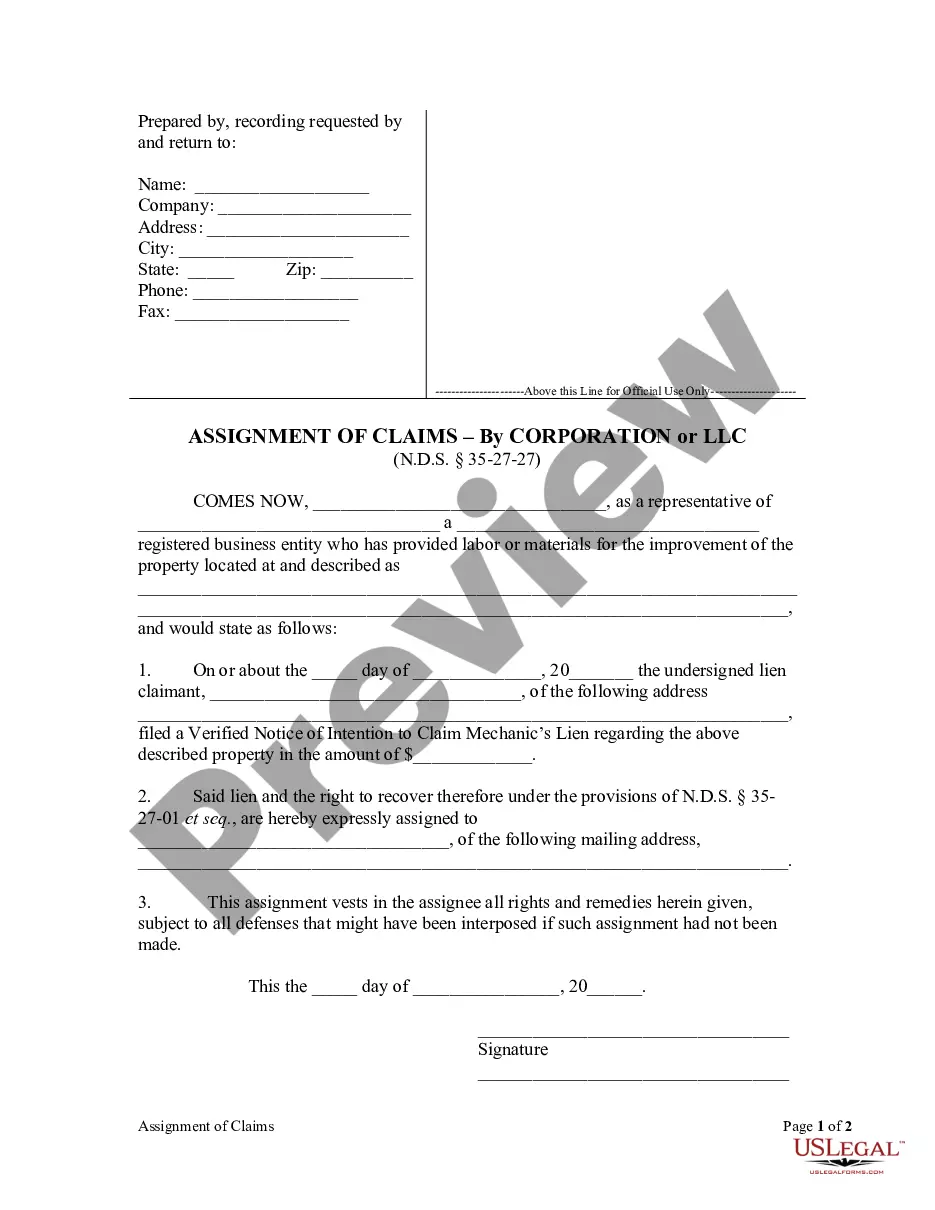

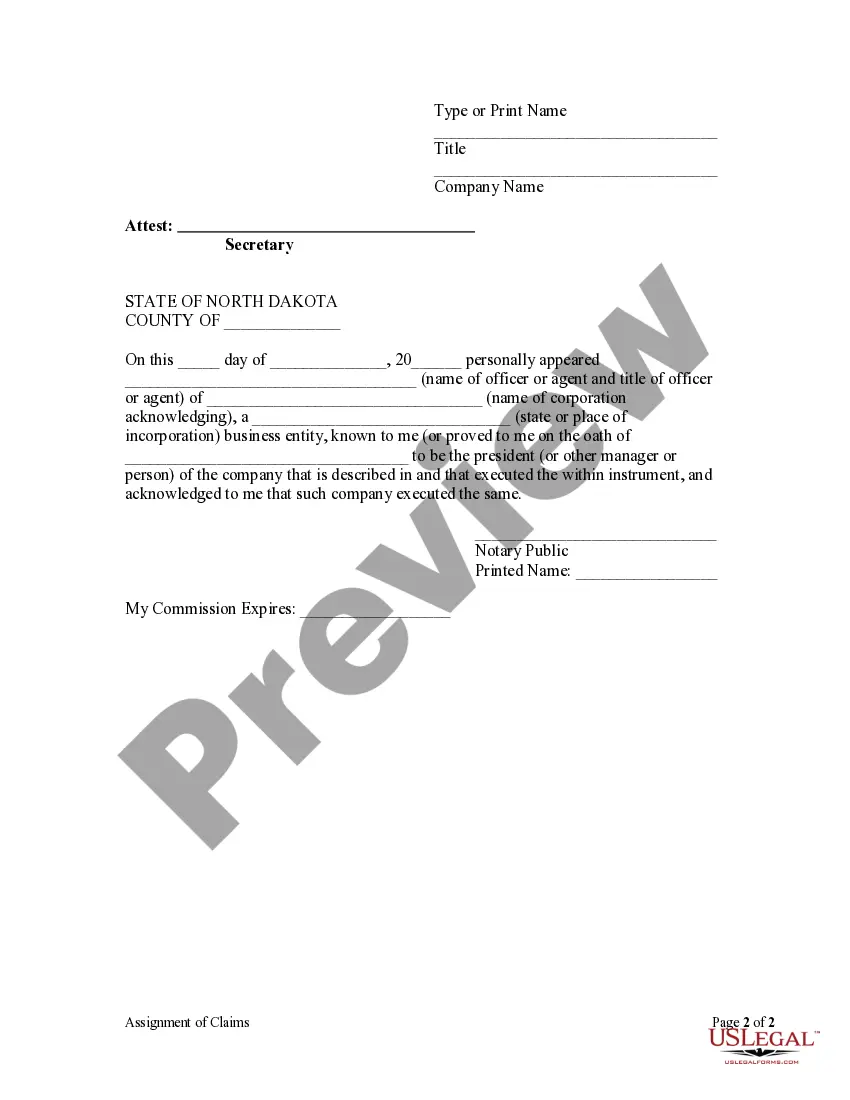

This Assignment of Claims form is for use by a corporation that has provided labor or materials for the improvement of real property to assign the corporation's lien for the same who will have all the rights and remedies of the lien claimant, subject to all defenses that might have been interposed if such assignment had not been made.

