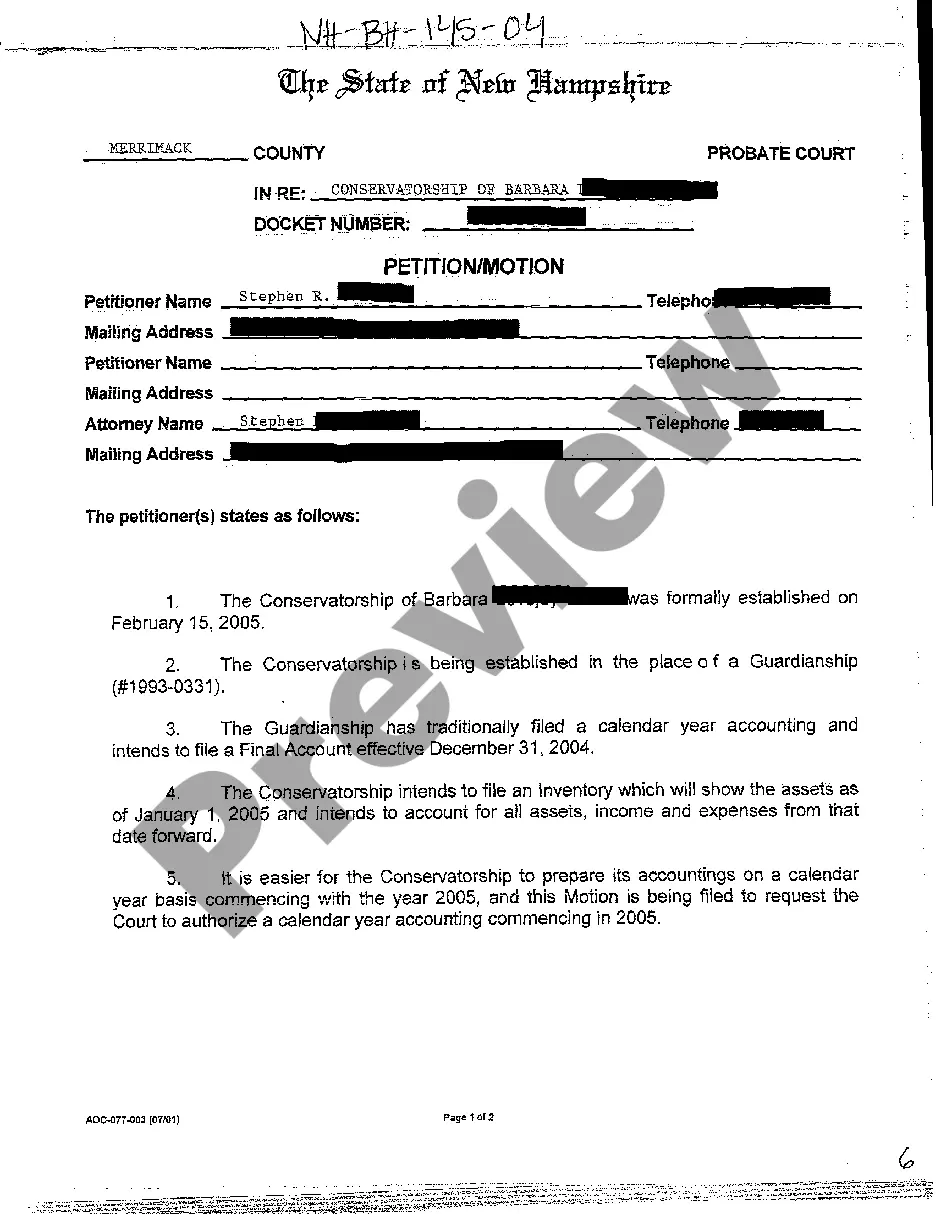

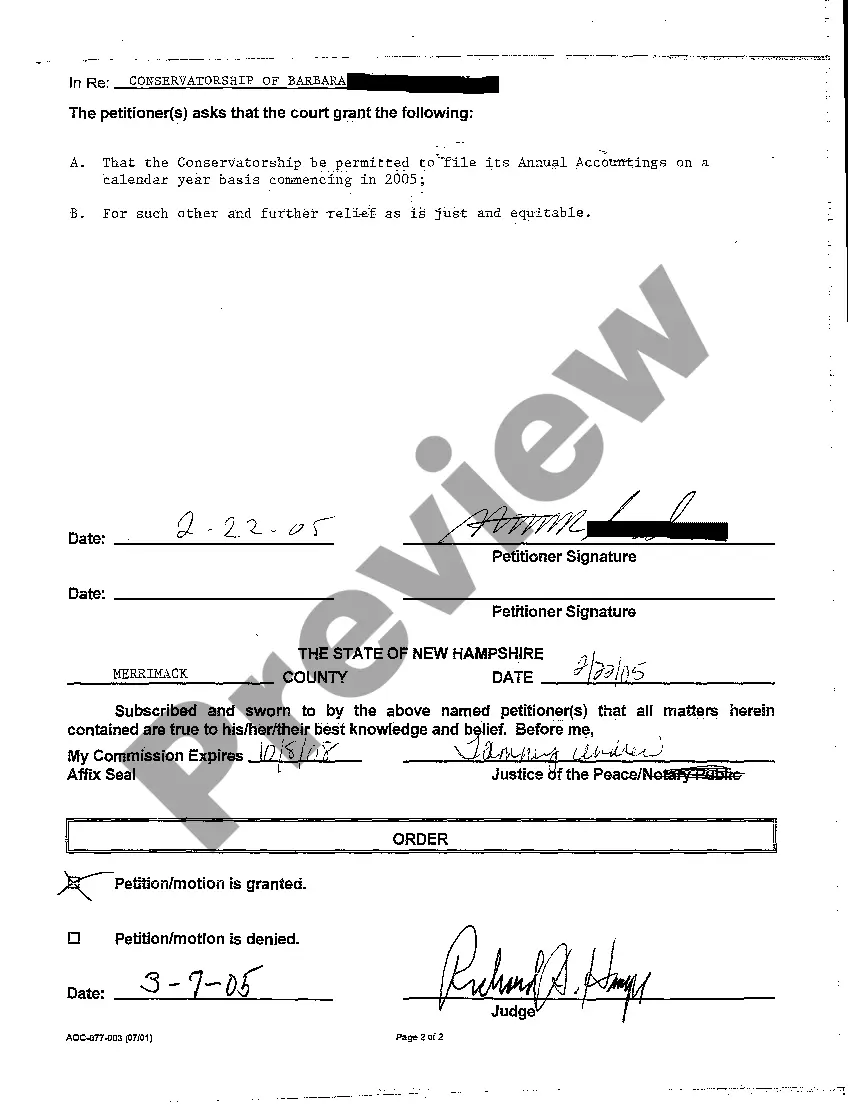

Petition For Accounting Of Estate

Description

How to fill out New Hampshire Petition Motion For Conservator Ship To File Annual Accountings?

Well-structured official documentation is one of the key assurances for preventing complications and legal disputes, but acquiring it without a lawyer's assistance may require time.

Whether you need to promptly locate a current Petition For Accounting Of Estate or any other forms for work, family, or business situations, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen file. Furthermore, you can access the Petition For Accounting Of Estate later at any time, as all documents ever acquired on the platform are accessible within the My documents section of your profile. Save time and money on document preparation. Experience US Legal Forms today!

- Confirm that the form is appropriate for your situation and area by examining the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Press Buy Now when you discover the relevant template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Petition For Accounting Of Estate.

- Click Download, then print the file to complete it or add it to an online editor.

Form popularity

FAQ

Assets that do not go through probate include properties held in a living trust, life insurance policies with designated beneficiaries, and retirement accounts like IRAs or 401(k)s. Understanding which assets bypass probate can simplify the estate management process. For those managing estates, filing a Petition for accounting of estate might still be necessary for assets that do enter probate.

To conduct probate accounting, gather all financial records related to the estate, including bank statements, invoices, and tax documents. Create a detailed report listing all assets, liabilities, receipts, and expenditures. If needed, individuals can file a Petition for accounting of estate for formal evaluation by the court, ensuring all parties are well-informed and fairly treated.

A waiver of accounting in probate allows beneficiaries to give up their right to receive a detailed financial report from the executor or trustee. This simplifies the process and can expedite the settlement of the estate. However, beneficiaries should fully understand what they are giving up, as it can impact their ability to challenge the handling of the estate later, including related to a Petition for accounting of estate.

