Transfer Death Deed Agreement For A Property

Description

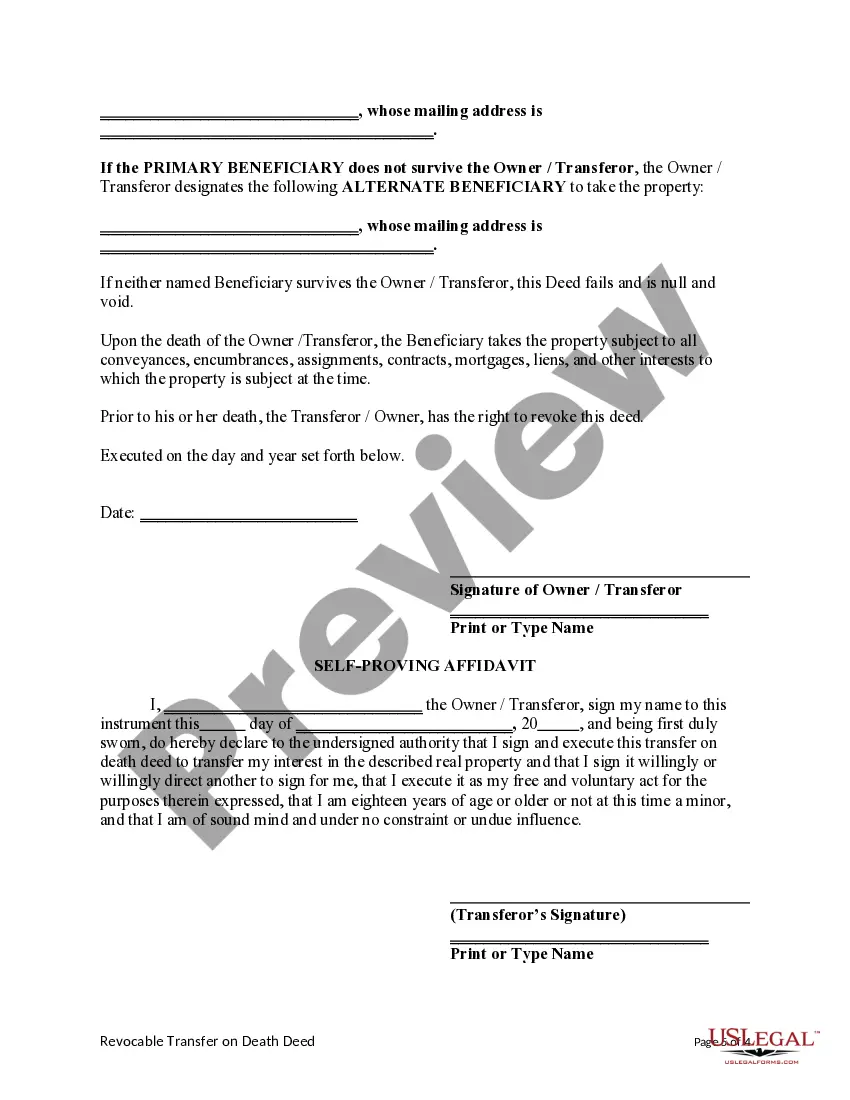

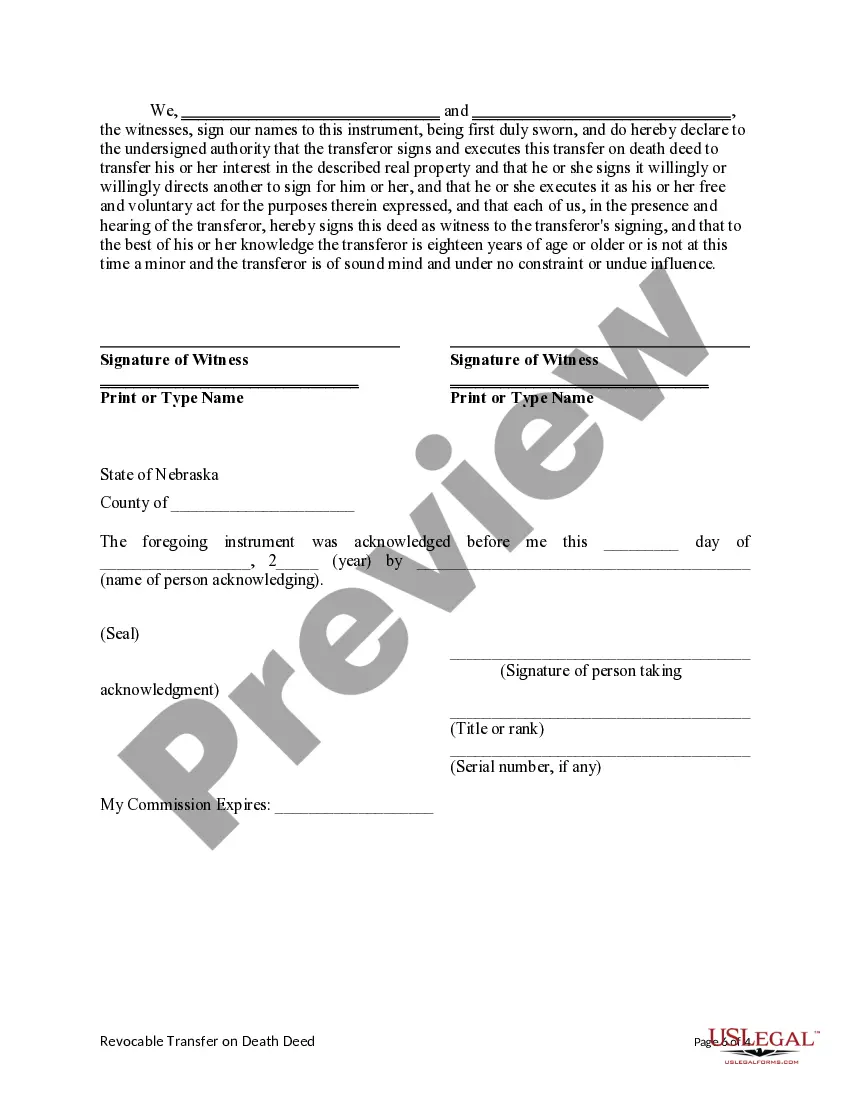

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

- Log in to your existing US Legal Forms account. Ensure your subscription is active; if not, renew it to access the necessary templates.

- Review the available form templates in the Preview mode. Choose the one that fits your specific needs and complies with local laws.

- If you can't find the right document, use the search feature at the top of the page to locate additional options.

- Purchase the document by clicking the Buy Now button, and select your preferred subscription plan. Create an account if you haven't done so yet.

- Complete the payment process either through credit card or PayPal to finalize your subscription.

- Download your selected form to your device. You can always access it later via the My Forms section of your profile.

By following these straightforward steps, you can easily transfer a death deed agreement for a property with confidence.

Don't wait—take control of your legal documentation today with US Legal Forms and simplify the process of securing your property transfers.

Form popularity

FAQ

Yes, New York State allows transfer death deed agreements for a property, enabling a seamless transition of ownership after your passing. This tool can simplify the transfer process, as it avoids the lengthy probate procedure. However, specific legal requirements must be followed, so it is advantageous to seek guidance. Resources from US Legal Forms can assist you in ensuring your agreement meets New York's legal standards.

