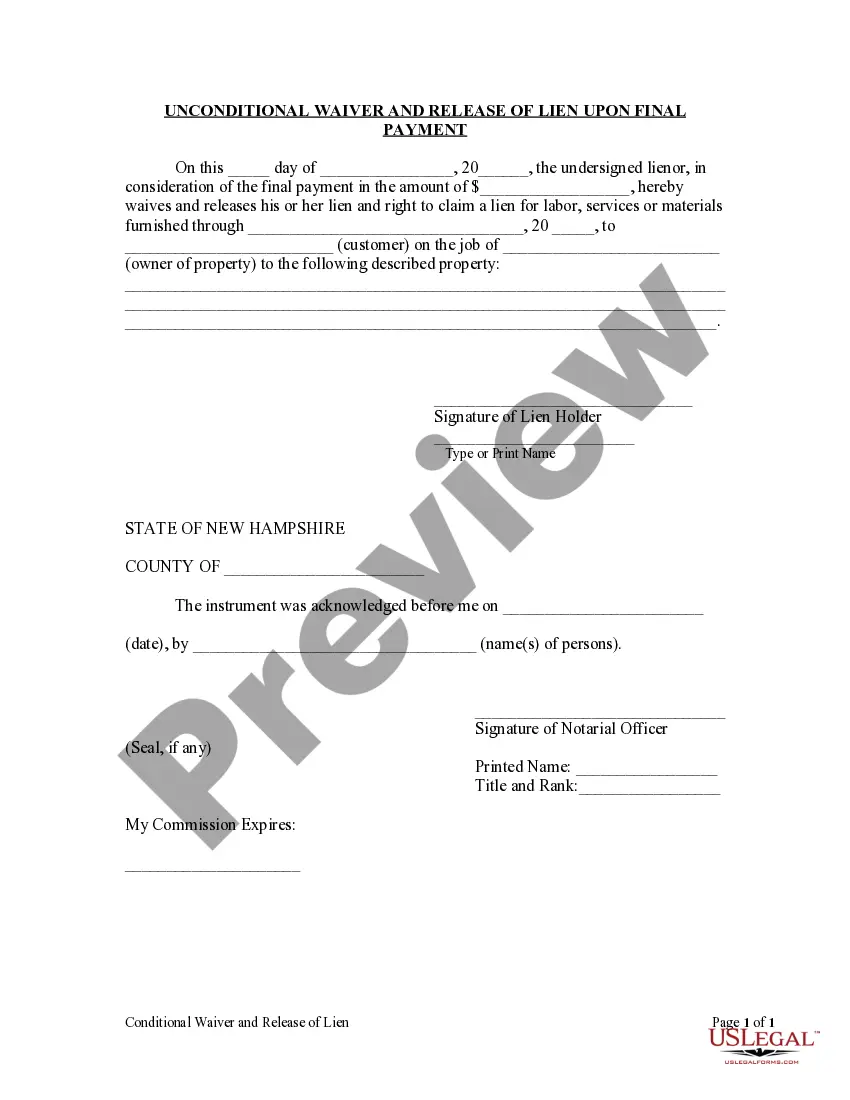

New Hampshire Release Form Withholding

Description

How to fill out New Hampshire Unconditional Waiver And Release Of Lien Upon Final Payment?

When you need to complete the New Hampshire Release Form Withholding in alignment with your local state's regulations, there can be numerous options to select from.

There's no requirement to scrutinize every document to ensure it meets all the legal standards if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Using US Legal Forms makes acquiring professionally drafted official documents easy. Additionally, Premium users can also take advantage of the robust integrated tools for online document editing and signing. Try it today!

- US Legal Forms is the largest online repository with a collection of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are validated to comply with each state's legislation.

- Thus, when downloading the New Hampshire Release Form Withholding from our platform, you can be assured that you possess a valid and up-to-date document.

- Acquiring the necessary template from our site is remarkably simple.

- If you already have an account, simply Log In to the system, verify your subscription status, and save the selected file.

- In the future, you can visit the My documents section in your profile and access the New Hampshire Release Form Withholding at any time.

- If it's your initial experience with our library, please follow the instructions below.

- Review the suggested page and ensure it aligns with your needs.

Form popularity

FAQ

Plenty of income tax returns are still being mailed in filled out by hand, and I guarantee you that lots of those income tax returns have white-out all over them. White-out what needs to be whited out and enter correct numbers by hand, recheck your math and you'll be fine.

The NH Interest and Dividends return is called Form DP-10. This one form is used for resident and part-year resident returns. There is no filing requirement for nonresidents. See for instructions, the Interest and Dividends Quick Checklist(what is/isn't taxable by NH) and tax forms.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

New Hampshire does not currently have an individual income tax, so there is no withholding tax.

NH taxes interest and dividends: Residents (including part year residents) earning more than $2,400 ($4,800 MFJ) in interest and dividends are subject to a 5% tax. The NH Interest and Dividends return is called Form DP-10. This one form is used for resident and part-year resident returns.