A trust accounting in California needs to detail all transactions that occurred during the trust’s administration. This includes income, expenses, distributions, and the overall value of the trust assets. It aims to provide beneficiaries with a clear picture, potentially leading to a Petition for accounting of estate if disputes arise.

Yes, in California, executors are required to provide an accounting to beneficiaries. This is typically done after the estate has been settled. If beneficiaries request it, the executor might also need to file a Petition for accounting of estate, ensuring transparency and maintaining trust in the estate's management.

Waiving an accounting means that beneficiaries agree to forgo the detailed financial report of the estate. This could happen when beneficiaries trust the executor and feel comfortable with the management of the estate. However, when you file a petition for accounting of estate, you assert your right to transparency. It’s essential to consider the implications of waiving this accounting, as it may limit your ability to understand the estate’s financial status.

If a trustee is unwilling to provide an accounting, beneficiaries can file a petition for accounting of estate in court. This legal action formally requests the trustee to disclose all financial information. The court can then order the trustee to comply, ensuring beneficiaries receive the information they need. Taking this step can clarify misunderstandings and protect the interests of the estate.

A final account summarizes all financial activities of an estate before distribution. It details how the assets were managed and the expenses incurred, leading to the distribution of the remaining assets. When you file a petition for accounting of estate, you often include the final account and petition for distribution to simplify the process for beneficiaries. This step ensures all parties understand what to expect during the distribution phase.

Yes, beneficiaries have a right to receive an accounting of the estate. This ensures transparency regarding the handling of the estate’s assets and liabilities. When you file a petition for accounting of estate, you request a detailed report of all transactions involving the estate. Understanding this information helps beneficiaries make informed decisions about their interests.

Yes, beneficiaries generally have the right to access information about the estate accounts. This access is vital for understanding how the estate operates and how assets are managed. If you find that access is denied, you may consider filing a petition for accounting of estate to ensure compliance by the executor. Platforms like uslegalforms can help illustrate the legal processes involved, ensuring you know your rights.