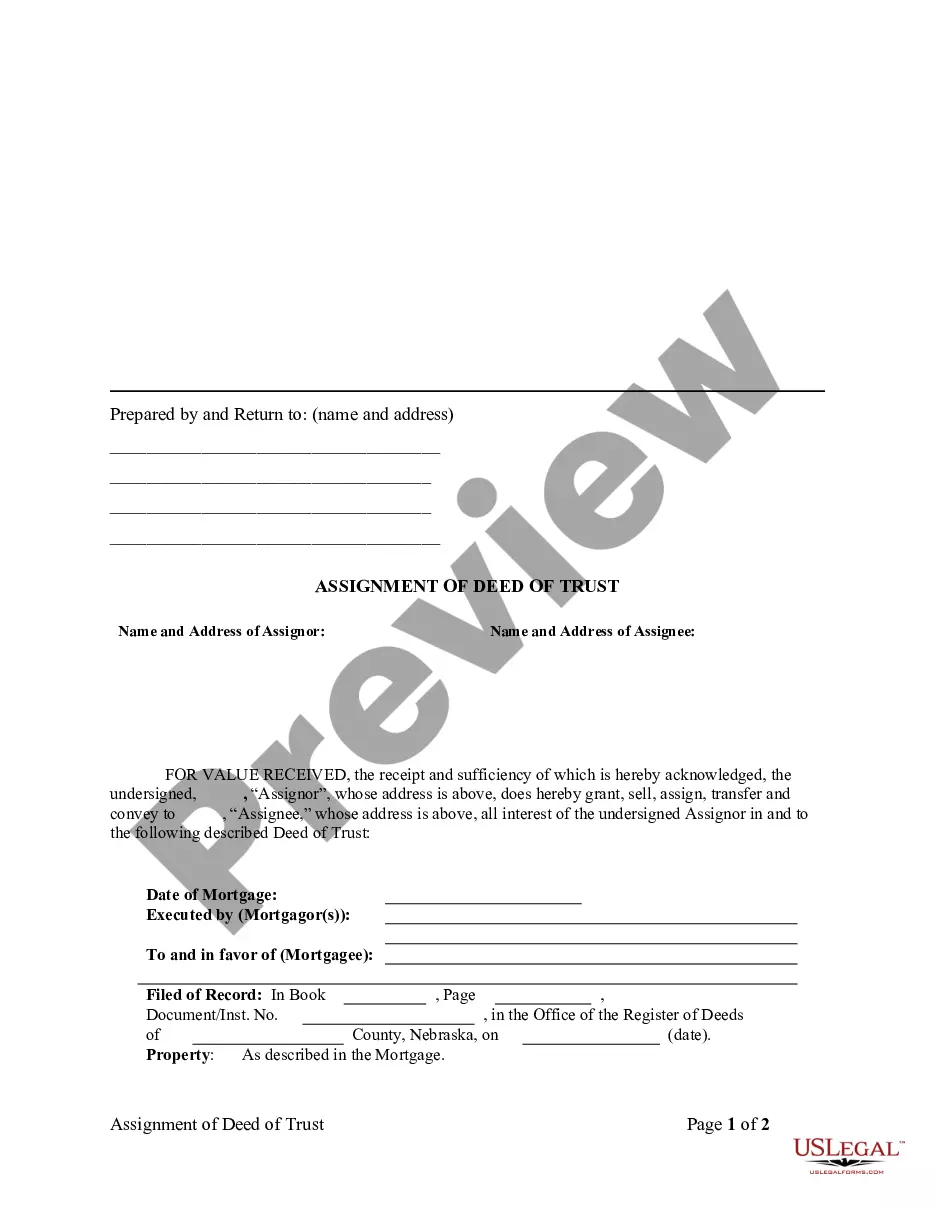

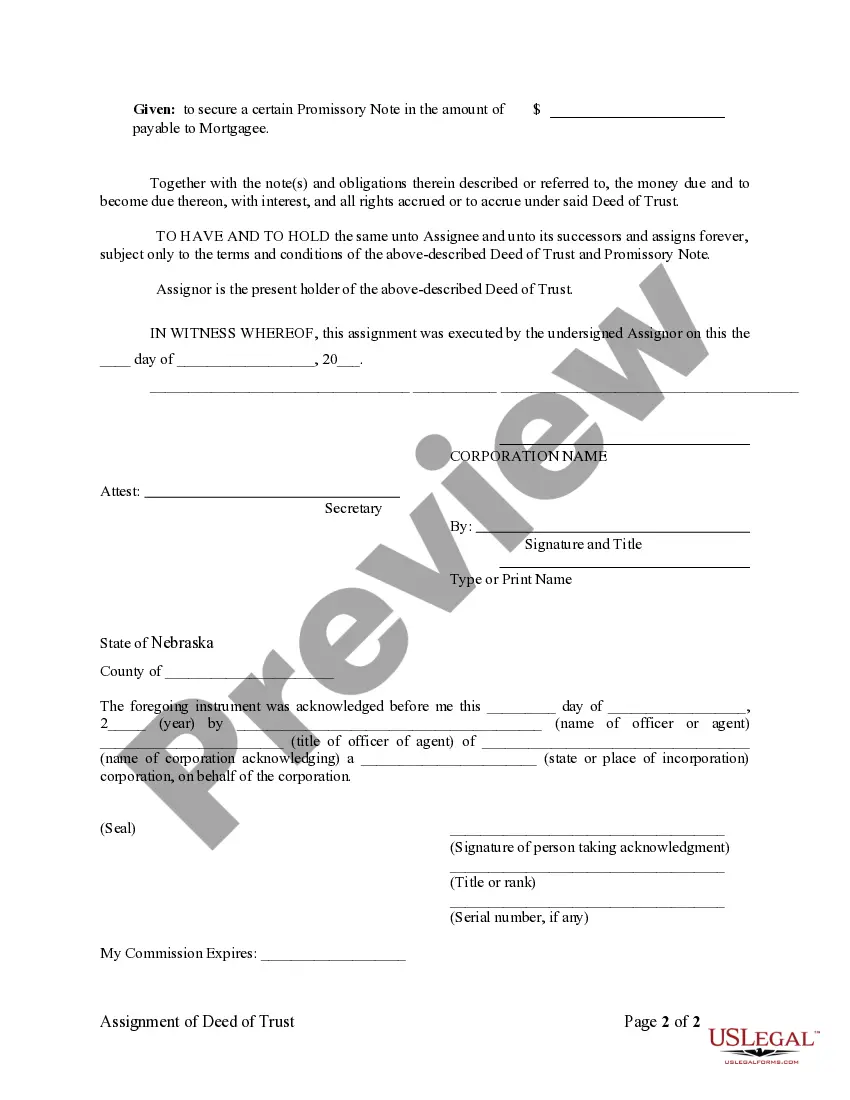

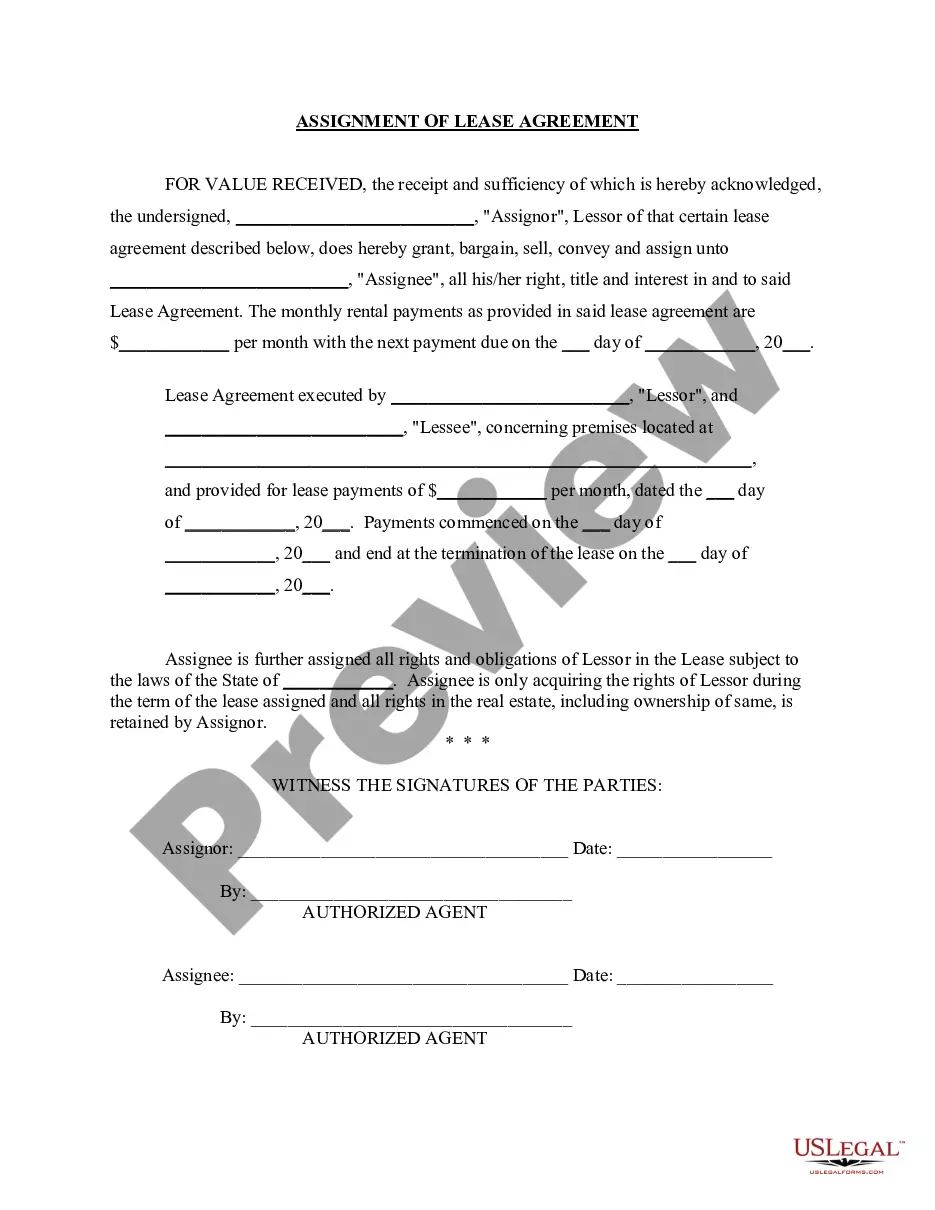

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Nebraska Assignment Withholding

Description

How to fill out Nebraska Assignment Withholding?

Individuals typically link legal documentation with complexity that requires a professional's expertise. In some respects, this is accurate, as creating Nebraska Assignment Withholding necessitates a comprehensive grasp of subject matter requirements, encompassing state and county laws. However, with US Legal Forms, the process has become simpler: a collection of ready-to-use legal templates for various life and business situations tailored to state regulations is now housed in a single online repository, accessible to all.

US Legal Forms provides over 85,000 updated forms organized by state and category, ensuring that searching for Nebraska Assignment Withholding or any other specific template only takes a few moments. Users who have previously registered and hold a valid subscription must Log In to their account and click Download to retrieve the document. New users to the platform will need to first create an account and subscribe before they can access any paperwork.

Here’s a detailed guide on how to obtain the Nebraska Assignment Withholding.

All templates available in our library are reusable: once purchased, they remain saved in your profile. You can access them anytime as needed through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- Review the webpage content carefully to ensure it meets your requirements.

- Read the form description or view it using the Preview feature.

- Search for an alternative sample using the Search field located in the header if the previous option doesn't fit your needs.

- Click Buy Now once you identify the appropriate Nebraska Assignment Withholding.

