Transfer-on-death Deed

Description

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

- If you're an existing user, log in to your account and download the transfer-on-death deed template by clicking the Download button. Ensure your subscription is active, and renew it if necessary.

- For first-time users, start by checking the Preview mode and form description. Confirm it meets your requirements and is aligned with your local jurisdiction.

- If the form doesn’t fulfill your needs, search for another template using the Search tab. Once you find the right one, proceed to the next step.

- Purchase the document by clicking on the Buy Now button and selecting your preferred subscription plan. You’ll need to create an account for full access to the resources.

- Complete your payment by entering your credit card information or using your PayPal account.

- Download your transfer-on-death deed template and save it on your device. You can also access it later from the My Forms section of your profile.

By using US Legal Forms, you can leverage an extensive library of over 85,000 legal forms, gaining peace of mind with high-quality, editable documents.

Take charge of your estate planning today. Explore US Legal Forms for all your legal documentation needs!

Form popularity

FAQ

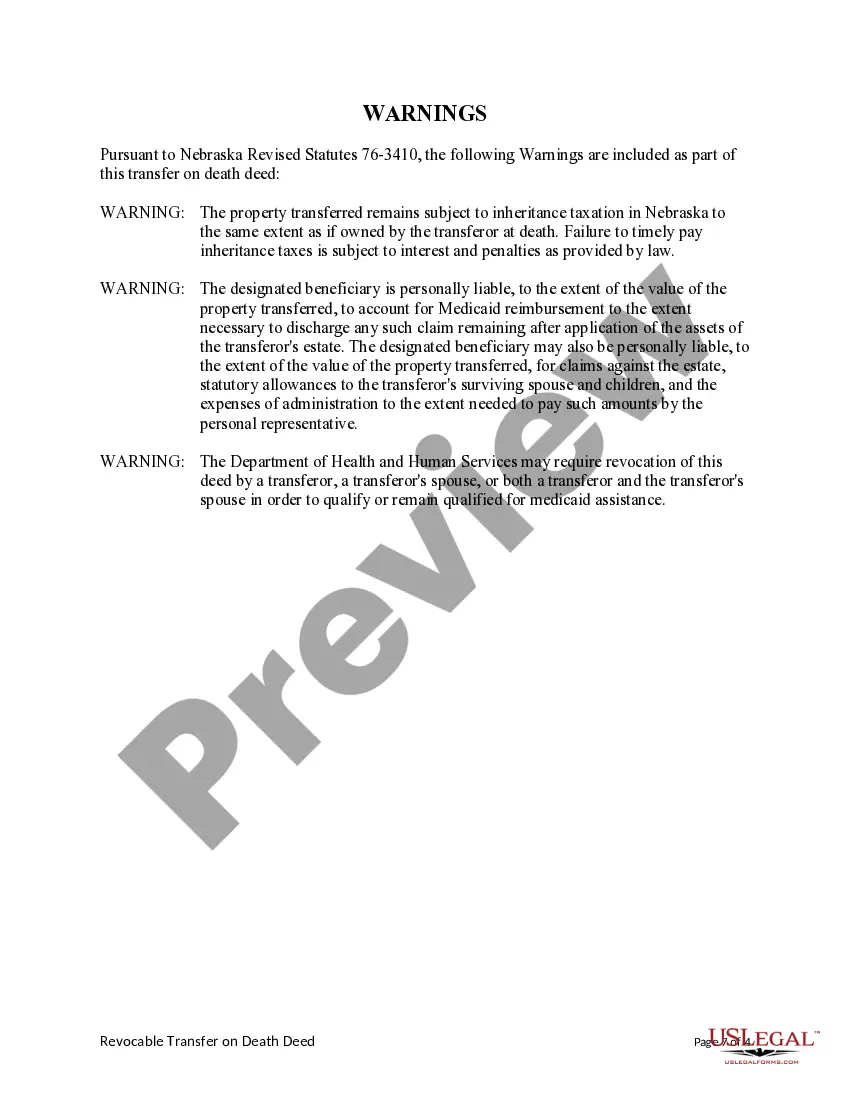

While a transfer-on-death deed offers many benefits, it may not suit everyone's situation. One potential downside is the lack of control over the property once you pass; beneficiaries receive the property outright. Additionally, if the TOD is not executed properly, it could lead to disputes among heirs. Always consider consulting uslegalforms for proper guidance.

