Form Death Beneficiary For A Trust

Description

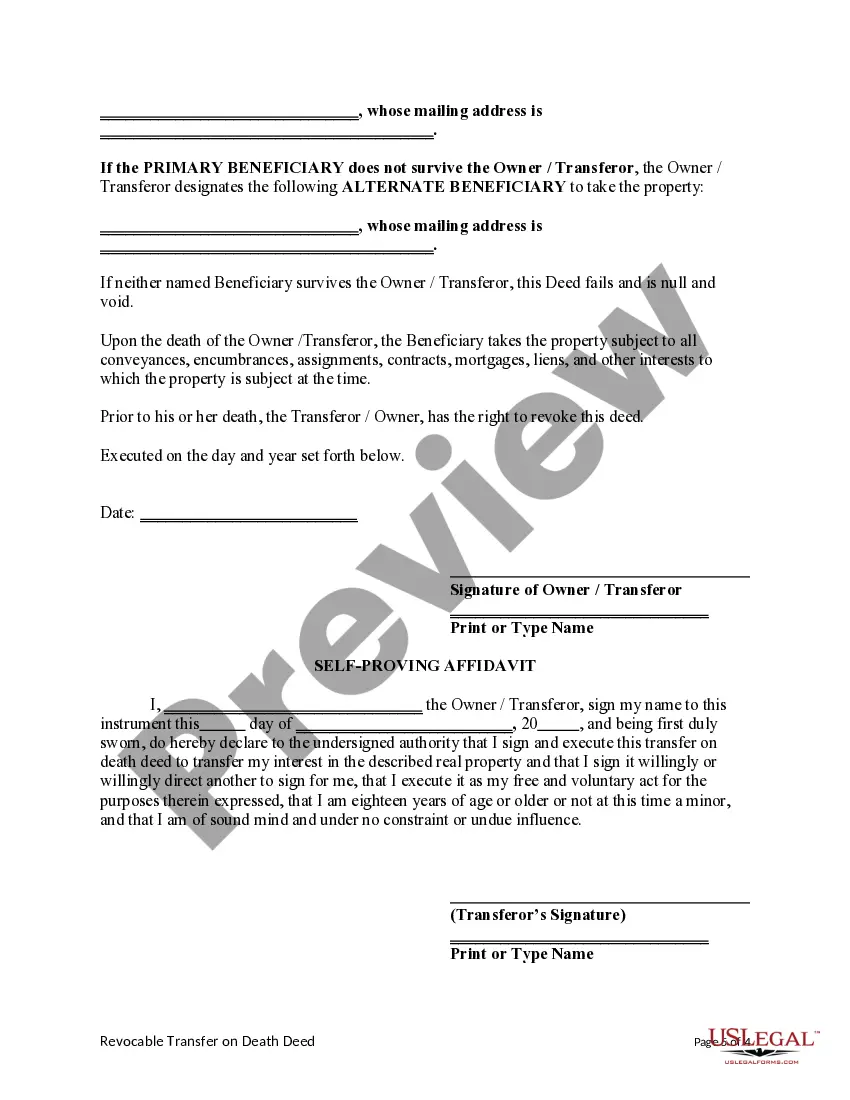

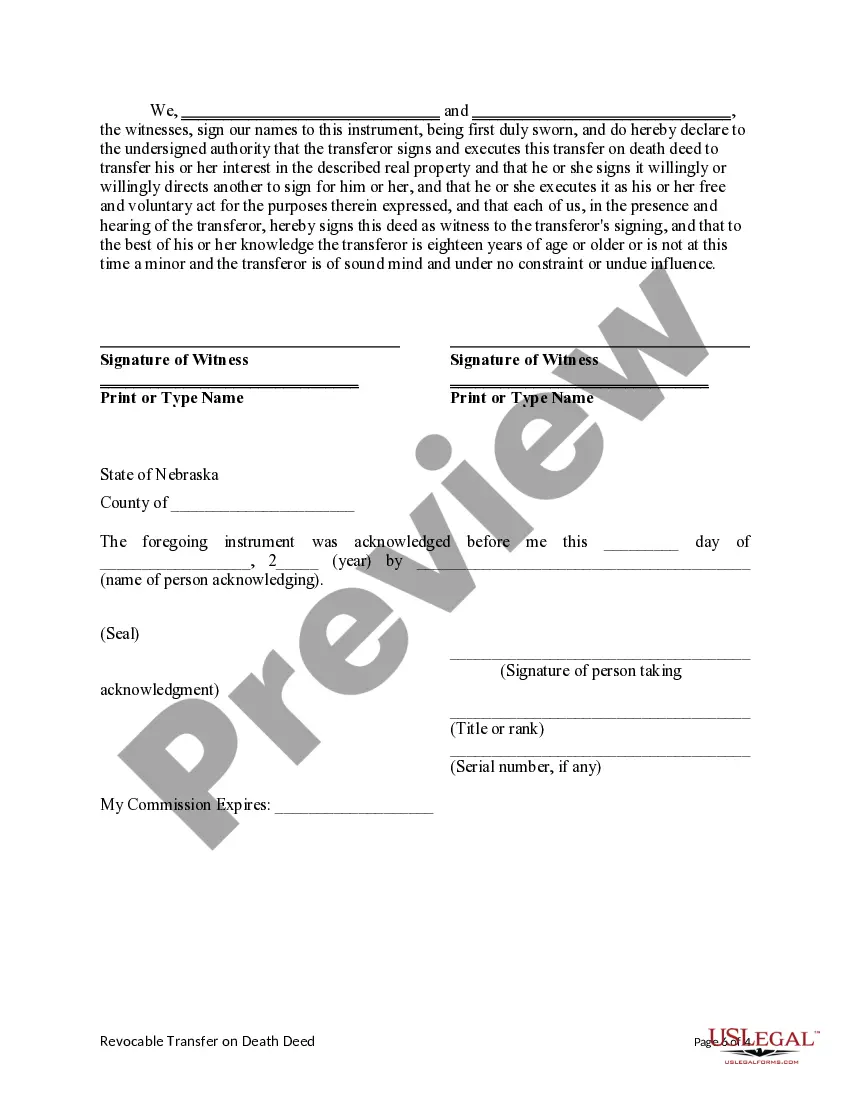

