Tod Deed Form Illinois

Description

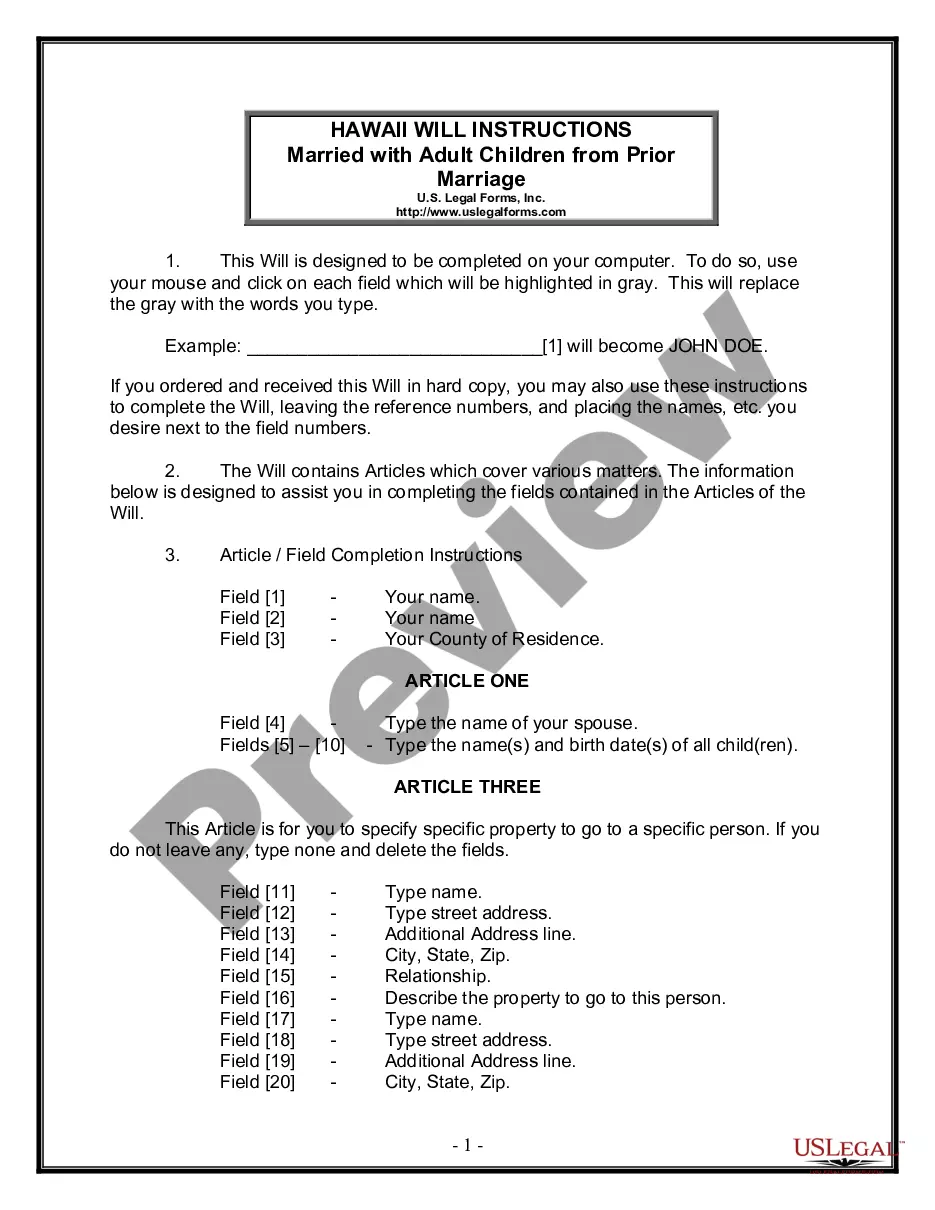

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

Regardless of whether it's for corporate reasons or individual issues, everyone must navigate legal matters at some point in their lives.

Filling in legal paperwork requires meticulous care, starting from selecting the suitable form template.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Use the library’s straightforward navigation to find the right template for any situation.

- Locate the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search feature to find the Tod Deed Form Illinois template you need.

- Download the file when it suits your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: either a credit card or PayPal account.

- Select the file format you prefer and download the Tod Deed Form Illinois.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

The Name. This state was named by Dutch explorer Adrian Block. He named it "Roodt Eylandt" meaning "red island" in reference to the red clay that lined the shore. The name was later anglicized when the region came under British rule.

An annual report is a simple, one-page form that captures basic information about a business. It does not contain financial or ownership information. Annual reports can be filed online, by mail or in person at our office located at 148 W. River Street, Providence, RI 02904.

All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

You should receive your refund within five to seven weeks. Some refunds may be delayed slightly due to our increased screen- ing for refund fraud. Also, the closer to April 15 you file, the longer it will take for your return to be processed and your refund issued.

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

Extensions - Rhode Island allows an automatic extension to October 15 if no additional tax is due and if a federal extension is filed.

You may find the following points helpful in preparing your Rhode Island Income Tax Return. RESIDENT INDIVIDUALS ? Every resident individual of Rhode Island who is required to file a federal income tax return must file a Rhode Island individual income tax return (RI-1040).