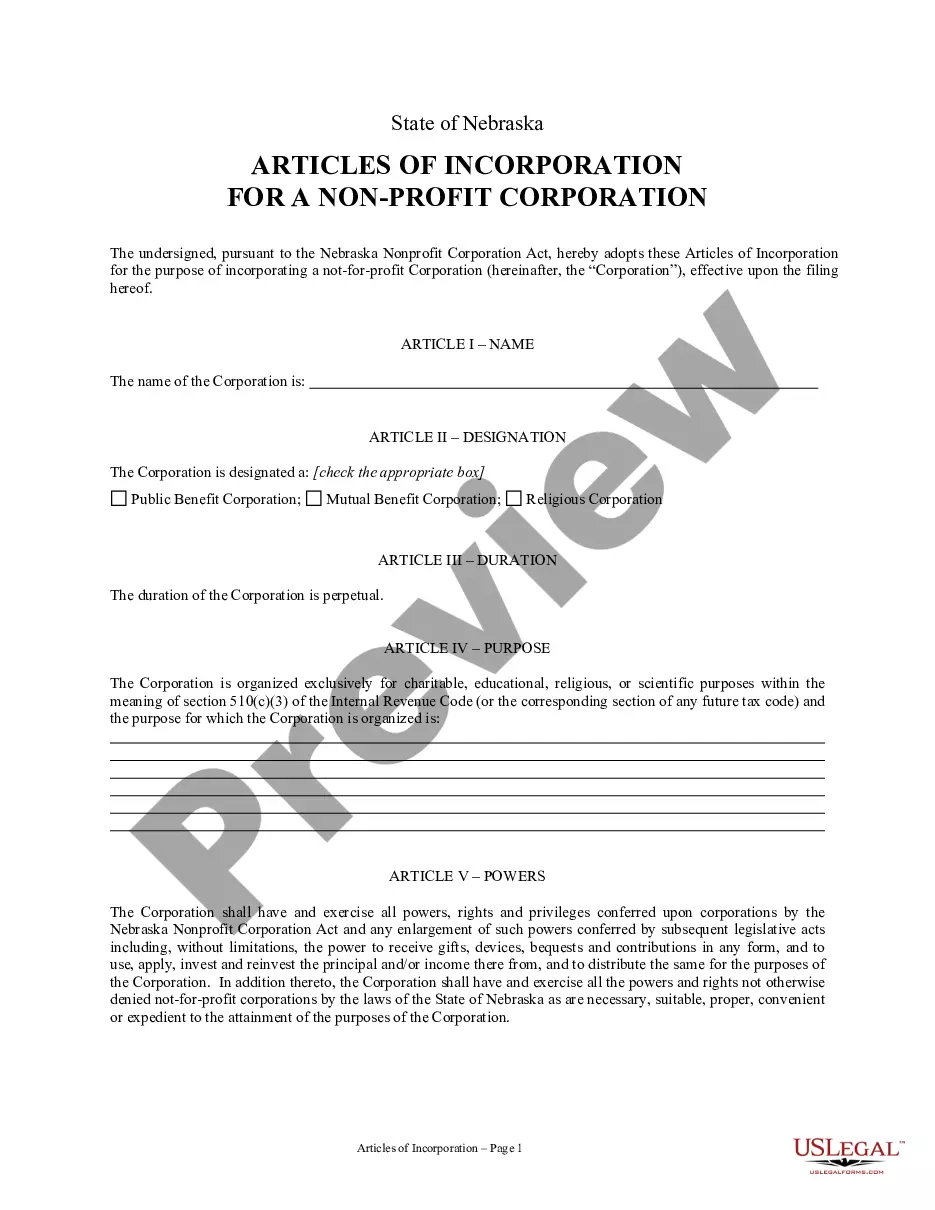

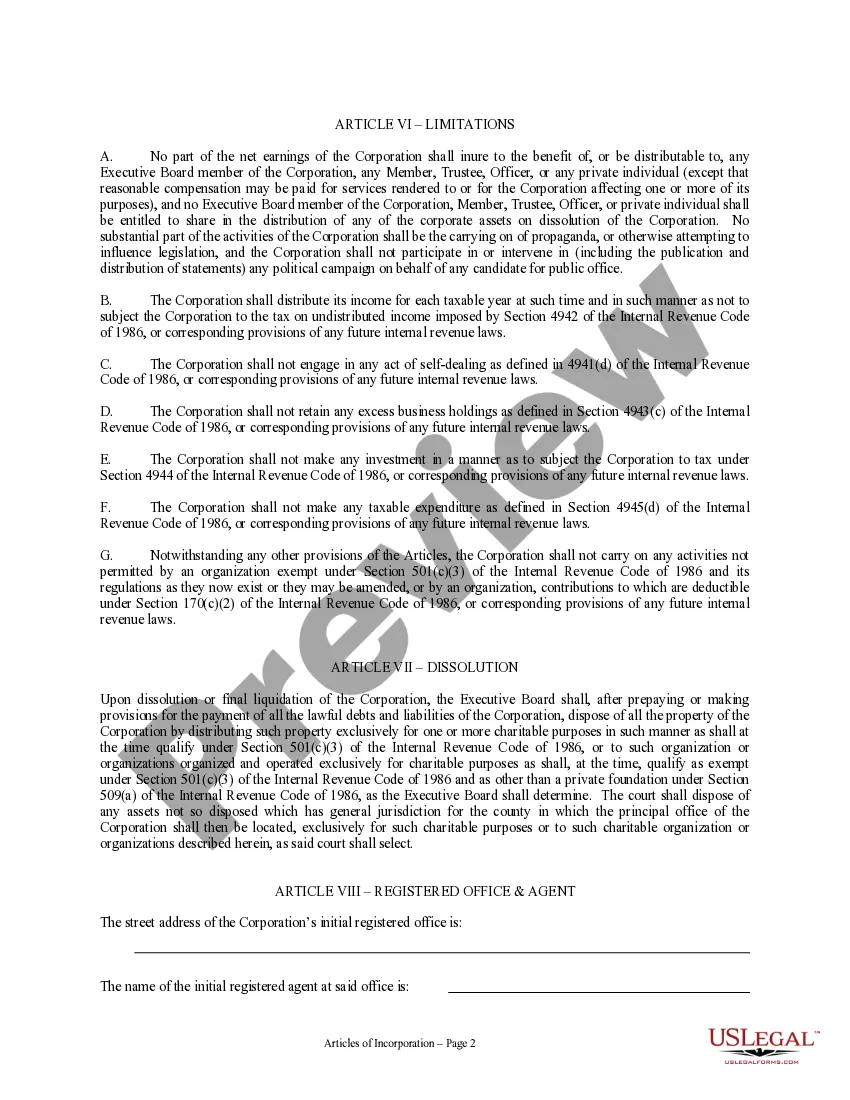

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Nebraska Grants For Nonprofit

Description

Form popularity

FAQ

The value added producer grant in Nebraska supports agricultural producers who seek to create new products or expand markets. This grant assists nonprofits that work alongside farmers to increase profitability and enhance local food systems. If your organization aims to make an impact in the agricultural sector, this Nebraska grant for nonprofit could provide the funding necessary for innovative projects. explore the application process to position your nonprofit for success in utilizing this resource.

The shovel ready grant in Nebraska is designed to offer financial assistance for projects that are ready to begin construction. This grant helps nonprofits by funding infrastructure projects that enhance community services and provide employment opportunities. Accessing this Nebraska grant for nonprofit organizations can stimulate growth in your area by facilitating vital building initiatives. Make sure to assess whether your project qualifies for this grant to take advantage of this opportunity.

To file for a nonprofit in Nebraska, you must first choose a suitable name and ensure it is not already in use. Next, you will need to prepare and file your Articles of Incorporation with the Nebraska Secretary of State. Additionally, consider applying for a federal tax-exempt status, which is essential for receiving Nebraska grants for nonprofit organizations. You can also explore platforms like USLegalForms to streamline the filing process and avoid common pitfalls.

The nonprofit security grant in Nebraska provides funding to enhance security measures for nonprofits at risk of hate crimes or other threats. This grant focuses on improving facilities through security upgrades, such as surveillance systems and access controls. If your nonprofit is eligible, applying for this Nebraska grant can significantly increase your protection and safety. Stay informed about the application process to ensure your organization benefits from this vital support.