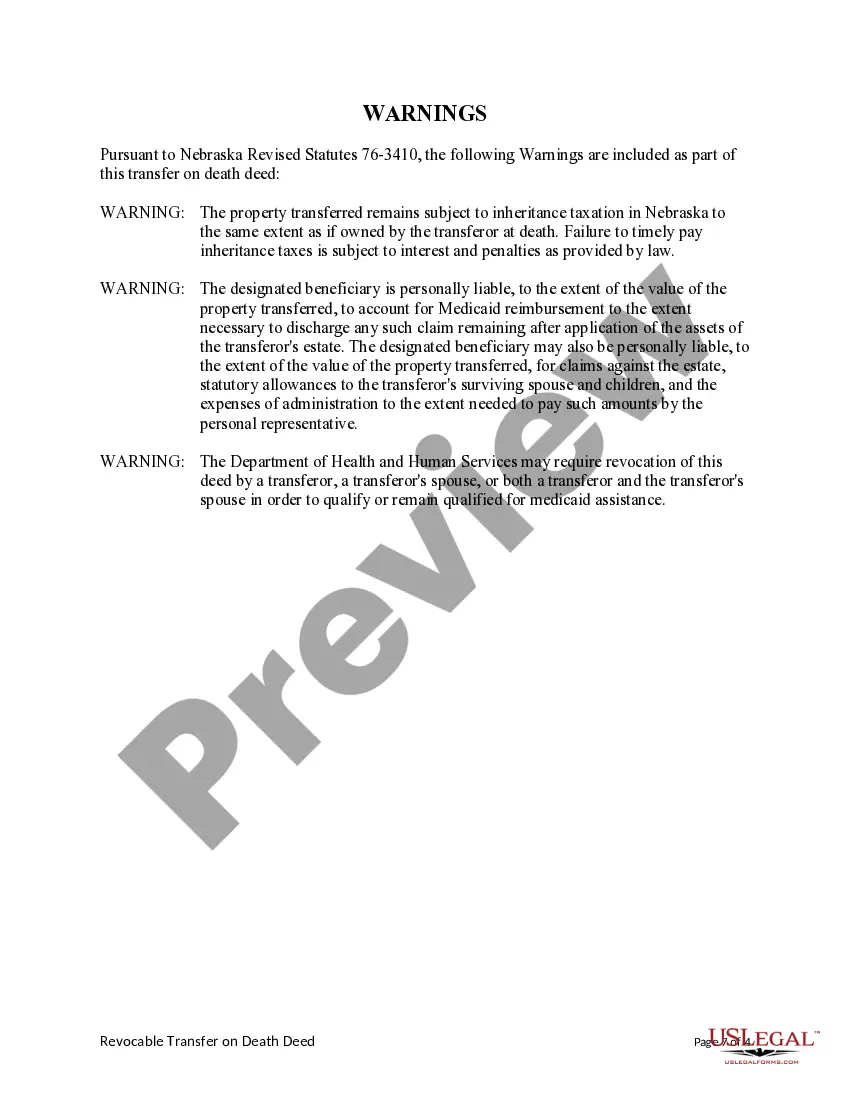

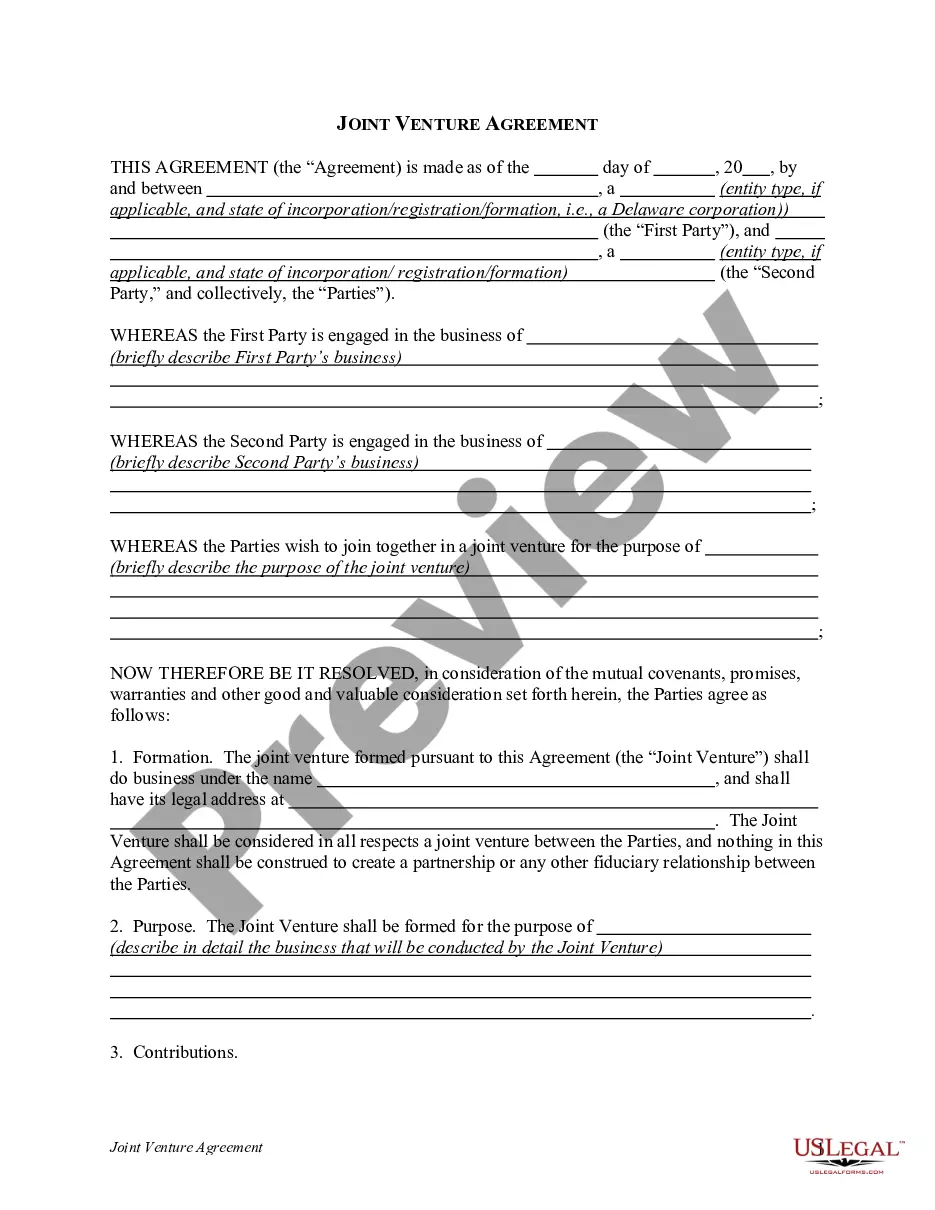

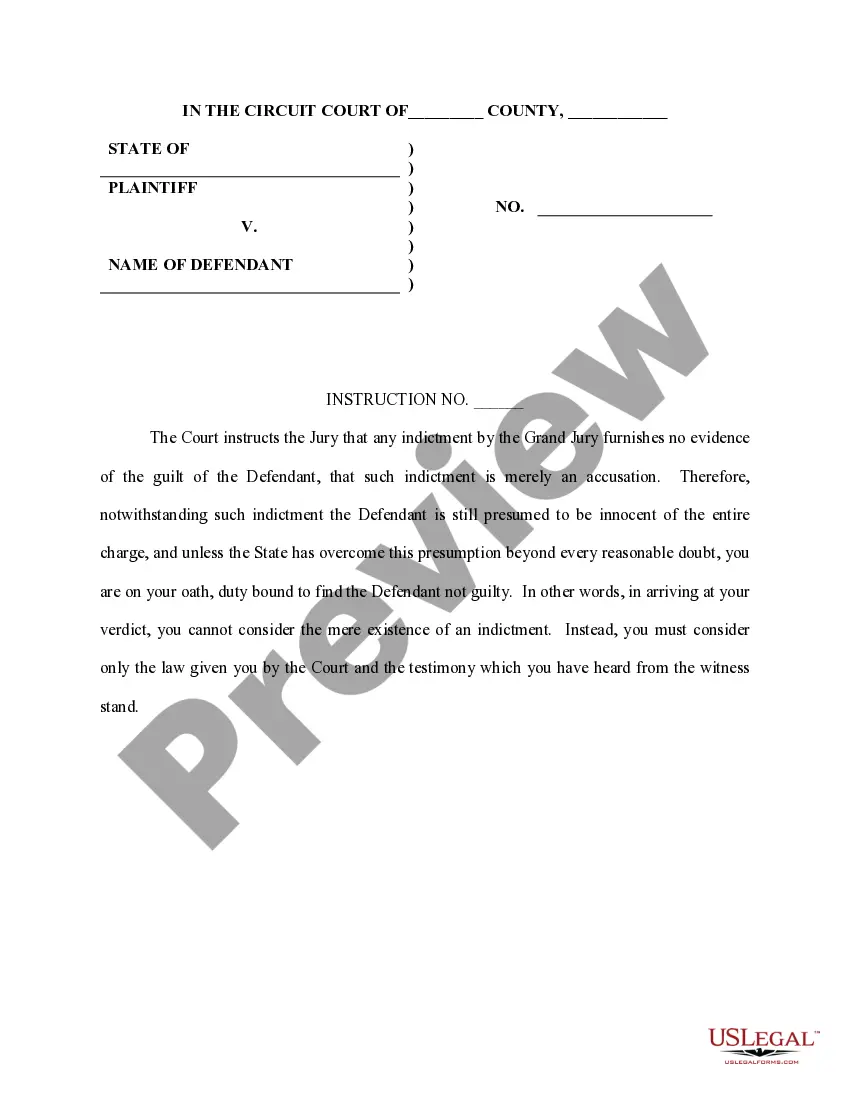

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

- If you have an existing account with US Legal Forms, log in and download the form template directly. Be sure your subscription is active; renew it as necessary.

