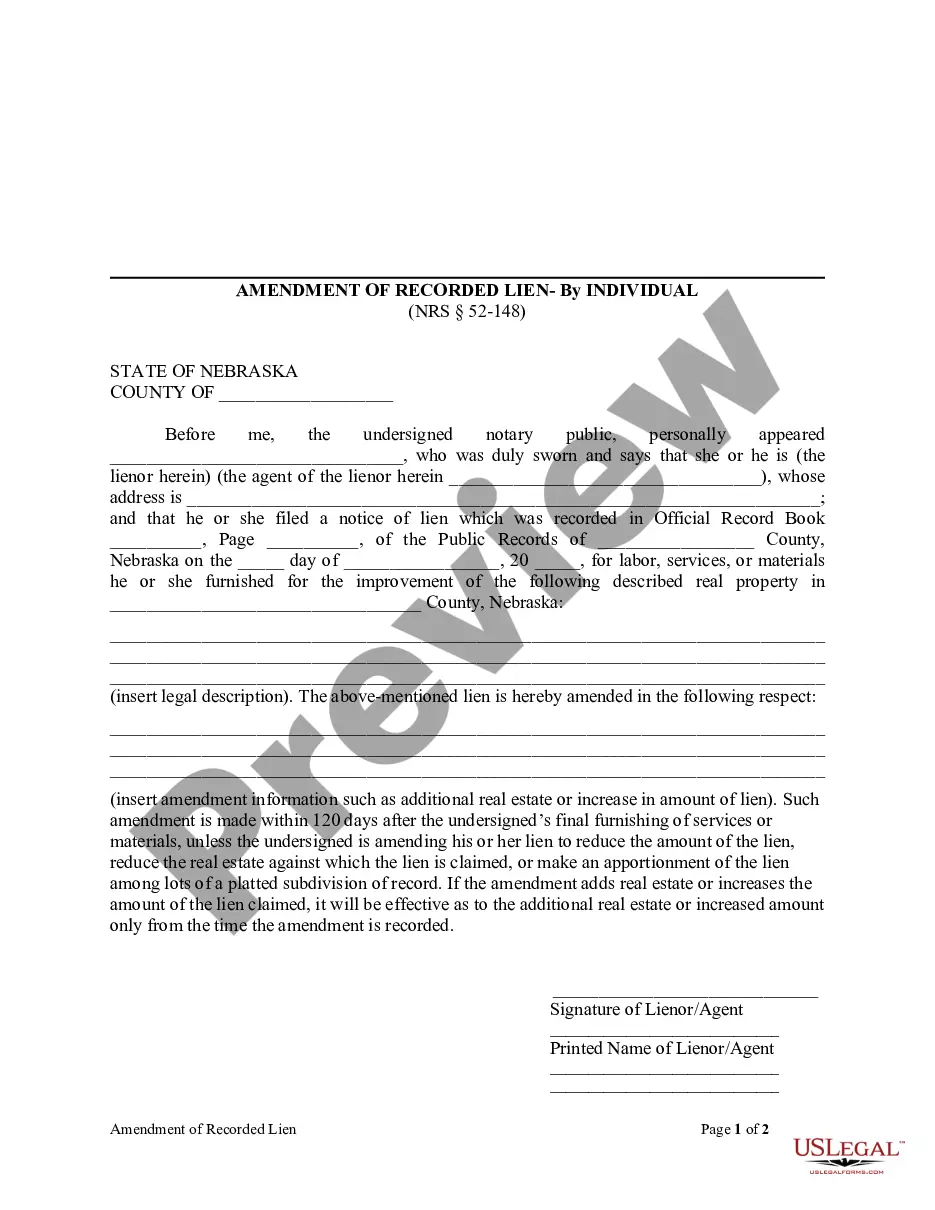

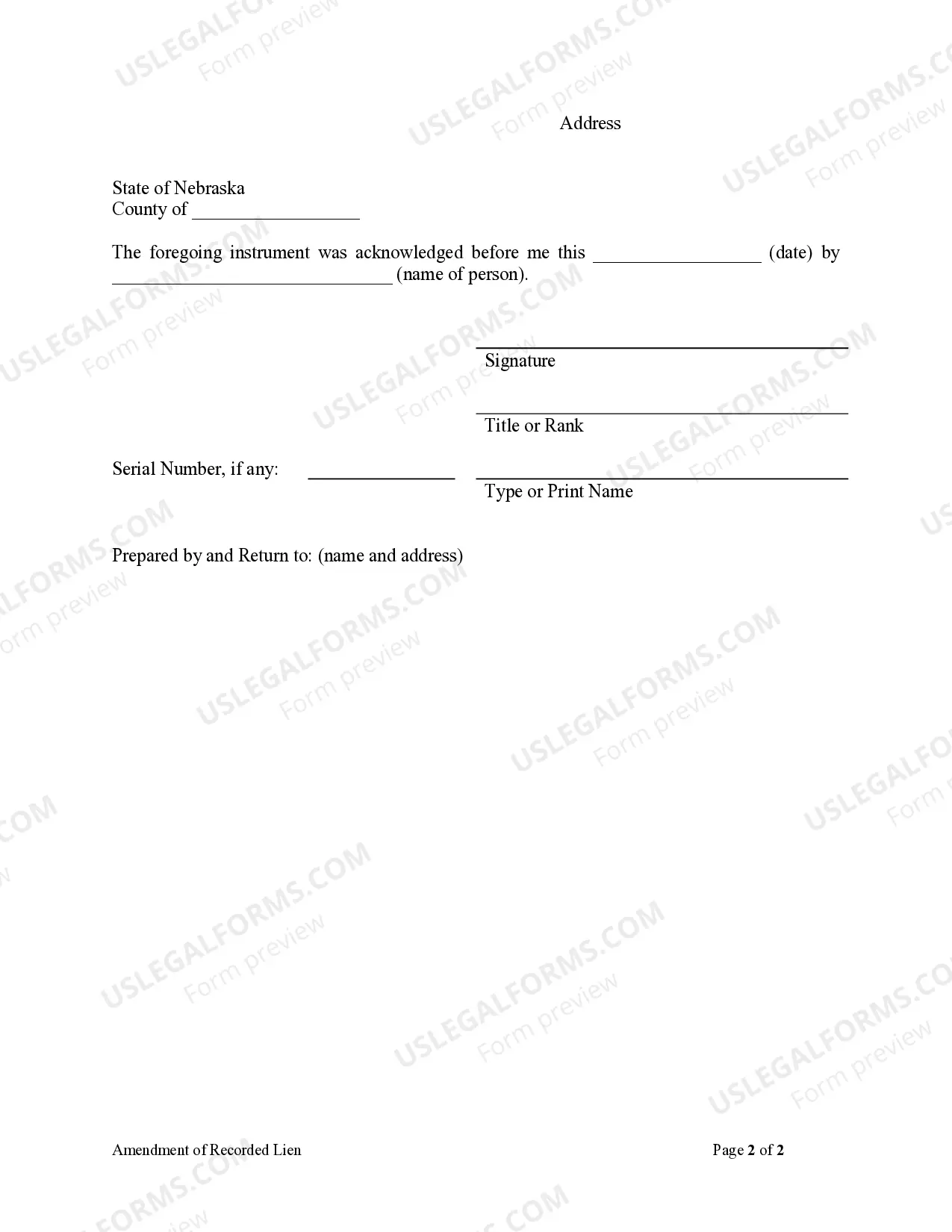

This Amendment of Recorded Lien form is for use by an individual lienor or agent of the lienor who filed a notice of lien which was recorded for labor, services, or materials he or she furnished for the improvement of real property, to amend such lien.

Amendment Lien Foreclosure

Description

Form popularity

FAQ

Disputing a foreclosure requires gathering relevant documentation and evidence to support your case. Homeowners should identify any errors in the foreclosure process, including improper notifications or issues with the mortgage agreement. Once you collect the necessary information, you can file a response with the court or contact the lender directly. Utilizing US Legal Forms can simplify this process, ensuring you have the right documents for effectively disputing an amendment lien foreclosure.

The final judgment of foreclosure is a court order confirming that the lender has a right to sell the property due to the borrower's default. This judgment marks the end of the legal process and allows the lender to proceed with the sale of the property at auction. Understanding this judgment is critical for homeowners facing foreclosure. Resources like US Legal Forms can provide clarity on the implications of the final judgment in amendment lien foreclosure cases.

Reversing a foreclosure is possible, but it often depends on specific circumstances of the case. Homeowners might be able to file an appeal if they believe the foreclosure was unjust or based on errors. Additionally, negotiating temporary solutions with the lender can provide alternative paths, but it requires quick action. Consulting with professionals in amendment lien foreclosure can offer valuable guidance on achieving a reversal.

