Inherited Mineral Rights North Dakota Without A Deed

Description

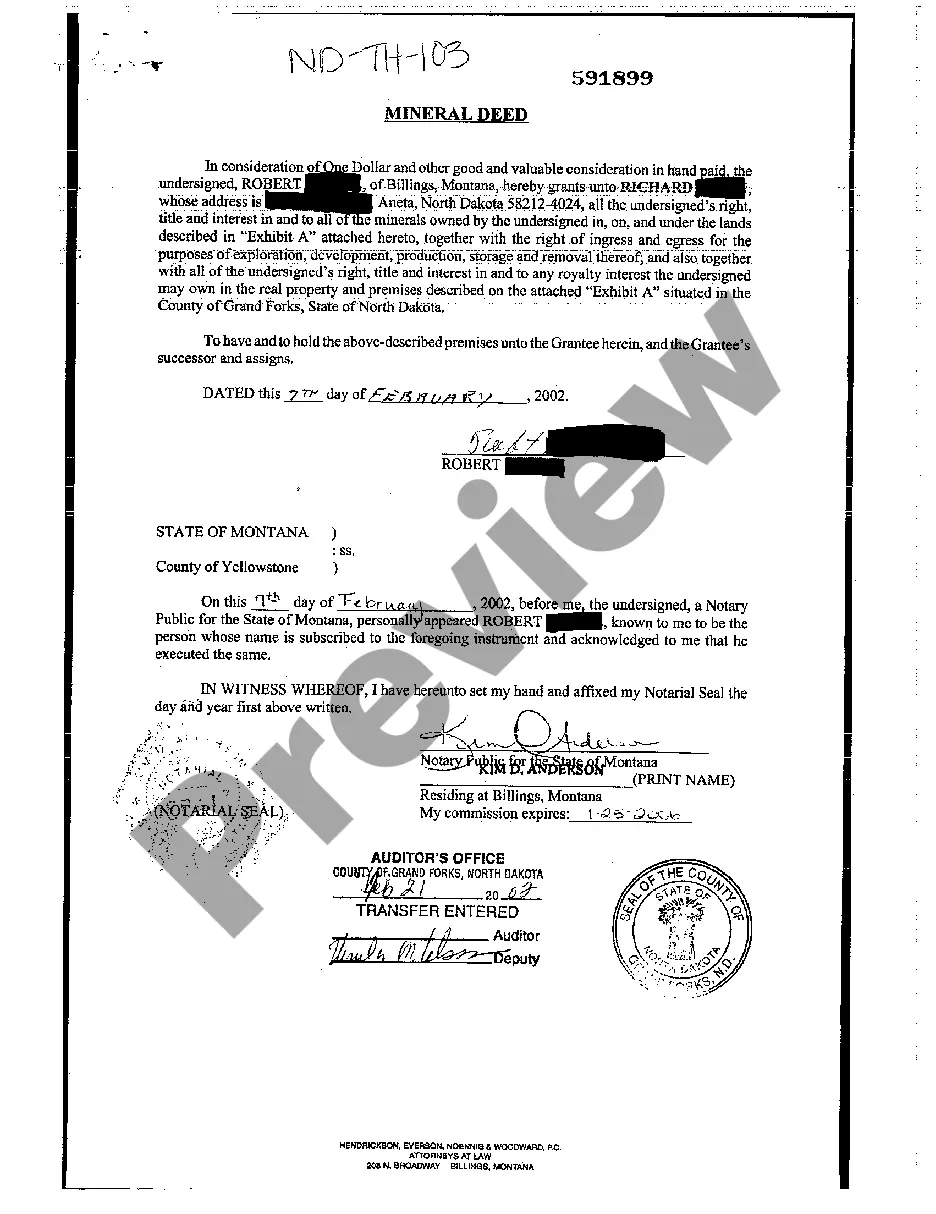

How to fill out North Dakota Mineral Deed Individual To Individual?

