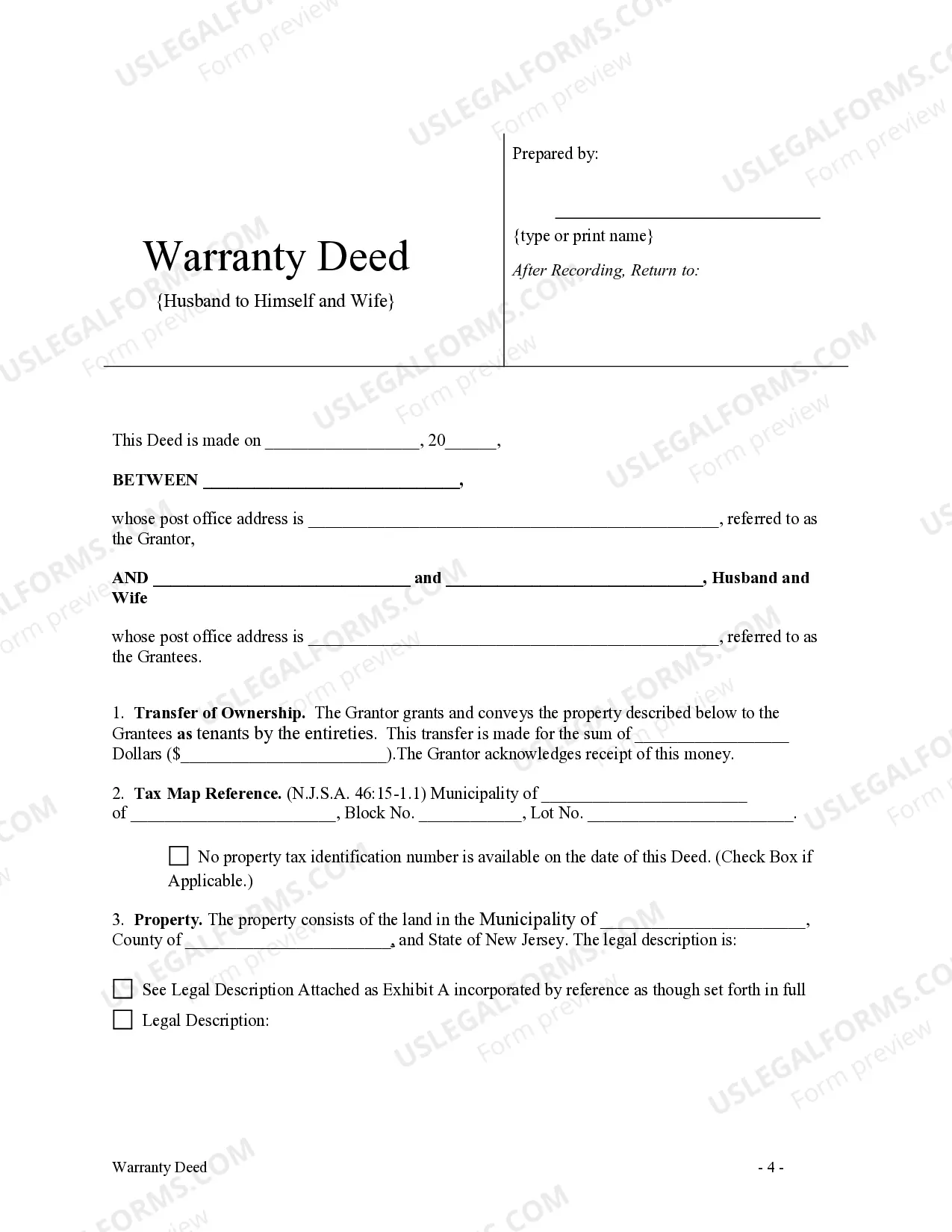

To fill out a quit claim deed in New Jersey, start by obtaining the correct form tailored for your situation, such as the New Jersey executor's deed form. Clearly write the names of the grantor and grantee, and include the legal description of the property. After completion, be sure to sign the document in front of a notary public, then file it with your local county clerk's office to ensure it is legally recognized. Using uslegalforms can streamline this process, providing you access to the right forms and guidance with ease.

Yes, you can prepare your own deed in New Jersey, including the New Jersey executor's deed form. However, it is crucial to ensure that you follow the correct procedures and include all necessary details. If you feel uncertain about the process, using a platform like uslegalforms can provide templates and guidance to assist in accurate preparation.

You do not necessarily need a lawyer to transfer a deed in New Jersey, but having legal assistance can be beneficial. A lawyer can provide guidance on completing the New Jersey executor's deed form, ensuring everything complies with state laws. This can reduce the risk of errors and future complications.

