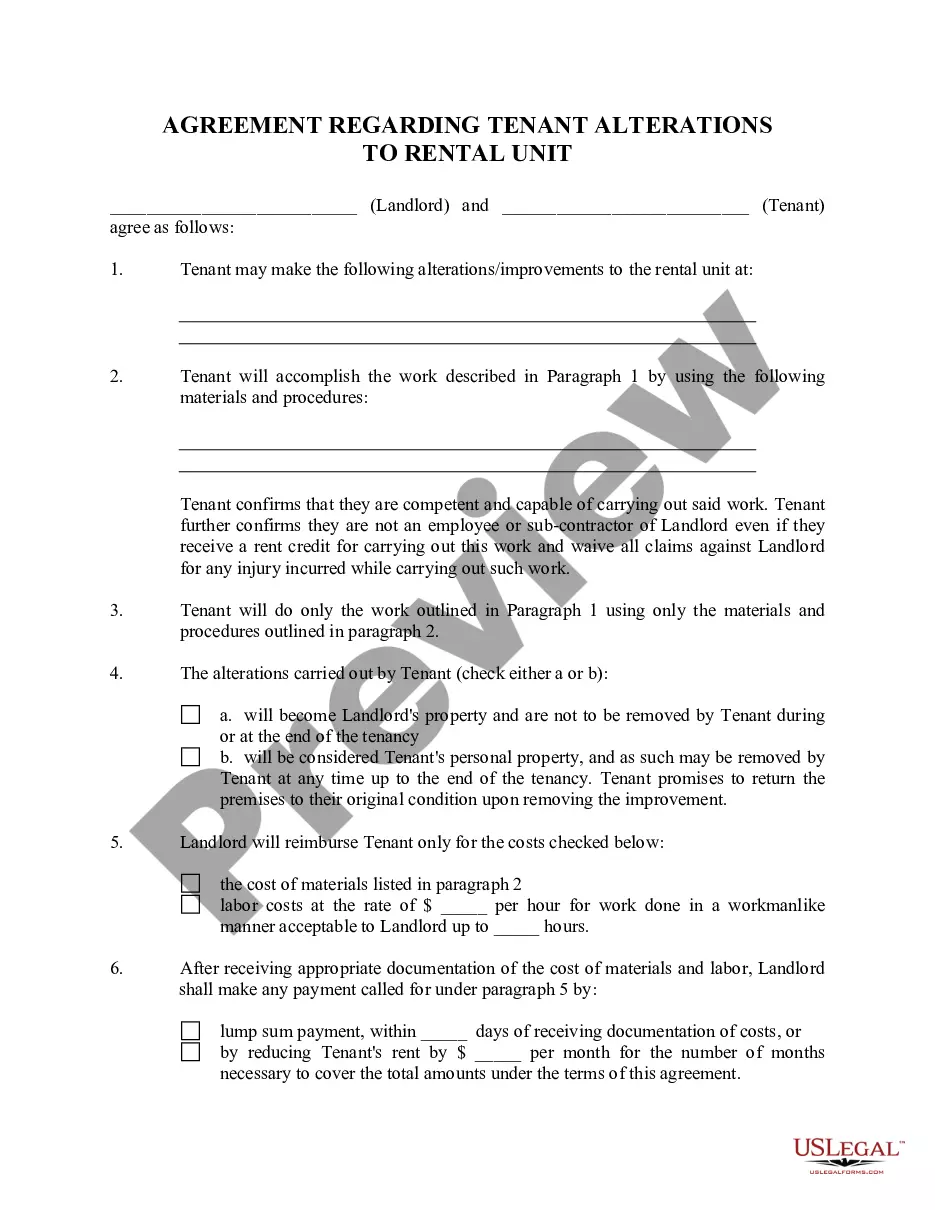

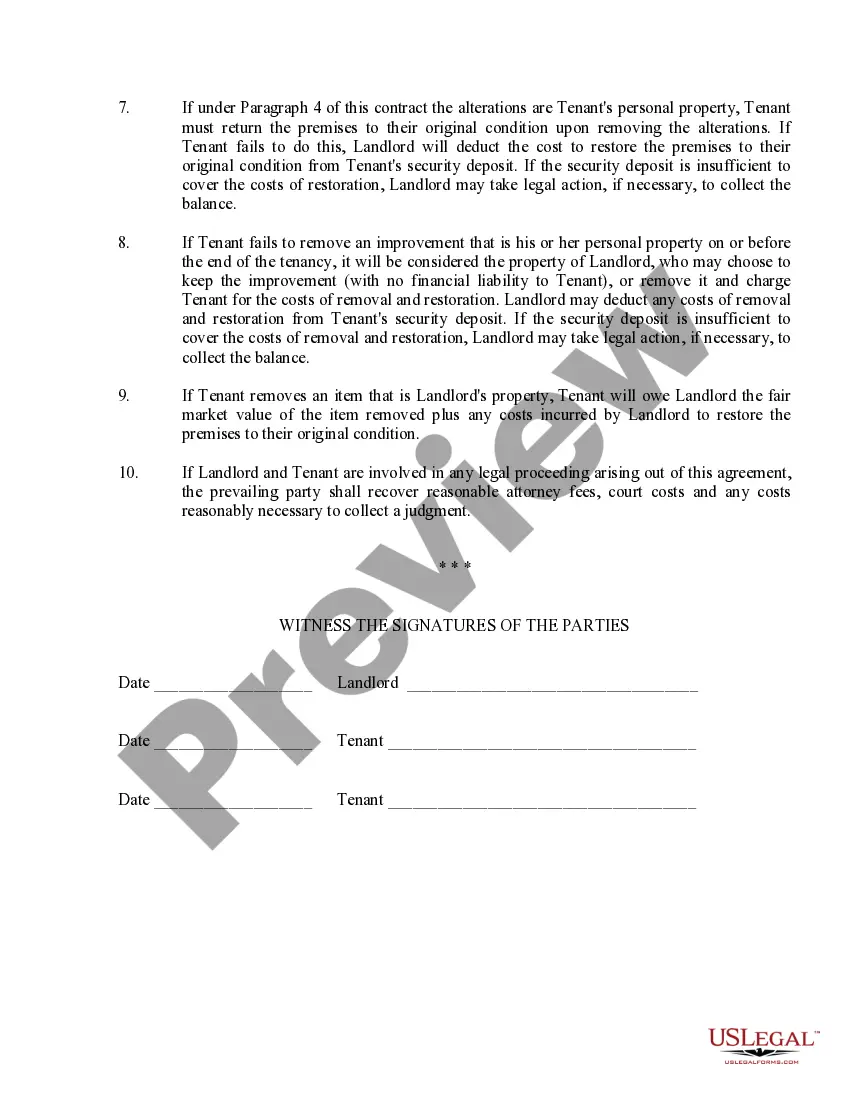

This Landlord Agreement to allow Tenant Alterations to Premises contract is an agreement between a landlord and a tenant regarding changes the tenant wishes to make to the rented premises. A written agreement is helpful in avoiding misunderstandings that might otherwise occur. Various issues are covered, including who will pay for the improvements, whose property the improvements will be considered, and whether or not and under what circumstances the tenant may remove the alterations if and when the tenant decides to move out.

North Dakota Agreement Withholding Tax Registration

Description

How to fill out North Dakota Landlord Agreement To Allow Tenant Alterations To Premises?

Individuals frequently link legal documentation with complexity that only an expert can manage.

In a manner, this is accurate, as composing the North Dakota Agreement Withholding Tax Registration necessitates a profound comprehension of subject criteria, encompassing regional and local laws.

However, with US Legal Forms, the process has turned more user-friendly: ready-to-use legal templates for any personal and business scenario tailored to state regulations are gathered in a solitary online repository and are now accessible to all.

All templates in our collection are reusable: once bought, they remain stored in your profile, ensuring you can access them whenever necessary through the My documents tab. Explore all benefits of using the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85,000 current forms organized by state and application area, making it easy to search for the North Dakota Agreement Withholding Tax Registration or any other specific template in just a few minutes.

- Registered users holding an active subscription must Log In to their account and click Download to retrieve the form.

- New users of the platform will need to first create an account and subscribe before they can download any documentation.

- Here is a detailed guide on how to acquire the North Dakota Agreement Withholding Tax Registration.

- Review the content on the page carefully to ensure it aligns with your requirements.

- Check the form description or view it using the Preview feature.

- If the previous sample does not meet your needs, look for another template using the Search field above.

- Once you identify the appropriate North Dakota Agreement Withholding Tax Registration, click Buy Now.

- Select a pricing plan that suits your requirements and budget.

- Create an account or Log In to continue to the payment page.

- Complete the payment for your subscription via PayPal or your credit card.

- Choose the format for your template and click Download.

- Print your document or import it into an online editor for quicker completion.

Form popularity

FAQ

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

The W-4 requires basic personal information, like your name, address, and Social Security number. Previously, the number of allowances and your tax filing status determined how much income tax was withheld from your pay.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.18-Dec-2019

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold.

Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of employees. You do not have to fill out the new W-4 form if you already have one on file with your employer. You also don't have to fill out a new W-4 every year.