Legal management may be overwhelming, even for skilled specialists. When you are interested in a Inherited Mineral Rights North Dakota Without A Deed and don’t get the a chance to devote looking for the right and updated version, the processes might be stressful. A robust web form library could be a gamechanger for everyone who wants to take care of these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any needs you could have, from individual to enterprise paperwork, in one location.

- Employ advanced tools to complete and deal with your Inherited Mineral Rights North Dakota Without A Deed

- Gain access to a useful resource base of articles, instructions and handbooks and resources related to your situation and requirements

Help save effort and time looking for the paperwork you need, and use US Legal Forms’ advanced search and Preview tool to get Inherited Mineral Rights North Dakota Without A Deed and get it. If you have a membership, log in in your US Legal Forms account, search for the form, and get it. Review your My Forms tab to see the paperwork you previously downloaded as well as to deal with your folders as you see fit.

If it is the first time with US Legal Forms, register an account and obtain unrestricted usage of all benefits of the library. Here are the steps to consider after accessing the form you need:

- Validate it is the proper form by previewing it and looking at its information.

- Ensure that the sample is approved in your state or county.

- Choose Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the file format you need, and Download, complete, eSign, print out and send your papers.

Take advantage of the US Legal Forms web library, backed with 25 years of experience and stability. Enhance your everyday papers management in a smooth and user-friendly process today.

Form popularity

FAQ

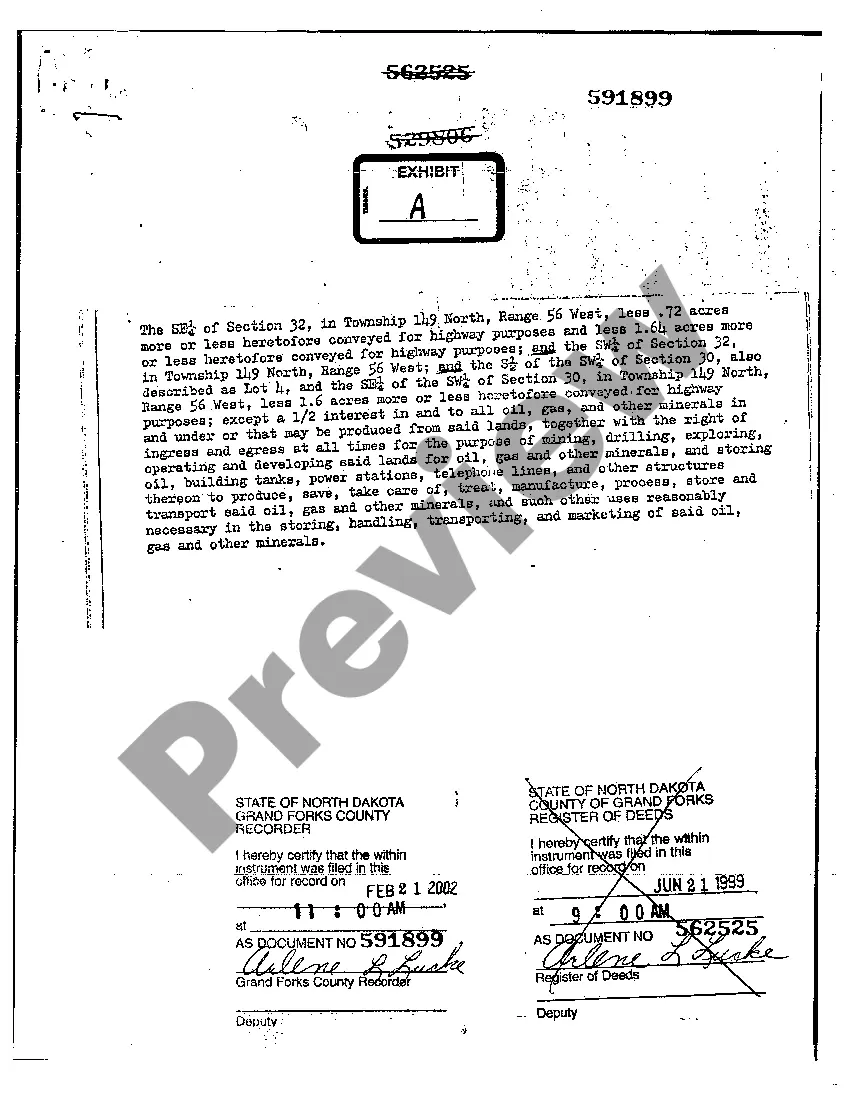

How can I find out who owns the oil rights on property in North Dakota? To determine mineral rights on a parcel of land, you need to go to the County Recorder's Office in the county of that parcel and request any recorded deed documents for the parcel.

