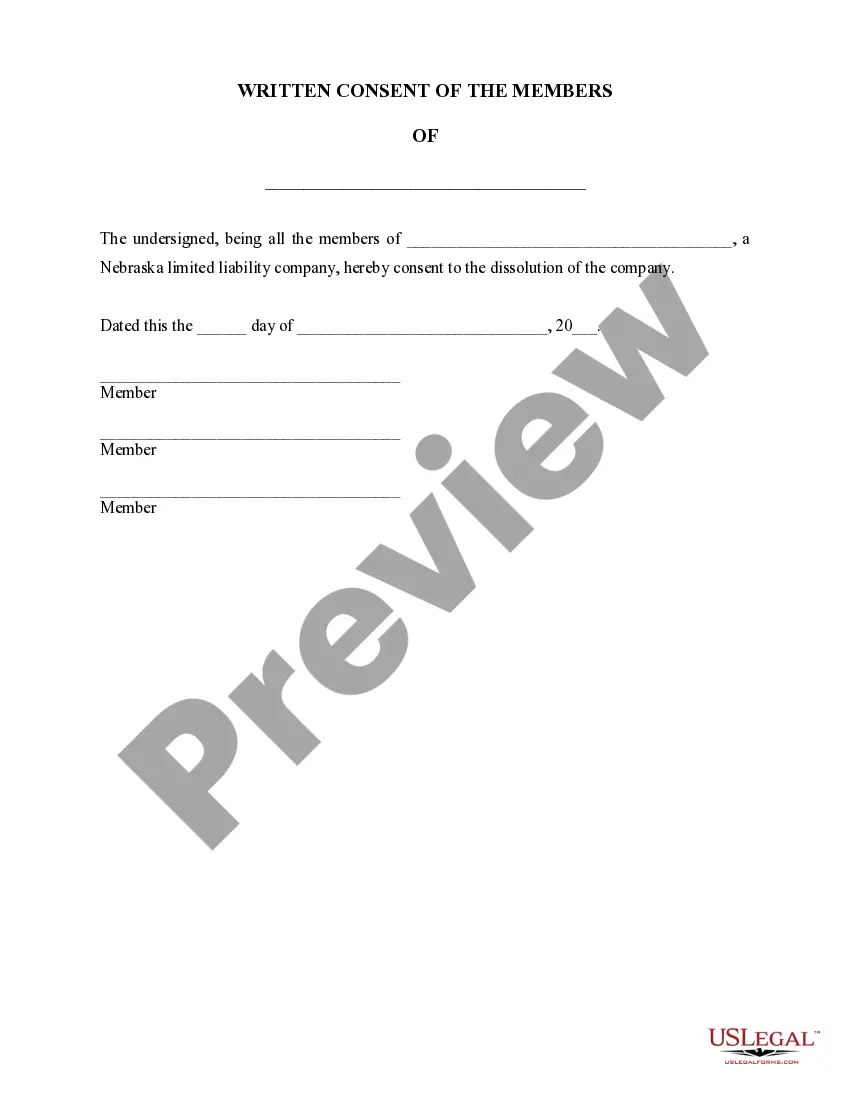

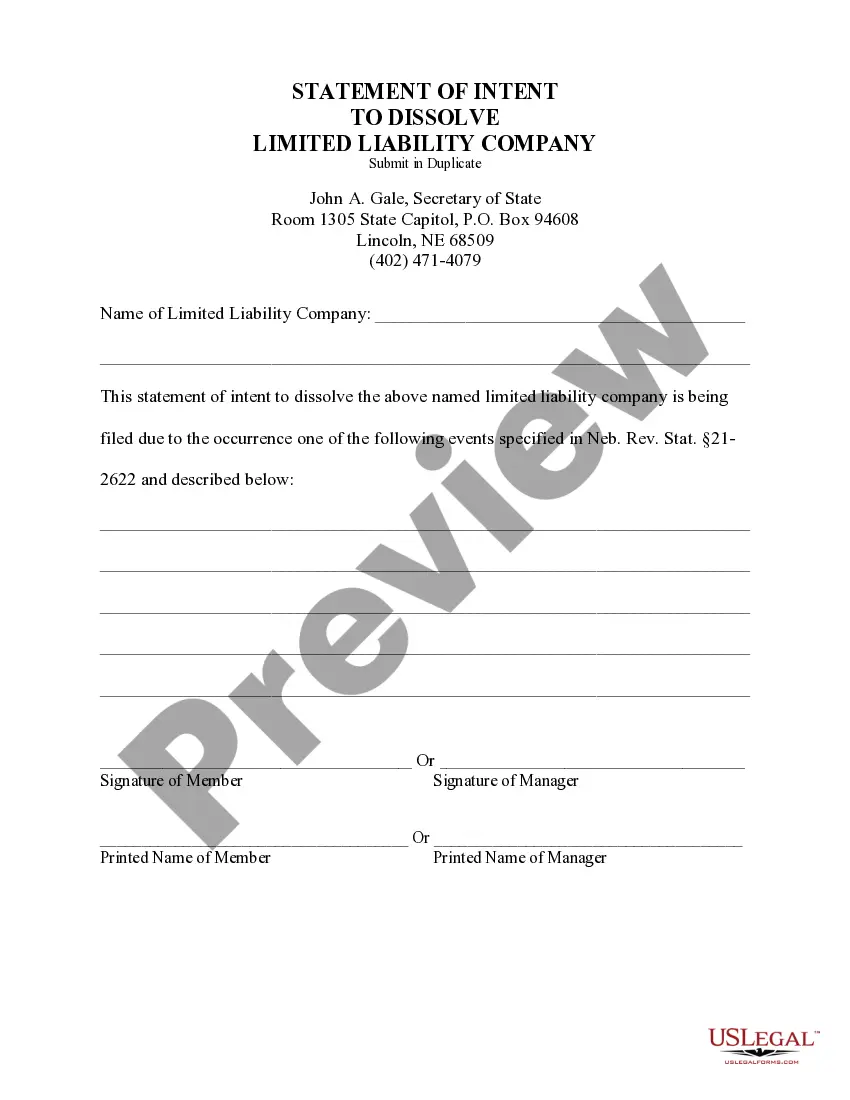

The dissolution package contains all forms to dissolve a LLC or PLLC in Nebraska, step by step instructions, addresses, transmittal letters, and other information.

Dissolve Llc Form With Ein

Description

Form popularity

FAQ

Dissolving an LLC can be a straightforward process if you adhere to the correct steps. Prepare all necessary documents, settle debts, and file the required forms with state authorities. While it can take some time to complete, having a clear plan helps. A dissolve LLC form with EIN can assist you in navigating the requirements efficiently.

Form 966 is generally required for corporations, not LLCs. However, it is vital to familiarize yourself with your state’s requirements for dissolving an LLC. Each state may have different forms and processes. To ensure you fulfill all requirements, consider using a dissolve LLC form with EIN that aligns with your state’s laws.

To dissolve an LLC in the USA, you need to follow specific steps. Start by holding a vote among members, then file the dissolution documents with your state. Also, ensure you settle any debts and obligations before finalizing the process. Utilizing a dissolve LLC form with EIN can simplify the paperwork required for this transition.

Yes, notifying the IRS is an essential step when closing your LLC. You should file the appropriate forms, such as the final tax return and any other relevant documents that show your LLC is no longer active. Keeping the IRS informed helps prevent future tax issues. Using a dissolve LLC form with EIN can streamline this process.