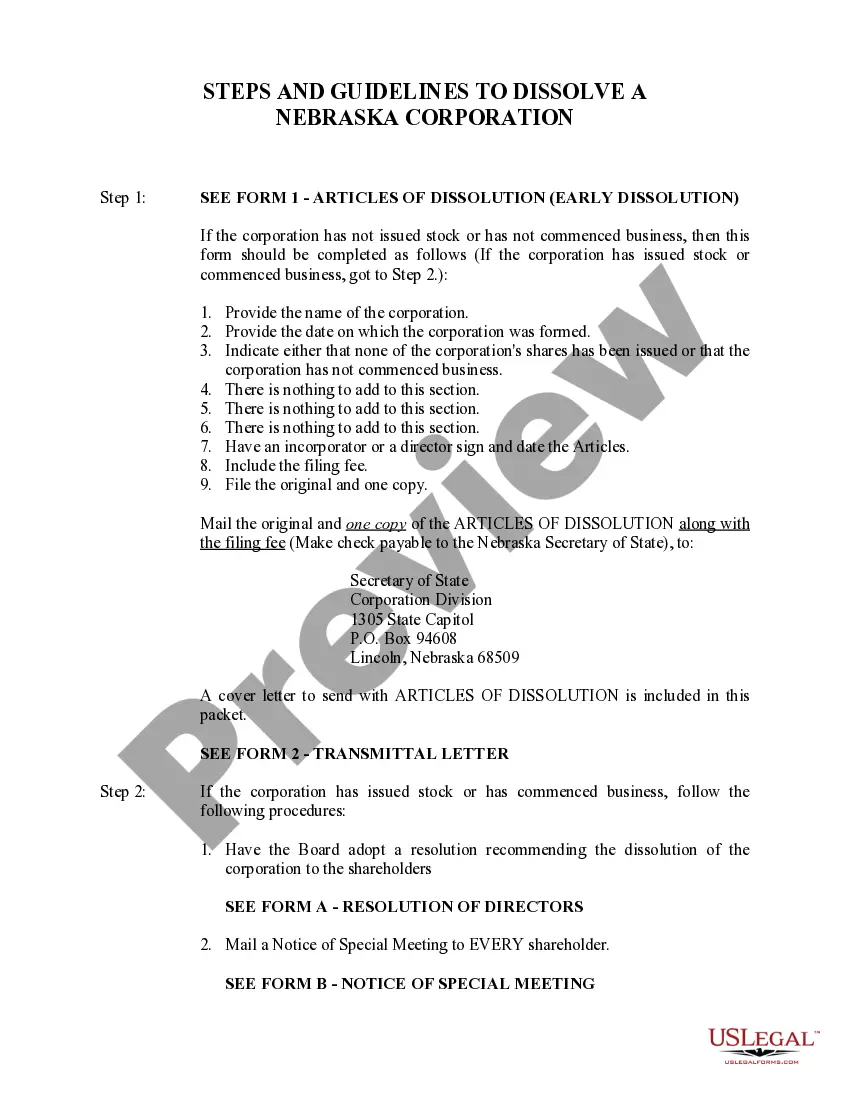

The dissolution of a corporation package contains all forms to dissolve a corporation in Nebraska, step by step instructions, addresses, transmittal letters, and other information.

Nebraska Dissolve Corporation For State

Description

How to fill out Nebraska Dissolve Corporation For State?

Individuals typically link legal documentation with something intricate that only an expert can handle.

In some respects, this is accurate, as creating a Nebraska Dissolve Corporation for the State necessitates significant knowledge of subject matter criteria, including state and local laws.

However, with US Legal Forms, matters have become simpler: pre-made legal templates for various life and business situations specific to state regulations are gathered in a single digital library and are now accessible to everyone.

Make your payment via PayPal or using your credit card. Select the format for your file and click Download. Print your document or upload it to an online editor for faster completion. All templates in our collection are reusable: once purchased, they are stored in your profile. You can access them anytime as needed through the My documents tab. Explore all benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and area of application, so searching for Nebraska Dissolve Corporation for State or any other specific template only requires a few minutes.

- Registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users on the platform will first need to set up an account and subscribe before they can download any documents.

- Here are the detailed instructions on how to obtain the Nebraska Dissolve Corporation for State.

- Carefully review the page content to ensure it meets your requirements.

- Read the form description or evaluate it through the Preview option.

- If the previous sample isn't suitable for you, search for an alternative using the Search bar located in the header.

- Click Buy Now once you locate the appropriate Nebraska Dissolve Corporation for State.

- Choose the pricing plan that aligns with your needs and budget.

- Create an account or sign in to continue to the payment page.