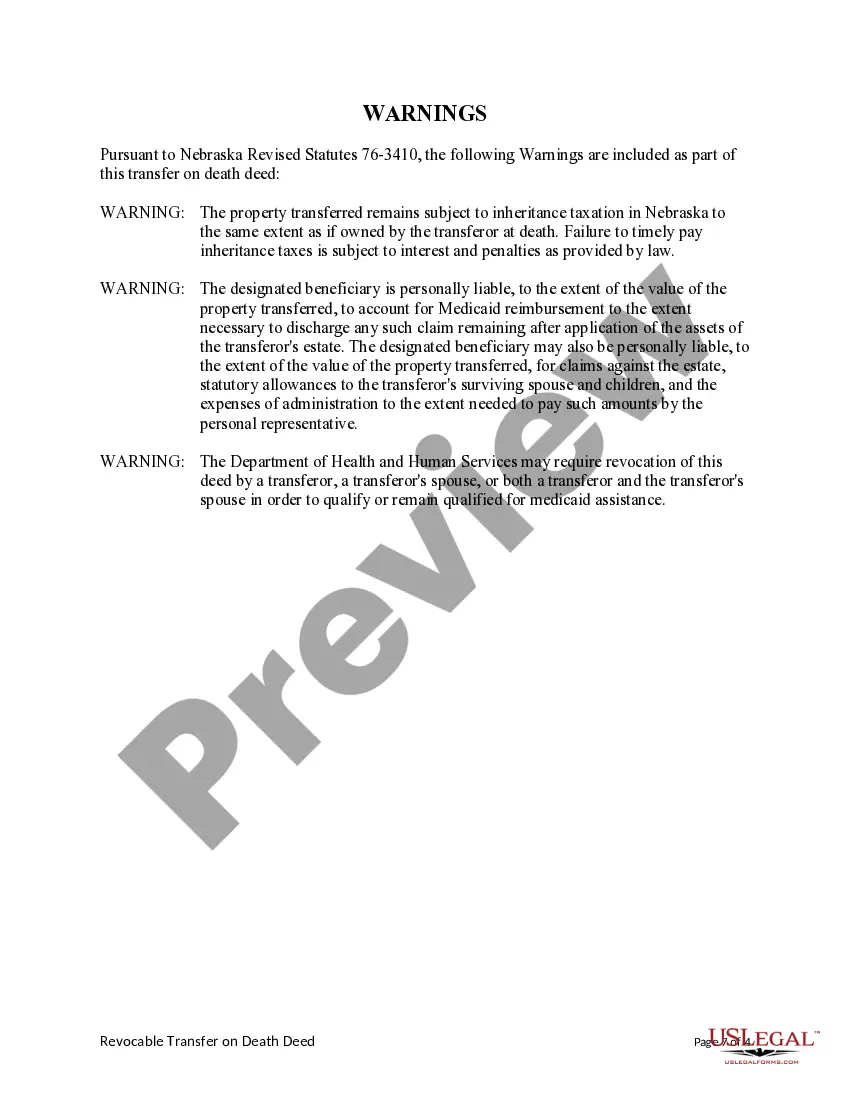

While transfer death deed agreements for a property offer benefits, there are potential downsides. One concern involves the lack of control during the owner’s lifetime; the property automatically transfers upon death, which may not align with changing circumstances. Additionally, creditors may still have claims on the property after your death. It is wise to weigh these factors and consider legal assistance to avoid complications.

Many states across the U.S. permit transfer death deed agreements for a property, including California, New Mexico, and Arizona. Each state has its own rules regarding how these deeds must be structured and executed. If you are considering this option, it's wise to check the specific laws in your state or consult a legal expert. US Legal Forms can provide comprehensive information and templates tailored to your state's requirements.

Yes, New Jersey allows the use of transfer death deed agreements for a property. This option provides a straightforward way to transfer ownership without going through probate. It’s a convenient tool for many homeowners who want to ensure their property passes smoothly to their loved ones. Utilizing resources from US Legal Forms can help you navigate this process efficiently.

You do not necessarily need a lawyer to create a transfer death deed agreement for a property, but consulting with one is beneficial. A lawyer can help you understand the legal requirements and implications specific to your state. Using a legal platform like US Legal Forms can make the process easier and ensure that your deed is correctly prepared. Ultimately, having expert guidance can save you time and prevent future disputes.

A transfer death deed agreement for a property may not avoid capital gains tax altogether. When the property is sold after the owner's death, its value at the time of transfer determines the basis for capital gains calculation. However, in many cases, heirs step up the property's basis to its fair market value at death, which can mitigate tax liabilities. Therefore, professional guidance is recommended to navigate these tax impacts.

As of now, several states in the United States allow for a transfer death deed agreement for a property, including California, Florida, and Texas. Each state has its own regulations regarding how these deeds should be executed and the implications they carry. Be sure to research local laws or consult with a legal expert to understand the specifics in your state.

In general, a transfer death deed agreement for a property does not inherently avoid inheritance tax. The property value will typically be included in the estate's overall value, and taxes may apply based on the estate's total worth. It's advisable to consult a tax professional for clarity on how this deed may influence tax obligations in your specific situation.

Similar to the first question, the transfer death deed agreement for a property can lead to complications when multiple heirs are involved. Disagreements among heirs could result in disputes, leading to costly legal battles. Furthermore, since the transfer does not take effect until death, the property remains part of the owner's estate during their lifetime.

The primary disadvantages of a transfer death deed agreement for a property include potential challenges during the probate process and the possibility of creditors claiming the property post-death. Additionally, if the property owner incurs debts, the transfer may not be protected from claims. It's essential to consider how this deed may interact with estate planning strategies.