Final Trust Distribution Letter Form

Description

Form popularity

FAQ

To obtain a certificate of inheritance, you generally need to file a request with the probate court in the jurisdiction where the deceased resided. This process may require submitting certain documents, such as a will and personal identification. Additionally, consider using a final trust distribution letter form as part of your documentation, to clarify the relationship and inheritance details in support of your request. This certificate is essential for the legal recognition of your status as an heir.

A letter of inheritance to beneficiaries is a formal communication that informs them of their entitlement to assets from an estate. It typically outlines what they will receive and under what conditions. Using a final trust distribution letter form can be beneficial to ensure all required details are presented clearly and legally. This letter serves to keep beneficiaries informed and aids in a smoother transfer of assets.

Writing a final distribution letter requires a clear format and specific content. Include the date, the names of the beneficiaries, and details about the trust and its assets. A final trust distribution letter form can guide you in creating this document efficiently, ensuring all necessary information is included to prevent confusion. This precise communication helps manage expectations and reinforces trust among beneficiaries.

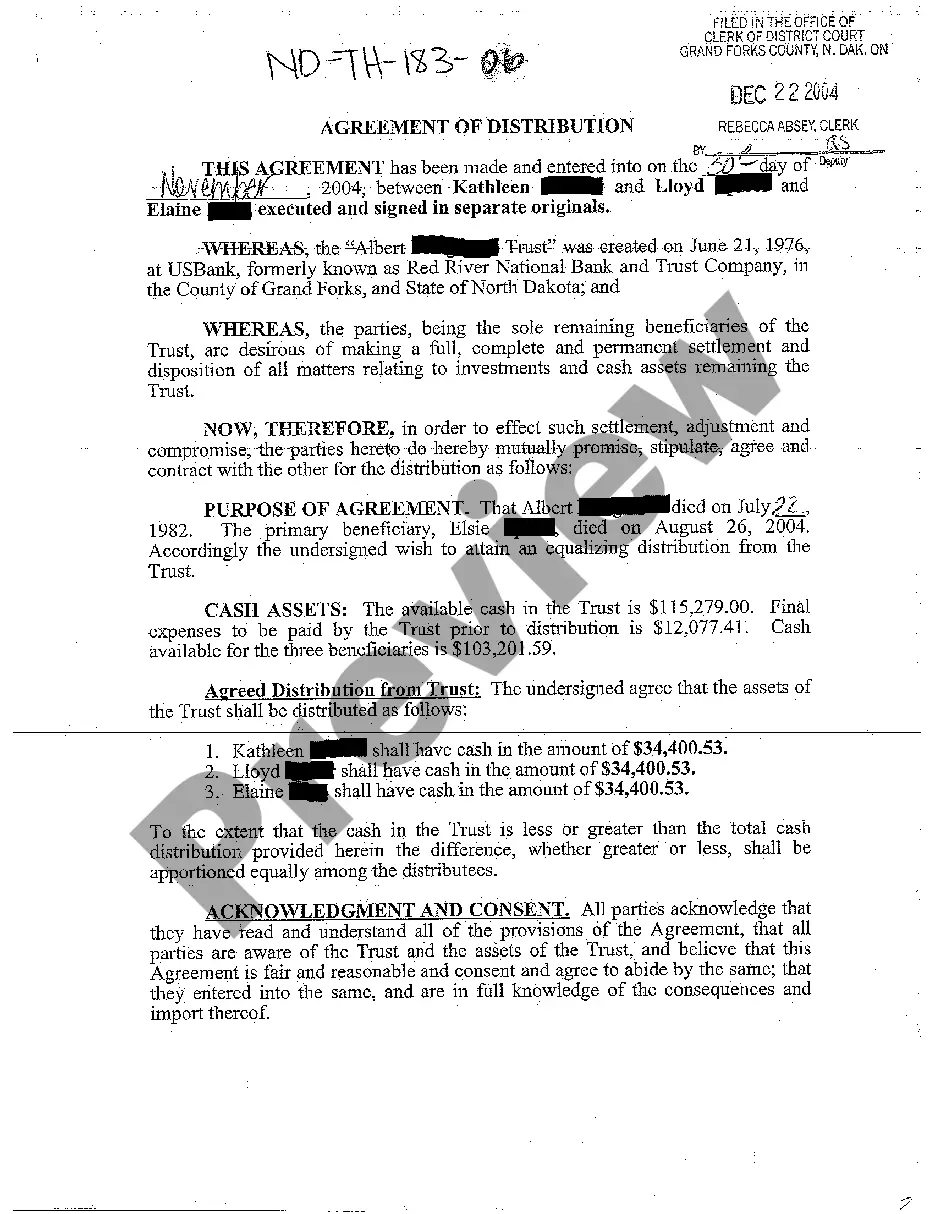

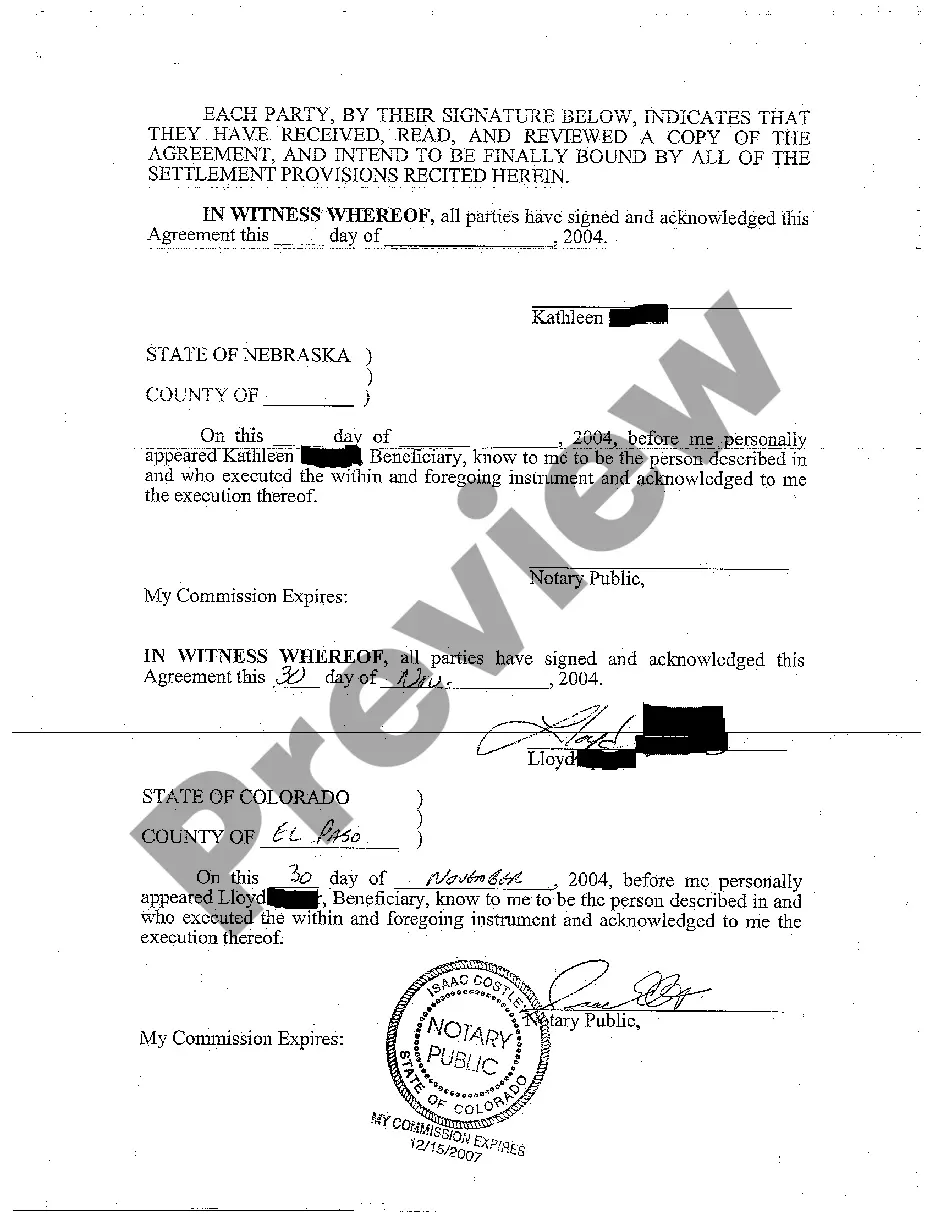

A trust distribution letter is a document that outlines how assets from a trust will be distributed to beneficiaries. It serves as an official notification, detailing each beneficiary's share and the terms of the distribution. Utilizing a final trust distribution letter form can help streamline this process by providing a clear and standardized format to convey this important information effectively. This letter fosters transparency and clarity among all parties involved.

A letter of proof of inheritance is a document that confirms an individual's right to inherit assets from a deceased person's estate. This letter often includes details about the deceased, the heir’s relationship to them, and information regarding the will or trust. Using a final trust distribution letter form can provide a structured approach to composing this letter, making it easier to present to financial institutions. This document is vital for claiming inherited assets or property.

