Tod Deed Form California

Description

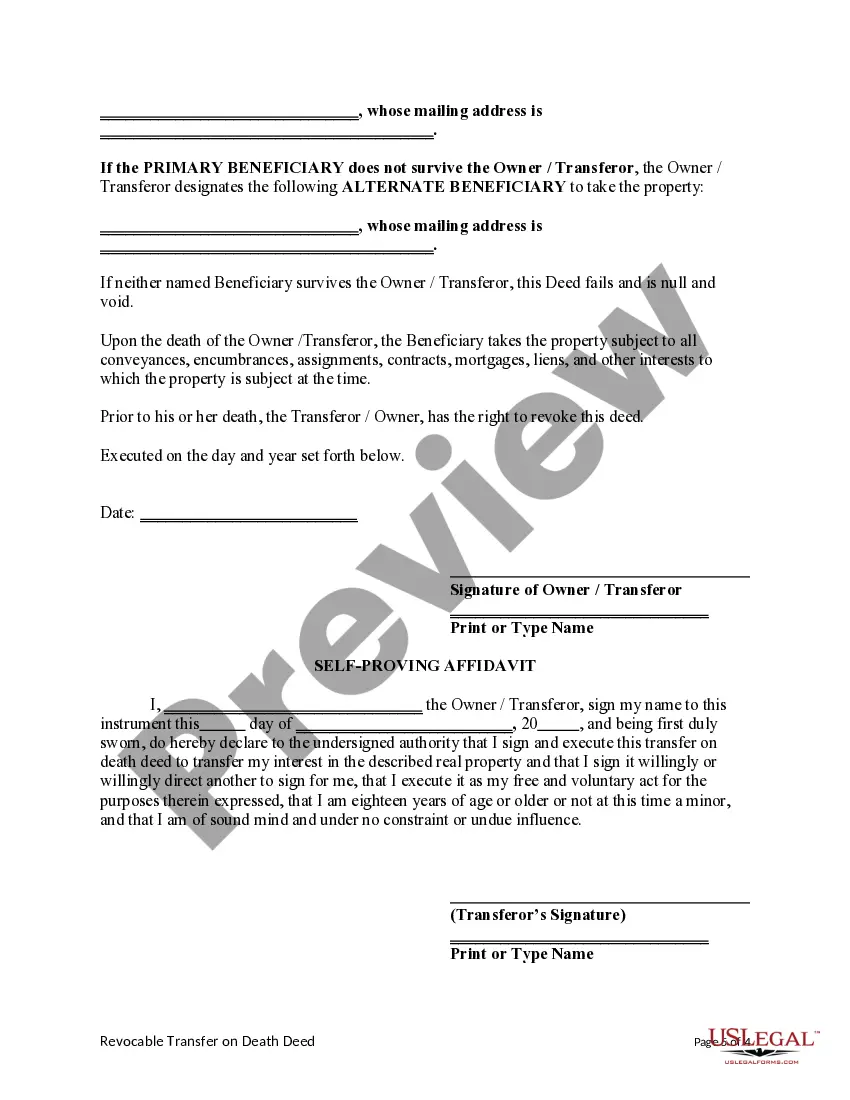

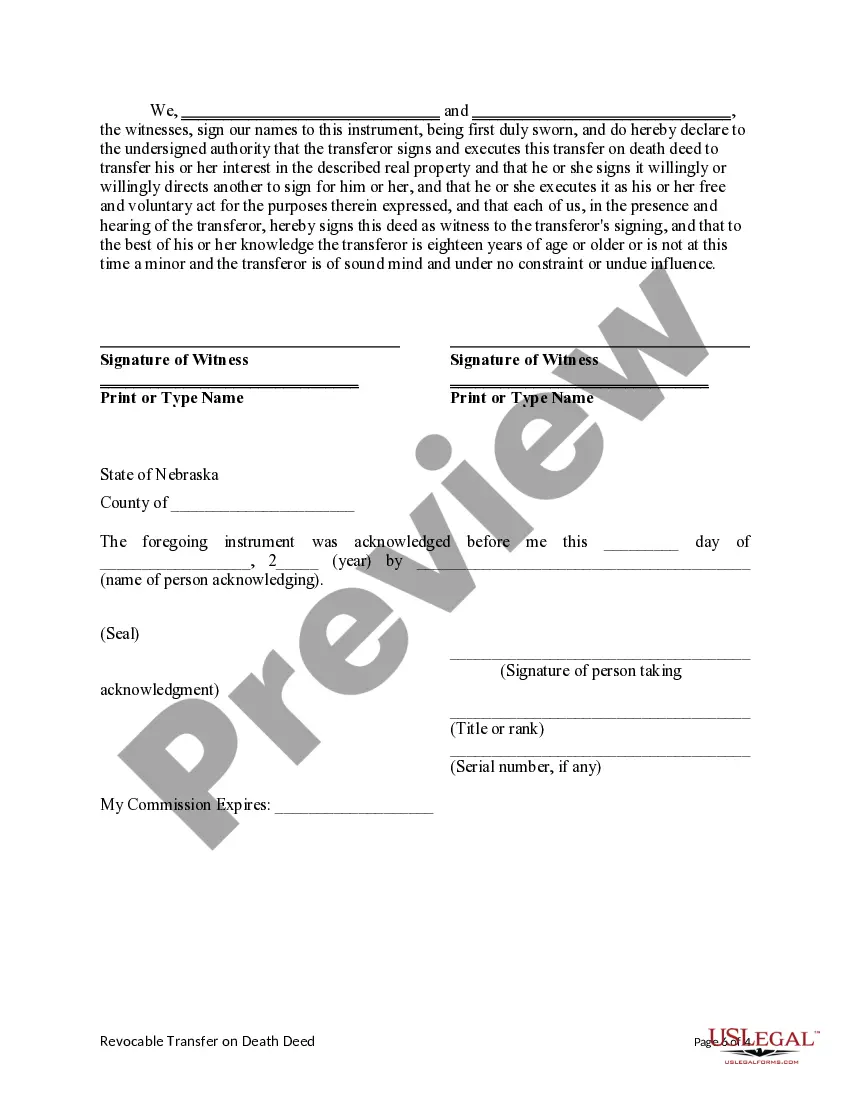

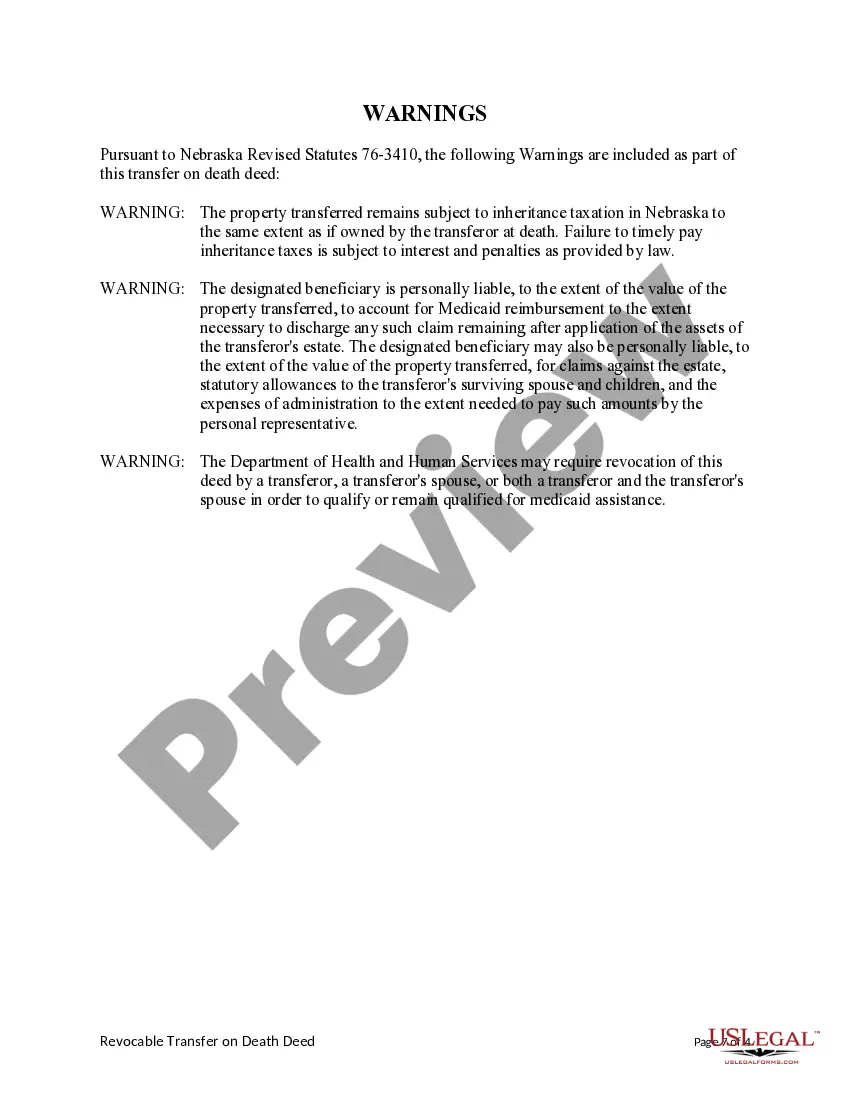

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

It’s clear that you cannot transform into a legal authority instantly, nor can you swiftly master how to prepare the Tod Deed Form California without possessing a dedicated skill set.

Drafting legal documents is a lengthy endeavor that necessitates particular education and expertise. Therefore, why not entrust the creation of the Tod Deed Form California to the experts.

With US Legal Forms, which boasts one of the largest libraries of legal templates, you can locate anything from court documentation to office communication templates. We recognize the significance of compliance and following federal and state regulations. This is why, on our site, every form is regionally tailored and current.

You can regain access to your forms from the My documents section at any time. If you’re a current customer, you can simply Log In and locate and download the template from the same tab.

No matter the reason for your documents—whether financial, legal, or personal—our site has everything you need. Give US Legal Forms a try today!