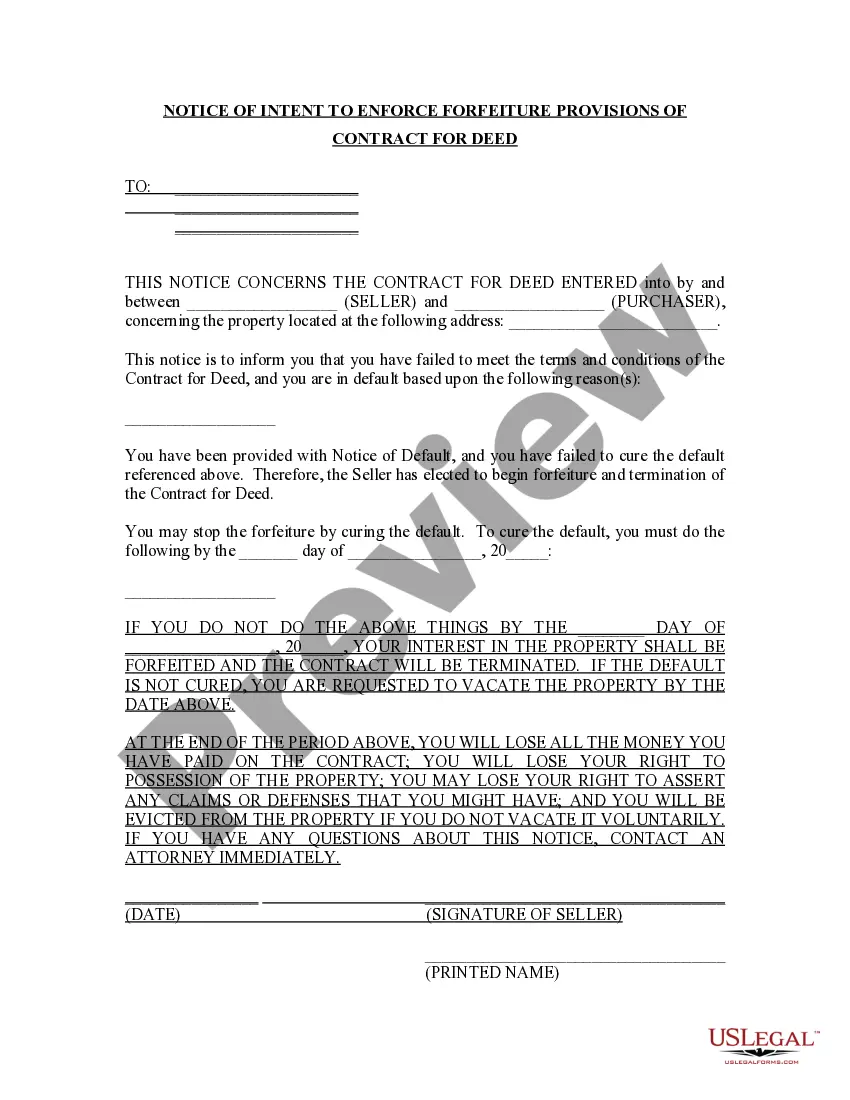

Transferring Mineral Rights After Death An individual must claim heirship with the governmental office responsible for titles and deeds in the municipality where the property is located. The oil and gas operators would then be contacted to determine the documentation required to take ownership of the minerals.

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.

The first step in claiming your inherited mineral rights is to find the deed or title to the property. This document will outline who owns the mineral rights and how you can transfer them. Once you have the deed or title, you must contact the appropriate state agency to make a claim.