Form popularity

FAQ

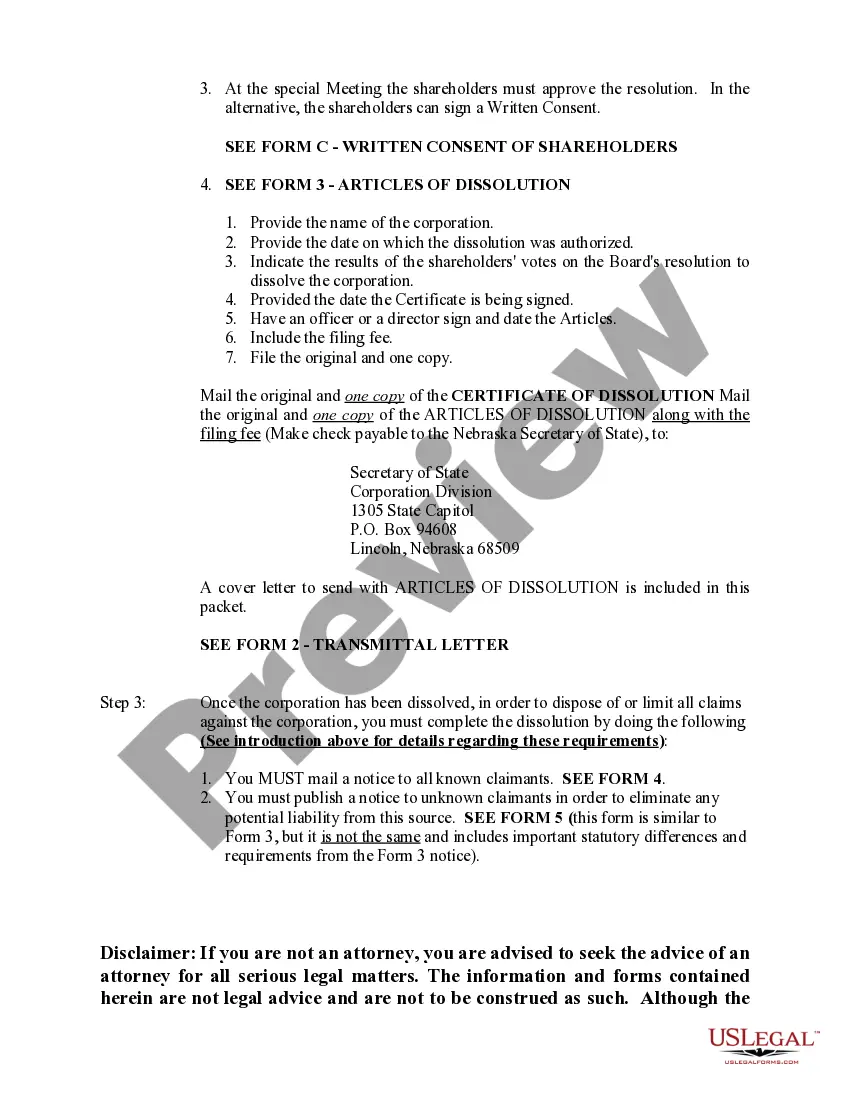

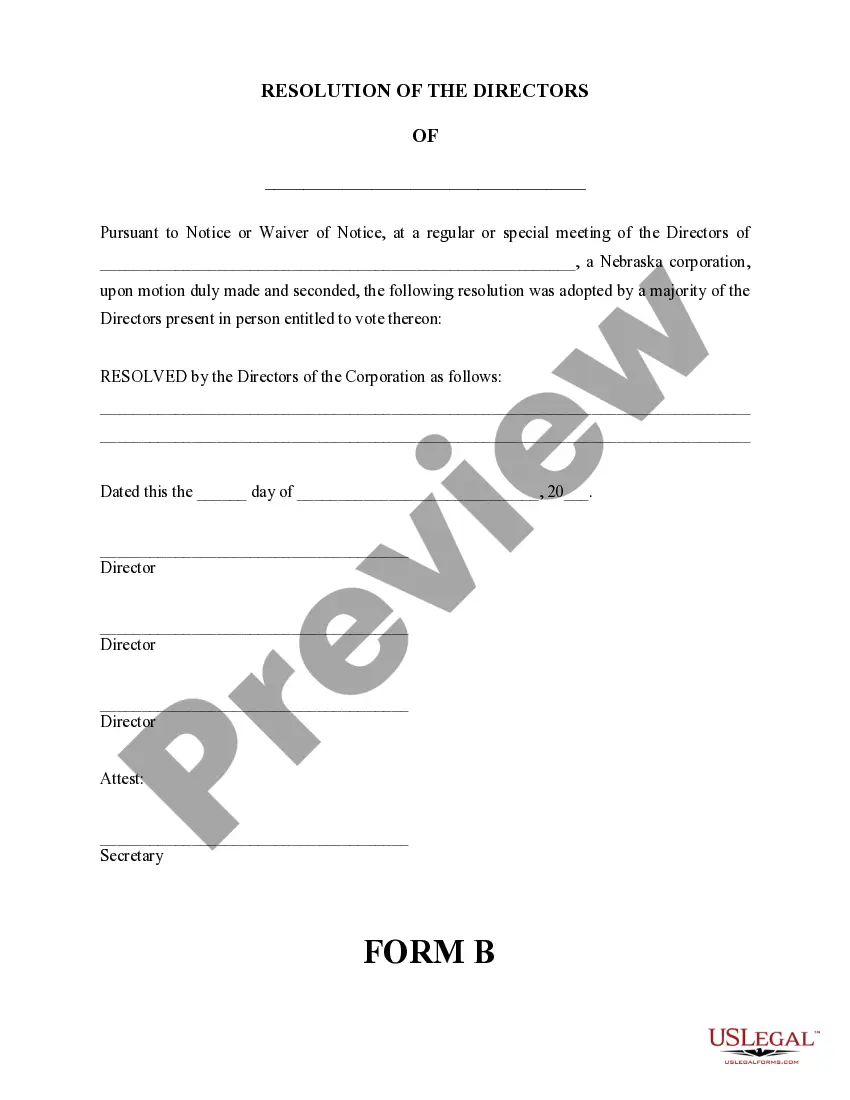

The three types of dissolution in Nebraska include voluntary dissolution, involuntary dissolution, and administrative dissolution. Voluntary dissolution occurs when a corporation decides to end its existence, while involuntary dissolution is initiated by the state due to compliance issues. Educating yourself on these types helps you to Nebraska dissolve corporation for state appropriately and choose the best option for your business scenario.

A notice of dissolution in Nebraska is a document that informs interested parties about the corporation's intention to dissolve. This notice is typically filed with the Nebraska Secretary of State and serves as a formal announcement to creditors and stakeholders. If you are looking to Nebraska dissolve corporation for state, providing this notice ensures transparency and allows for a smoother dissolution process.

A decree of dissolution in Nebraska is a formal court order that legally ends a corporation's existence. This decree is issued after a corporation has fulfilled all legal requirements and has submitted the necessary documents for dissolution. When you seek to Nebraska dissolve corporation for state, obtaining a decree is a crucial step to ensure compliance with state regulations.

Yes, you can set up an S corporation yourself. The process involves completing the necessary paperwork, including the articles of incorporation and the IRS Form 2553 for S corporation status. However, while it is possible to manage these aspects independently, using platforms like uslegalforms can provide guidance and ensure that you address every critical requirement for your Nebraska dissolve corporation for state seamlessly.

Starting a corporation in Nebraska requires several foundational steps. Begin by selecting a unique business name and preparing the articles of incorporation, which you will submit to the Nebraska Secretary of State. Once your corporation is filed and approved, you’ll need to draft corporate bylaws and hold an organizational meeting. These steps lay the groundwork for your business and provide you with options for dissolution, if necessary.