- Select the subscription plan that aligns with your needs and financial plan.

- Create an account or Log In to continue to the payment page.

- Make your subscription payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

When dealing with Nebraska assignment withholding, holding back between 15-20% for taxes is often advisable for most individuals. This approach helps you mitigate tax liabilities and prepare for unexpected tax bills. You can adjust this percentage based on your specific financial situation to ensure optimal withholding.

Being exempt from Nebraska withholding means you do not have to withhold state taxes from your income. This status typically pertains to individuals who expect their total income to fall below the taxable threshold. It's essential to consider your circumstances carefully and ensure you apply for the exemption accurately.

In Nebraska, assignment withholding for state taxes usually requires withholding about 5-6.84%, depending on your income. This percentage aligns with state tax brackets, helping to ensure you meet your state tax obligations. You can customize your withholding further based on your overall financial picture.

For Nebraska assignment withholding, the withholding allowance can depend on your personal and financial situation. Typically, one allowance can lower your taxable income by about $4,300 for the year. Consider evaluating your deductions and credits to find the right balance.

The best withholding percentage for Nebraska assignment withholding often hinges on your financial situation. Generally, a range of 10-12% can help most taxpayers avoid underpayment penalties. It's crucial to assess your income level to determine the ideal percentage for your circumstances.