- Begin your journey by previewing the form description. Confirm that it complies with your local jurisdiction requirements and meets your specific needs.

- If the required template isn’t available, search using the tab at the top of the page for additional options.

- Once you identify the correct form, click the 'Buy Now' button. Choose a suitable subscription plan and create an account to access the forms.

- Proceed with the payment by entering your credit card information or using PayPal to complete your purchase.

- Finally, download your form and save it on your device. You can access it anytime through the My Forms section of your profile.

In conclusion, using US Legal Forms simplifies the process of obtaining legal documents like the form death beneficiary for a trust. Their extensive library and user-friendly interface empower you to complete your legal needs efficiently.

Explore the vast range of forms available and take control of your legal documentation today!

Form popularity

FAQ

While the trustee has more operational control over the trust, beneficiaries hold power in their rights to the trust's benefits. A trustee must act in accordance with the trust's terms and prioritize the beneficiaries' interests. This dynamic underscores the importance of transparency and communication between the two parties. For a smoother process, consider using the Form death beneficiary for a trust to establish clear expectations.

If a beneficiary in a trust dies, the trust document usually specifies what happens next. Often, their share may pass to their heirs or be redistributed among the remaining beneficiaries. It's essential to update the trust documentation after a beneficiary’s death to reflect these changes. You can utilize the Form death beneficiary for a trust to ensure that the trust accurately conveys your intentions after such changes occur.

The trustee typically holds the most power in a trust due to their control over asset management and distribution. However, beneficiaries also hold significant power as they benefit from the trust's assets. The balance of power can vary depending on the trust's terms and the trustee's commitment to acting fairly. Using a Form death beneficiary for a trust can help establish a clear framework for beneficiaries' rights.

The real power in a trust often lies with the trustee, as they manage the trust assets and make decisions about distributions. However, beneficiaries have rights and may influence decisions through their legal entitlements. It's a collaborative relationship, with the trustee owing a duty of care to the beneficiaries. By utilizing the Form death beneficiary for a trust, you can clarify and enhance the rights of beneficiaries.

Yes, a trustee can sometimes ignore a beneficiary, but doing so may violate their fiduciary duty. Trustees must act in the best interests of the beneficiaries, which includes communicating vital information. If you feel your trustee is not fulfilling their obligations, it may be wise to consult a legal professional. To ensure your wishes are honored, you can use the Form death beneficiary for a trust.

Filling out a beneficiary designation requires you to be methodical. Start by identifying the accounts or policies for which you want to specify beneficiaries. Next, when addressing the form death beneficiary for a trust, ensure that each beneficiary’s name and details are correctly included. If you find the process daunting, US Legal Forms provides user-friendly templates and guidance to make it easier.

You should avoid naming minors as beneficiaries, as they may lack the legal capacity to manage assets. Additionally, consider omitting individuals with a history of financial irresponsibility or those who may not respect your wishes. When you complete the form death beneficiary for a trust, it's crucial to think carefully about who you choose. Take the time to reflect on those who understand and will honor your intentions.

To fill out a beneficiary designation form for a trust, begin by clearly identifying the trust and its purpose. Input the name of the trust and the trustee. Also, provide details about each beneficiary, ensuring you include the form death beneficiary for a trust specifics. If you encounter challenges, reference US Legal Forms, where you can find templates and resources to assist you.

Filling out a beneficiary form requires careful attention to detail. Start by gathering relevant information about the beneficiaries, including their names, addresses, and relationships to you. Next, when detailing the form death beneficiary for a trust, ensure that each person’s information is accurate. If you have questions about the process, consider using platforms like US Legal Forms for guidance.

A designated beneficiary could be anyone you name in a beneficiary form, such as a family member or a close friend. For instance, if you list your spouse as the beneficiary for your life insurance policy, that makes them a designated beneficiary. When discussing the form death beneficiary for a trust, remember that these designations can directly influence asset distribution. Make sure to specify this information clearly.