To start a nonprofit in Nebraska, you must first choose a unique name and appoint a board of directors. Next, you will need to file your articles of incorporation with the state and obtain an Employer Identification Number (EIN) from the IRS. Once established, nonprofits can apply for Nebraska grants for nonprofit organizations, which can provide essential funding to help achieve their missions and serve the community effectively.

Nebraska is home to over 19,000 registered nonprofit organizations. This diverse range includes charities, community foundations, and social service providers. Understanding these numbers highlights the vibrant nonprofit sector and the importance of Nebraska grants for nonprofit organizations in supporting their initiatives. These grants can play a crucial role in promoting growth and sustainability for nonprofits across the state.

The Nebraska Opportunity Grant provides financial aid to eligible students attending Nebraska colleges or universities. This grant helps increase access to higher education for students with significant financial needs. Non-profit organizations committed to education can leverage Nebraska grants for non-profit projects that aim to support students and foster educational initiatives throughout the region.

The grant for small businesses in Nebraska supports emerging and growing enterprises with funding to enhance operations or promote sustainability. These grants often target specific sectors or communities to bolster economic development. If your non-profit aligns with small business growth, exploring Nebraska grants for non-profit funding may provide valuable resources to make a significant impact.

The Mid Nebraska Community Foundation betterment grant focuses on improving community life in specified areas of Nebraska. The grant aims to fund projects that enhance local services, education, and overall community development. Non-profits interested in applying for Nebraska grants for non-profit work should consider this grant to support their community-focused initiatives.

The Nebraska FFA Foundation Grant supports agricultural education and leadership development within the state. This grant provides resources to enhance programs and projects that benefit FFA members and local communities. By utilizing Nebraska grants for non-profit initiatives, organizations can foster agricultural growth and leadership opportunities for young people across Nebraska.