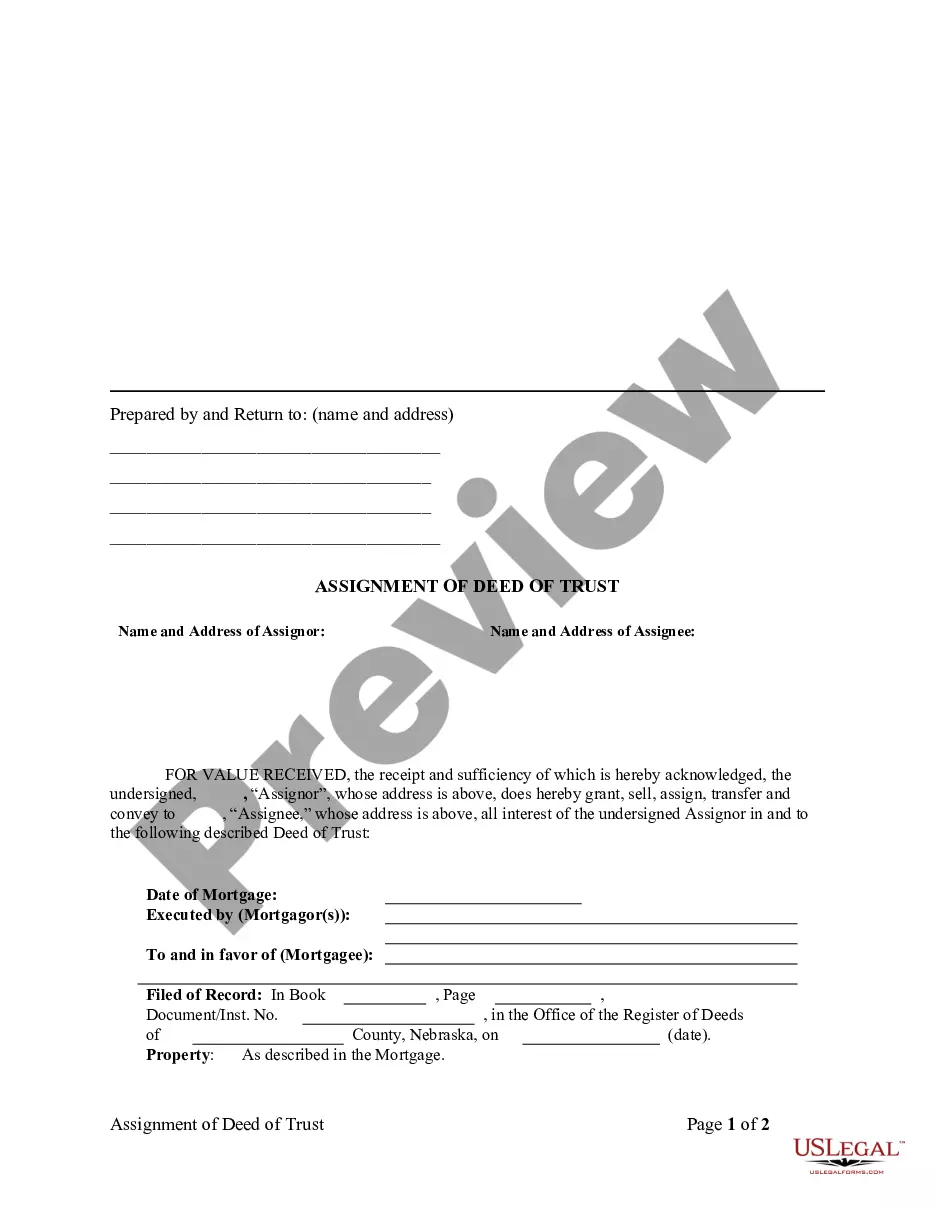

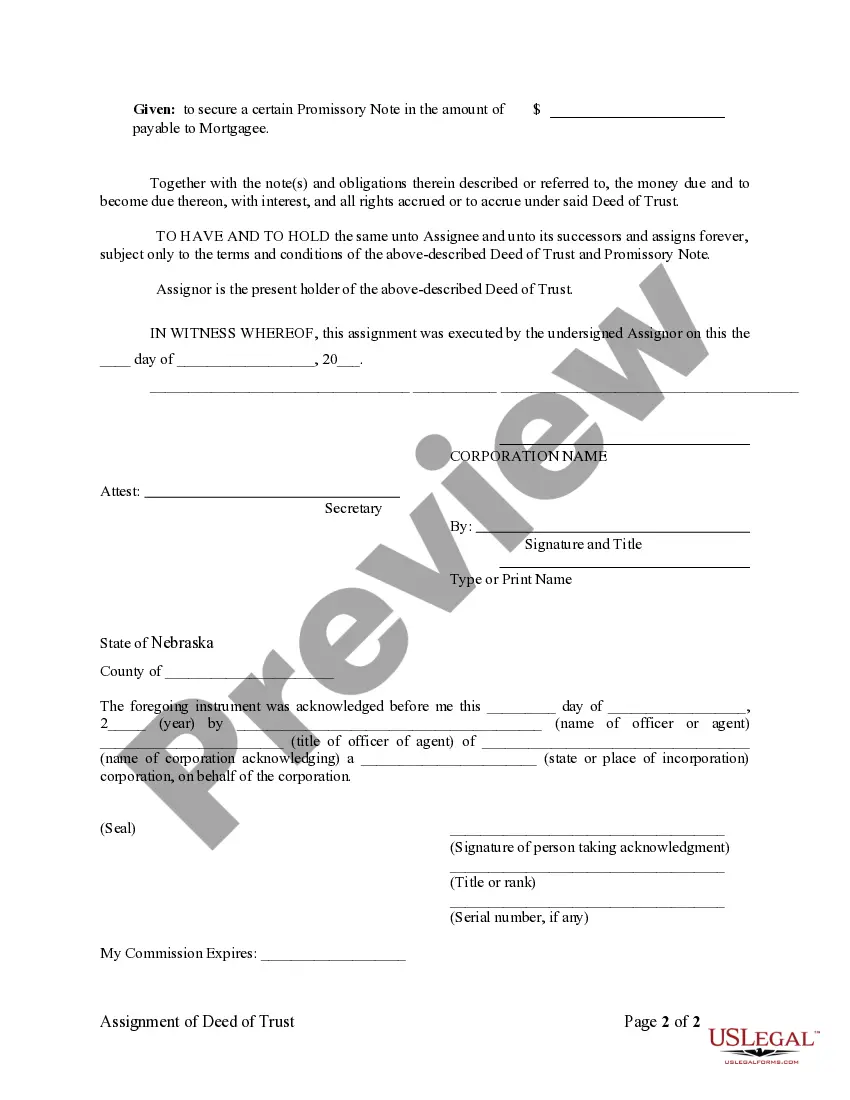

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Nebraska Assignment With A Returned Value

Description

How to fill out Nebraska Assignment With A Returned Value?

When you have to complete Nebraska Assignment With A Returned Value according to your local state's statutes and regulations, there may be several choices available.

You don't have to review every form to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in acquiring a reusable and current template on any subject.

Banner through the suggested page and check it for compatibility with your needs.

- US Legal Forms is the most extensive online catalog with a compilation of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading Nebraska Assignment With A Returned Value from our platform, you can be confident that you possess a valid and current document.

- Obtaining the required sample from our platform is extremely simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- Subsequently, you can navigate to the My documents section in your profile and keep access to the Nebraska Assignment With A Returned Value at any time.

- If this is your first time using our website, please follow the instructions below.

Form popularity

FAQ

Statute 28 611 in Nebraska addresses the issue of assignment with a returned value. This law specifies the requirements for the assignment of benefits and obligations within contracts when a return value is involved. Understanding this statute is crucial for individuals engaged in transactions that involve Nebraska assignment with a returned value, as it helps protect your rights. If you need assistance with legal documents related to this statute, US Legal Forms offers tailored solutions to help you navigate these requirements.

To use a returned value in a Nebraska assignment, start by clearly defining the purpose of your assignment. This will guide you on how to interpret the value returned by the assignment process. You can verify, document, and apply the returned value to ensure it meets legal requirements and enhances your understanding of your rights. With the US Legal Forms platform, you can easily navigate Nebraska assignments with a returned value to ensure compliance and clarity.

A power of attorney (POA) is a legal document that allows someone to act on your behalf regarding financial or medical decisions. This can encompass actions like managing a Nebraska assignment with a returned value. If necessary, you can send your POA form via FedEx to ensure prompt and secure delivery to the relevant parties.