To set up an S Corporation in Nebraska, begin by incorporating your business at the state level. This involves filing the articles of incorporation with the Nebraska Secretary of State and paying the required fees. After your corporation is established, you will submit Form 2553 to the IRS to elect S corporation status. Following these steps ensures you meet Nebraska's requirements and can focus on growing your business.

Starting an S corporation in Nebraska involves several steps. First, you need to register your corporation by filing articles of incorporation with the Nebraska Secretary of State. After your corporation is formed, you can then elect S corporation status by filing Form 2553 with the IRS. Make sure to stay compliant with Nebraska's requirements, as your goal is to successfully operate your business while addressing the processes to dissolve a corporation if needed.

Yes, Nebraska recognizes S corporations. This means that businesses can choose to be taxed as an S corporation if they meet the requirements set by both state and federal regulations. Such a choice allows for pass-through taxation, which can benefit many small businesses. It is vital to complete the necessary filings to enjoy these benefits while complying with Nebraska's rules.

Dissolving an S Corporation in Florida involves submitting Articles of Dissolution to the Florida Department of State. You will also need to settle any debts and account for taxes before finalizing the process. For those interested in the Nebraska dissolve corporation for state options, you can find similar resources that guide you through dissolution at US Legal Forms.

To exit an S Corporation, you can choose to either sell your shares or dissolve the corporation. Each option has its implications, including tax consequences that you should consider carefully. If you are exploring the Nebraska dissolve corporation for state, US Legal Forms can help facilitate this decision by providing relevant legal documents.