Nebraska Nonprofit Biennial Report Form

Category:

State:

Nebraska

Control #:

NE-00INCT

Format:

Word;

PDF;

Rich Text

Instant download

Description

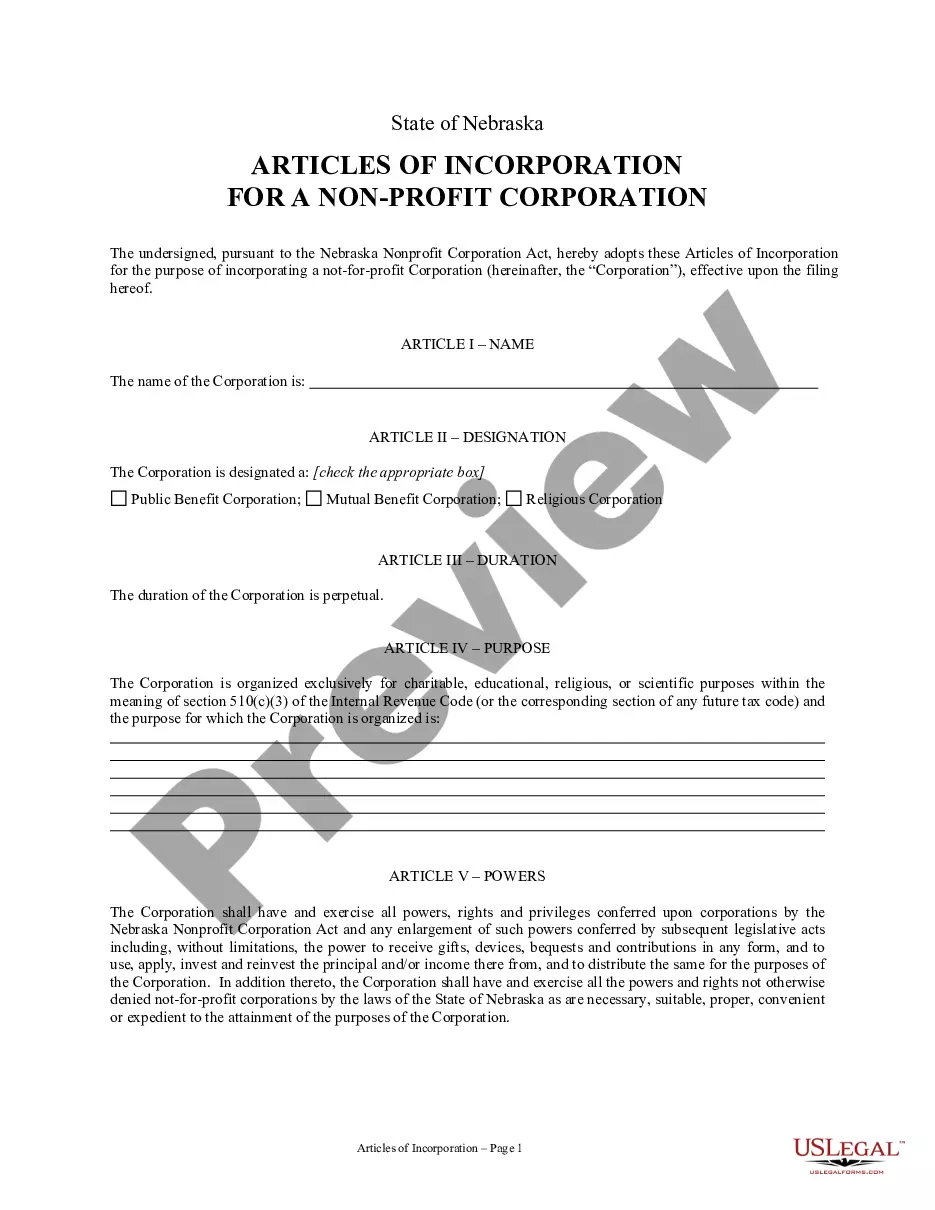

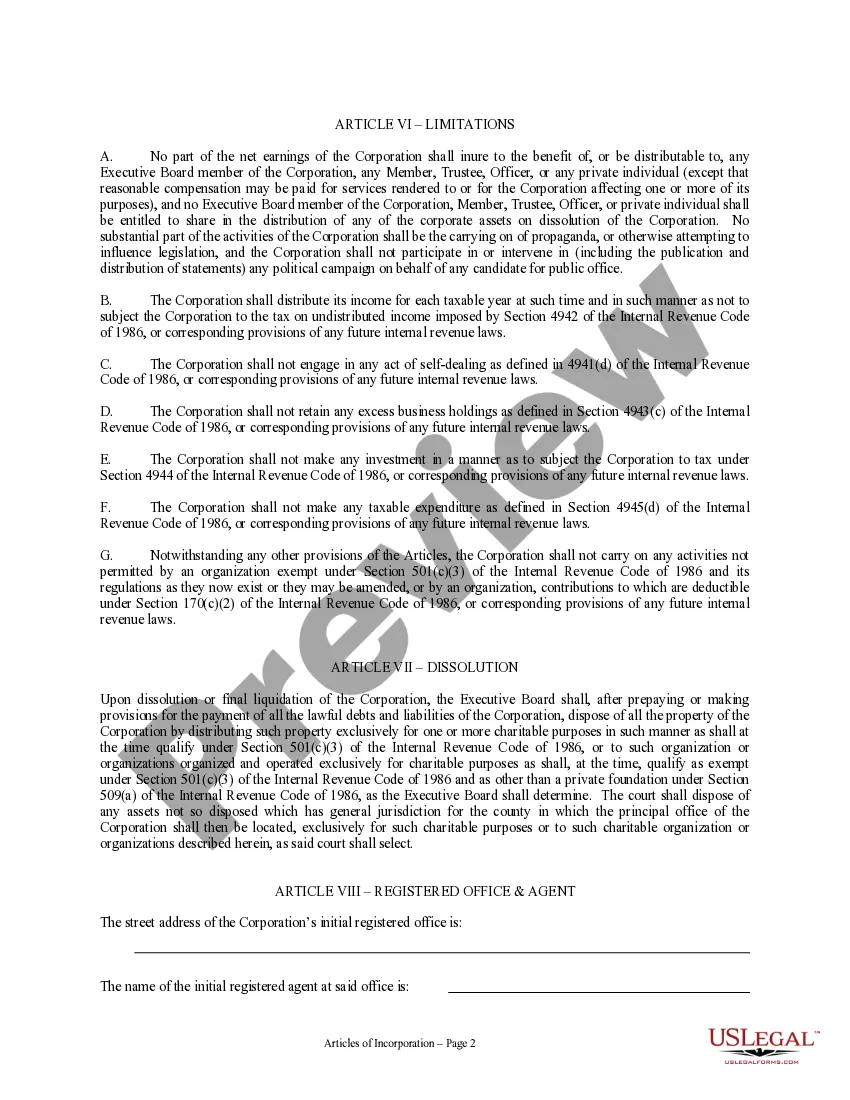

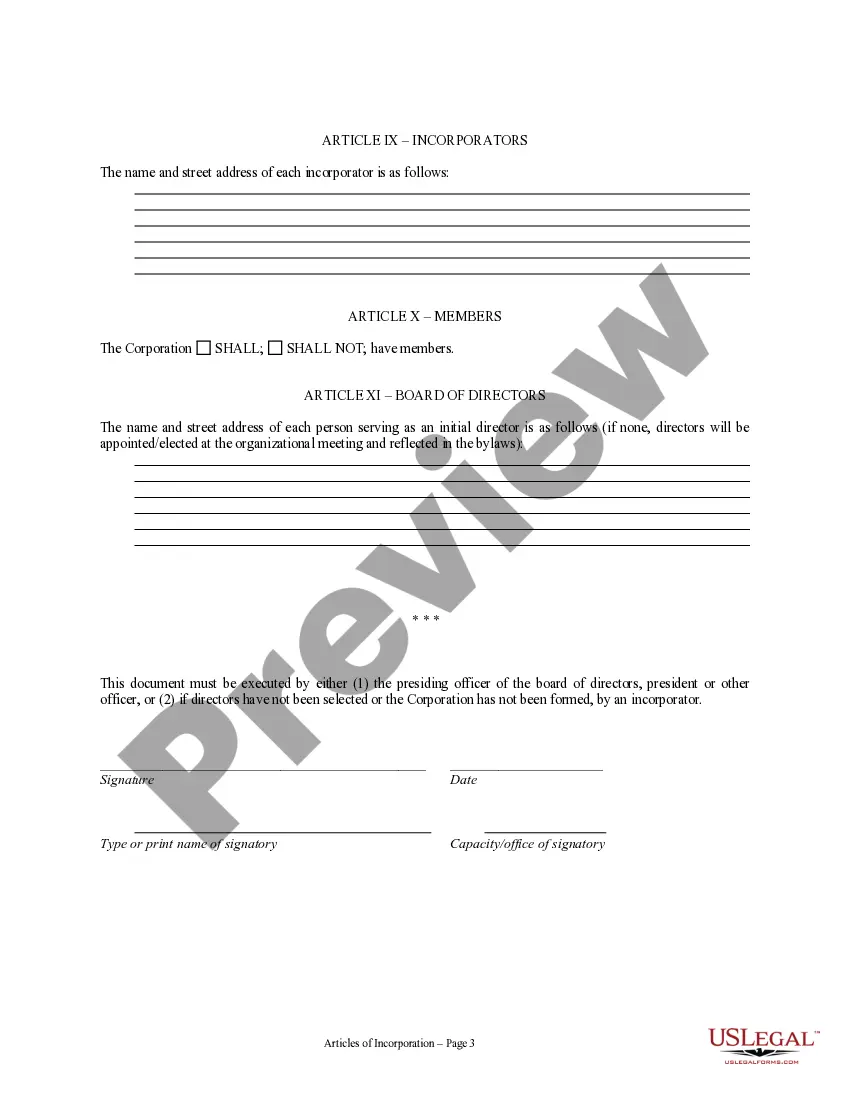

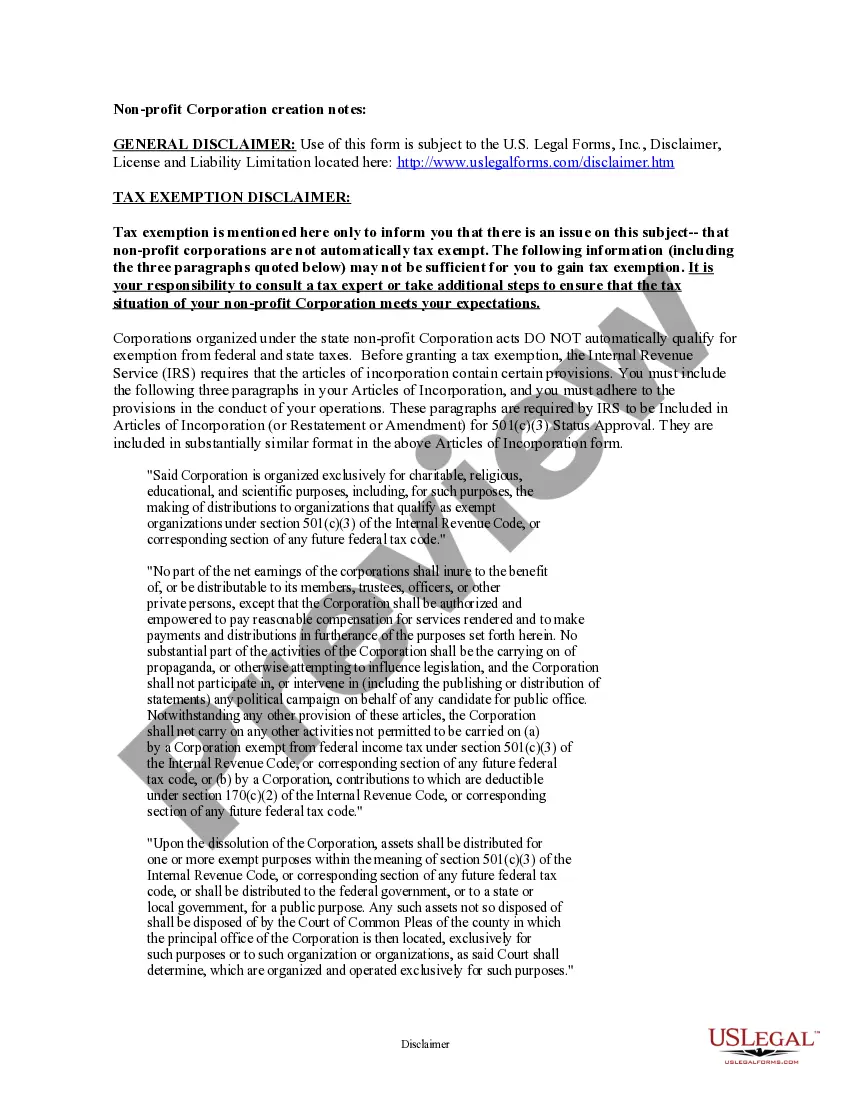

The Nebraska nonprofit biennial report form is essential for maintaining compliance with state regulations concerning nonprofit organizations. This form is typically due every two years and requires information such as the nonprofit's name, address, registered agent, and any significant changes since the last report. Filling out the form accurately is crucial, as it ensures that the organization remains in good standing and avoids penalties. Users can edit the form as necessary to reflect changes in governance or organizational structure. It is designed for use by various professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants, who may assist nonprofit organizations in meeting their legal obligations. The form not only serves as a reporting tool but also provides a mechanism for transparency, showing stakeholders the current status of the nonprofit. Failure to file the biennial report can result in administrative dissolution, making timely submission vital. Overall, this form supports the operational integrity of nonprofit entities by ensuring adherence to legal standards.

Free preview