A transfer-on-death deed does not directly avoid inheritance tax, as properties passed through a TOD may still be subject to taxation. However, this deed allows assets to bypass probate, which can be advantageous for your heirs. It’s wise to discuss your specific situation with a tax professional to understand any potential implications.

The best way to leave property upon death often depends on your goals and circumstances. A transfer-on-death deed offers an efficient way to transfer property without the delays of probate. By carefully planning your estate, you can ensure your wishes are honored while minimizing complications for your heirs.

A transfer-on-death deed can be a beneficial option for many homeowners. It provides a straightforward way to transfer real estate upon death, avoiding lengthy probate proceedings. However, it's essential to weigh the potential legal implications and consult with an expert to determine if a TOD fits your needs.

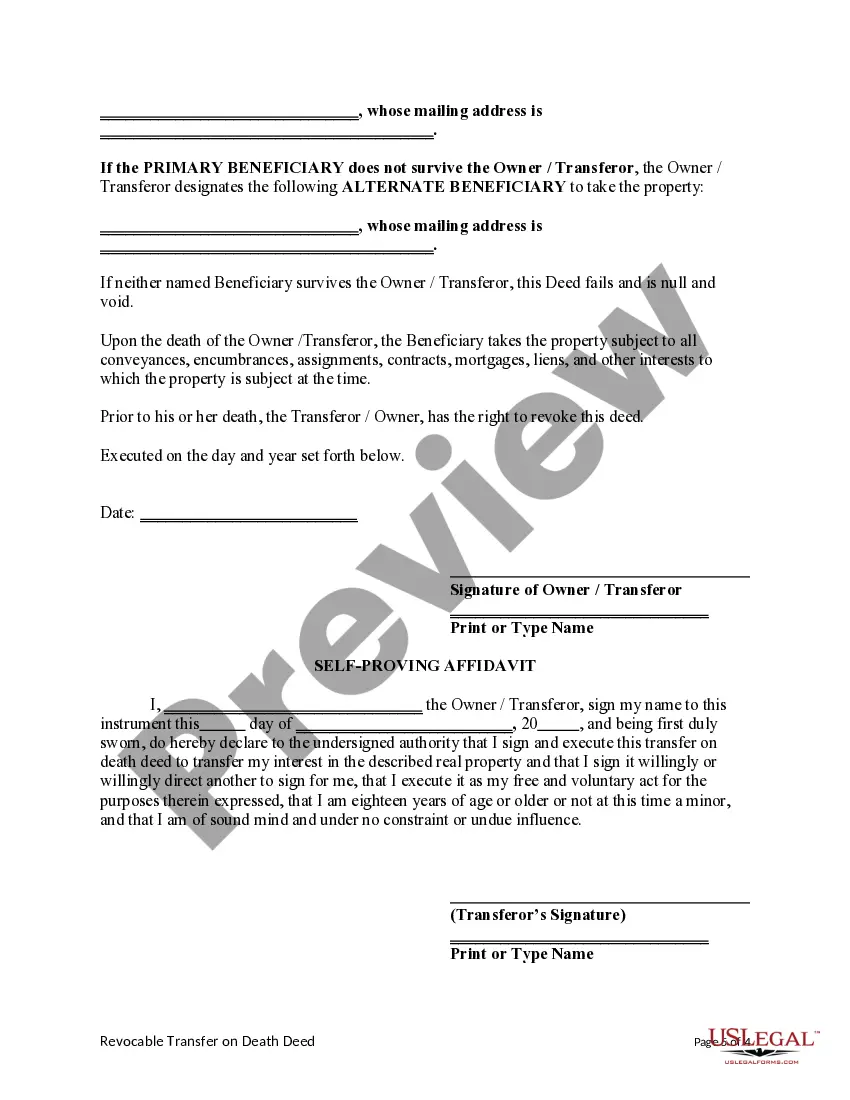

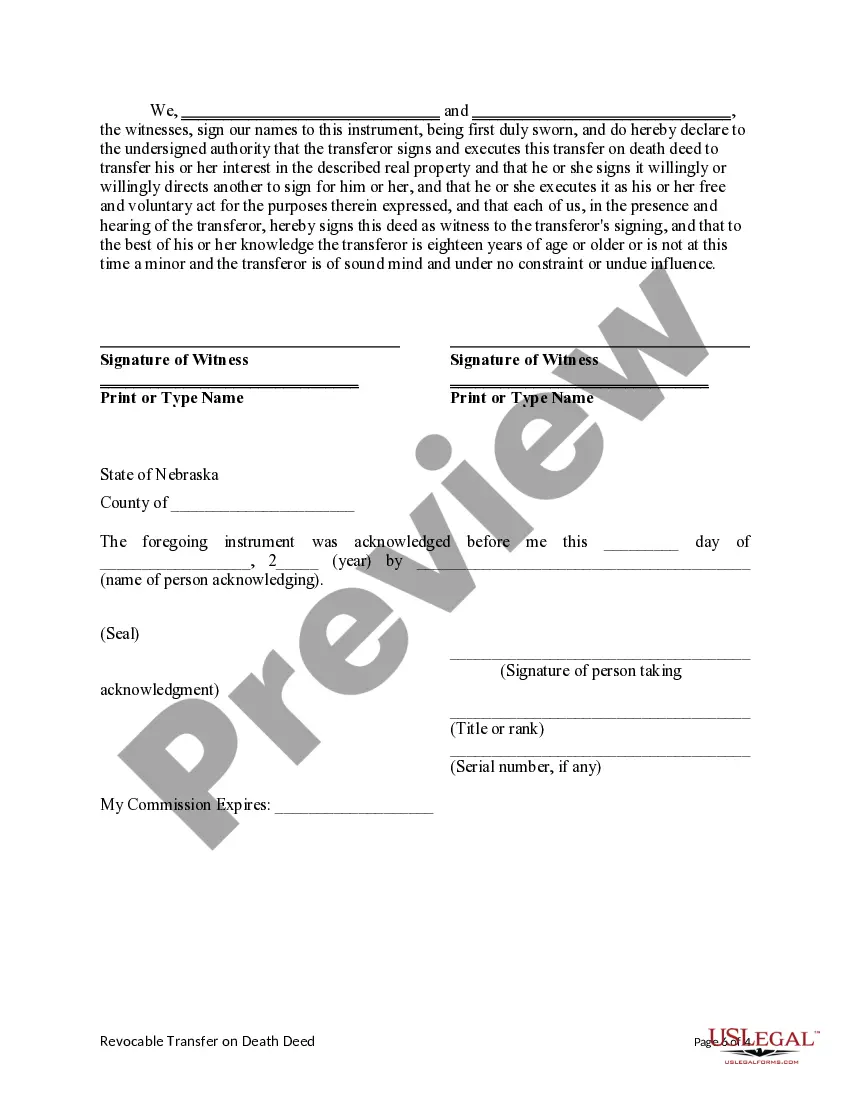

Writing a transfer-on-death deed involves several key steps. First, you must identify the property and clearly state the beneficiary's name. Then, ensure you sign the deed in the presence of a notary public to make it legally binding. If you need assistance, consider using uslegalforms to streamline the process.

Choosing between a transfer-on-death deed (TOD) and a beneficiary can depend on your specific situation. A TOD deed allows property to transfer seamlessly to your designated beneficiary without the need for probate. Think about what works best for your estate, as a TOD may simplify the transfer process.

