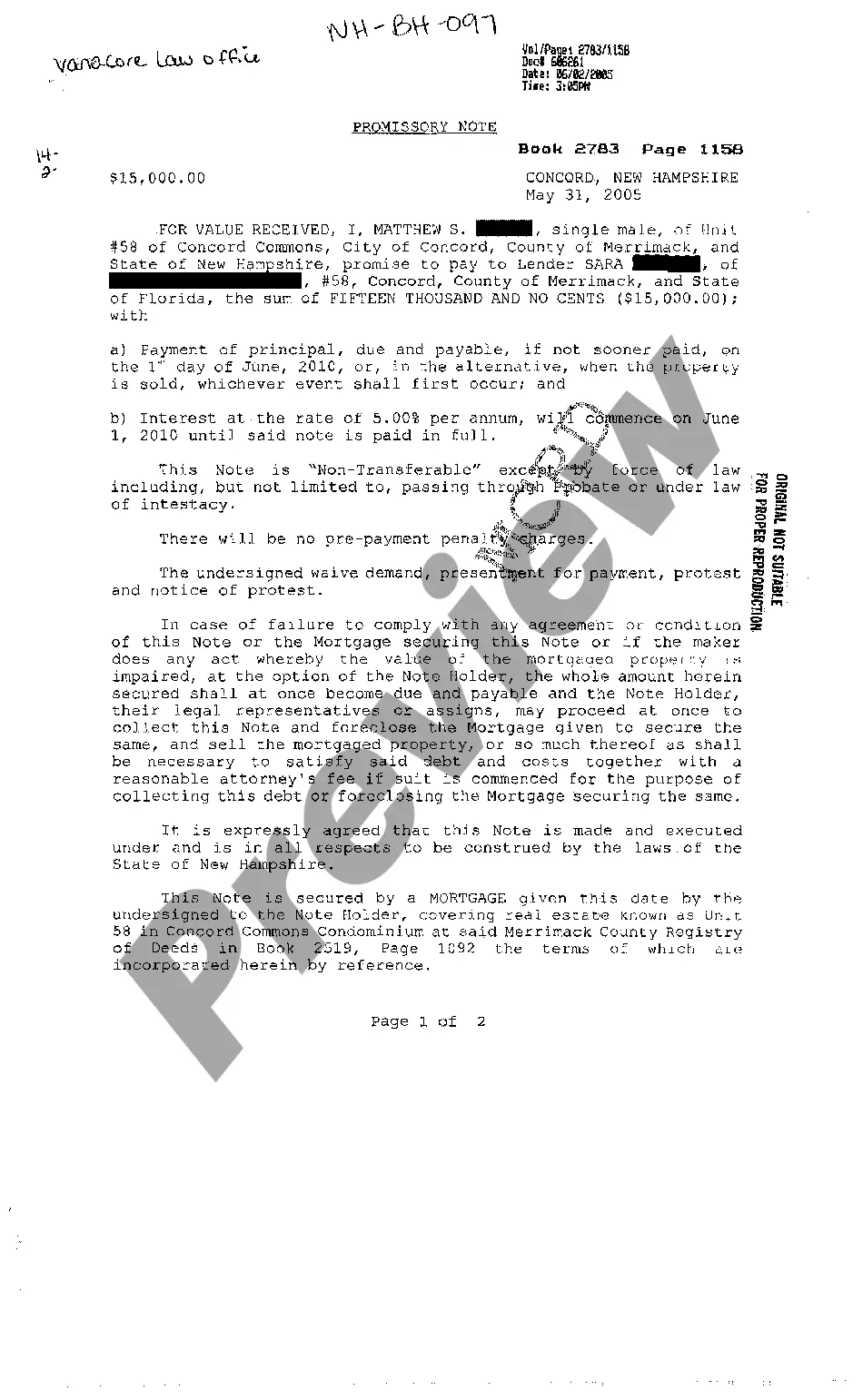

Promissory Note Secured By Mortgage With Chattel

Description

How to fill out New Hampshire Promissory Note Secured By Mortgage?

How to obtain expert legal documents that adhere to your state's laws and create the Promissory Note Secured By Mortgage With Chattel without consulting an attorney.

Numerous online services offer templates for various legal needs and procedures. However, it may require time to determine which of the accessible samples fulfill both your specific use case and legal criteria.

US Legal Forms is a trusted provider that assists you in finding official documents crafted according to the most recent updates in state laws, allowing you to save on legal expenses.

If you do not have an account with US Legal Forms, follow these steps: Browse the webpage you have opened and confirm whether the form meets your requirements. To accomplish this, use the form description and preview options, if available. Look for another template in the header with your state if necessary. Click the Buy Now button once you identify the correct document. Select the most suitable pricing plan, then Log In or pre-register for an account. Choose your payment method (credit card or PayPal). Select the file format for your Promissory Note Secured By Mortgage With Chattel and click Download. The obtained templates will remain in your possession: you can always access them in the My documents tab of your profile. Subscribe to our library and prepare legal documents independently like a seasoned legal expert!

