New Hampshire Agreement Withholding Tax

Description

How to fill out New Hampshire Installment Purchase And Security Agreement With Limited Warranties - Horse Equine Forms?

Steering through the red tape of standard documents and formats can be challenging, particularly when one is not engaged in such tasks professionally.

Even locating the appropriate format for the New Hampshire Agreement Withholding Tax can be laborious, as it needs to be accurate and correct to the very last numeral.

Nevertheless, you will invest considerably less time selecting a suitable template if it originates from a source you can rely on.

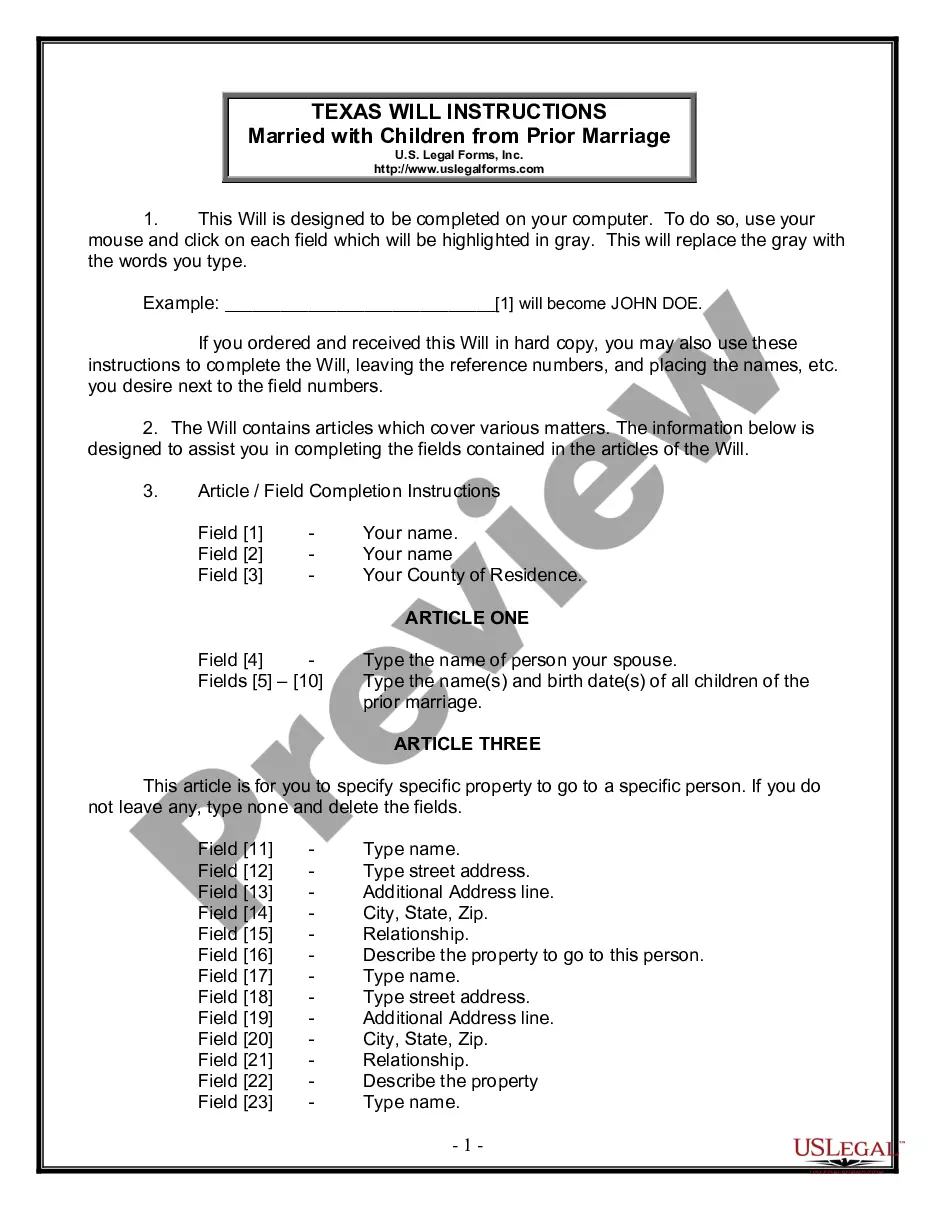

Obtain the correct document in a few straightforward steps: Enter the document's name in the search field. Select the appropriate New Hampshire Agreement Withholding Tax from the outcomes. Review the description of the sample or view its preview. When the template meets your criteria, click Buy Now. Then choose your subscription plan. Use your email and create a password to register at US Legal Forms. Choose a credit card or PayPal payment method. Finally, save the template document to your device in your preferred format. US Legal Forms will save you considerable time verifying if the document you discovered online meets your requirements. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of locating the right documents online.

- US Legal Forms is a single resource you need to access the most recent document samples, confirm their usage, and download these samples for completion.

- This is a repository with over 85,000 documents applicable in various professional fields.

- When looking for a New Hampshire Agreement Withholding Tax, you will not have to question its authenticity as all the documents are validated.

- Creating an account at US Legal Forms will ensure you have all the required samples at your fingertips.

- You can store them in your records or include them in the My documents collection.

- You can access your saved documents from any device by clicking Log In at the document library site.

- If you do not yet possess an account, you can always search for the template you need.

Form popularity

FAQ

New Hampshire does not currently have an individual income tax, so there is no withholding tax.

The NH Interest and Dividends return is called Form DP-10. This one form is used for resident and part-year resident returns. There is no filing requirement for nonresidents. See for instructions, the Interest and Dividends Quick Checklist(what is/isn't taxable by NH) and tax forms.

Residents and part-year residents must file DP-10 if gross interest and dividends from all sources (DP-10 line 3 or Form 1040 lines 2a + 2b + 3b + taxed 1099-R distributions) exceed $2,400/4,800. Clients not required to file a federal return may still need to file DP-10.

A. The New Hampshire new employer tax rate is 2.7% (UI Rate: 2.3% / AC Rate: 0.4%).

The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules, Rev 800. The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer.