North Dakota Commercial Mortgage Withholding Form

Description

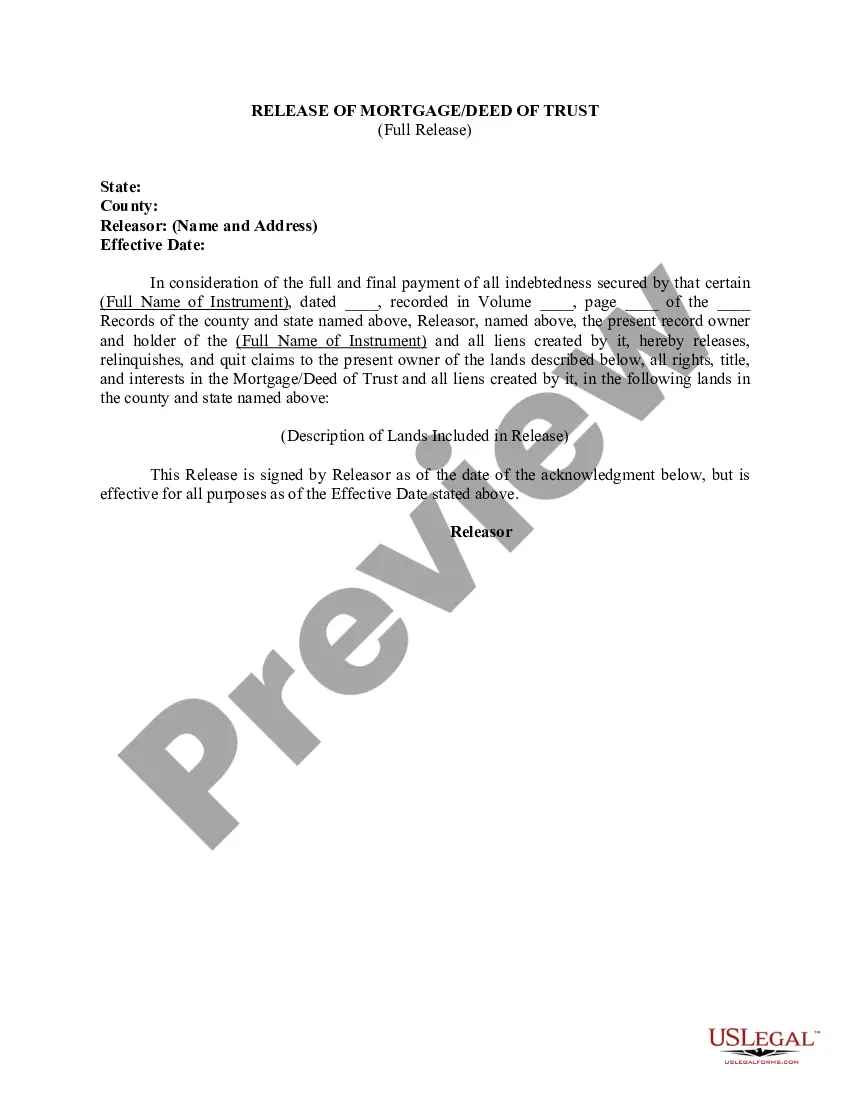

How to fill out North Dakota Satisfaction, Cancellation Or Release Of Mortgage Package?

There’s no further justification to waste time searching for legal documents to fulfill your local state requirements.

US Legal Forms has compiled all of them in a single location and enhanced their accessibility.

Our website offers over 85,000 templates for any business and personal legal situations categorized by state and area of use.

Utilize the search bar above to find another template if the previous one did not suit your needs. Click Buy Now next to the template title once you find the suitable one. Choose the desired subscription plan and register for an account or sign in. Complete the payment for your subscription with a card or via PayPal to proceed. Select the file format for your North Dakota Commercial Mortgage Withholding Form and download it to your device. Print out your form to fill it out manually or upload the sample if you prefer to work with an online editor. Preparing official documentation under federal and state laws and regulations is quick and easy with our platform. Try US Legal Forms today to keep your documentation organized!

- All documents are professionally drafted and verified for validity, ensuring you obtain an up-to-date North Dakota Commercial Mortgage Withholding Form.

- If you are familiar with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all obtained paperwork at any moment by visiting the My documents tab in your profile.

- If you've never used our service before, the process will require a few additional steps to complete.

- Here’s how new users can find the North Dakota Commercial Mortgage Withholding Form in our library.

- Review the page content carefully to ensure it has the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

ND Form 307 refers to the Individual Income Tax Return for residents of North Dakota. This form helps individuals report their income and calculate their state tax obligations. If involved in real estate, including commercial mortgages, making use of the North Dakota commercial mortgage withholding form may help streamline your reporting process and ensure compliance with state tax regulations.

Yes, North Dakota has a state withholding form that employers use to determine the amount of tax to withhold from employees' paychecks. It's crucial for both employers and workers to understand this form. When dealing with commercial activities, the North Dakota commercial mortgage withholding form plays a significant role in compliance and accurate tax withholding.

To fill out a withholding exemption form, start by providing your personal information and identifying your exemptions clearly. Make sure you follow the specific instructions provided on the form. If your financial matters involve commercial mortgages, utilizing the North Dakota commercial mortgage withholding form can help ensure your withholding aligns with your exemption status.

Yes, North Dakota offers e-filing options for its tax forms. E-filing provides a convenient way to submit your tax returns electronically. For those dealing with withholding, the North Dakota commercial mortgage withholding form can be filed electronically, simplifying the process and ensuring timely submission.

Form 307 is North Dakota's Individual Income Tax Return form for residents and part-year residents. This form is essential for reporting your income and calculating your tax liability. If you have been involved in real estate transactions, especially with commercial mortgages, utilizing the North Dakota commercial mortgage withholding form can sometimes be integrated with your Form 307 submissions.

Bonuses in North Dakota are subject to state income tax, which varies based on your overall income. The withholding calculates separate from your regular paycheck. To effectively manage your tax obligations, consider utilizing the North Dakota commercial mortgage withholding form for accurate withholding adjustments if bonuses become a substantial part of your earnings.

Nonresidents of North Dakota must file a North Dakota nonresident tax return if they earn income derived from North Dakota sources. This includes income from rental properties, business operations, or employment. If you are a nonresident and have withheld taxes using the North Dakota commercial mortgage withholding form, ensure you include that information on your return for accurate processing.

The Global Intangible Low-Taxed Income (GILTI) deduction may be applicable depending on your income and specific tax situation. North Dakota follows federal guidelines, which can impact how GILTI is treated. If you're engaged with matters regarding the North Dakota commercial mortgage withholding form, consulting with a tax professional can clarify any implications related to the GILTI deduction.

Many states, including North Dakota, require taxpayers to submit state tax withholding forms, especially if an employer is involved. These forms help maintain transparency and ensure tax obligations are met. If you navigate through the North Dakota commercial mortgage withholding form, you will be attuned to similar requirements across different states.

North Dakota does implement state withholding on wages and other forms of income. This withholding helps ensure that individuals meet their tax obligations throughout the year. For those involved with the North Dakota commercial mortgage withholding form, understanding state withholding regulations becomes crucial for proper compliance.