When considering Nebraska assignment withholding, a common guideline is to withhold around 10-15% for federal taxes. This percentage can ensure you cover your tax liabilities adequately throughout the year. However, personal circumstances, and other income sources can influence your specific withholding needs.

The 20% mandatory withholding refers to the federal requirement to withhold a flat 20% from certain types of payments, including distributions from retirement accounts. If you do not opt out or specify otherwise, this percentage will be withheld automatically. This requirement is crucial to consider for anyone facing Nebraska assignment withholding on such payments. Consulting with resources on uslegalforms can clarify your obligations.

When filling out your withholding allowance, input factors such as your marital status, number of dependents, and any adjustments for additional income or deductions. This information helps your employer calculate the appropriate amount to deduct for Nebraska assignment withholding. It is essential to be accurate, as claiming too many allowances may result in owing taxes later. Uslegalforms can assist you in understanding your options.

A withholding allowance certificate is a form that you submit to your employer to indicate how much federal income tax should be withheld from your paychecks. It helps determine the number of allowances you can claim based on your personal and financial situation. This document is crucial for ensuring that the right amount is withheld for Nebraska assignment withholding. You can easily access resources for this process on the uslegalforms platform.

You become subject to withholding when you receive income that is taxable under federal or state law, including wages, salaries, and certain payments. If your income exceeds a specific threshold, Nebraska assignment withholding will apply. Also, if you work for an employer, they are required to withhold taxes from your paycheck. Understanding these details can help you manage your withholdings effectively.