Trust Registration Forms With Hmrc

Description

Form popularity

FAQ

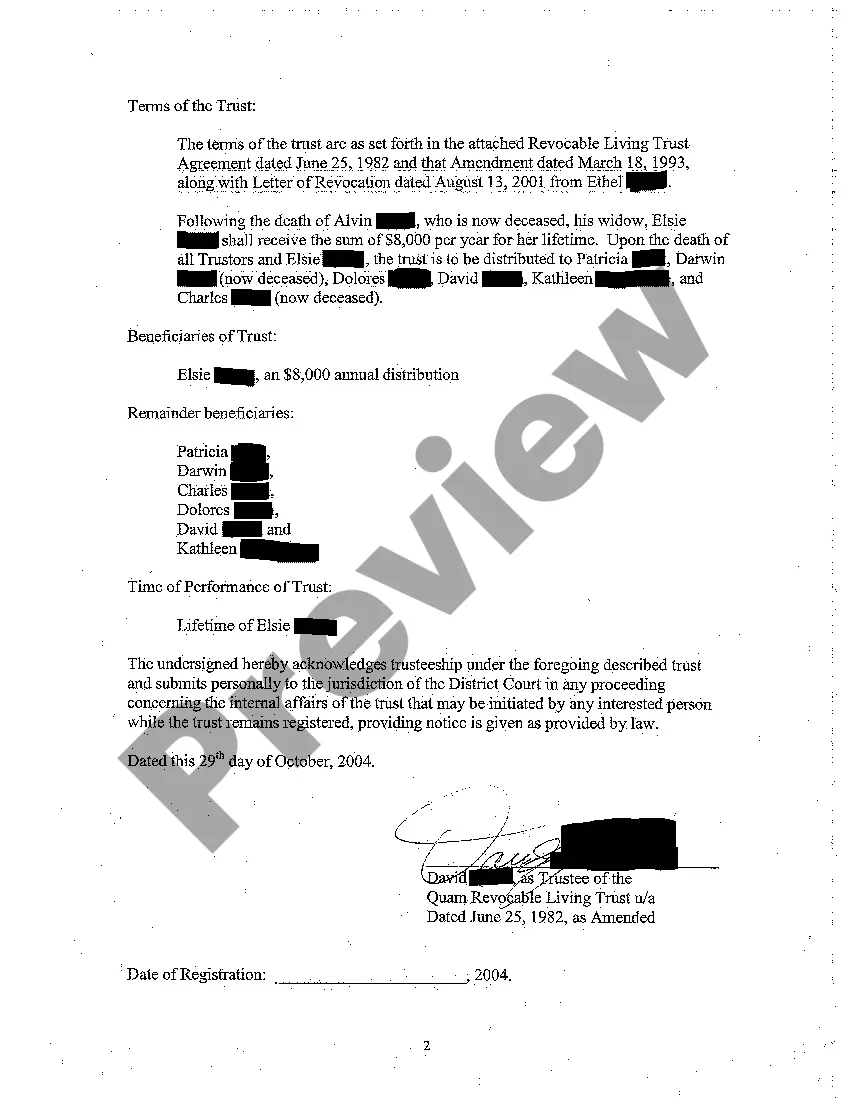

Yes, you can sell a house held in a trust in the UK, but it typically requires the consent of the trustee. The proceeds from the sale will then go to the beneficiaries, according to the terms of the trust. It's crucial to understand the implications of such transactions and to have the correct trust registration forms with HMRC filled out to keep everything compliant.

Yes, a trust can absolutely own property in the UK. The legal ownership rests with the trustee, enabling management and protection of the asset for the beneficiaries. Properly completing the trust registration forms with HMRC is essential to ensure that the property is recognized legally and for tax purposes.

In general, the trustee owns the house on behalf of the beneficiaries of the trust. The trustee holds legal title while beneficiaries have beneficial interests. When it comes to trust registration forms with HMRC, it’s important for trustees to accurately disclose ownership with these forms to comply with tax regulations.

