Living Trust New Hampshire Form

Description

Form popularity

FAQ

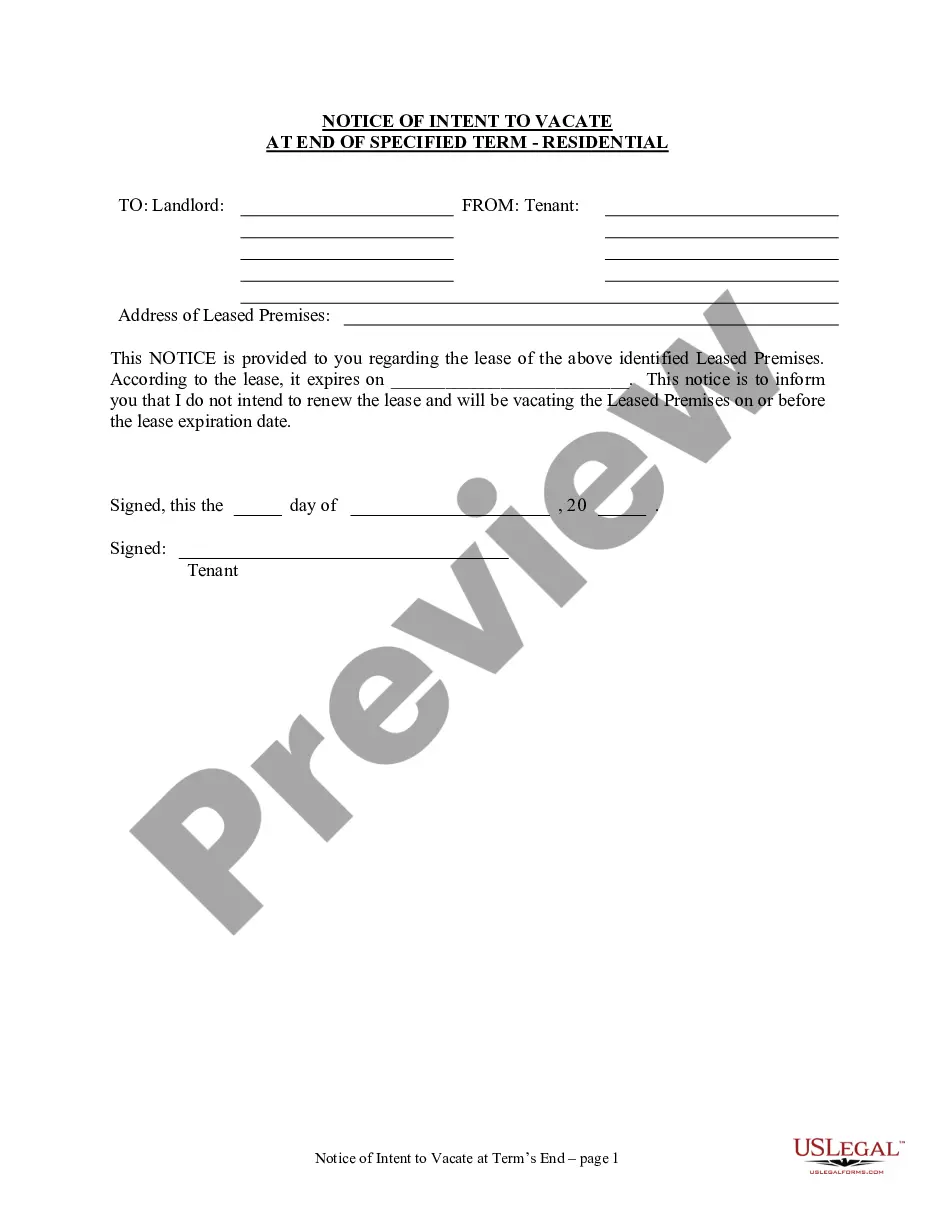

Filling out a living trust involves several steps, starting with choosing the correct living trust New Hampshire form. You will need to input specific information, such as the names of your beneficiaries and details about your assets. After completing the form, review it for accuracy and ensure all required signatures are in place. Using platforms like US Legal Forms can simplify this process by offering easy-to-follow templates.

Creating a living trust in New Hampshire begins with gathering important documents, like your will and property deeds. You can use a living trust New Hampshire form to streamline the process. Once you've completed the form, you'll need to sign it in front of a notary. It's wise to consult with an attorney to ensure your trust meets all legal requirements.