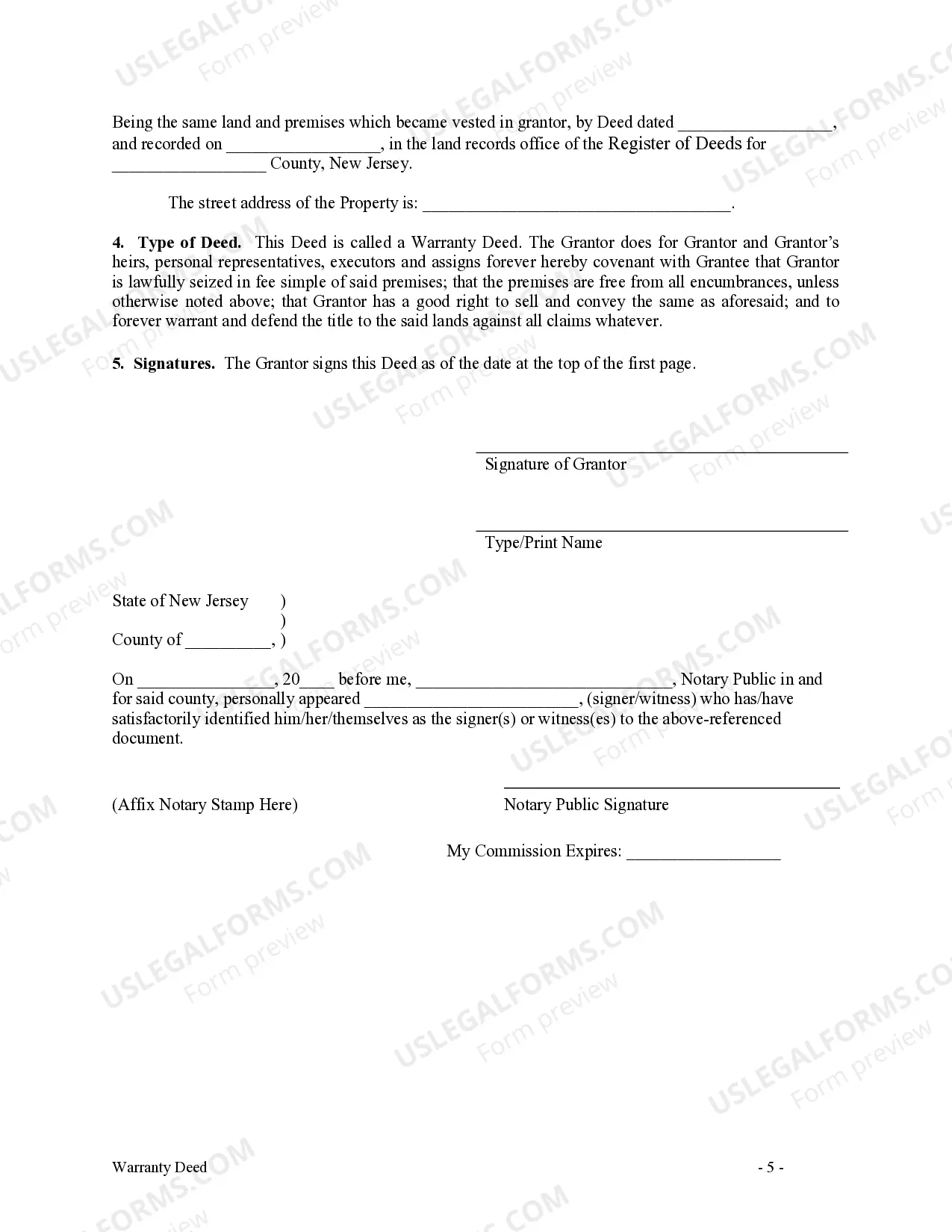

Filing a deed in New Jersey requires you to submit the completed New Jersey executor's deed form to the county clerk where the property is located. It's essential to include the required supporting documents, like the original deed and any necessary identification. Upon filing, ensure you receive a stamped copy for your records.

To transfer the deed of a house after death in New Jersey, the executor must file the New Jersey executor's deed form with the county clerk's office. This process involves gathering necessary documents, such as the death certificate and the will. Completing these steps ensures a smooth transfer of property ownership.

While it is not a legal requirement for an attorney to prepare a deed in New Jersey, it is often advisable. An attorney can help ensure that the New Jersey executor's deed form is completed correctly and meets all legal requirements. This assistance can prevent potential issues down the line.

In New Jersey, an executor typically has nine months to settle an estate from the date of death. However, complications such as disputes or tax issues can extend this timeline. It's important for the executor to act promptly in managing estate assets, including preparing the New Jersey executor's deed form for property transfers.

To execute a deed transfer in New Jersey, you’ll first need to complete the New Jersey executor's deed form with the appropriate details. Once filled out, this form must be signed and notarized. Finally, you will file the deed with the county clerk’s office, where fees may apply, to finalize the transfer and make it a matter of public record.

Getting a copy of your deed online in New Jersey is straightforward. Many county clerk offices have digital platforms where you can search for and download your deed documents, including the New Jersey executor's deed form. Just visit your county's website, navigate to the property records section, and follow the instructions to access your deed.

To obtain a copy of a deed in New Jersey, you can visit the county clerk's office where the property is located. You may also use online resources provided by the county or state to request the document. Having the New Jersey executor's deed form easily accessible can facilitate property transactions and record-keeping.