- US Legal Forms is not an ordinary online catalog.

- It is a compilation of over 85,000 validated templates for a variety of business and personal situations.

- All documents are categorized by field and state to streamline your search process.

- Moreover, it incorporates powerful tools for PDF editing and eSignatures, permitting users with a Premium subscription to quickly complete their paperwork online.

- Obtaining the necessary documents requires minimal time and effort.

- If you already possess an account, Log In and verify the validity of your subscription.

- Download the Promissory Note Secured By Mortgage With Chattel by clicking the appropriate button next to the file name.

Form popularity

FAQ

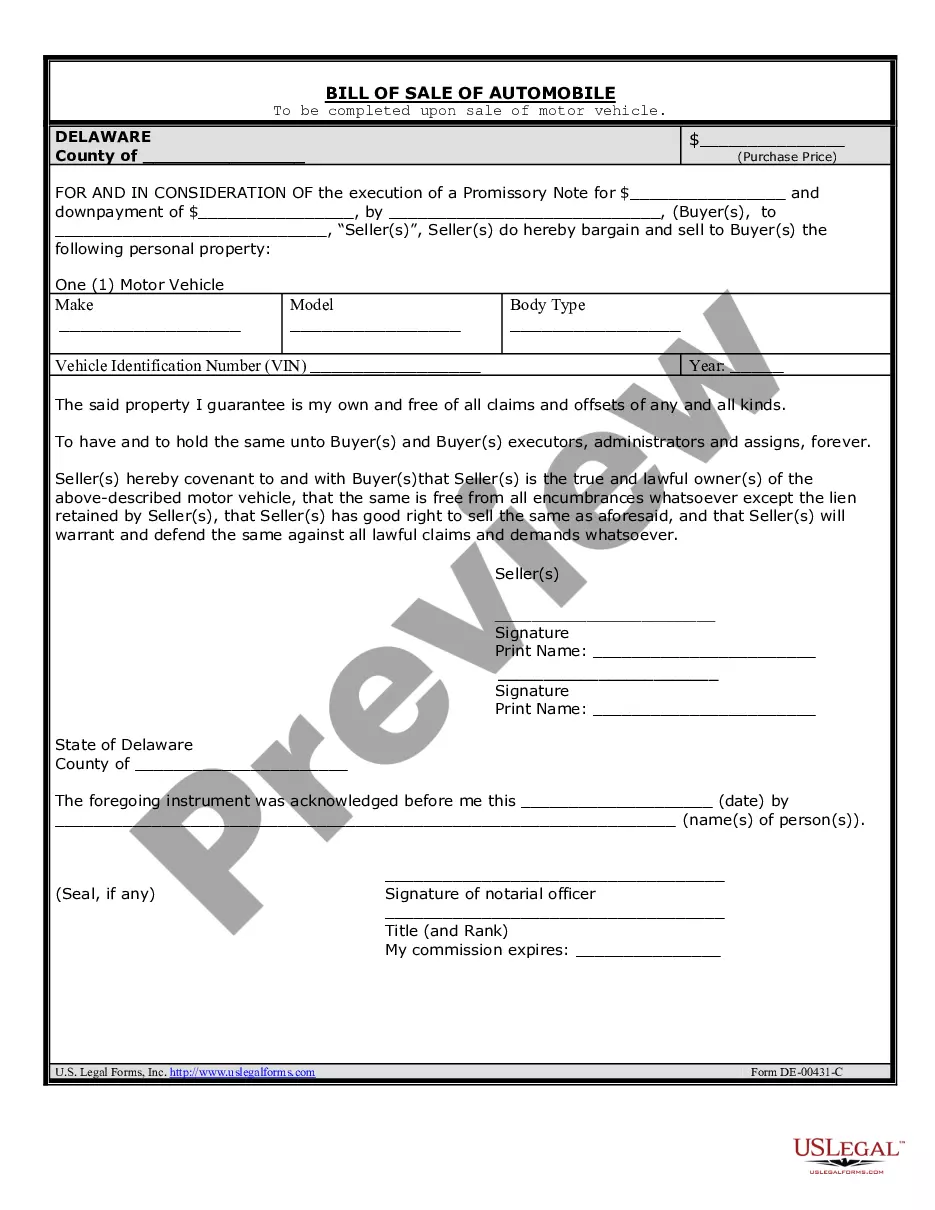

Essentially, a mortgage promissory note is an agreement that promises that the money borrowed from a lender will be paid back by the borrower. The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

A chattel loan is secured with the movable item, or chattel, that is used to purchase the loan. The lender holds an ownership interest on the chattel. Mobile or manufactured homes, where the homeowner buys the residential unit but not the land that it occupies, are often financed with chattel mortgages.