Titulo De Carro De New Jersey Without Insurance

Description

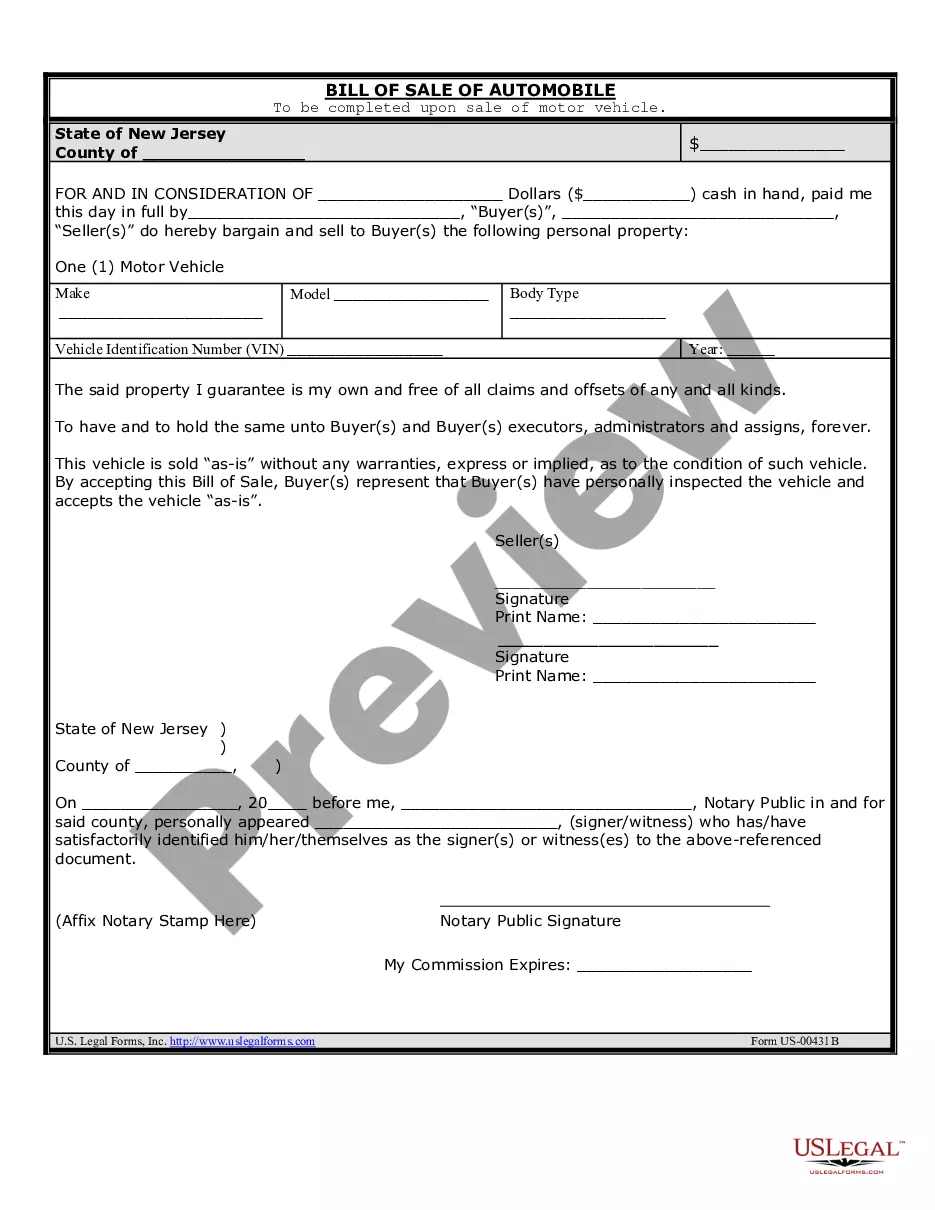

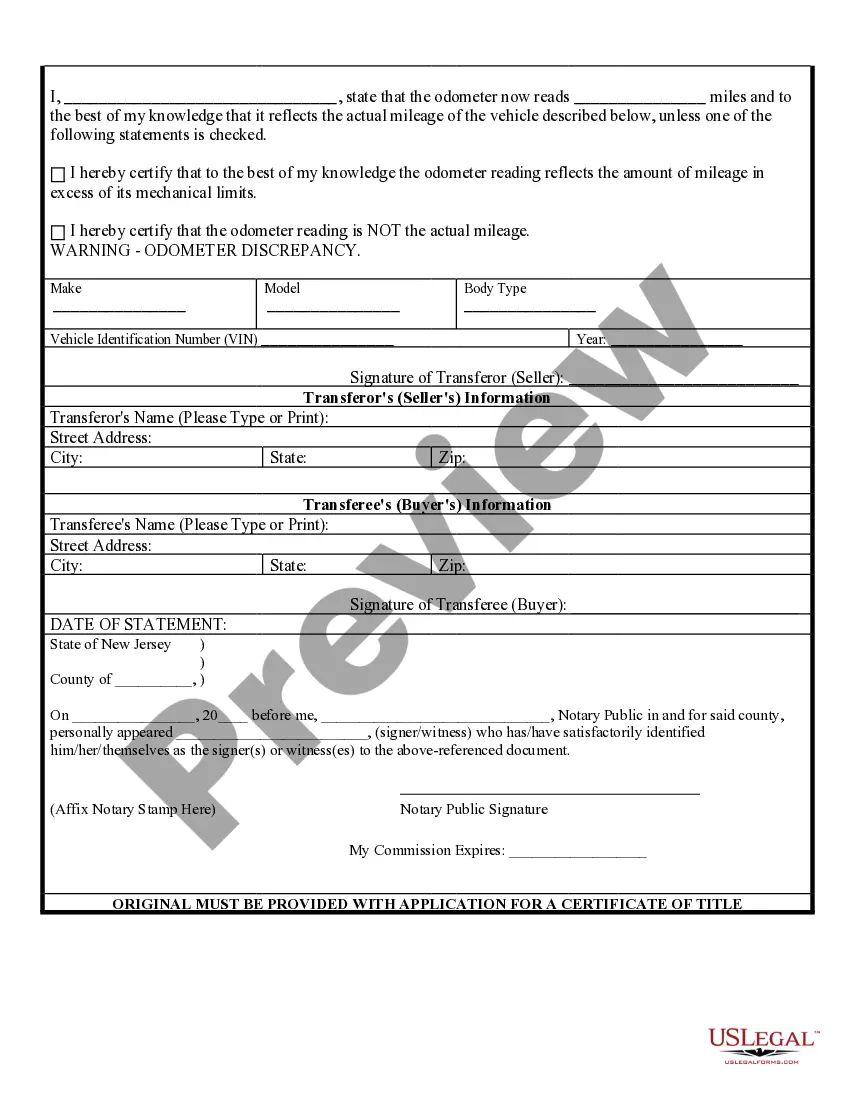

How to fill out New Jersey Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

It’s no secret that you can’t become a law professional overnight, nor can you learn how to quickly prepare Titulo De Carro De New Jersey Without Insurance without having a specialized background. Creating legal forms is a long process requiring a certain training and skills. So why not leave the creation of the Titulo De Carro De New Jersey Without Insurance to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and obtain the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Titulo De Carro De New Jersey Without Insurance is what you’re searching for.

- Begin your search over if you need a different form.

- Set up a free account and select a subscription option to purchase the form.

- Choose Buy now. Once the transaction is through, you can get the Titulo De Carro De New Jersey Without Insurance, complete it, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

In order to register a car in New Jersey, you need to have proof of insurance. You'll need to bring your New Jersey car insurance when registering your car.

Pay the $60 title fee (or $85 for a financed vehicle title fee) In addition, a new registration and proof of New Jersey insurance in the estate name is necessary if the vehicle will be operated. The existing registration can be transferred to an immediate family member for $4.50.

$60 for a standard vehicle. $85 for a financed vehicle with one lien. $110 for a financed vehicle with two liens. For your convenience, the MVC accepts American Express® card, MasterCard®, Visa® card, Discover card®, checks, money orders and cash.

To do a New Jersey title transfer as a new resident from out-of-state, you'll need: Driver's license. Current title. Proof of insurance. Universal Title Application (Form OS/SS-UTA) Vehicle Registration Application (Form BA-49. Transfer title fee of $60. Applicable registration fees.

Titling fee ? $60 for a standard vehicle, $85 for a financed vehicle with one lien, and $110 for that with two liens. Registration fee ? Varies with the vehicle type. Sales tax fee ? You can contact the New Jersey Division of Taxation to know details about the sales tax fee.