- Locate the form you require using the search function located at the top of the page.

- View it (if this feature is available) and review the accompanying description to determine if the Tod Deed Form California meets your needs.

- If you need a different form, restart your search.

- Establish a complimentary account and select a subscription plan to acquire the template.

- Select Buy now. Once your payment is completed, you can obtain the Tod Deed Form California, fill it out, print it, and deliver it to the appropriate individuals or organizations.

Form popularity

FAQ

Get Answers Over the Telephone Most of the issues you might have can be addressed by contacting our office using the main telephone number 458-4400 or by calling the direct phone number of your assigned case worker.

Rhode Island's combined state and local general revenues were $16.2 billion in FY 2021, or $14,749 per capita. National per capita general revenues were $12,277. Rhode Island uses all major state and local taxes.

The RIde Program is for people with disabilities that prevent the use of fixed-route buses, RIPTA offers paratransit service through the RIde Program, as required by the Americans with Disabilities Act (ADA). ADA Paratransit provides door to door service and requires advance reservations. ADA Service.

IF THIS IS A PRIVATE CASE YOU MUST REPORT YOUR CHANGE OF ADDRESS BY USING THE CSS-1 FORM. THAT CAN BE FOUND ON . YOU MAY ALSO REQUEST THE UPDATE BY VISITING THE RHODE ISLAND FAMILY COURT. PLEASE NOTE: *IF MAILING OR FAXING CHANGE OF ADDRESS FORM TO OCSS, A VALID PHOTO ID IS REQUIRED.

The largest state and local general own-source funds came from property taxes (17 percent) and charges (16 percent), followed by individual income taxes and general sales taxes (both 12 percent) and selective sales taxes (6 percent).

Rhode Island only has $7.9 billion of assets available to pay bills totaling $12 billion. Because Rhode Island doesn't have enough money to pay its bills, it has a $4.1 billion financial hole. To fill it, each Rhode Island taxpayer would have to send $10,200 to the state.

Rhode Island's combined state and local general revenues were $16.2 billion in FY 2021, or $14,749 per capita.

Today, major Rhode Island industries include biomedicine, defense shipbuilding and maritime products and manufacturing.