Yes, a foreclosure can be dismissed under certain circumstances. If the homeowner can prove that the lender failed to follow legal procedures or did not adhere to the terms of the mortgage, the court may dismiss the case. Additionally, showing that payments were made or that other issues exist can also lead to dismissal. Leveraging resources like US Legal Forms can help you understand the requirements and steps needed for a successful dismissal in cases involving amendment lien foreclosure.

Yes, settling a tax lien is possible, often through negotiation with your tax authority. You may propose a payment plan or a reduced settlement amount to resolve the lien effectively. Utilizing tools like Uslegalforms can assist you in understanding your options and navigating the amendment lien foreclosure landscape to achieve the best outcome.

In Florida, certain liens can survive foreclosure, including specific government liens such as those for taxes or special assessments. These liens generally remain attached to the property even after the foreclosure sale. Understanding which liens may persist is important, especially during the amendment lien foreclosure process, as it helps you prepare for potential financial responsibilities.

To eliminate a tax lien in New Jersey, start by paying off the owed debt, including any interest or fees. After settling the lien, request a release from the Department of the Treasury to ensure proper documentation. If you encounter challenges, consider exploring resources available through Uslegalforms, which can help clarify your liabilities related to amendment lien foreclosure.

The new foreclosure law in New Jersey aims to streamline the process and provide more relief to homeowners facing financial difficulties. Key changes include extended timelines for banks to file foreclosure and increased opportunities for mortgage modifications. This legislation is crucial for those impacted by amendment lien foreclosure, as it seeks to offer more protection and options for distressed homeowners.