Creating an inheritance letter involves writing a formal document that declares your status as an heir. Start by including key details such as your name, the deceased's information, and specifics about the estate. Utilizing a final trust distribution letter form can also simplify this process, as it typically includes all necessary elements while ensuring legal compliance. Always ensure the letter is clear, concise, and formally formatted.

To show proof of inheritance, you typically need to present a copy of the will or trust that designates you as an heir. Additionally, you can use a final trust distribution letter form, which outlines the terms of distributions to beneficiaries. This document verifies your entitlement and is often required by banks and other institutions when claiming inherited assets. Having this clear documentation helps ensure a smooth transfer process.

An inheritance distribution letter typically details how assets will be divided among heirs according to the wishes of the deceased. For instance, it can specify that one heir receives the family home while others receive financial assets. Utilizing a Final trust distribution letter form can standardize this communication and provide clarity and assurance to all parties involved.

The final estate distribution letter is a document that outlines how the remaining assets of an estate will be distributed among heirs after settling debts and taxes. This letter serves as a formal notification to beneficiaries and can simplify the distribution process. For a clear and legally sound document, consider using a Final trust distribution letter form tailored to your specific needs.

One of the biggest mistakes parents often make is failing to communicate their intentions clearly to their beneficiaries. This lack of communication can lead to misunderstandings and disputes after the trustmaker's passing. Using tools like a Final trust distribution letter form can help clarify intentions and set expectations upfront, fostering transparency among family members.