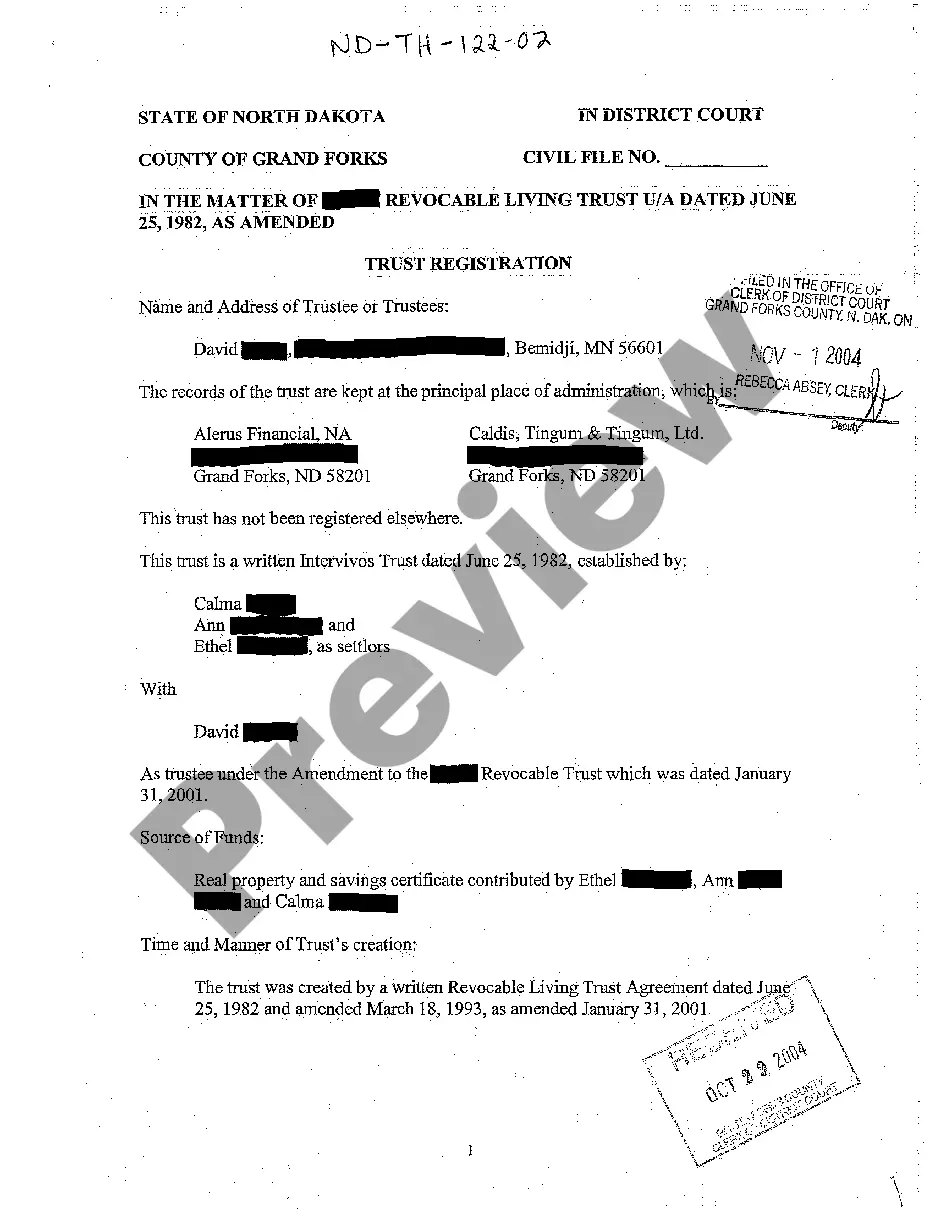

A trust verification form is a document used to formally establish the existence and details of a trust. It often contains important information regarding the trust's terms, the trustee, and the beneficiaries. When you submit trust registration forms with HMRC, you help to ensure that the trust complies with legal requirements and tax obligations. Using platforms like US Legal Forms can simplify this process, guiding you step-by-step through the necessary documentation.

The authority to change a beneficiary lies primarily with the trustee, depending on the terms outlined in the trust document. In some cases, all beneficiaries must agree to any changes. Therefore, understanding your Trust registration forms with HMRC will provide clarity on the legal rights and responsibilities involved in this process.

Changing the beneficiaries of a trust typically requires following the instructions in the trust document. In some situations, you may need consent from all beneficiaries or court approval. It is essential to utilize Trust registration forms with HMRC to properly document and execute any modifications.

Transferring a trust to another person can be complex and often depends on the type of trust involved. Generally, irrevocable trusts cannot be easily transferred without legal process. If you are considering such a transfer, ensure you review the necessary Trust registration forms with HMRC to facilitate a smooth transition.

While placing your house in a trust can offer protection and avoid probate, there are potential disadvantages, such as loss of control over the asset and certain tax implications. Additionally, costs associated with setting up the trust may be significant. It's wise to review Trust registration forms with HMRC to understand how they apply to your situation.

To remove someone from an irrevocable trust, you typically must consult the trust agreement and state laws. In some cases, it may require a court order or permission from the beneficiaries. Using Trust registration forms with HMRC can help clarify the intentions behind any changes and ensure compliance with legal requirements.

A common mistake parents make when setting up a trust fund in the UK is not clearly defining the terms and purpose of the trust. This lack of direction can lead to disputes or unintended outcomes for beneficiaries. Proper documentation and the use of trust registration forms with hmrc are essential to avoid these pitfalls and ensure your wishes are fulfilled.