A transfer-on-death deed does not inherently avoid capital gains tax; however, it provides some benefits. When you transfer an asset through this deed, the beneficiary receives a step-up in basis, which may reduce their capital gains tax liability. This means that the asset is valued at its fair market value at the time of your death. Understanding these implications is crucial, and tools from USLegalForms can assist in navigating the complexities of transfer-on-death deeds.

Transfer on death presents certain drawbacks, such as limited control over the asset during your lifetime. Once the deed is in place, you cannot change beneficiaries without altering the document, which can become cumbersome. Additionally, assets transferred through a transfer-on-death deed may still be subject to creditor claims after death. It’s wise to evaluate your options with a legal professional familiar with transfer-on-death deeds.

Transfer-on-death accounts may complicate estate planning if not done correctly. They can lead to disputes among beneficiaries, particularly if multiple heirs expect to inherit the same asset. Furthermore, if a beneficiary predeceases the account owner, the account may not automatically transfer as intended, which may create unnecessary confusion. Using a transfer-on-death deed can help clarify these wishes and streamline the transfer process.

In Texas, a transfer-on-death deed must be signed and executed in accordance with state laws, including being notarized. You can also revoke or change the deed at any time during your lifetime. It's vital to ensure your deed is properly recorded with the appropriate county office to enforce your wishes regarding the transfer of property after your death.