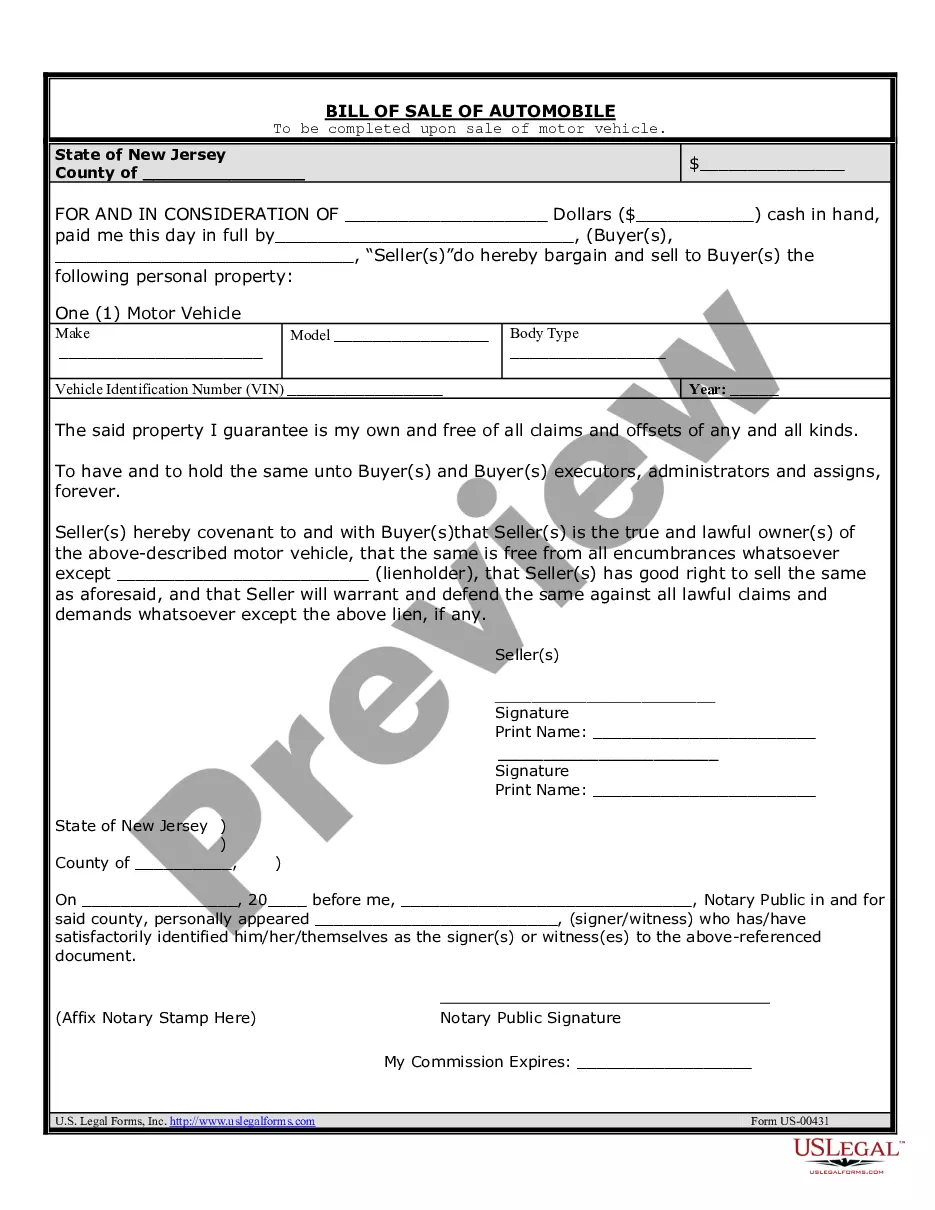

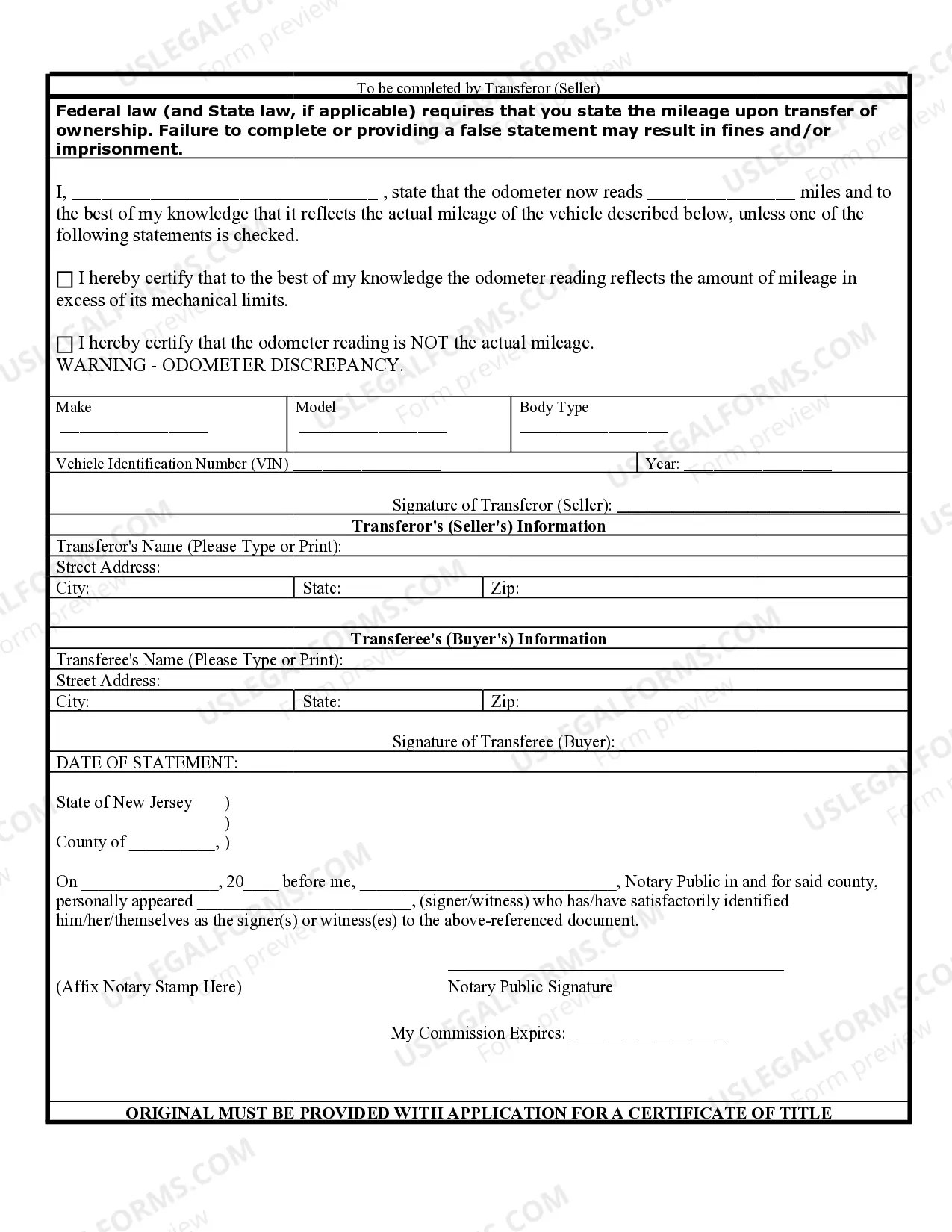

Odometer Disclosure Statement New Jersey With Lienholder

Description

How to fill out New Jersey Bill Of Sale Of Automobile And Odometer Statement?

Accessing legal document samples that comply with federal and state laws is crucial, and the internet offers many options to pick from. But what’s the point in wasting time looking for the right Odometer Disclosure Statement New Jersey With Lienholder sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal case. They are easy to browse with all documents collected by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a Odometer Disclosure Statement New Jersey With Lienholder from our website.

Obtaining a Odometer Disclosure Statement New Jersey With Lienholder is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the guidelines below:

- Take a look at the template utilizing the Preview option or via the text outline to make certain it meets your needs.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Odometer Disclosure Statement New Jersey With Lienholder and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

This is where we get our "7-in-7" concept. You can attempt to contact a consumer about 1 debt 7 times in 7 days. And it's the "1 debt" that's key here. Phone numbers do not matter; how many debts your agency has for the consumer does.

Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

You can request that a collection agency verify the amount and validity of a debt. But you must act quickly.

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts.

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted. Ask for the debt collector's mailing address at this time as well, in case you decide to request a debt verification letter.