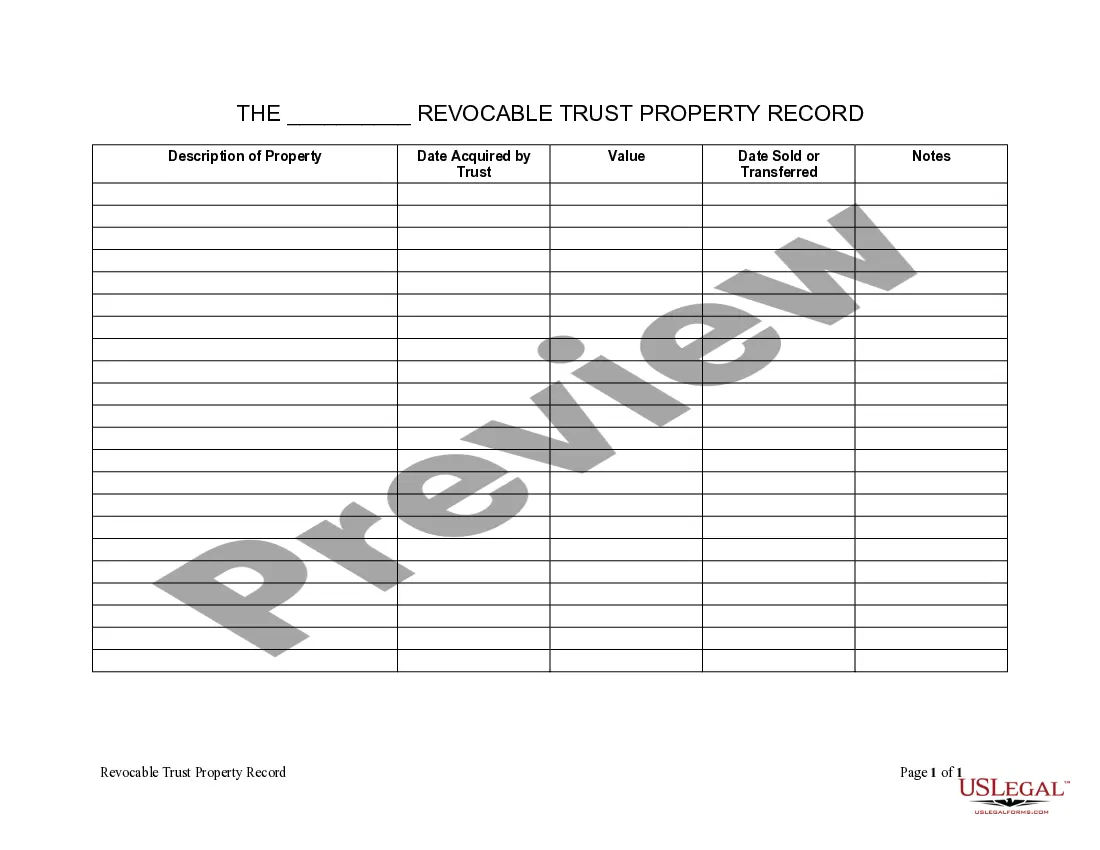

When creating a living trust in New Hampshire, it's important to know which assets to exclude. Generally, you should not place retirement accounts, like 401(k)s and IRAs, into a trust as it may trigger taxes. Additionally, vehicles and personal belongings may be better managed outside the trust for easier access. For efficient management of your estate plan, consider using a living trust New Hampshire form from UsLegalForms.

To successfully form a trust, you need to establish five key elements: a grantor, a trustee, beneficiaries, a trust property, and a valid purpose. The grantor creates the trust, the trustee manages it, and the beneficiaries receive the benefits. Additionally, you must clearly specify the trust property and its intended use. Understanding these elements will guide you in accurately completing your living trust New Hampshire forms and achieving your estate planning goals.

The most effective way to create a living trust is to outline your wishes clearly and consult a legal professional if needed. Start by gathering information about your assets and beneficiaries, and then complete the required living trust New Hampshire forms. Consider using online resources or platforms like US Legal Forms, as they offer guided templates and support to ensure your trust meets all legal requirements. This way, you can have peace of mind regarding your estate planning.

To create a living trust in New Hampshire, you'll need several important forms. Typically, you require a trust agreement, a property transfer deed, and possibly a pour-over will. These documents clearly outline your wishes and ensure that your assets transfer smoothly according to your instructions. Using the US Legal Forms platform can simplify this process, as it provides easy access to the necessary living trust New Hampshire forms.

The biggest mistake parents often make is neglecting to fund their trust adequately. Without proper funding, the trust cannot fulfill its intended purpose, leaving your loved ones without the intended support. It’s essential to review and update the living trust New Hampshire form regularly to ensure all assets are included, and working with platforms like uslegalforms can help streamline this process.

Creating a living trust in New Hampshire involves several straightforward steps. First, you need to draft the living trust New Hampshire form, which outlines how your assets will be managed and distributed. Next, you should fund the trust by transferring your assets into it. Finally, consider consulting with a legal expert to ensure everything is properly executed.

In New Hampshire, notarization is not a strict requirement for a living trust. However, having your living trust New Hampshire form notarized can add an extra layer of legitimacy and help reduce confusion in the future. It's advisable to consult with a legal professional to ensure your trust meets all necessary criteria and to facilitate any transactions.