Inherited Mineral Rights North Dakota Withholding

Description

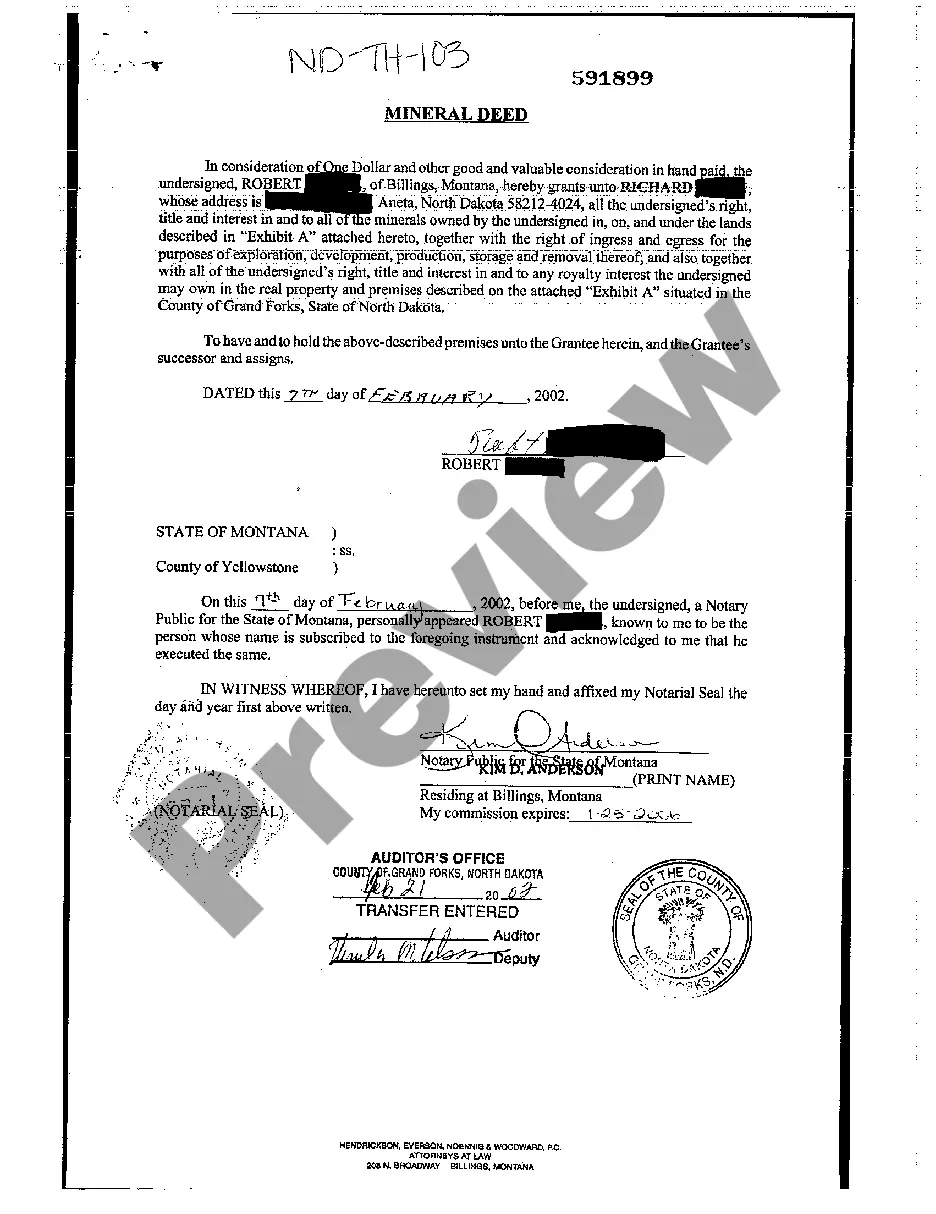

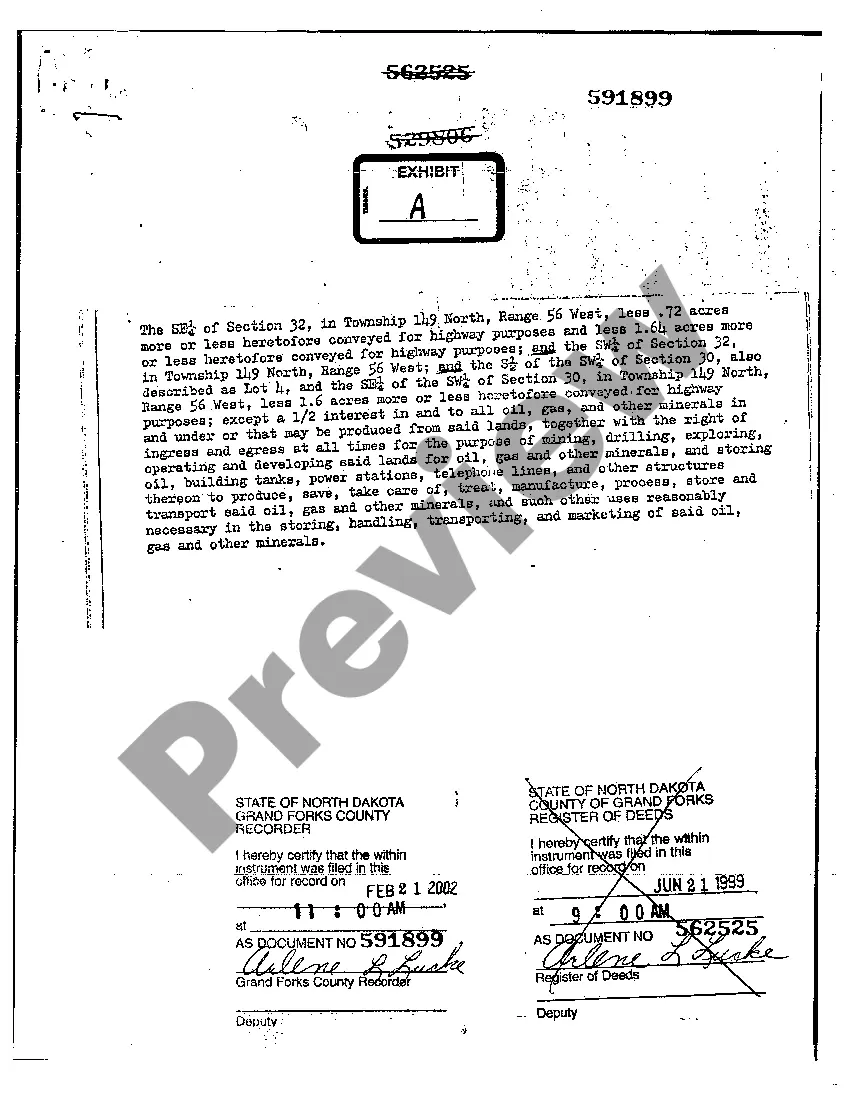

How to fill out North Dakota Mineral Deed Individual To Individual?

Obtaining legal templates that comply with federal and state regulations is essential, and the internet offers numerous options to choose from. But what’s the point in wasting time searching for the correctly drafted Inherited Mineral Rights North Dakota Withholding sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life scenario. They are easy to browse with all files arranged by state and purpose of use. Our professionals keep up with legislative updates, so you can always be confident your form is up to date and compliant when obtaining a Inherited Mineral Rights North Dakota Withholding from our website.

Obtaining a Inherited Mineral Rights North Dakota Withholding is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

- Analyze the template utilizing the Preview feature or through the text description to ensure it meets your needs.

- Look for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Inherited Mineral Rights North Dakota Withholding and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

The Internal Revenue Service (IRS) classifies all royalties earned from oil, gas, and mineral properties as taxable income. Most often, taxpayers will report royalty income on Schedule E, either as rents and royalties or working interest. Sometimes, they may opt to report it as both and do so on Schedule C.

To stake a claim to any oil/gas interests in North Dakota, you need to go online and file a 'statement of claim' form. Fill in the county name and provide the legal description of the lot with the name and address of everyone making the claim.

If you have capital gains from the sale of mineral rights, you'll need to report them on your federal income tax return for the year you made the sale. The purchaser of the mineral rights might send you a tax form, such as a Form 1099, but they might not.

North Dakota does not have an inheritance tax. The inheritance tax was repealed in 1927 and replaced with an estate tax.

The cost basis for inherited mineral rights is ?fair value.? It's simply the book value of what you receive on the day you acquire it. If you sell your rights afterward, you'll have to pay capital gains tax on the difference between your cost basis and the sale price.