North Dakota Assignment Withholding Tax Due Dates

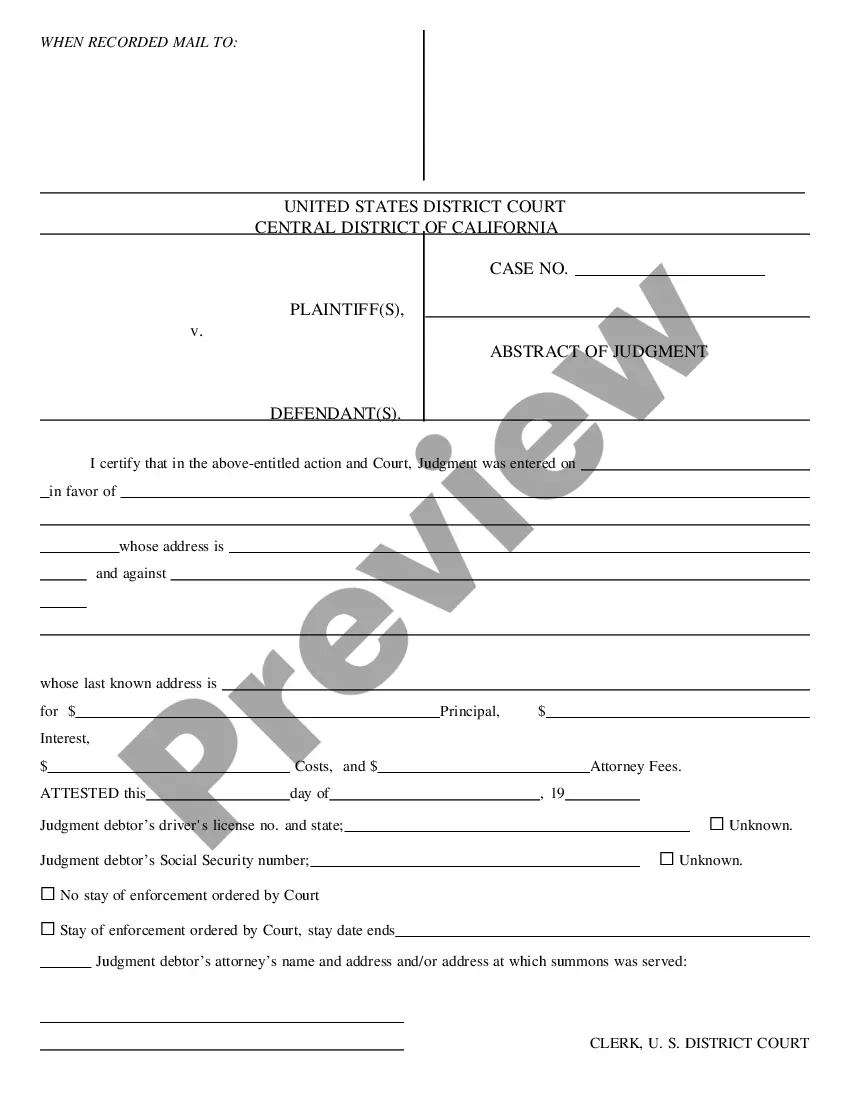

Description

How to fill out North Dakota Assignment Withholding Tax Due Dates?

When you need to present North Dakota Assignment Withholding Tax Due Dates that adheres to your local state's laws and regulations, there can be several options available to select from.

There's no necessity to scrutinize every document to ensure it fulfills all the legal requirements if you are a US Legal Forms subscriber.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any subject.

Obtaining appropriately drafted official documentation becomes simple with US Legal Forms. Additionally, Premium users can also benefit from the powerful integrated solutions for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and individual legal situations.

- All templates are authenticated to align with each state's laws and regulations.

- Consequently, when downloading North Dakota Assignment Withholding Tax Due Dates from our platform, you can be assured that you possess a valid and updated document.

- Acquiring the necessary sample from our site is quite straightforward.

- If you already have an account, simply Log In to the system, confirm your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and retrieve the North Dakota Assignment Withholding Tax Due Dates at any time.

- If this is your first time using our library, please follow the instructions below.

- Review the suggested page and verify it for alignment with your criteria.

Form popularity

FAQ

Form 307 North Dakota Transmittal of Wage and Tax Statement, Form W-2, and any Forms 1099 that have North Dakota state income tax withheld are due on or before January 31 of the following year.

What Do I Need To Do? Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form W-4V; and give it to the payer, not to the IRS. Note. For withholding on social security benefits, give or send the completed Form W-4V to your local Social Security Administration office.

The due date for withholding tax payment is the 7th day of the month in which withholding tax is deducted. However, for the month of March, the due date for withholding tax payment is 30 April.

If you want an extra set amount withheld from each paycheck to cover taxes on freelance income or other income, you can enter it on lines 4(a) and 4(c) of Form W-4.

2 tax form shows important information about the income you've earned from your employer, amount of taxes withheld from your paycheck, benefits provided and other information for the year. You use this form to file your federal and state taxes.