There are several types of power of attorney forms available in Nebraska, each designated for different purposes. Common types include general, durable, and limited powers of attorney, tailored to specific needs. Understanding which form to choose is essential for effectively managing your Nebraska assignment with a returned value.

Property values in Nebraska are assessed based on various factors such as location, improvements, and market trends. Local assessors analyze these elements to determine a fair market value. This process directly impacts your Nebraska assignment with a returned value, making it crucial for property owners to stay informed about assessments.

Form 458 in Nebraska is related to the state’s property tax and serves as the assessment return for property owners. By filing this form, you ensure that your property is accurately assessed, which carries implications for your Nebraska assignment with a returned value. Using uslegalforms can simplify filling out and submitting this important document.

To obtain a durable power of attorney in Nebraska, you need to complete the appropriate form that specifies your wishes. This document remains effective even if you become incapacitated, protecting your interests regarding the Nebraska assignment with a returned value. Services like uslegalforms can streamline this process with easy-to-use templates.

Yes, a power of attorney needs to be notarized in Nebraska to be legally valid. This notarization process provides an added layer of security and authenticity to the document, ensuring that the Nebraska assignment with a returned value is executed correctly. You can rely on platforms like uslegalforms to guide you through this process.

A form 33 power of attorney in Nebraska is a document that allows one person to act on behalf of another when it comes to tax matters. This form grants specific authority to the representative, which can include handling Nebraska assignment with a returned value. It is essential for ensuring your tax matters are managed according to your wishes.

Yes, you can e-file a Nebraska amended return. This process allows you to efficiently correct any discrepancies on your original return, which is beneficial for your tax compliance. Utilizing e-filing also streamlines the submission, making it easier for you to track your Nebraska assignment with a returned value.